janiecbros

REIT Rankings: Healthcare

This is an abridged version of the full report published on Hoya Capital Income Builder Marketplace on July 26th.

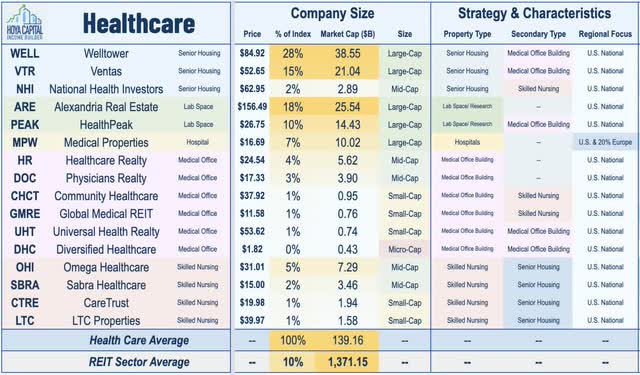

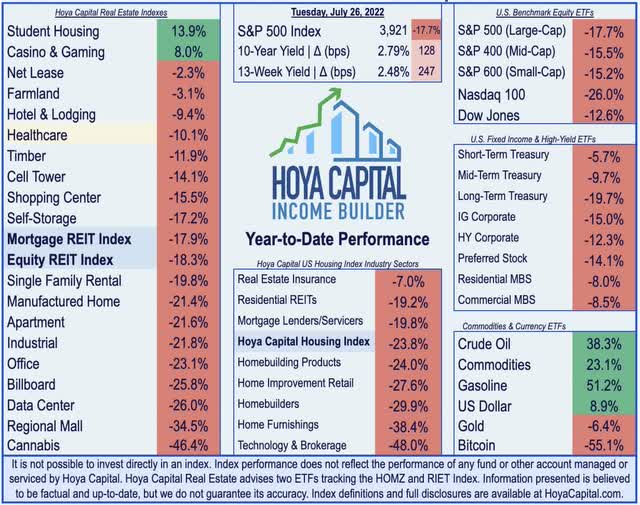

Healthcare REITs – the weakest-performing property sector last year – have been among the top-performing property sectors in 2022, benefiting from their status as relatively defensive and recession-resistant REITs. The ebbing of the COVID pandemic has sparked a much-needed recovery in Senior Housing and Skilled Nursing fundamentals, which were challenged by record-low occupancy rates and crippling labor shortages. A sharp slowdown in biotechnology fundraising activity, however, has slammed the previously high-flying lab space REITs while the rising rate environment has cooled some of the upward momentum for acquisition-focused medical office and hospital-focused REITs. Within the Hoya Capital Healthcare REIT Index, we track all 16 healthcare REITs, which account for roughly $140 billion in market value.

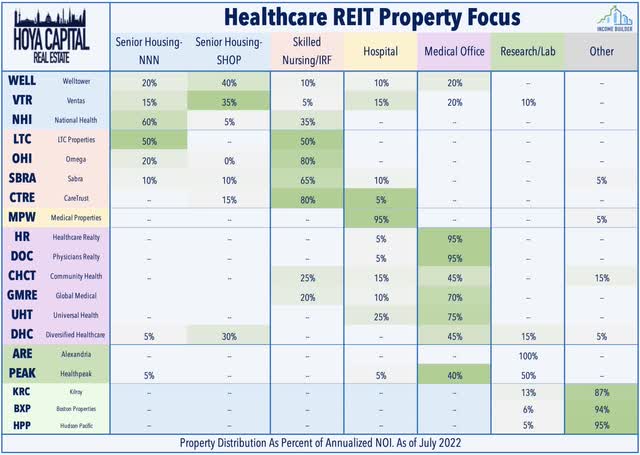

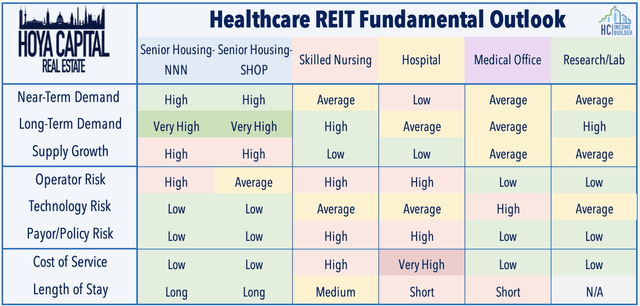

Healthcare REITs – which were literally “ground zero” of the COVID pandemic – will experience lasting effects – both positively and negatively – from the (hopefully) once-in-a-generation pandemic. Previously seen as one of the more “bond-like” REIT sectors due to the predictable nature of healthcare demand along with their heavy use of long-term triple net lease structures, healthcare REITs fundamentals are finally beginning to normalize after several years of dramatic dislocations. There are five distinct sub-sectors within the healthcare REIT category – senior housing, skilled nursing, hospital, medical office, and research/lab space. The senior housing sub-sector is comprised of independent living, assisted living, and memory care facilities – which REITs typically categorize based on lease structure: triple-net leased (“NNN”) properties and senior housing operating (“SHOP”) properties.

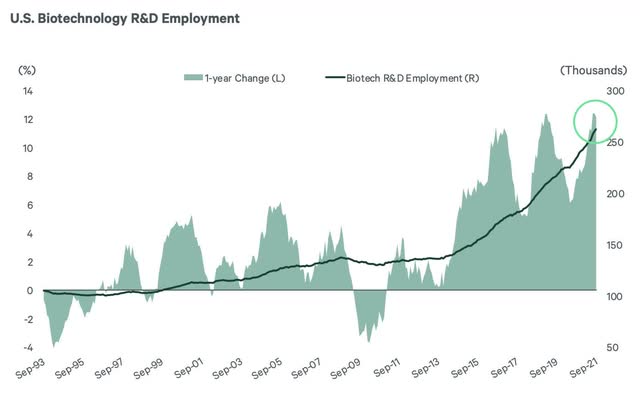

Each of these sectors has distinct risk/return characteristics and has been affected by the pandemic in varying intensities. While SHOP facilities were the hardest hit by the pandemic, no sector was entirely immune. For the “public pay” Skilled Nursing Facilities (“SNF”) and hospitals REITs – which rely heavily on Medicare and Medicaid reimbursements – the pandemic initially exasperated issues with their troubled operators before a wave of government relief funds temporarily quelled these concerns, but issues have re-emerged as funding dried up. Meanwhile, demand for Medical Office Building (“MOB”) space has remained steady throughout the pandemic after initial concerns that remote care or broader work-from-home trends would materially impact space demand. Lab space demand has boomed from a “biotech bonanza” of record levels of biotechnology and pharmaceutical fundraising activity, fueling insatiable demand for specialized lab space in several key research clusters.

Healthcare REIT High-Level Fundamentals

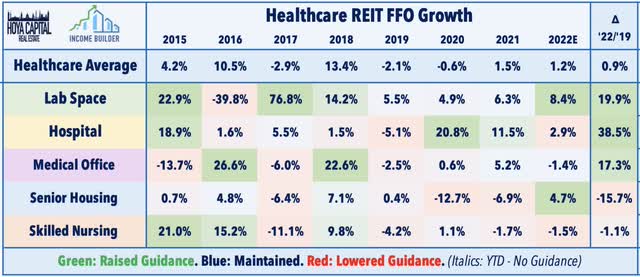

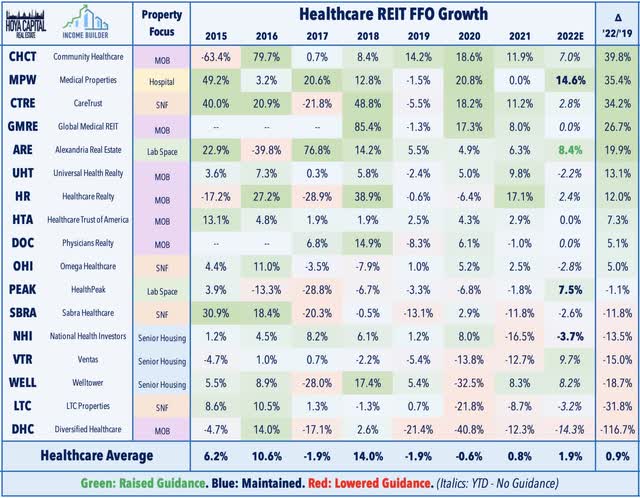

Senior housing REITs have taken on more operating exposure over the past decade as they attempt to mitigate the risks from third-party operators, a shift which has come back to bite these REITs in recent years, particularly during the pandemic. The result of this shift and the broader bifurcation in operating performance between these healthcare sub-sectors is apparent in their reported Funds From Operations (“FFO”) metrics as senior housing FFO will is expected to remain more than 10% below pre-pandemic levels in 2022. Skilled Nursing FFO has remained relatively flat as significant government stimulus funds temporarily eased persistent tenant struggles. On the other side of the healthcare sector, medical office FFO is expected to be about 17% above 2019-levels while lab space REITs are expected to record FFO that is nearly 20% above pre-pandemic levels this year.

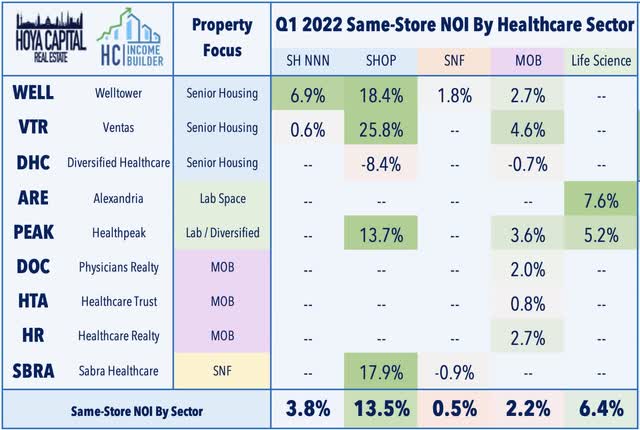

Looking deeper at property-level metrics, while Senior Housing lagged on the downside during the pandemic, it’s now leading the upside recovery. Welltower and Ventas posted same-store Net Operating Income (“NOI”) growth of around 20% in their SHOP segments in Q1 and recent updates have indicated that the momentum has continued in recent months. Life sciences properties continue to see mid-to-high single-digit NOI growth while medical office properties are seeing modest 2-4% NOI growth depending on the lease structure. Skilled nursing fundamentals, however, are far shakier than the muted FFO and NOI metrics suggest as the triple-net structure allowed these REITs to avoid much of the immediate downside from property-level operations, but tenant operator issues have reemerged as relief funds have dried up, so non-payment of rent has become a mounting issue for some SNF assets.

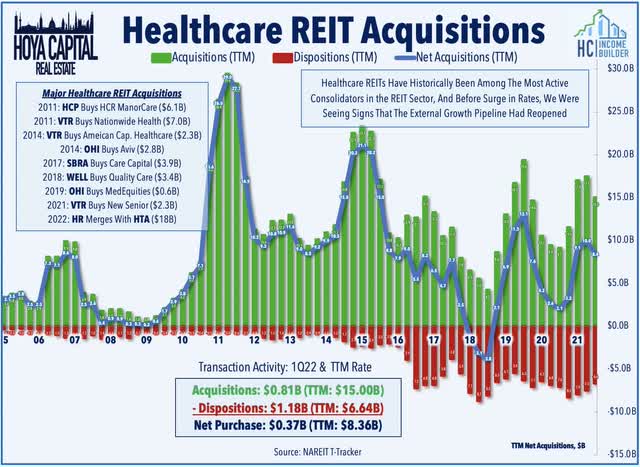

Plentiful acquisition opportunities have been a silver lining of the pandemic and we projected that we may see a “buying spree” similar to the prior recession when these REITs acquired tens of billions of dollars worth of assets from troubled operators. Healthcare REITs have historically been among the most active acquirers and consolidators, using the competitive advantages of their REIT structure to fuel accretive external growth. While rising rates have slowed transactional activity in the real estate sector significantly this year, Healthcare REITs have still acquired nearly $10B in net assets over the last twelve months, one of the largest hauls since the mid-2010s.

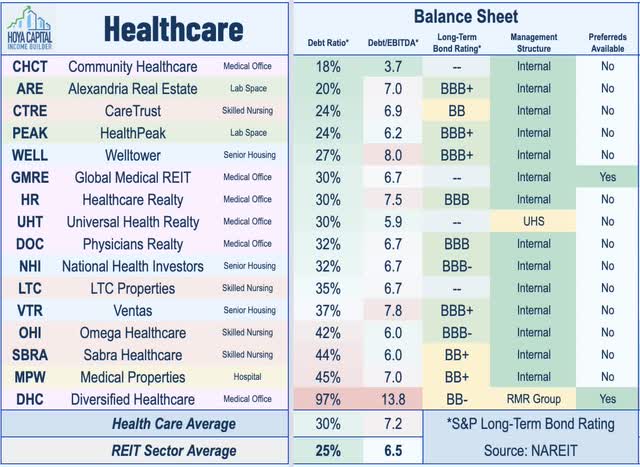

Importantly, many of the larger healthcare REITs operate with some of the more well-capitalized balance sheets across the real estate sector, and ample access to capital is one of the persistent strengths of the sector, allowing for accretive external growth via acquisitions which we believe may be more plentiful over the next several years as weaker private operators get “shaken out” by the pandemic’s lingering impacts. Eight of the eighteen REITs command investment-grade bond ratings from S&P. The average healthcare REIT had a debt ratio of 30% compared to the 25% REIT sector average, and the sector trades also in line with the REIT Average based on Debt/EBITDA metrics.

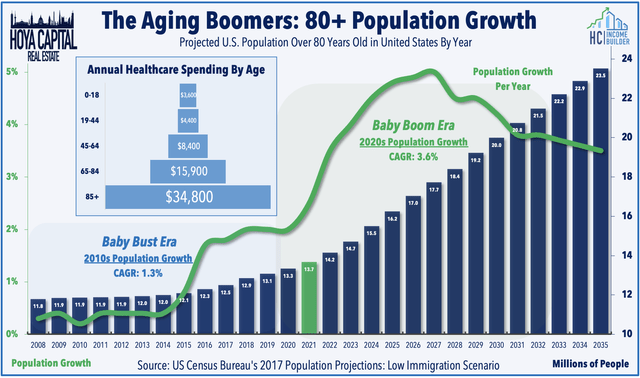

Helping to provide some additional light at the end of the tunnel for the entirety of the healthcare REIT sector, the demographic-driven demand boom from the aging Baby Boomer generation is finally on the horizon. After years of stagnation in the critical 80+ population cohort, this age segment will nearly double over the next 30 years and grow at an estimated 4% per year through 2040. The Boomer generation is substantially wealthier than the Silent Generation that preceded it and driven by robust home price appreciation and stock market gains, Boomers have accumulated $1.6 trillion in excess savings over the past two years according to recent Federal Reserve data.

Healthcare REIT Performance

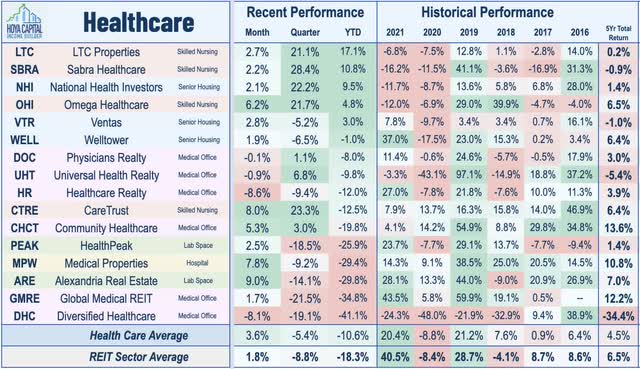

Propelled by the long-awaited waning of the COVID pandemic, healthcare REITs have been among the performance leaders thus far in 2022. The sector was slammed during the early onset of the outbreak and after a post-vaccine resurgence, the share price recovery stalled in the back half of 2021 amid the Delta and Omicron waves, and healthcare REITs ended the year as the worst-performing REIT sector with total returns of 16%, underperforming the 41% returns on the Equity REIT Index. Closely mirroring the COVID cases-count trends, healthcare REITs have posted solid outperformance this year with the Hoya Capital Healthcare REIT Index lower by 10.1% in 2022 compared to the 18.3% decline from the market-cap-weighted Vanguard Real Estate ETF (VNQ) and the 17.7% decline from the S&P 500 (SPY).

Diving deeper into notable individual performances, skilled nursing and senior housing REITs have led the way in 2022. Notably, 5 of the 7 REITs in these sub-sectors have delivered positive total returns this year – the second highest percentage behind the casino REIT sector led by LTC Properties (LTC) and Sabra Health Care (SBRA) while Ventas (VTR) and Welltower (WELL) have also delivered notable outperformance. Lab space and office REITs have generally lagged this year, pressured by a rotation from growth and defensively-oriented REITs into more value-oriented and pro-cyclical sectors, but these REITs have caught a bid over the past month as interest rates and inflation expectations have receded.

Lab Space Fundamentals

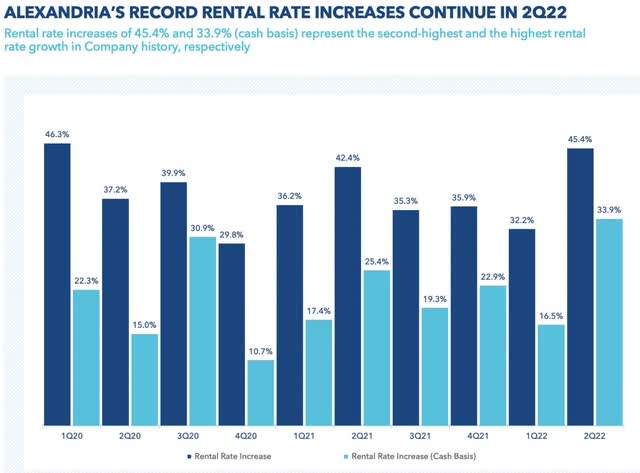

Lab space-focused Alexandria Real Estate (ARE) kicked off healthcare REIT earnings season this week with better-than-expected results and raised its full-year outlook. Despite the sharp cooldown in biotech venture capital and IPO activity – underscored by a 60% plunge in the S&P Biotech ETF (XBI) from its peaks in early 2021 to its recent bottom in June – lab space demand showed few signs of cooling as ARE’s beat was driven by a record rental rate increase – 45.4% GAAP and 33.9% cash – and a historically high leasing volume of 2.3M square feet, the third-highest quarter of leasing volume in the company’s history. ARE now sees FFO growth of 8.4% this year – up 40 basis points from its prior outlook – and raised its same-store NOI growth outlook by 30 basis points to 7.8% at the midpoint.

On its earnings call, ARE commented that demand is “consistent with the past two years with no significant drop in our quarters” and reiterated that the specialized nature of lab space facilities – which typically have HVAC and electrical infrastructure that would be extremely costly to retrofit into a traditional corporate office building – serves as a barrier to entry. ARE noted that “current vacancy rates continue to be very tight” in its core clusters and that unlike in traditional office markets that have seen signs of weakening demand in recent months, it’s not seeing significant sub lease activity in these markets. In its most recent Life Sciences report, CBRE noted that life sciences employment increased by 5.4% year-over-year in Q1 2022, above its three-year average growth of 4.7%, helping to drive the overall lab vacancy rate across the top 12 markets lower by 30 basis points in Q1 to 5.3%.

Senior Housing Fundamentals

While we await earnings results from senior housing REITs which begin next week, we did get a glimpse into recent fundamental trends through the closely-watched National Investment Center (“NIC”) quarterly senior housing report and through recent REITweek updates. In early June, Welltower (WELL) boosted the midpoint of its Q2 adjusted FFO to $0.855 – up from $0.845 – citing improving senior housing occupancy and “robust” pricing power. Welltower – which has been among the most active acquirers of any REIT in recent quarters – also announced a major $502M acquisition of a 25-property senior apartment portfolio from Calamar. Upon completion of the deal, Welltower will own nearly 10,000 age-restricted rental housing units under its Wellness Housing platform and will fund the deal, in part, with OP UPREIT units. Wellness Housing properties operate with low-to-no staffing and an average length of stay of approximately 5 years, resulting in operating margins and capex budgets closer to the multifamily sector.

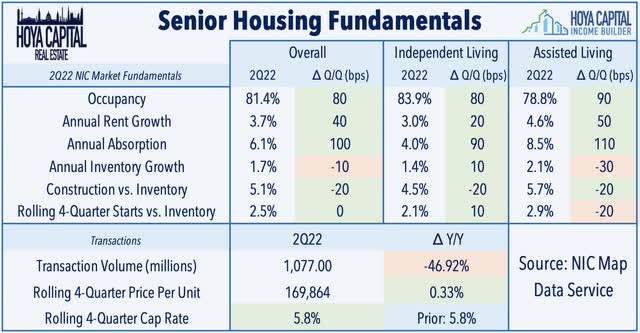

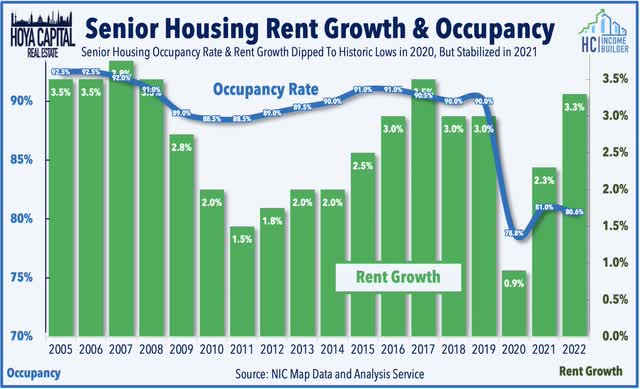

Encouragingly, NIC reported that quarterly senior housing demand was at its highest level since NIC MAP Vision began reporting the data in 2005. All housing types, particularly assisted living, saw improved occupancy for the quarter. The NIC report showed that senior housing occupancy rates increased for the fourth consecutive quarter in Q2, rising 80 basis points to 81.4%, representing nearly 400 basis point improvement from its pandemic low of 78% in early 2021. Operators were able to achieve rent growth of 3.7%, the strongest quarter of rent growth since 2017, led by a record-high 4.6% rent growth in assisted living facilities, which had seen more significant occupancy declines during the pandemic than the independent living segment.

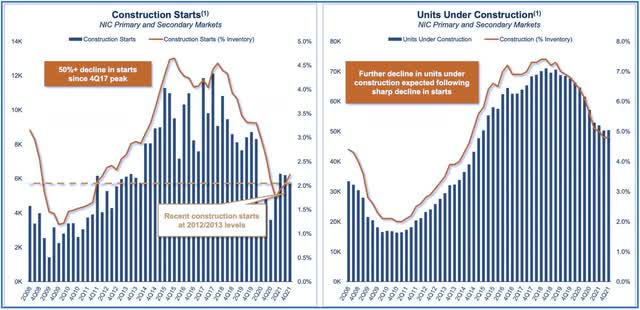

Also of note, NIC reported a continued slowdown in inventory growth to the lowest since 2013 – good news for senior housing REITs as supply growth had been the most persistent headwind for the senior housing sector before the pandemic. The relentless supply growth over the past several years put constant downward pressure on rental rates and occupancy even before the pandemic, but a silver lining of the pandemic will be the likely pullback in supply growth. Inventory growth in the second quarter was the weakest since 2013, while new construction starts as a percent of inventory declined to around 1.7% in Q2, the lowest since 2014, consistent with Welltower’s projections of a “precipitous decline in starts resulting from accelerating construction costs and challenges in construction financing.”

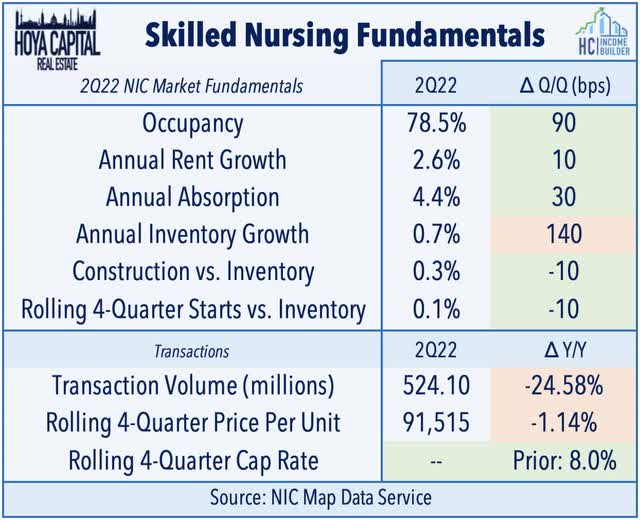

Skilled Nursing REIT Fundamentals

For skilled nursing REITs, the recovery in occupancy rates can’t come fast enough as operator issues have re-emerged as government relief funds begin to dry up and as labor shortages persist. Operator struggles are certainly nothing new for SNF REITs and remain the primary source of near-term and medium-term risk. In its most recent update in June, Omega Healthcare (OHI) reported that it failed to collect 15% of its 1Q22 annualized contractual rent and mortgage obligations – which was an improvement from its prior update in Q1 earnings season in which it noted that it failed to collect 18% of its rent in March. Sabra (SBRA) noted in late 2021 that Avamere, its largest tenant at 9.3% of NOI, experienced cash flow constraints resulting from admission bans and increased labor pressures, but through its latest update in May, it has continued to collect 99.5% of our its forecasted rents from the beginning of the COVID-19 pandemic through April 2022, including 100% of Avamere’s rent under its previous and amended leases.

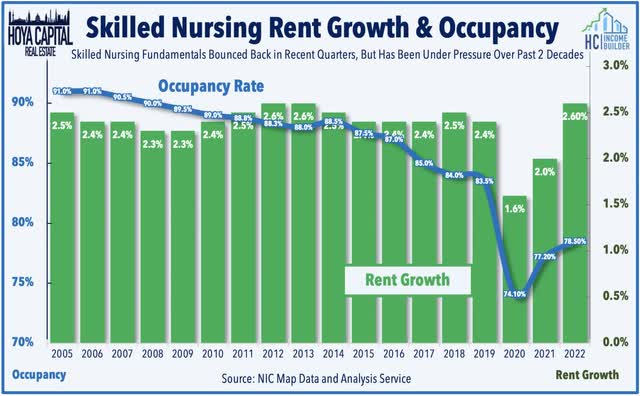

NIC data showed that SNF occupancy rates recovered to 78.5% in Q2, continuing a recovery from its pandemic low of 74% in the first quarter of 2021 but still far below its pre-pandemic level of 86.6%. Staffing shortages remain critical issues at skilled nursing facilities, pressuring not only operating margins but also forcing some facilities to turn away new business. According to a survey from the NCAL, facilities cited the lack of qualified interested candidates which most attributed to a combination of unemployment benefits, vaccine mandates, and uncompetitive wages. A recent survey by NIC found that only 20% of SNF operators anticipate that staffing challenges will improve in the next year with an increasing number of operators expecting expenses to outpace revenue growth over the coming year.

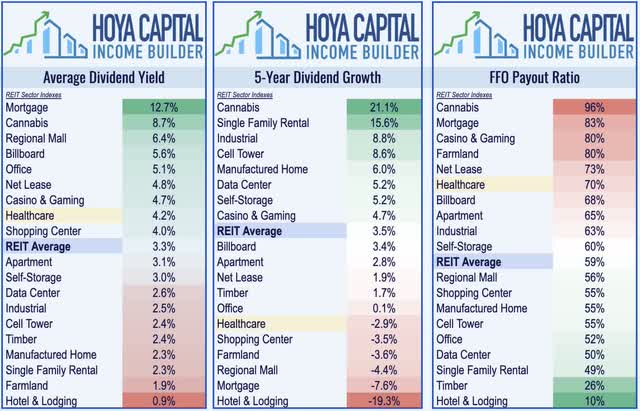

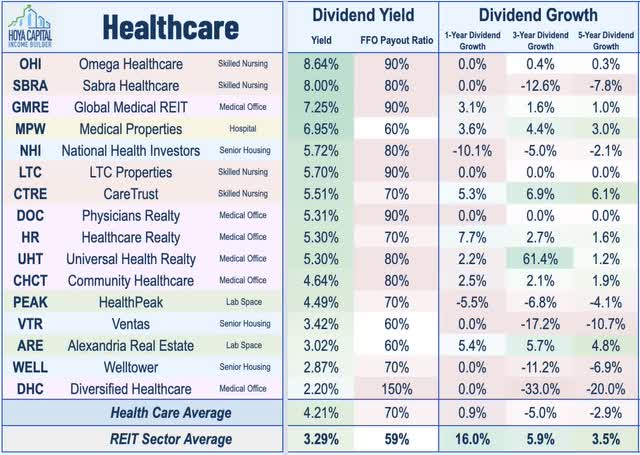

Healthcare REIT Dividend Yields

Healthcare REITs have historically been strong dividend payers and continue to rank towards the top of the REIT sector in that regard. Healthcare REITs currently pay an average dividend yield of 4.2% – well above the market-cap-weighted REIT sector average of 3.3%. While several healthcare REITs have delivered very strong dividend growth in recent years, on average, the sector has seen muted dividend growth over the past half-decade.

With a reasonable payout ratio of around 70%, on average, we believe that current dividend levels for healthcare REITs look healthy and sustainable. Eight healthcare REITs boosted their dividend last year while another four have raised their payouts this year: Community Healthcare (CHCT), Medical Properties (MPW), Global Medical (GMRE), and CareTrust (CTRE). Dividend yields of the individual names in the healthcare REIT sector range from a low of 2.20% from Diversified Healthcare (DHC) which cut its dividend last March to a high of 8.64% from Omega Healthcare (OHI).

Takeaway: Coming Out Of Rehab

Healthcare REITs – the weakest-performing property sector last year – have been among the top-performing REIT sectors in 2022, benefiting from their status as relatively defensive and recession-resistant REITs. The ebbing of the COVID pandemic has sparked a much-needed recovery in Senior Housing and Skilled Nursing fundamentals, which were challenged by record-low occupancy rates and crippling labor shortages. While healthcare REIT valuations are at the upper-end of the warranted range, we remain optimistic about the long-term outlook for the senior housing, medical office, and lab space REITs given the structural-demographic tailwinds and moderating supply growth.

For an in-depth analysis of all real estate sectors, be sure to check out all of our quarterly reports: Apartments, Homebuilders, Manufactured Housing, Student Housing, Single-Family Rentals, Cell Towers, Casinos, Industrial, Data Center, Malls, Healthcare, Net Lease, Shopping Centers, Hotels, Billboards, Office, Farmland, Storage, Timber, Mortgage, and Cannabis.

Disclosure: Hoya Capital Real Estate advises two Exchange-Traded Funds listed on the NYSE. In addition to any long positions listed below, Hoya Capital is long all components in the Hoya Capital Housing 100 Index and in the Hoya Capital High Dividend Yield Index. Index definitions and a complete list of holdings are available on our website.

Be the first to comment