Tonktiti

Company

Hello Group (NASDAQ:MOMO) is the name of a Chinese-based social media company. The company operates a digital network that enables users to engage with individuals who share their interests and are located in the same approximate region. Hello Group is the respective owner of the MOMO and Tantan applications. It should come as no surprise that social networking and instant messaging are two of Momo’s most prominent features. Popular in China and throughout Asia, Tantan is surprisingly similar to Tinder in terms of style and functionality. As of December 2021, MOMO has 114.5 million Monthly Active Users (MAUs), while Tantan only has 27 million.

After its release, Momo had a meteoric rise in popularity, and by the end of its first year, it had 10 million active members. It reached the milestone of 50 million MAU by the middle of 2014. In December 2014, Momo Inc. went public on the NASDAQ under the ticker symbol “MOMO”, at $13.5.

Since 2015, when Momo decided to switch its business model to livestreaming, the company’s revenue, profitability, and market capitalization have all improved dramatically. In 2018, the firm’s market value briefly topped $10 billion as a result of its stock price exceeding $50 per share. Tantan, a Tinder (MTCH) clone, is the most popular pure-play dating app in China, and Momo has gone back to its dating-app roots by purchasing Tantan for circa $650 million. When Momo’s development came to a halt, the firm recognised an opportunity to acquire Tantan and transform it into the company’s future growth engine.

Now I will discuss the execution of our strategic priorities in the second quarter. At the beginning of the year, I set strategic growth for Momo, Tantan and the new endeavours. For the Momo app, our goal is to maintain a stable user base with a limited marketing budget and seek growth on top of that, while ensuring the cash cow business remained stable. Although the consumer and regulatory environment was full of uncertainties in the first half, we still did a very good job in reaching Momo’s strategic goals. This demonstrates our team’s strong adaptability and execution skills. Tantan’s strategic goal was to deliver solid user growth by improving marketing efficiency and the core dating experience. However, we encountered quite serious external challenges in meeting Tantan’s growth scope.

Wang Li – CEO

Since its all-time high in 2018, the share price of Momo has been rapidly declining, losing more than 90 percent of its value. This precipitous fall can be traced back to a variety of issues, all of which stem from many issues related to China and the company’s growth prospects.

The Dangers Associated with Regulations

Due to the fact that Hello Group is mostly based in China, it faces an especially complex set of regulatory challenges. According to the Holding Foreign Firms Accountable Act, Hello Group and all other Chinese businesses listed on U.S. exchanges may be de-listed in 2024 owing to incompatibilities between U.S. audit procedures and Chinese data protection regulations. Due to the fact that the two sets of regulations are incompatible, this possibility presents a real threat to the business. There has been extensive coverage of this issue in the business press, but the overwhelming belief is that the United States and China will be able to find a solution that will allow Chinese companies to keep their presence on U.S. markets. The delisting of Chinese firm shares is unlikely to render such shares worthless; rather, it will impede the trade of those shares. Even if the event mentioned above does not occur, this still holds true.

Momo’s live streaming revenue totaled RMB 1.4 billion for the second quarter, down 26% year-over-year and 5% quarter-over-quarter. The year-over-year decrease was mainly due to 3 factors: First, regulators imposed restrictions on the design of the ranking system and PK competition in May, which had a negative impact on cost spending. Second, the negative impact of tax compliance scrutiny on the engagement of talent agencies. And third, content softness due to the COVID resurgence.

Wang Li – CEO

In May of 2019, it was reported that both Momo and Tantan were compelled to temporarily disable their respective social newsfeed sections. Tantan was obliged to comply with these restrictions after it was removed against its will from Chinese app stores for apparent violations of corporate policy. Since the management of Momo completely collaborated with Chinese authorities, the government has largely disregarded the company. Despite the fact that the company’s stock price took a considerable knock as a result of these episodes and has not yet fully recovered from those losses, the company’s stock price has continued to rise. It appears that the management’s plan, which consisted of cooperating with and respecting the relevant authorities, was successful.

China’s economic development, which has been the nation’s source of pride, has prompted the government to send widespread indications that the crackdown on local IT enterprises is ending. This is due to the failure of China’s economic progress. Hello Group’s ability to maintain GAAP profitability and positive FCF despite choppy seas over the past three years is a testament to the company’s robust business model and competent management. Despite the fact that the regulatory environment will continue to evolve in the future, this goal was accomplished. Almost certainly, Hello Group’s profitability and cash flows will rise to pre-epidemic levels if the company is able to immediately resume sales growth.

Both the adoption of China’s Zero Covid strategy and the current harsh intermittent lockdowns in the country’s most populous cities have been detrimental to Hello Group’s bottom line. It stands to reason that location-based social and dating programmes would not be successful in a culture where physical contact with others is criminalised. Given this perspective, it should not come as much of a surprise that Tantan’s paid user base has decreased dramatically. However, restrictions on covid will not exist for much longer, not even in China. There is a strong likelihood that the acceptance of online dating will increase once again, not only in China but also in the rest of the world. Hello Group only needs to maintain its current market position for its investors to realise financial returns.

Financial State of the Company

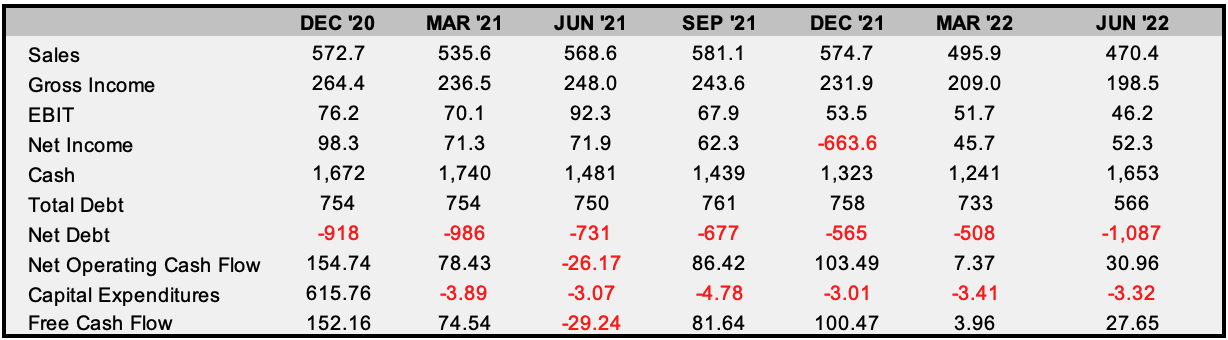

Despite the fact that the company’s sales growth has continued to stall and its margins have contracted, the company’s near-term growth prospects seem promising. There may be overlooked information in the company’s fundamentals, despite the fact that the majority of its problems relate to its country of operation. This company simply does not screen well, since its revenues have decreased and its gross margins have shrunk by half, but these are frequently the best market prospects.

The company’s balance sheet is deep enough to support a lengthy period of growth stagnation through the utilisation of accumulated cash. This amount of cash is sufficient to pay out the company’s debt three times over. As the company continues to move into an economic slowdown, the balance sheet’s resiliency and their previous ability to increase free cash flow will ensure that the business will continue to run without difficulty.

FactSet, Author’s Work

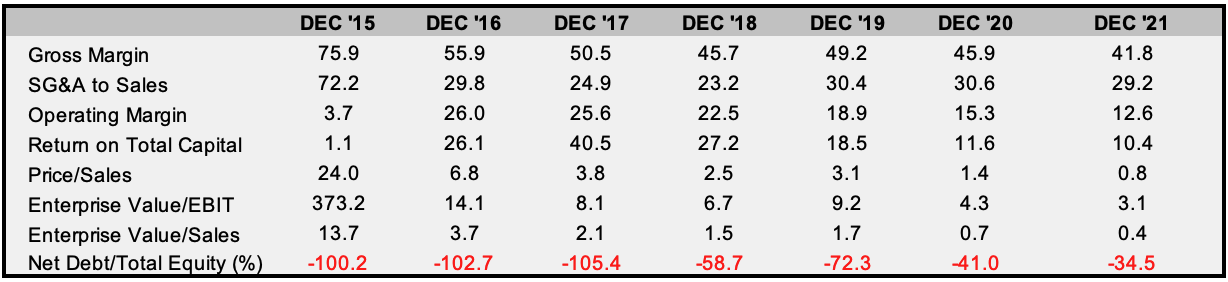

As is in line with the above operating performance with the company, MOMO has continued to be punished for their decline in growth. It is to be noted however, I believe that we have decreased from ‘bubble like’ territory, to ‘depression like’ valuations. While this may be justified based on the fundamentals, I do not believe that the company’s prospects validate a Price to Sales ratio of 0.8 or an EV/EBIT ratio of 3.1. These represent 80% declines from only 5 years ago.

FactSet, Author’s Work

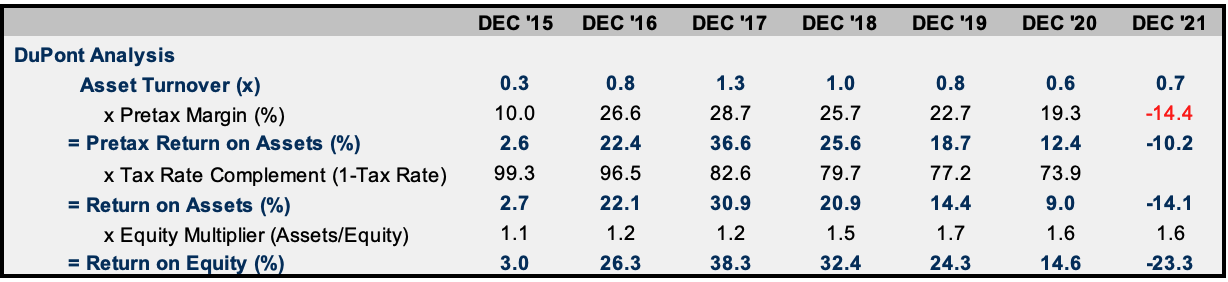

In the preceding fiscal year, the company experienced its first “negative” return on equity. This, however, has declined relatively rapidly over the years. A DuPont analysis is essential to comprehending the inner workings of a business in order to determine its return and profitability drivers. Evidently, the company operated at an optimum level in 2017, achieving its highest Pre-Tax margins and Asset turnover to produce its highest annual ROE. This was accomplished using the lowest leverage ratio of the company. The fact that a significant increase in the leverage ratio (to the magnitude of 50%) has not been able to assist the company in achieving a sustainable return to shareholders adds to the concern surrounding the decline in ROE.

FactSet, Author’s Work

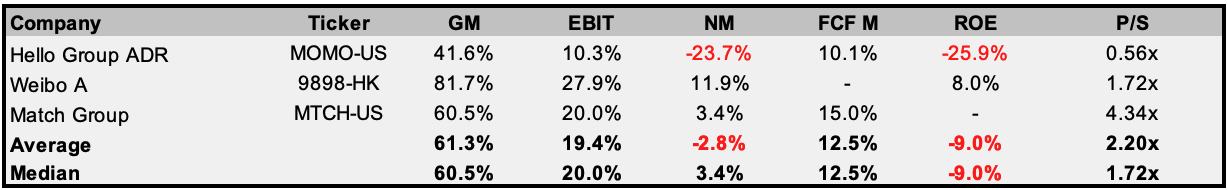

To comprehend the market’s driving force, it is essential to examine the company’s competitors in comparison. I believe what follows is merely a reiteration of what has already been stated, with the important caveat that the company is experiencing significant exogenous issues that have had a significant impact on the share price, more so than I believe the share price would have fallen based solely on fundamentals. The company’s significantly below-average operating profit explains why it is significantly less expensive than many of its competitors.

FactSet, Author’s Work

Final Thoughts

I have assigned MOMO a rating of “hold” due to the contradictory nature of this evaluation. I believe there is substantial upside based on the depressed valuation and a possible continuation of the upswing resulting from management’s move towards operating leverage. I am however aware of the issues that have preceded the company and do not consider it a good investment opportunity for those who do not hold it.

Be the first to comment