mysticenergy

Introduction

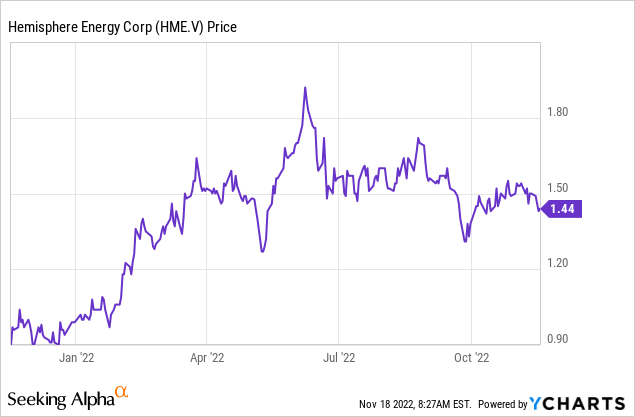

I have been keeping tabs on Hemisphere Energy (TSXV:HME:CA) (OTCQX:HMENF) as it is one of the small-scale producers in my portfolio. While I’m usually not a fan of small producers with just a few thousand barrels per day in oil production (as a small problem could have a large impact), Hemisphere has performed well this year although the production results are slightly lower than I had anticipated. But on the other hand, the debt-free producer offers an attractive dividend yield and I see no reason to sell.

The free cash flow in Q3 allowed Hemisphere to repay all debt

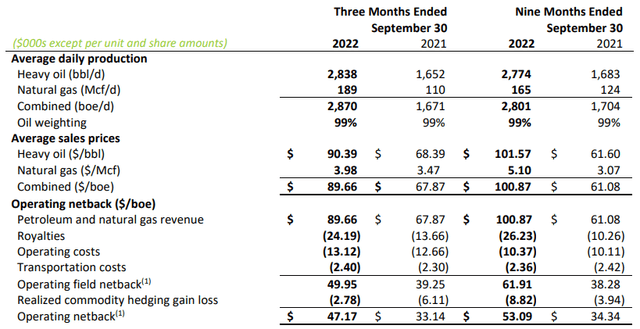

During the third quarter, Hemisphere Energy produced just under 2,900 barrels of oil-equivalent per day, of which 99% consisted of heavy oil. That’s slightly lower than I had expected as Hemisphere disclosed an average daily production rate of in excess of 3,000 boe/day in July. It received an average price of just C$90.39 per barrel of heavy oil (which isn’t a surprise as heavy oil trades at a discount to light oil) while the natural gas was sold at an average price of just under C$4 per Mcf. This resulted in a net realized price of C$89.66 per barrel of oil-equivalent.

Hemisphere Energy Investor Relations

As the royalty rate moves along with the oil price, the average royalty payment per barrel of oil-equivalent decreased as well but unfortunately the pure operating expenses increased on a per-barrel basis, resulting in a netback of C$49.95 per barrel of oil-equivalent and approximately C$47.17 after taking the impact of hedges into account.

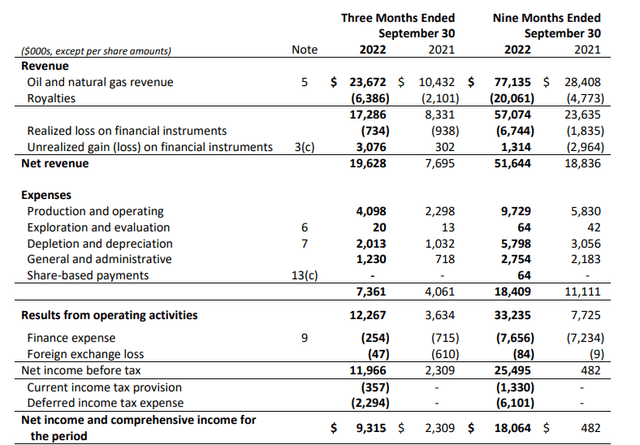

The total revenue was approximately C$23.7M before taking the royalty payments into account, and the net revenue, including the realized and unrealized hedging losses and gains, was C$19.6M. This resulted in an operating income of C$12.3M, including approximately C$2M in depreciation and depletion expenses.

Hemisphere Energy Investor Relations

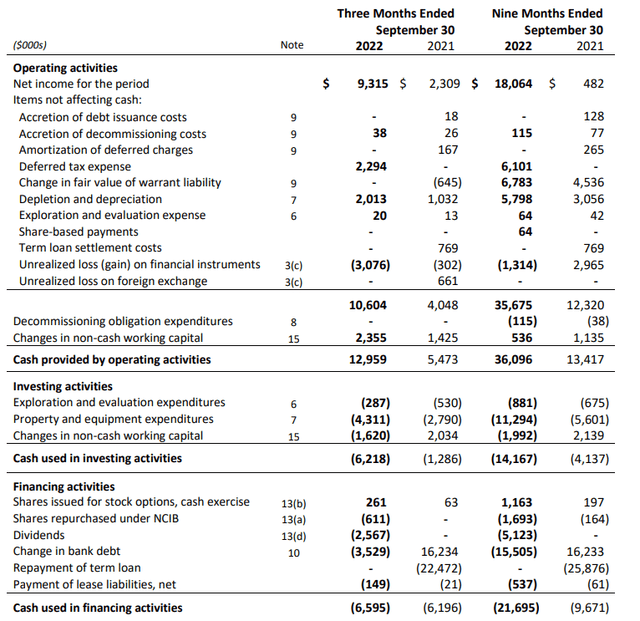

As Hemisphere had very little debt, the interest and finance expenses were pretty low as well, and that’s why the pre-tax income is almost identical to the operating income. After deducting the tax expense, the net attributable income was C$9.3M which translates into an EPS of C$0.09. Keep in mind this includes about C$2.3M in unrealized gains and this obviously boosted the pre-tax income by the same amount. Excluding this unrealized gain, the EPS would have been approximately C$0.07 which is obviously still a good result.

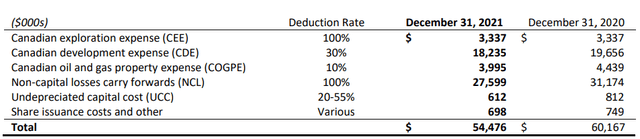

As you can see in the income statement, the majority of the income tax is ‘deferred’. Hemisphere still had access to just under C$55M in tax pools when it started the year but the strong result in 2022 has obviously reduced this available amount and the company will likely have to start paying all taxes in the very near future.

Hemisphere Energy Investor Relations

But during the third quarter, the majority of the taxes were still deferred and that helped to boost the operating cash flow. The reported cash flow was C$10.6M and after deducting the C$149,000 in lease expenses, the adjusted operating cash flow was C$10.5M. This includes the C$0.7M in unrealized hedging losses but excludes the C$3M in hedging gains and the C$2.3M in deferred taxes.

Hemisphere Energy Investor Relations

The total capex for the quartet was approximately C$4.6M resulting in an adjusted free cash flow result of approximately C$6M. With just over 103M shares outstanding, the free cash flow per share came in just under C$0.06.

And as you can see above, the majority of the free cash flow was used to pay off debt and Hemisphere ended the third quarter with a net cash position of a few hundred thousand dollar (excluding lease liabilities and decommissioning obligations). That’s good news as this also means the C$0.15M in interest expenses incurred in the third quarter will no longer appear on the income statement.

This also means the quarterly dividend of C$0.025 per share is well-covered by the cash flow, as the company only needs about C$3M per quarter to cover the dividend.

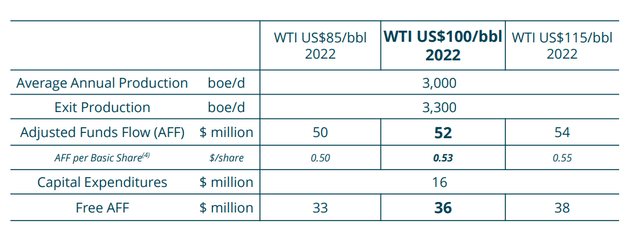

The company plans to maintain its capex program at approximately C$4M per quarter for a full-year capex of C$16M. Unfortunately Hemisphere hasn’t provided a guidance for next year yet but I would expect similar numbers with a free cash flow result of around C$30M at US$85 WTI.

Hemisphere Energy Investor Relations

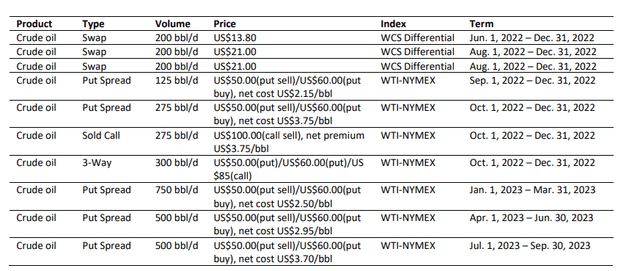

The company still has some hedges but these shouldn’t have a massive impact on the financial performance.

Hemisphere Energy Investor Relations

Investment thesis

I have a small long position in Hemisphere Energy and see no reason to sell. The company is now debt-free and although I generally don’t like small-scale producers with an output of just a few thousand barrels per day, I am fine with my exposure to Hemisphere. The current dividend of C$0.025 per share per quarter and C$0.10 per year gives me a 7% dividend yield while Hemisphere is applying a 30% payout ratio.

I am looking forward to seeing the more detailed plans for 2023 and the year-end reserve statement.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Be the first to comment