Denis_Vermenko

Most REITs have been pummeled in recent weeks and months over rising rates and general economic uncertainty. Some segments, such as office, have been more beaten down than others. However, a number of questions remain around return to office, and for those investors who seek a higher level of safety, healthcare REITs may be a better choice for income.

This brings me to Healthpeak Properties (NYSE:PEAK), which flies under the radar for most investors, standing in the shadow of juggernauts such as Welltower (WELL) and Ventas (VTR). This article highlights why PEAK is a beaten down REIT worth looking into for potentially strong returns, so let’s get started.

Why PEAK?

Healthpeak Properties is one of the 3 big diversified healthcare REITs and is a member of the S&P 500 index. Unlike REITs such as Omega Healthcare (OHI) and Physicians Realty Trust (DOC) that that are more pure-play REITs in their respective segments, PEAK is focused on the three private-pay healthcare assets of Life Science, MOB (Medical Office Buildings), and Senior Housing.

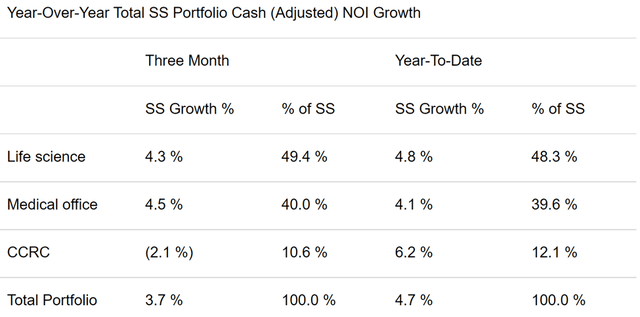

This diversification helps PEAK to offset weakness in any one sector (i.e. think senior housing troubles in 2020). As shown below, PEAK’s derives just under half of its NOI from the growing Life Sciences segment, with the remaining 40% and 10.6% coming from MOB and Senior Housing.

PEAK Segment Mix (Q2 Earnings Release)

Also encouraging, PEAK’s Life Sciences segment appears to be rather strong, with around 200 tenants. It’s highly concentrated among its top 5 tenants, which represent 21% of life science annual base rent, and comes from the familiar names Amgen (AMGN), Johnson & Johnson (JNJ), Pfizer (PFE), Bristol Myers Squibb (BMY), and AstraZeneca (AZN).

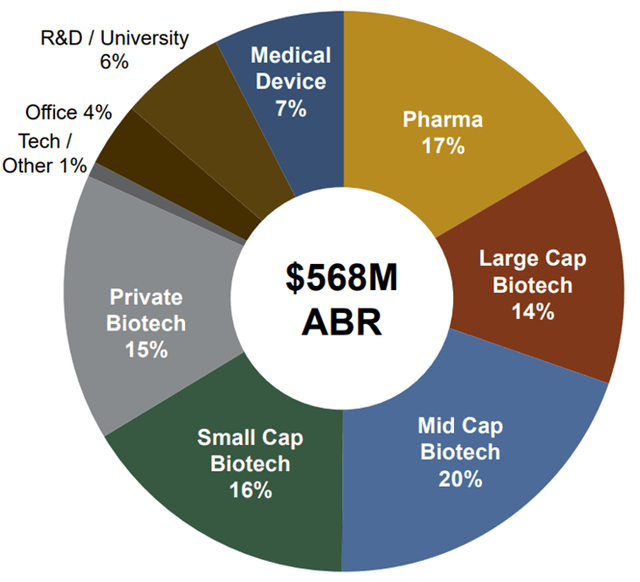

Moreover, the overall life science tenant base is rather solid, with 75% of ABR coming from publicly-traded tenants, which have more access to capital than privately-owned peers, and just 3% of ABR comes from higher risk pre-clinical biotech tenants. Here is a breakdown of PEAK’s Life Science tenant mix.

PEAK Life Science Mix (Investor Presentation)

Meanwhile, PEAK is demonstrating stable growth, with total same-store cash NOI growth of 3.7% YoY during the second quarter. This was driven by Life Science and MOB NOI growth of 4.3% and 4.5%, respectively. PEAK also has an attractive life science pipeline through its South San Francisco Joint Ventures.

This includes a near-term redevelopment of seven buildings on PEAK’s prime located Pointe Grand campus in South SF. PEAK also recently signed a similar JV structure to build out its Vantage campus also in South SF. At present, 81% of its $1 billion of active life sciences developments are pre-leased.

Risks to PEAK include challenge to its Senior Housing segment, which saw a 2.1% SS NOI decline during the second quarter (2.6% decline excluding funds from the CARES Act). This sector has remained challenged due to wage inflation and labor shortages. However, as noted earlier, it represents just 10.6% of PEAK’s total NOI. Plus, I’m encouraged to see that demand is picking up for Senior Housing, as PEAK is seeing record entry fee sales.

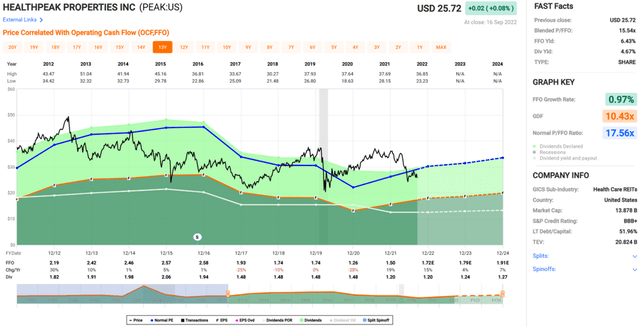

Meanwhile, PEAK pays a healthy 4.7% dividend yield, which is supported by a 68% payout ratio, based on Q2 FFO per share of $0.44. This is further supported by a strong BBB+ with a net debt to adjusted EBITDAre of just 5.1x and a very strong adjusted fixed charge coverage ratio of 5.9x. Moreover, PEAK has no bonds maturing until 2025, which helps it to avoid refinancing debt in the current period of higher rates, and has $2.5 billion in available liquidity.

Turning to valuation, PEAK appears to be attractively priced at $25.72 with a forward P/FFO of 14.9, sitting below its normal P/FFO of 17.6 over the past 10 years. Management also appears to think the stock is cheap, as the Board recently approved a $500 million stock repurchase program, representing 3.6% of the current equity market cap. Sell side analysts have a consensus Buy rating on the stock with an average price target of $31.89, translating to a potential one-year 29% total return including dividends.

Investor Takeaway

In summary, I believe that PEAK is an attractive play considering the ongoing growth in the life sciences segment, which should help it to continue to deliver respectable results. This also helps it to mitigate weaknesses in the senior housing segment, which should ameliorate after labor numbers normalize. Lastly, PEAK now trades well below its near term high of $35 from as recently as April, and represents good value at present.

Be the first to comment