Iurii Garmash/iStock via Getty Images

Fund Returns (6/30/2022)

| Since Inception (%) | 20-Year (%) | 15-Year (%) | 10-Year (%) | 5-Year (%) | 3-Year (%) | 1-Year (%) | YTD* (%) | QTD* (%) | |

|---|---|---|---|---|---|---|---|---|---|

| Value

Investor Class |

10.96 | 7.30 | 4.21 | 7.27 | 5.31 | 7.04 | -11.04 | -14.17 | -11.74 |

| Value

Institutional Class |

11.03 | 7.43 | 4.38 | 7.44 | 5.46 | 7.17 | -10.94 | -14.12 | -11.71 |

| Russell 2000® Value | 10.45 | 7.77 | 5.58 | 9.05 | 4.89 | 6.18 | -16.28 | -17.31 | -15.28 |

*Not annualized

Source: FactSet Research Systems Inc., Russell®, and Heartland Advisors, Inc.

The inception date for the Value Fund is 12/28/1984 for the investor class and 5/1/2008 for the institutional class.

“There are no new eras—excesses are never permanent.”

—Bob Farrell

With inflation higher than expected, the Federal Reserve dramatically raised interest rates and the broad market fell into the third bear market in the past 15 years. An unprecedented era of free money has come to an end and, with it, sky-high valuations for Unicorns, Crypto’s, IPO’s, and growth stocks priced for perfection.

The ever-popular NASDAQ Composite was hit hard, dropping -30% year to date, while the S&P 500 Index fell -20%. Many unprofitable companies, once valued in the billions, have plummeted -50%, -75%, or more, from their recent highs. Small value stocks were not spared but held up better, with the Russell 2000 Value Index off -17.3% and the Heartland Small Cap Value Strategy down -14.2% year to date.

This across-the-board selling has taken down high-quality companies alongside speculative fare. We admit to being a bit frustrated by the indiscriminate selling thus far—a few of our holdings have been marked down to only four times earnings, while some are priced below cash per share and many below book value. In the end, bear markets aren’t much fun but offer the possibility for enterprising, disciplined value investors to get a crack at well-managed companies with strong balance sheets that usually don’t fall into the low price-to-earnings value category.

Extremely Negative Sentiment Sets up Opportunities

No one knows when this bear market will end, but we do know investor sentiment is extremely negative.

One gauge, a recent University of Michigan survey of consumer sentiment, fell to a record low of 50 in June. That’s the lowest level since 1952! Since consumers account for about 70% of GDP, historic drops such as this signal a potential economic slowdown which investors are pricing in.

Source: University of Michigan, University of Michigan![Chart: Consumer Sentiment [UMCSENT], retrieved from FRED](https://static.seekingalpha.com/uploads/2022/7/14/saupload_Chartweb_1.jpg)

Consumer Sentiment [UMCSENT], retrieved from FRED, Federal Reserve Bank of St. Louis; University of Michigan: Consumer Sentiment, 1/1/1978 to 6/30/2022 monthly. All indices are unmanaged. It is not possible to invest directly in an index. Past performance does not guarantee future results.

Multiple compression has occurred, and stock prices could continue to be pressured as analyst estimates ratchet lower. However, historically low sentiment readings such as this have been a precursor to better stock returns ahead. In fact, when consumer sentiment drops to extreme lows, the small cap Russell 2000 Value Index has outperformed the Russell 3000 Growth Index and the broad market by over +5% on a three-year average.

In our view, this presents an ideal setup for active fundamental research coming to the fore. As Benjamin Graham eloquently stated, “The intelligent investor is a realist who sells to optimists and buys from pessimists.” Thus, for discerning investors who have the patience to look past current market gyrations, near-term vulnerability is creating an opportunity for small cap bargain hunters.

Companies We Know

One such opportunity is Carriage Services (CSV), a leading owner of funeral homes and cemetery operations throughout the country. CSV’s economies of scale, professional management, and superior operating model has allowed it to take share organically and through value-added acquisitions, in what we view as an attractive, highly cash flow generative industry. CSV is a long-tenured holding in the portfolio; however, its weighting has fluctuated, based on our view of its attractiveness. In 2021, a COVID-19-related spike in mortality rates boosted fundamentals and the stock price with it, causing us to reduce our holdings by around 20%. More recently, the stock has sold off materially, likely in sympathy with its consumer discretionary peers that are often economically sensitive. We continue to forecast robust fundamentals for CSV as its demand tends to be highly inelastic. Trading at less than 10 times enterprise value to EBITDA and at 11 times Heartland’s estimate of current year earnings, we think CSV is an attractive investment, so we built back the position over the last quarter.

Numerous other such portfolio optimization activities, which we view as low hanging fruit, have occurred during the quarter, both within current portfolio holdings and related to companies we have researched and owned in the past. We believe these actions centered on valuation analysis should serve our clients well.

Companies with Pricing Power

With inflation remaining persistent, the ability to pass on rising prices has become a real test for companies and a differentiator for the performance of their underlying securities.

SunOpta (STKL) is a plant-based food and beverage company with its primary product being plant-based milks of various types (almond, oat, soy, etc.). Heartland believes STKL is a highly attractive franchise due to its strong secular growth, excellent management team, and its upcoming, near-term deployment of significant capacity additions that have yet to be reflected in the company’s economics. Normally, investors would have to pay dearly for these characteristics, but due to the aforementioned inflation concerns along with industry-wide supply chain issues, we were able to purchase shares at metrics that fit our criteria. We viewed these issues as transitory. Q1 started to affirm this investment case and provided increased visibility to the firm’s long-term growth prospects. Despite a material runup in the stock price, we continue our favorable view as STKL trades at a meaningful discount to lower-growth food and beverage peers, which have much lesser-competitive positions and barriers to entry.

As can be seen by any trip to the gas station, another pocket of pricing power has been Energy, which was a top-performing sector on a year-to-date basis. In this area, HF Sinclair (DINO) was a standout for the portfolio. Sinclair is a refiner, which is the process that converts crude oil into a mix of differentiated petroleum products, including gasoline. The profitability, known as the crack spread, of a refinery comes from the difference in value between the crude oil it processes and the finished goods it produces. DINO has benefitted from favorable supply and demand dynamics, both from extremely low inventory levels of refined product and due to geographically advantaged supply costs related to the types of crude feedstock they use (20% of its oil is Western Canadian crude which is priced lower than West Texas Intermediate). The outcome of this combination has been outsized crack spreads to the positive. After a doubling in price in the stock, we trimmed the position, with the majority still held, as we believe the company’s current returns profile warrants a sizable premium to the current valuation modestly above book value and just six times estimated earnings.

Energized Industrials

Though a recession could weigh on economically sensitive sectors in general, one area seeing strength is among Industrials exposed to the Energy patch and Utilities.

Northwest Pipe Co. (NWPX), North America’s largest manufacturer of engineered steel water pipe systems, with 50% share, is benefitting from the growing demand for clean water, which has rebounded post COVID-19 and remains heightened by drought and population growth in warmer, drier regions of the country. Last quarter, Northwest’s backlog hit a record high of more than $400 million, and a strong bidding environment bodes well for future business. Yet, in our opinion, Northwest Pipe remains an attractive value in the water sector, as the stock is priced well below its peers at eight times cash flow and 12 times earnings per share.

CECO Environmental Corp. (CECE), serves the industrial air quality and fluid handling markets. The company is transitioning from a cyclical, project-driven business to a more predictable, higher-margin and diversified environmental and pollution control equipment business. Successful evolution should be rewarding, as targeted peers trade in the low double-digit EV/EBITDA range vs. the company’s current mid-single digit mark. Heartland believes investors underappreciate the growth and earnings potential underway, and the recent earnings report represented movement in the right direction with record orders and backlogs, which were contracted with what is expected to be nicely expanded profitability. Also, we are encouraged by consistent, meaningful buying of CECO shares by officers and directors.

Outlook

Amid the current sell-off in equities, the significant valuation disparity between growth and value stocks has narrowed, but in our opinion has much further to go. It will take some time for this massive speculative bubble to fully deflate. In the meantime, we remain focused on the same disciplined investment process that we have been utilizing for decades to uncover undervalued businesses priced well below their intrinsic worth.

So far, in a period of excessive pessimism, we have been able to assemble a portfolio of what we believe to be compelling opportunities that should participate in the continuing resurgence of common-sense value investing.

Thank you for your continued trust and confidence.

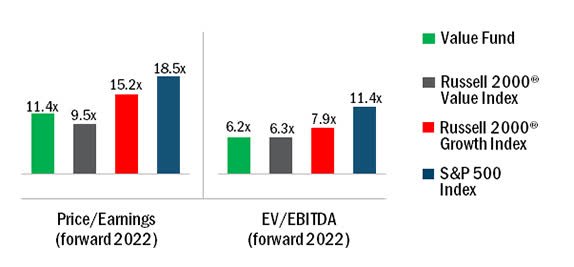

Value Fund Valuations

Source: FactSet Research Systems Inc., Russell®, Standard & Poor’s, and Heartland Advisors, Inc., as of 6/30/2022.

Price/Earnings and EV/EBITDA are calculated as weighted harmonic average. Certain security valuations and forward estimates are based on Heartland Advisors’ calculations. Certain outliers may be excluded. Any forecasts may not prove to be true. Economic predictions are based on estimates and are subject to change. All indices are unmanaged. It is not possible to invest directly in an index. Past performance does not guarantee future returns.

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Be the first to comment