Denis_Vermenko

High yield investing is viewed by some as being risky. I would say it depends, however, on the asset class. This may be true for certain C-Corporations that are trading down in the dumps due to being overleveraged and having an unsustainable business model, and certain residential mortgage REITs that may not survive a full credit cycle.

However, BDCs are designed for high yield, and many, like Hercules Capital (NYSE:HTGC) were able to either maintain or grow payouts over the past 2 tumultuous years. In this article, I highlight why HTGC is a quality high yield pick for income investors, especially after its strong quarterly results.

Why HTGC?

Hercules Capital is just one of a handful of business development companies that’s internally managed, and focuses on making loans and equity investments in emerging technologies and life sciences. Since its inception in 2003, Hercules has deployed over $15.2 billion in investment capital and is in many cases, a lender of choice for entrepreneurs and venture capital firms seeking growth capital financing.

What sets HTGC apart from BDC peers is focus on the aforementioned high growth areas, and with no exposure to oil and gas. Its internally managed structure is also more efficient than externally managed peers. This helps to align the interest of management with that of shareholders, since management isn’t directly compensated on basis of assets under management.

This results in equity raises when timing and valuation is favorable, and the efficient structure is a key reason for why HTGC currently yields near 10% while trading at a healthy premium to NAV. Moreover, the current regular dividend rate of $0.36 per quarter is well covered by $0.39 in net investment income generated in the third quarter. HTGC also has plenty of capacity to continue its special dividends, as it has undistributed spillover income per share of $1.03.

Meanwhile, HTGC is showing no signs of slowing down, especially as the current market environment is unfriendly for tech IPOs, resulting in increased need for venture debt. This is reflected by record third quarter gross debt and equity commitments of $817 million, and record year to date total gross fundings of $1.1 billion.

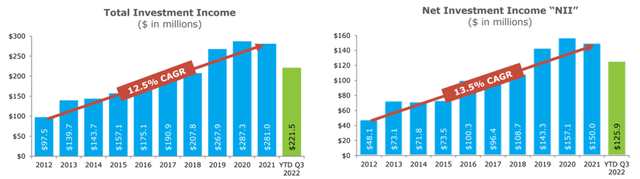

This, combined with higher interest rates have resulted in total investment income of $84.2 million during Q3, an increase of 20% YoY. As shown below, this has enabled HTGC to continue its track record of NNI growth at a 13.5% CAGR over the past decade.

HTGC NII Growth (Investor Presentation)

Also encouraging, investments on nonaccrual declined by 1 during the third quarter, as HTGC was able to successfully work out a loan that was impaired. At present, nonaccruals are very low, at just 0.5% of portfolio cost and 0.0% of portfolio fair value. Net asset value increased by just $0.04 sequentially during the third quarter. However, that had more to do with mark to market valuations in a volatile market for public and private investments.

Looking forward, HTGC remains well-positioned from a balance sheet perspective, as it carries a regulatory debt to equity ratio of 1.0x, sitting well below the 2.0x statutory limit. Moreover, management sees plenty of growth runway for venture debt, as private equity continues to raise large amounts of capital, as highlighted during the recent conference call:

The venture capital ecosystem continued its healthy pace for the first three quarters of 2022 with fundraising activity at record $151 billion and investment activity at $195 billion according to data gathered by PitchBook and the National Venture Capital Association. After only three quarters, the venture capital ecosystem continues to exhibit a healthy level of activity. Investments have turned in the second highest year on record and fundraising has achieved an all-time record high.

To put this into further perspective, over $386 billion has been raised in the last three years with the amount of available capital to invest at historic highs, we remain optimistic that venture capital activity will begin to accelerate in the coming months and extend well into 2023. Capital raising across our own portfolio remains strong in Q3 with our active portfolio companies, once again, raising nearly $1.5 billion of new capital during the quarter.

Lastly, I continue to see value in HTGC at the current price of $14.74. While HTGC trades at a large premium to NAV, I believe this gap will be bridged when fair market value of investments after less market volatility. Moreover, efficient internally managed BDCs should be measured more based on their earnings power. At present, HTGC carries a forward PE of 10.3, with analysts projecting 11 – 17% annual earnings growth over this year and next.

Investor Takeaway

Hercules Capital is doing just fine in the current environment, and continues its strong track record of growth, with record commitments in the recent quarter. HTGC should continue to see strong growth as private equity remains robust and the unfavorable environment for IPOs should continue to require high levels of venture debt. Lastly, HTGC offers a high, growing, and well-covered regular dividend that should be supplemented by special dividends with plenty of spillover income. HTGC is a high quality income pick at present.

Be the first to comment