Rusty Russell

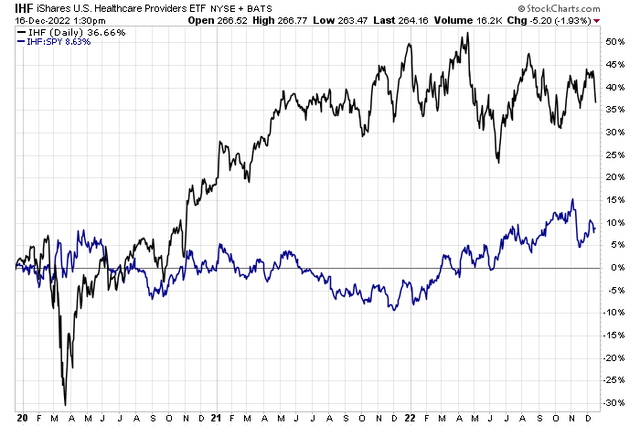

Healthcare providers have been in a steady uptrend against the S&P 500 for most of 2022. With sideways price action in the last 18 months, that means the industry has significant relative strength in a market of falling stocks and bonds. One major hospital firm is a big component in the iShares U.S. Healthcare Providers ETF (IHF) and features an interesting valuation and decent chart.

Safety in Health Care

Stockcharts.com

According to Bank of America Global Research, HCA Healthcare (NYSE:HCA) is the largest for-profit hospital company in the US, representing 4-5% of the hospital industry. HCA owns and operates 184 hospitals with approximately 48,500 beds, as well as 125 freestanding surgery centers. The company also provides extensive outpatient and ancillary services.

The Tennessee-based $67.8 billion market cap Health Care Providers & Services industry company within the Health Care sector trades at a low 13.4 trailing 12-month GAAP price-to-earnings ratio and pays a small 0.9% dividend yield, according to The Wall Street Journal. The company was reiterated a pick from Credit Suisse’s HOLT model that looks at how a firm converts income to investment cash flow. Back in October, the company beat on the bottom line but missed analysts’ revenue expectations.

HCA is positioned well to cut costs in a tough macro operating environment which should help protect margins. While there has been a rebound post-Covid, recession risks could weigh on the stock, though. A strong balance sheet helps the valuation, but risks are seen if volumes fall, and its payor mix deteriorates. Moreover, labor costs are a key concern for HCA.

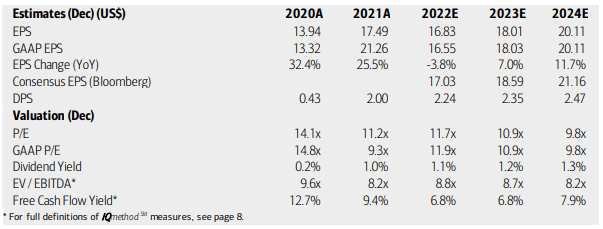

On valuation, analysts at BofA see earnings falling slightly in 2022, but then recovering modestly next year. A re-acceleration is seen in 2024. The Bloomberg consensus forecast is a bit more optimistic than what BofA sees. Dividends are expected to increase commensurate with earnings while the stock’s operating and GAAP P/Es should trade at reasonable levels given the growth outlook. With a single-digit EV/EBITDA multiple and solid free cash flow, I like the valuation picture.

HCA: Earnings, Valuation, Free Cash Flow Forecasts

BofA Global Research

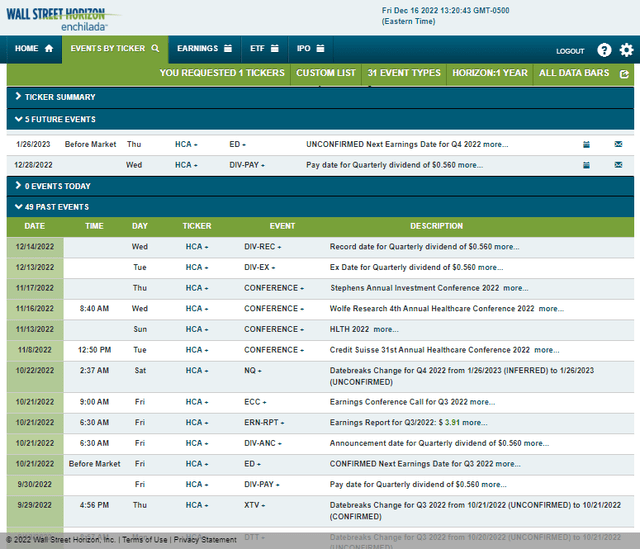

Looking ahead, corporate event data from Wall Street Horizon show an unconfirmed Q4 2022 earnings date of Thursday, January 26. Before that, a dividend pay date of December 28 is on the calendar. No other volatility catalysts are on the horizon.

Corporate Event Calendar

Wall Street Horizon

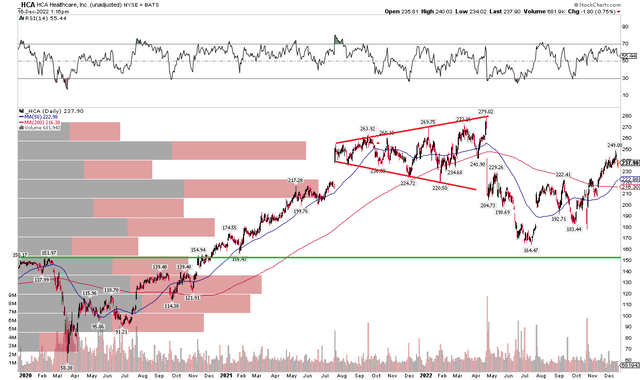

The Technical Take

HCA remains below a key bearish broadening formation from late 2021 through early 2022. The bulls want to see shares rise above $280. Although, the stock is above both its 50 and 200-day moving averages and is up big after notching a low back in July while the broad market struggles. I see long-term support in the $152 to $165 range while there could be near-term buyers in the $222 to $229 area. Overall, I like the stock’s relative strength lately, but the chart is not a slam dunk.

HCA: Bearish Broadening Formation, But Shares Hold Long-Term Support

Stockcharts.com

The Bottom Line

With a low-teens earnings multiple and improving profits next year and in 2024, HCA looks like a reasonable value here. Shares have also outpaced the broader market over the last six months, so I would not be surprised to see a year-end rally. I think both long-term and short-term investors have reasons to like HCA.

Be the first to comment