gorodenkoff/iStock via Getty Images

These days, there are many different ways to play the medical industry. For those bullish the medical space, one interesting opportunity is to buy into REITs that lease their properties out to various medical companies. This provides the advantage that traditional real estate investing offers while simultaneously avoiding the risk that can often come with buying into some of the more volatile medical company is out there. Fortunately for investors, there are a number of players in the space to consider. One fairly large prospect is a company called Healthpeak Properties (NYSE:PEAK). In recent years, management has done well to grow the company’s revenue at a nice clip. Cash flows have been a bit more volatile, but generally robust. The most recent data provided by management shows a company that has taken a significant step higher in terms of revenue. And as a result, shares of the company are trading at levels that should be considered quite lofty. Due to this high price, investors should be careful if they decide to bet on this prospect.

Recent performance more or less as expected

The last time I wrote about Healthpeak Properties was in an article published in June of 2021. At that time, I called the company a decent play for patient investors. I applaud the company’s top-line growth in recent years but pointed out the fact that its bottom line has failed to follow suit. This, combined with the high multiple the company was trading at, led me to ultimately rate the firm a neutral prospect. And since then, shares have behaved more or less as I would have anticipated. While the S&P 500 has generated a return for investors of 4.6% over the timeframe covered, this particular prospect has seen a loss for investors of about 1.6%.

This lackluster return should not be viewed as a negative view of the company’s business model. In fact, the overall business model of the company looks attractive. Consider results from the company’s 2021 fiscal year. In that year, about 49% of its profits came from Life Science tenants, while 40% came from medical office tenants. A further 9% of profits came from continuing care retirement community real estate tenants, with the final 2% being miscellaneous properties the company owns. In all, the company has grown to have a fairly large footprint of 484 properties and, with a market capitalization of $18.25 billion, it is certainly a sizable player to contend with.

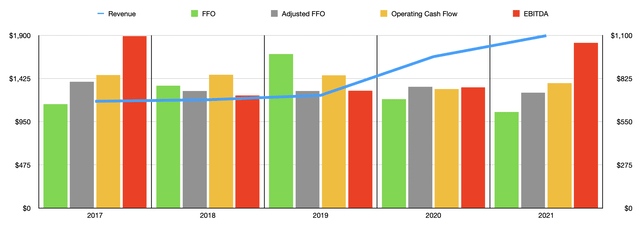

If the business model has not been the problem, then perhaps financial performance is the issue. But that doesn’t seem to hold up well either. When I last wrote about the company, it had only reported financial results for the first quarter of its 2021 fiscal year. Since then, the company has reported three additional quarters worth of data. That takes us through the 2021 fiscal year. And during that year, the company generated revenue of just under $1.90 billion. That represents an increase of 13.9% compared to the $1.66 billion generated one year earlier. This increase in sales came as a result of a couple of factors. Chief among them was an increase in the average occupied square feet the company owns. Under the life science category, occupied square feet increased by 16.4% relative to the 2020 fiscal year. For its medical office properties, this growth was 4.1%. And for the continuing care retirement community assets, growth was 4.9%. Some of this expansion appears to relate to the company’s growth initiatives. In the latest quarter, for instance, the company had just finished a $49 million project representing 172,000 square feet of medical office space in a facility in Tennessee. And moving forward, management has other plans. They are currently working on phase one of a $393 million, 343,000 square foot, life science development in San Francisco that should see initial occupancy in the second half of 2023. So investors should anticipate average occupied square feet across the company’s portfolio to continue climbing.

In addition to this, the company saw improvements in average annual rent per square foot. For the life sciences properties, this growth year over year was 4.8%. For the medical office properties, it was 3.3%. In addition to this, for its life science properties, the company saw a slight increase in occupancy rate, ticking up from 96% in 2020 to 97% in 2021. Though, it is worth mentioning that its other two classes of assets saw occupancy rates decline, the medical office properties from 91% to 90% and the continuing care retirement community assets from 81% to 79%.

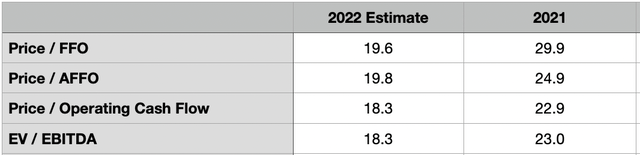

On the bottom line for 2021, the company also did alright but far from great. FFO, or funds from operations, came in at $610.89 million. That’s down from the $693.37 million generated one year earlier. Adjusted FFO, meanwhile, dropped from $772.31 million to $734.03 million. Operating cash flow, however, actually improved, climbing from $758.43 million to $795.25 million. And EBITDA increased from $769.10 million to $1.05 billion. For the 2022 fiscal year, using the company’s current share count, management is anticipating midpoint FFO of around $933 million. The adjusted equivalent of this should be about $922 million. Management did not provide any guidance for other profitability metrics. But if we assume the same kind of growth rate experienced there as we should see with adjusted FFO, then operating cash flow should be around $998.9 million while EBITDA should be around $1.32 billion.

Using this data, we can effectively price the business. On a price to FFO basis, its multiple stands at 29.9. The price to adjusted FFO multiple is 24.9, while the price to operating cash flow multiple is 22.9. Meanwhile, the EV to EBITDA multiple with the company is 23. If we assume that the 2022 forecasts and estimates are accurate, then these multiples would be 19.6, 19.8, 18.3, and 18.3, respectively. To put the pricing of the company into perspective, I decided to compare its 2021 estimates to the results of some other similar firms. On a price to operating cash flow basis, these companies ranged from a low of 9.3 to a high of 27.1. Of the five firms I looked at, Healthpeak Properties was more expensive than all but one of them. I also looked at the company through the lens of the EV to EBITDA multiple, resulting in a range of 12.3 to 31.4. And once again, four of the five companies were cheaper than our prospect.

| Company | Price / Operating Cash Flow | EV / EBITDA |

| Healthpeak Properties | 18.3 | 18.3 |

| CareTrust REIT (CTRE) | 12.2 | 16.6 |

| Omega Healthcare Investors (OHI) | 9.3 | 12.3 |

| Welltower (WELL) | 27.1 | 31.4 |

| Healthcare Trust of America (HTA) | 17.5 | 19.6 |

| Medical Properties Trust (MPW) | 17.9 | 17.3 |

Takeaway

Based on the data provided, I will say that I believe the long-term outlook for a company like Healthpeak Properties should be positive. If management can achieve the kind of growth that they are anticipating for the 2022 fiscal year, shares might start to look a bit attractive. But as they are today, they just look too lofty for a value-oriented investor like myself to consider buying into.

Be the first to comment