skynesher/E+ via Getty Images

REIT Rankings: Healthcare

This is an abridged version of the full report published on Hoya Capital Income Builder Marketplace on October 24th.

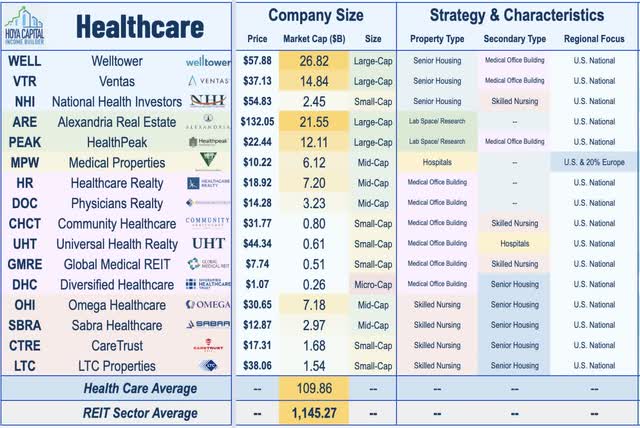

Healthcare REITs – which were literally “ground zero” of the COVID pandemic – will experience lasting effects – both positively and negatively – from the (hopefully) once-in-a-generation pandemic. Previously seen as one of the more “bond-like” REIT sectors due to the predictable nature of healthcare demand along with their heavy use of long-term triple net lease structures, healthcare REIT fundamentals are slowly normalizing after several years of dramatic dislocations, but aren’t entirely out of the woods yet as near-term headwinds persist. Within the Hoya Capital Healthcare REIT Index, we track all 16 healthcare REITs, which account for roughly $110 billion in market value.

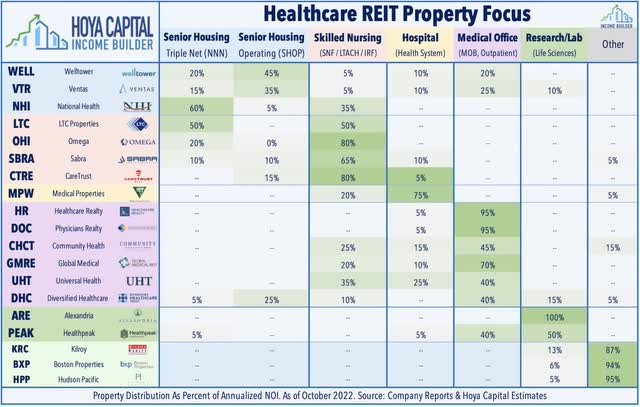

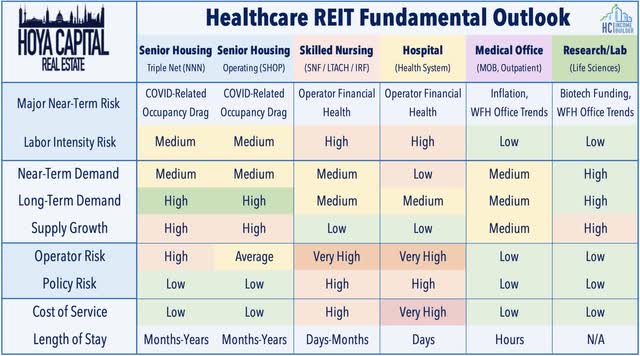

The healthcare REIT sector is a compilation of five rather distinct sub-sectors, each with different risk/return characteristics – Senior Housing (“SH”), Skilled Nursing (“SNF”), Hospital, Medical Office Building (“MOB”), and Lab Space. The senior housing sub-sector is further segmented based on lease structure: triple-net leased (“NNN”) properties and senior housing operating (“SHOP”) properties. Following a stretch of strong outperformance in early 2022, Healthcare REITs – particularly in the hospital, skilled nursing, and senior housing sub-sectors – have come under renewed pressure in recent months as sharply higher labor costs, a sluggish post-COVID recovery in overall patient volumes, and the waning of government fiscal support have pressured operators and raised questions over their rent-paying capacity.

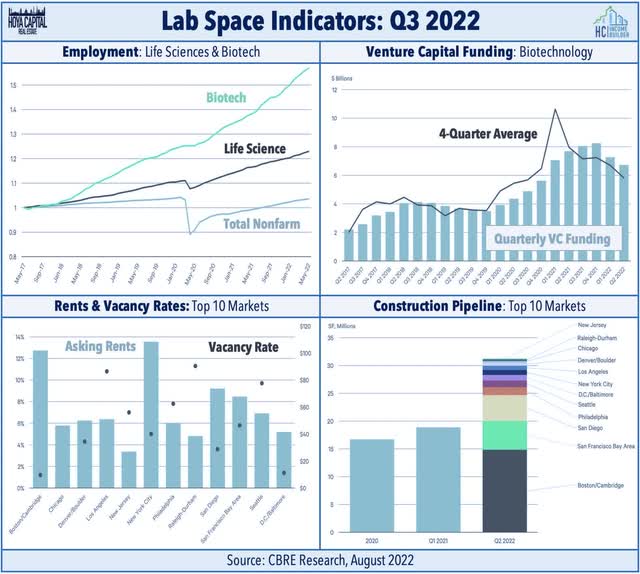

While the senior housing sub-sector took the most direct hit by the pandemic, no sector was entirely immune. For the “public pay” skilled nursing and hospitals – which rely heavily on Medicare and Medicaid reimbursements – the pandemic initially exasperated issues with their troubled operators before a wave of government relief funds temporarily quelled these concerns, but issues have re-emerged as funding dried up. Meanwhile, demand for Medical Office Building (“MOB”) space has remained steady throughout the pandemic, but even doctor’s offices aren’t immune from the “Work From Home” effects. For lab space, demand boomed early in the pandemic amid a wave of capital pouring into the biotechnology and pharmaceutical industries, but optimism has waned amid a sharp slowdown in biotech venture capital and IPO activity.

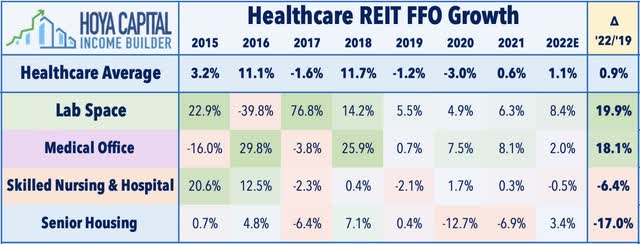

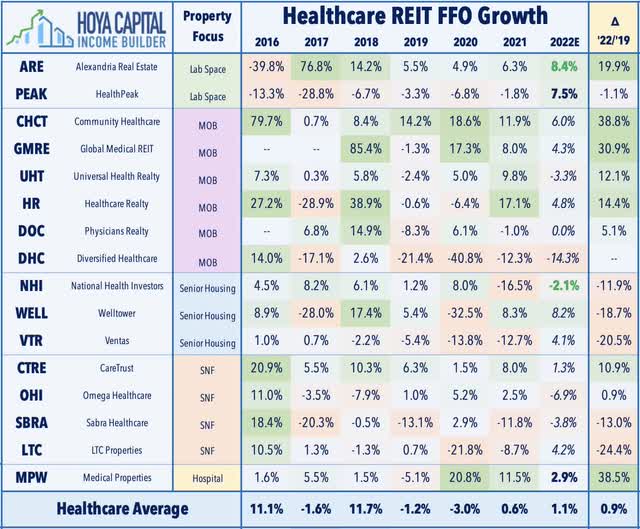

The bifurcation in operating performance between these healthcare sub-sectors during the pandemic is readily apparent in their reported Funds From Operations (“FFO”) metrics. Senior Housing REITs were hit the hardest with FFO expected to remain more than 10% below pre-pandemic levels in 2022. Skilled Nursing and Hospital REIT FFO has remained relatively flat through the pandemic as significant government stimulus funds temporarily eased persistent tenant struggles, but operator issues have reemerged as relief funds dry up. On the other side of the healthcare sector in segments less affected by lingering labor pressures, medical office FFO is expected to be about 18% above 2019-levels while lab space REITs are expected to record FFO that is nearly 20% above pre-pandemic levels this year.

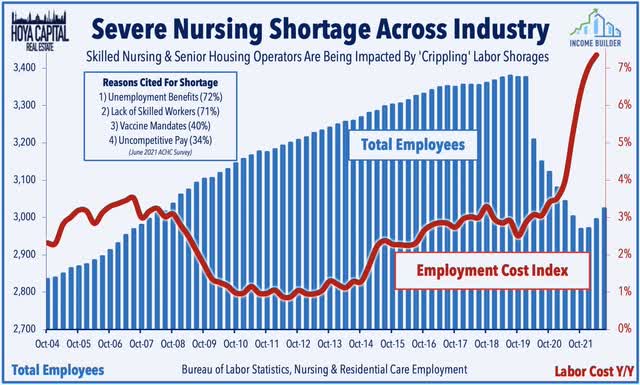

Healthcare REITs across all five sub-sectors typically lease properties to tenant operators under a long-term triple-net lease structure, and reliance on these third-party operators is a fairly unique feature of the sector. Triple net leases are only as “safe” as the tenant’s ability to pay the rent, and questions over the financial health of many operators are certainly nothing new for healthcare REITs but remain the primary source of near-term and medium-term risk. Already dealing with challenges on the labor-front before the pandemic, staffing shortages became critical issues at healthcare facilities during the pandemic as intensely-challenging work conditions prompted a surge in early retirements and career shifts. According to a survey from the NCAL, facilities cited a lack of available skilled workers unemployment benefits, vaccine mandates, and uncompetitive wages as key reasons behind hiring difficulties.

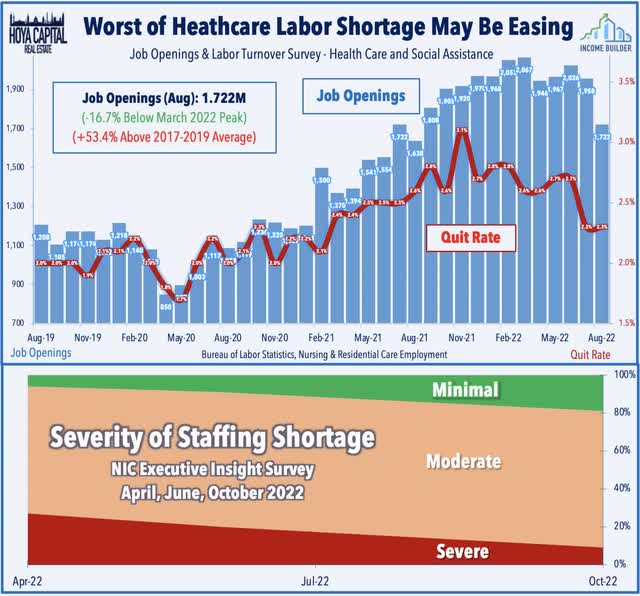

Skyrocketing labor costs from the reliance on third-party nursing agencies to plug staffing gaps have been the most pressing issue, but recent data suggest that the pressures may be easing. According to the most recent NIC Executive Insights Survey collected between Sept. 19 and Oct. 16, just 9% of senior care operators reported “severe” staffing shortages at their organization — down from 25% of respondents who reported the same back in March. According to Bureau of Labor Statistics data in the JOLTS report, the number of job openings in the Health Care and Social Assistance category peaked in March at nearly 2.1 million but has declined nearly 20% through the most recent August report, consistent with other employment reports and industry commentary suggesting that the worst of the labor crunch is easing – potentially removing one of the more immediate headwinds on operators.

Healthcare REIT Performance

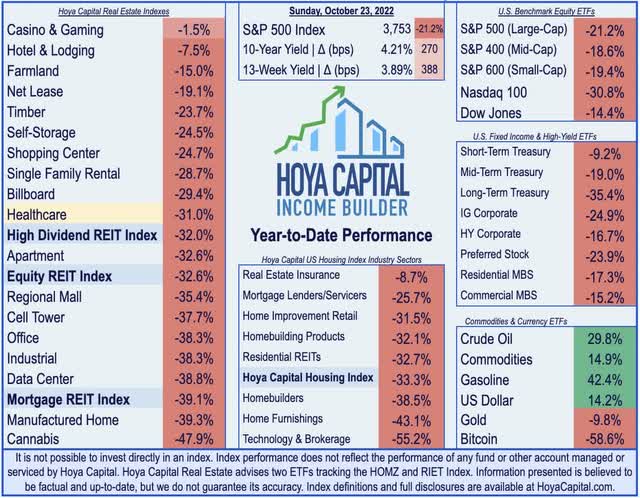

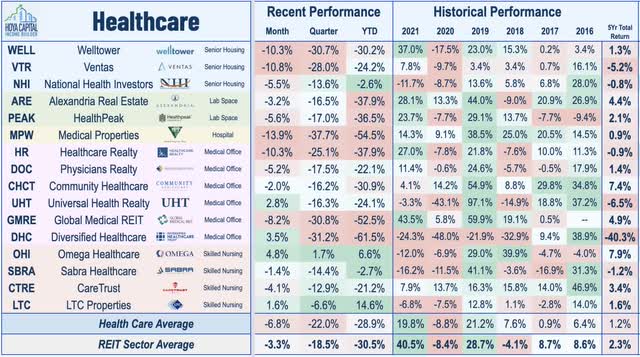

Healthcare REITs were slammed during the early onset of the COVID pandemic but were among the best-performing REIT sectors between the initial vaccine rollout and mid-2022 before lagging over the past quarter amid the renewed questions over operator health and broader economic headwinds. The Hoya Capital Healthcare REIT Index is lower by 31.0% in 2022 compared to the 32.6% decline from the market-cap-weighted Vanguard Real Estate ETF (VNQ) and the 21.2% decline from the S&P 500 (SPY).

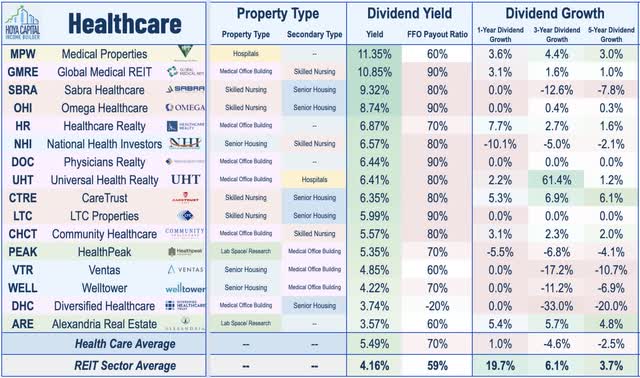

Diving deeper into notable individual performances, skilled nursing REITs continue to be notable standouts in 2022 with LTC Properties (LTC) and Omega Healthcare (OHI) leading the way – two of just eight REITs in positive territory this year while Sabra Health Care (SBRA) and National Health Investors (NHI) are close behind. Senior Housing REITs had been leaders in early 2022, but Welltower (WELL) and Ventas (VTR) have dipped nearly 30% over the past quarter. Lab space and office REITs have also generally lagged this year – pressured by a rotation from growth and defensively-oriented REITs into more value-oriented and pro-cyclical sectors. Hospital operator Medical Properties (MPW) has been a notable laggard this year with declines of over 50% – a name that has become a fiercely contested “battleground stock” after coming into the cross-hairs of short-sellers, which have focused their critique on financial health and complex relationship between MPW and its largest tenant – Steward Health Care.

Lab Space & Medical Office Fundamentals

Lab space-focused Alexandria Real Estate (ARE) kicked off healthcare REIT earnings season this week with better-than-expected results and maintained its full-year outlook calling for FFO growth of 8.4% and same-store NOI growth of 7.8% this year. Alexandria’s third-quarter results were highlighted by impressive cash NOI growth of over 20% driven by renewal rent spreads of 27.1% GAAP / 22.6% cash. While total leasing volumes have slowed considerably from the “biotech boom” in late 2021, leasing activity remained at levels that were above the 5 and 10-year averages. ARE noted last quarter that the specialized nature of lab space facilities – which typically have HVAC and electrical infrastructure that would be costly to retrofit into a traditional corporate office building – serves as a barrier to entry. ARE noted that “current vacancy rates continue to be very tight” in its core clusters and that unlike in traditional office markets that have seen signs of weakening demand in recent months, it’s not seeing significant sub lease activity in these markets.

The solid results were consistent with CBRE’s recent Lab Space report which noted that “despite caution by small and mid-sized companies, Big Pharma continued to gobble up space” which has driven the overall lab vacancy rate across the top 12 markets to another record-low last month. CBRE noted that life sciences employment increased by 5.5% year-over-year in Q2 2022, above its three-year average growth of 4.6%, helping to drive the overall lab vacancy rate across the top 12 markets lower by 10 basis points in Q2 to 5.2%. The average lab asking rent of the top 12 markets increased by another 5.8% quarter-over-quarter to $55/PSF – 20% higher on a year-over-year basis.

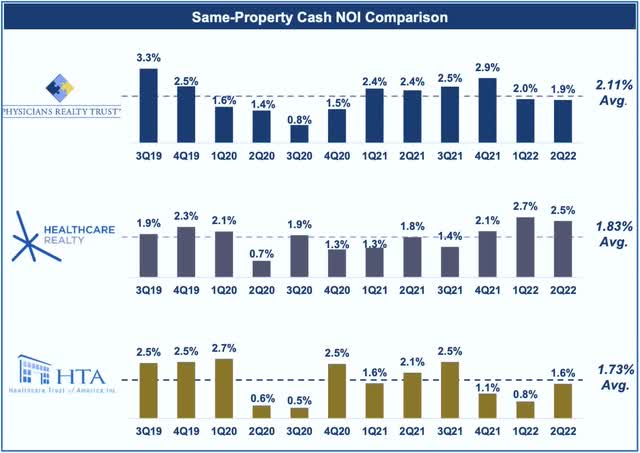

The typically-sleepy MOB space has been the center of attention in recent quarters following the merger between Healthcare Realty (HR) and Healthcare Trust of America which created the largest pure-play medical office building owner in the United States. The new company continues to operate with the Healthcare Realty name and still trades on the NYSE under the ticker symbol HR. A segment known for its stability and recession resistance, on-the-ground fundamentals have been less dynamic as MOB REITs continue to report relatively steady occupancy rates and limited new supply. With the majority of MOB leases being structured as long-term triple-net leases with fixed annual escalators resulting in steady 1-3% rent growth, persistently elevated inflation remains a risk factor.

Senior Housing Fundamentals

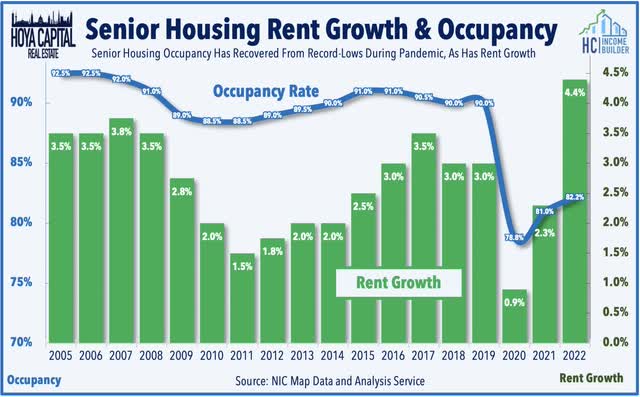

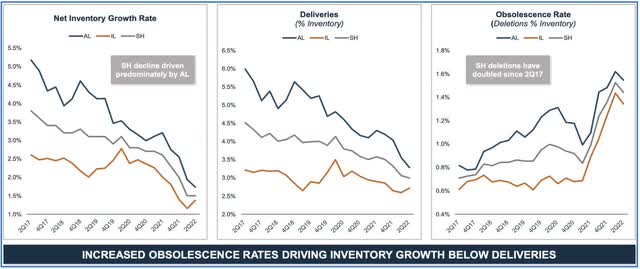

While we await earnings results from senior housing REITs which begin next week, we did get a glimpse into recent fundamental trends through the closely-watched National Investment Center (“NIC”) quarterly senior housing report. Consistent with recent interim updates from Welltower and Ventas, NIC reported that quarterly senior housing demand was at its highest level since NIC MAP Vision began reporting the data in 2005. All housing types, particularly assisted living, saw improved occupancy for the quarter. The NIC report showed that senior housing occupancy rates increased for the fifth consecutive quarter in Q3, rising 80 basis points to 82.2% – a 420 basis point improvement from its pandemic low of 78% in early 2021. Operators were able to achieve rent growth of 4.4% – the strongest quarter on record – led by a record-high 4.9% rent growth in assisted living facilities, which had seen more significant occupancy declines during the pandemic than the independent living segment.

Also of note, NIC reported a continued slowdown in inventory growth to the lowest since 2013 – good news for senior housing REITs as supply growth had been the most persistent headwind for the senior housing sector before the pandemic. The relentless supply growth over the past several years put constant downward pressure on rental rates and occupancy even before the pandemic, but a silver lining of the pandemic will be the likely pullback in supply growth. Inventory growth in the second quarter was the weakest since 2013, while new construction starts as a percent of inventory declined to around 1.4% in Q3, the lowest since 2014, consistent with Welltower’s projections of a “precipitous decline in starts resulting from accelerating construction costs and challenges in construction financing.”

Skilled Nursing REIT Fundamentals

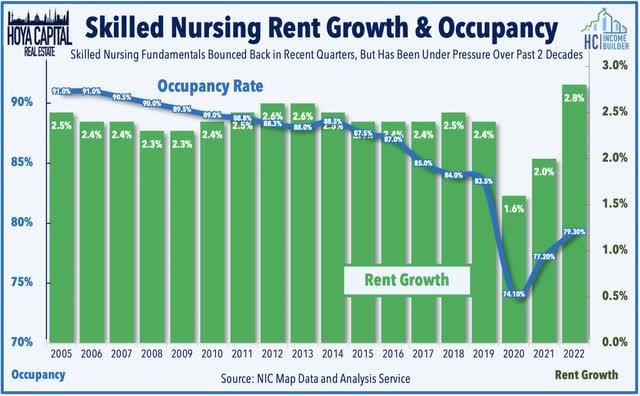

For skilled nursing REITs, the recovery in occupancy rates can’t come fast enough as operator issues have re-emerged as government relief funds begin to dry up and as labor shortages persist. In its most recent update in September, Omega Healthcare (OHI) reported that it failed to collect 8% of its 2Q22 annualized contractual rent and mortgage obligations – which was an improvement from its prior update in Q2 earnings season in which it noted that it failed to collect 15% of its rent. Sabra (SBRA) noted in early August that its “cash collections remain in line with where they have been.” In the prior quarter, SBRA noted that it collected roughly 99.5% of its forecasted rents but disclosed potential collection issues from Avamere, its largest tenant at 9.3% of NOI. NIC data showed that SNF occupancy rates recovered to 79.3% in Q3, continuing a recovery from its pandemic low of 74% in the first quarter of 2021 but still far below its pre-pandemic level of 86.6%.

Healthcare REIT Dividend Yields

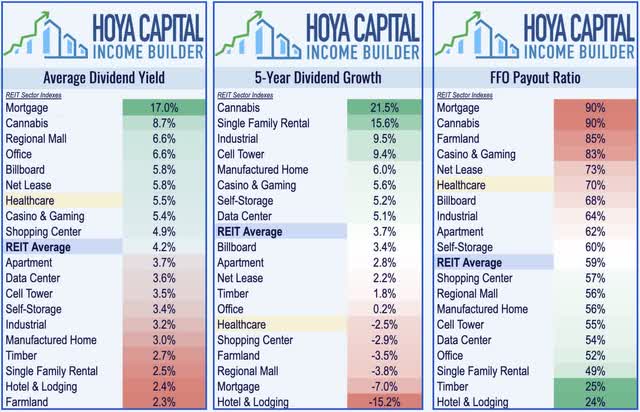

Healthcare REITs have historically been strong dividend payers and continue to rank toward the top of the REIT sector in that regard. Healthcare REITs currently pay an average dividend yield of 5.5% – well above the market-cap-weighted REIT sector average of 4.2%. While several healthcare REITs have delivered very strong dividend growth in recent years, on average, the sector has seen muted dividend growth over the past half-decade.

With a reasonable payout ratio of around 70%, on average, we believe that current dividend levels for healthcare REITs look healthy and sustainable. Six healthcare REITs have boosted their dividend this year led by a 5% bump from Alexandria Real Estate (ARE) while one REIT – National Health Investors (NHI) has reduced its payout. Dividend yields of the individual names in the healthcare REIT sector range from a low of 3.57% from Alexandria Real Estate to a high of 11.35% from Medical Properties (MPW).

Takeaway: Positive Prognosis As Labor Shortage Eases

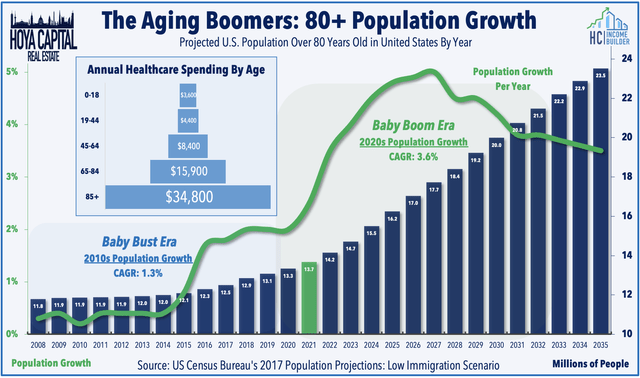

Healthcare REITs have lagged over the past quarter as sharply higher labor costs, a sluggish post-COVID recovery in patient volumes, and the waning of government fiscal support have pressured operators. Margin pressure from the reliance on third-party nursing agencies to plug staffing gaps has been the most pressing issue, but recent data suggest that the pressures may be easing. Several “battleground” REITs in these labor-intensive sub-sectors have come into the cross-hairs of short-selling firms and have been slammed particularly hard amid concerns over tenant financial health, but we now see risks skewed to the upside. We’d prefer to skew our longer-term exposure toward “private pay” sectors – senior housing, medical office, and lab space – which should more directly benefit from structural tailwinds associated with the aging population and shift towards lower-cost healthcare settings.

For an in-depth analysis of all real estate sectors, be sure to check out all of our quarterly reports: Apartments, Homebuilders, Manufactured Housing, Student Housing, Single-Family Rentals, Cell Towers, Casinos, Industrial, Data Center, Malls, Healthcare, Net Lease, Shopping Centers, Hotels, Billboards, Office, Farmland, Storage, Timber, Mortgage, and Cannabis.

Disclosure: Hoya Capital Real Estate advises two Exchange-Traded Funds listed on the NYSE. In addition to any long positions listed below, Hoya Capital is long all components in the Hoya Capital Housing 100 Index and in the Hoya Capital High Dividend Yield Index. Index definitions and a complete list of holdings are available on our website.

Be the first to comment