VJ/iStock Editorial via Getty Images

Investment thesis

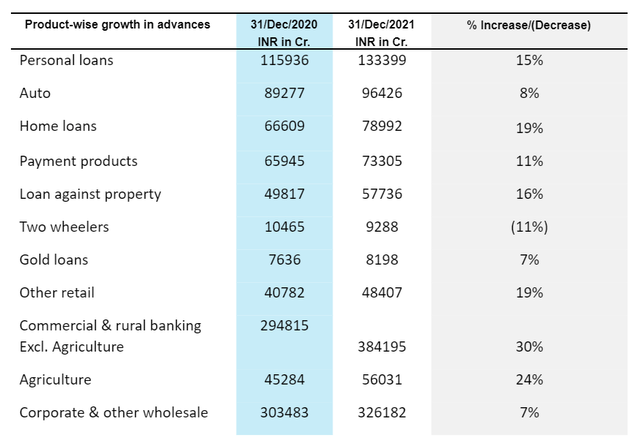

HDFC Bank (NYSE:HDB) recently announced a merger with HDFC Ltd. This mega-merger between HDFC Ltd. and HDFC Bank is set to bring a plethora of synergies and give birth to a financial behemoth. The bank also got positive news from the Reserve Bank of India (RBI) last month which lifted the restrictions on HDFC bank’s Digital 2.0 programme on March 11, 2022. The bank can now roll out its new digital initiatives. HDFC is also benefiting from the recovery in the Indian economy. Last quarter, the company reported a robust year-over-year growth of 16.5 percent and 13.8 percent in advance and deposits, a high liquidity coverage ratio of 123 percent and 10.5 percent year over year growth in standalone pre-provision operating profit. In the loan portfolio, except for the two-wheelers segment, all other loan segments have experienced either high-single-digit or double-digit growth on a year-over-year basis (see table below), indicating how the bank is benefiting from the recovering Indian economy. The bank is positioned well to capitalize on the growth opportunity as the economy recovers from the Covid related slowdown. We have assigned a buy rating on the stock.

HDFC Bank Product wise growth in advances (Company Data, GS Analytics Research)

Last Quarter Earnings Recap

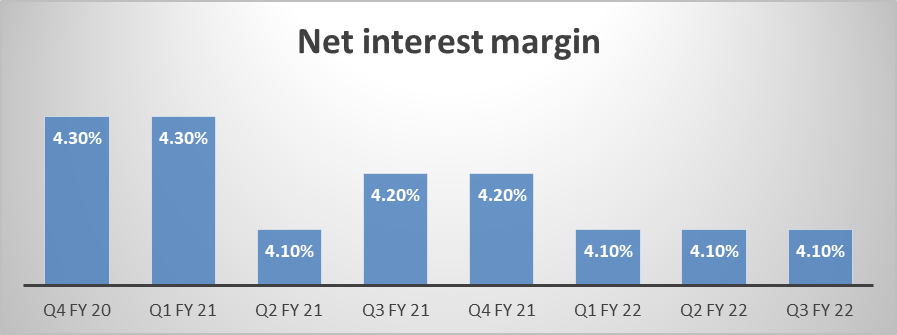

HDFC is the #1 private sector bank in India and is positioned well to benefit from a recovery in the Indian economy. Earlier this year, HDFC Bank reported third-quarter results for the period ending December 31, 2021, with standalone net revenue rising by 12.1 percent year on year from INR 23,760.8 Cr to INR 26,670 Cr., owing to overall advance growth of 16.5 percent and the deposit growth of 13.8 percent. On a year-on-year basis, net interest income increased by 13 percent. At 4.1 percent, the net interest margin remains unchanged. Other income, which accounts for about 30.7 percent of net revenue, increased by 9.9 percent from INR 7,443.2 crores in the same quarter last year to INR 8,183.6 crores. Fees and commission accounted for two-thirds of other income, up 2 percent year over year, driven by a 17 percent increase in fees, excluding payment products partly offset by lower fees on card loan products, cash advances, and overdraft fees reflecting the bank’s cautious approach to card-based lending. Operating expenses increased 14.9 percent over the previous year owing to a 20 percent increase in employee-related costs and 12.6 percent in other operating costs. Increased revenue and lower provisioning partially offset an increase in operating costs, resulting in an 18.1 percent increase in net profit to INR 10,342.2 crores.

Transformational merger of HDFC bank with HDFC Limited

The board of directors of HDFC Bank Limited, at the meeting held on April 04, 2022, approved a composite scheme of amalgamation of (i) HDFC Investments Limited and HDFC Holdings Limited, into Housing Development Finance Corporation Limited (“HDFC Limited”); and (ii) HDFC Limited into HDFC Bank. Shareholders of HDFC Limited will receive 42 shares of HDFC Bank for 25 shares of HDFC Limited. The deal is expected to bring a plethora of synergies like cross-selling to a large and growing customer base, leveraging the power of distribution in urban, semi-urban, and rural geographies, multi-decade mortgage underwriting expertise across credit cycles, underwriting of larger ticket size loans, including infrastructure loans, and last but not least, this merger is going to make a lot of sense for customers of both the organization who will have more access points and can benefit from complimentary product and services. The deal is expected to complete within 18 months subject to completion of regulatory approvals. Post-merger, existing shareholders of HDFC Limited will own 41 percent of HDFC Bank. The merged entity could become the third-largest listed company in India in terms of market capitalization with a significant weighting in the country’s benchmark NSE Nifty Index.

Restrictions on the Digital 2.0 program lifted

The RBI lifted the restriction on HDFC Bank’s business generating activities planned under the Bank’s Digital 2.0 program as of March 11, 2022. Because of repeated technology outages, the RBI had advised the bank against sourcing new card customers and also prohibited the bank from launching new digital initiatives in an order dated December 2, 2020. Although the RBI in August 2021 allowed it to issue new credit cards, the ban on introducing new digital initiatives remained in place. The bank has issued 9.5 lakh cards in the last quarter and 13.7 lakh cards since August. Credit card print and debit card printing have increased by 22% and 14% on a year on year basis. We believe that this momentum will continue in the future as HDFC Bank is well-positioned to gain market share in the card business thanks to its strong retail, CASA, and salary account franchise. Further, with the lifting of the ban on digital initiatives now, the bank’s customer acquisition will accelerate and add to the momentum that it is seeing in the cards business.

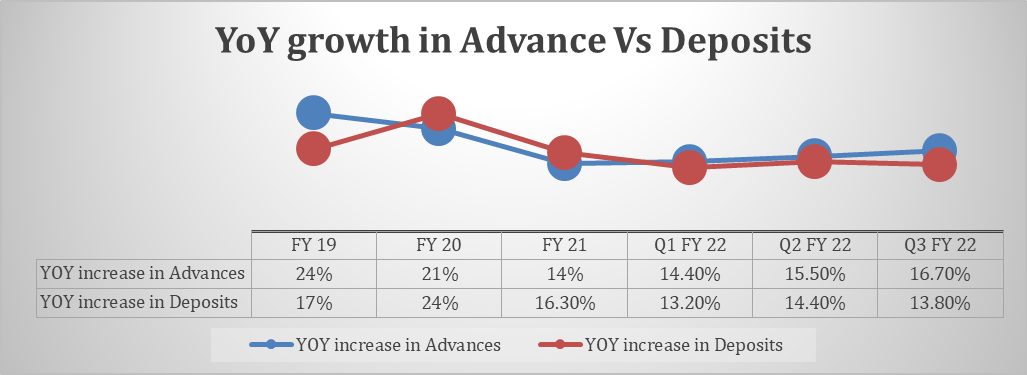

Strong loan and deposit growth to drive NII

HDFC Bank’s total deposits were INR 14,45,918 Cr. as of December 31, 2021, up 13.8 percent from the previous year. Current and Saving Account (CASA) deposits increased by 24.6 percent from the previous year. CASA deposits account for 47 percent of total deposits as of December 2021. Total advances as of December 2021 were INR 12,60,863 Cr, up by 16% from the previous year. As shown in the chart below, advances grew faster than deposits during the last three quarters, indicating an acceleration in lending activities as the economy recovers post-Covid. This bodes well for future NIMs of the bank.

HDFC Bank’s Y/Y growth in advance and deposits (Company Data, GS Analytics Research)

Commercial and Rural banking advances outpaced overall growth in advances last quarter, indicating underlying economic activity and continued market share gains. Retail and wholesale advances increased by 13.3 percent and 7.5 percent respectively. The net interest margin has remained flat at 4.1% this fiscal year. Despite monetary policy tightening by major central banks in response to global high inflation, RBI has so far taken a contrarian stand and prioritized growth over inflation. We believe that after a couple of quarters RBI can change its stance and begin raising interest rates, as a result of which NIM could regain its lost momentum from the pre-pandemic level.

HDFC Bank’s Net Interest Margins (Source: Company Data, GS Analytics Research)

Valuation and Conclusion

HDFC Bank Limited is currently trading at 23.44x FY22 EPS and 19.33x FY23 EPS. The stock has multiple catalysts which can drive earnings growth in the coming years including merger synergies, accelerating loan growth as the Indian economy recovers, and momentum from digital initiatives and card growth after the lifting of RBI’s restriction. The stock price has seen some upside after RBI lifted restrictions on digital initiatives and the announcement of the merger of HDFC Ltd. into HDFC Bank. We believe it is a good play on the secular growth potential of India with multiple medium-term catalysts and a reasonable valuation.

Be the first to comment