cemagraphics

Since I put out my bullish piece on Hawkins, Inc. (NASDAQ:HWKN), the shares are up about 8.27%. I’ve insisted on only ever buying this stock when the shares drop nicely in price, and this approach has served me well. Now that the shares are more expensive, it’s worth reviewing the name again. The company has posted results since I last reviewed the business, and a stock that’s 8.27% more expensive is, by definition, more risky. In this article, I want to work out whether or not it makes sense to buy more, hold, or take my gains and run. The latest financial results and the current valuation will figure prominently in this decision.

I know that my writing style can be tiresome for many people. I’m the sort of person who’s absolutely passionate about solving other people’s problems, and in support of this effort, I provide a “thesis statement” paragraph in each of my articles. This paragraph gives you the highlights of my thinking, without exposing you to the bad jokes, industrial-scale bragging, and other tedium that you might be exposed to. I know your instinct is to compose symphonies and paint murals in my honour but please don’t. Knowing that I have your undying gratitude is thanks enough for me. Anyway, I’ll be buying more Hawkins this morning. In spite of the run-up in price, the shares are as compelling now as they were back in May. This is because profitability has exploded higher. I determined that the dividend is well covered in an earlier article, and nothing’s happened in the meantime to move me from that view. In spite of this, the shares are very reasonably priced. In my view, it makes sense to buy whenever shares are reasonably priced, no matter the level of anxiety in the overall market. I have faith that, sooner or later, buying good companies at good prices is rewarded.

Financial Snapshot

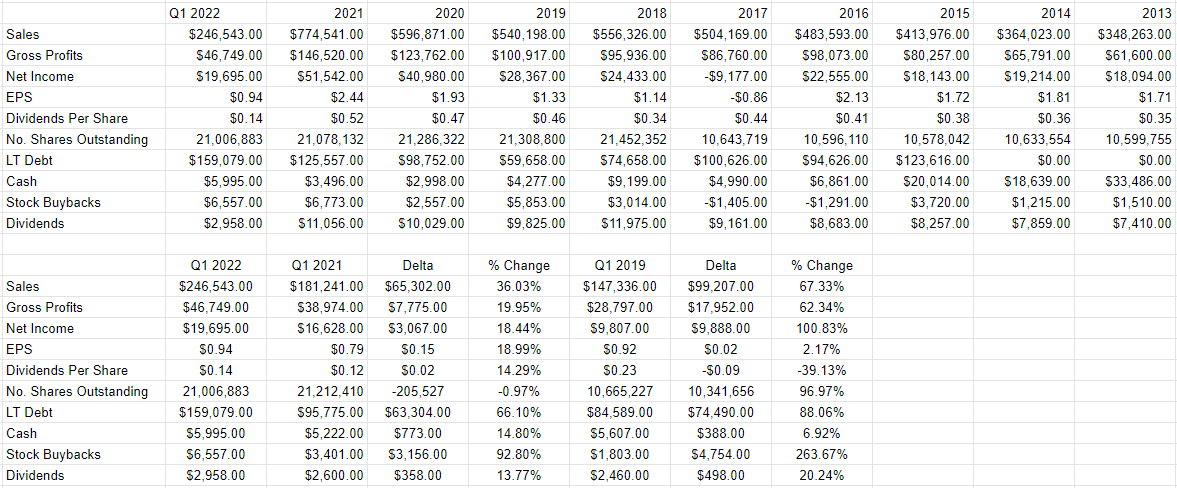

Once again, Hawkins has posted what I consider to be an excellent financial result. Specifically, revenue, gross profits, and net income in 2022 are higher by 36%, 20%, and 18.4% when compared to the same period in 2021. Management has seen fit to reward shareholders with another uptick in the dividend, which grew by about 14% from the year-ago period.

In case you’re concerned that I’m comparing the most recent quarter to a “soft” year, fret no further. The first quarter of 2022 is spectacular when compared to the same period in 2019, too. Revenue and net income are now 67%, and 100% higher than they were.

Nothing’s perfect, though, and Hawkins is no different in this regard. I’ve been moaning about the capital structure for a while now because long-term debt is about 66% higher now than it was this time last year. While that’s troubling, I would say that the debt is relatively cheap. For instance, the interest rate on the debt is currently about 1.2%, which is reasonable in my view. Additionally, the revolving credit facility doesn’t mature until April 30, 2027. So, although I don’t love the added debt, I’m not too concerned about it at the moment.

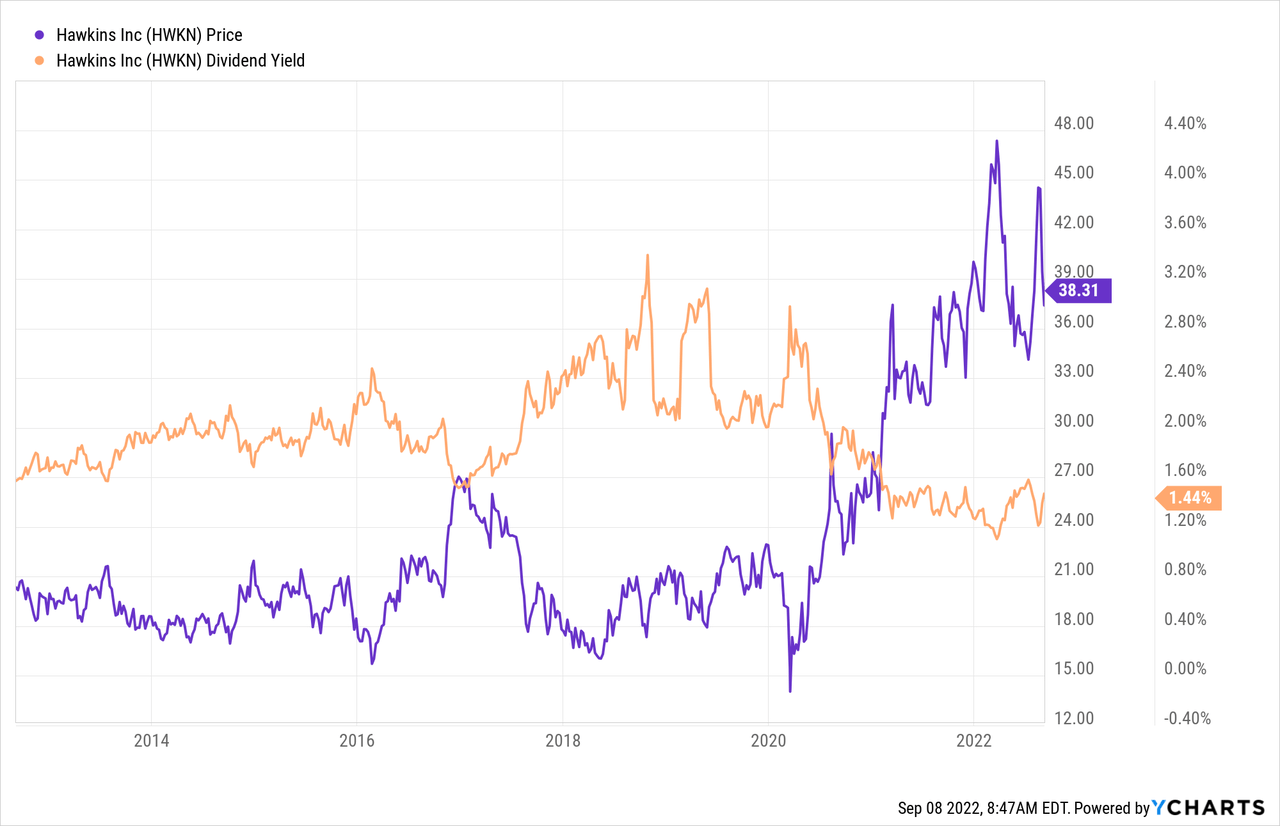

Finally, I should write that in earlier work I determined that the dividend is reasonably well covered and nothing’s happened in the meantime to change my mind on that.

Given all of this, I’d be happy to buy more at the right price.

Hawkins Inc. Financials (Hawkins Inc. investor relations)

The Stock

If you subject yourself to my stuff regularly, you know that I think the stock is distinct from the business in many ways. A business buys a number of inputs, like elements that go into various chemicals, adds value to them, and then sells the results for a profit. The stock, on the other hand, is a traded instrument that reflects the crowd’s aggregate belief about the long-term prospects for a given company, and it’s buffeted by a number of forces that may have little to do with the underlying business. For instance, a fashionable analyst may offer an opinion about a significant customer, and that drives the stock up and down. The crowd may form a view about the relative attractiveness of stocks in general, and that drives shares up or down. The stock of a given company may be affected by narratives about currencies, and the shares of a given company get taken along for the ride. Strangest of all, stock investors can be mesmerized by the pronouncements of Fed officials, who drive prices up or down massively because of a 25 basis point difference in the overnight rate. Anyway, every company is impacted by things like the relative changes of one currency or another, but you’d be forgiven for thinking the shares often “overreact.”

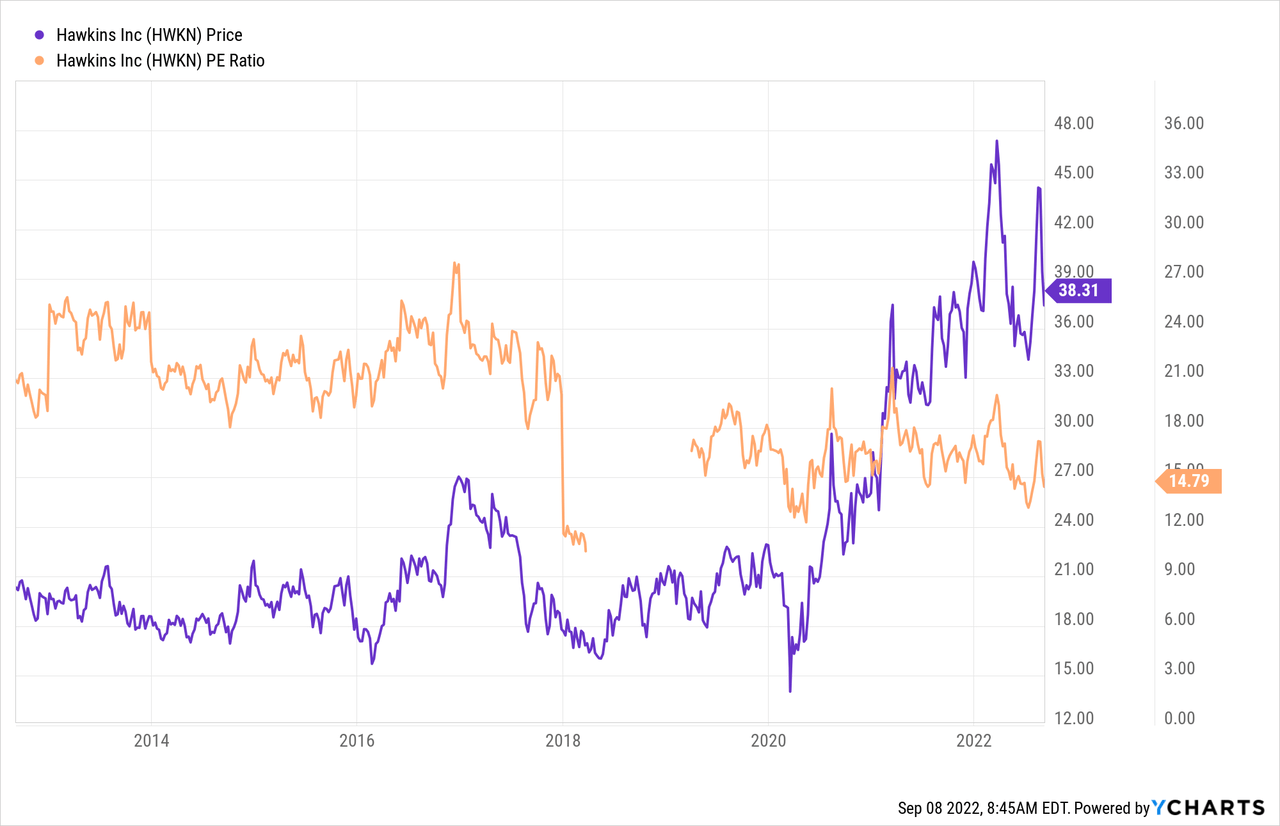

Although it’s tedious to see your favorite investment get buffeted around for reasons having little to do with the health of the business, within this tedium lies opportunity. If we can spot discrepancies between the price the crowd dropped the shares to, and likely future results, we’ll do well over time. It’s typically the case that the lower the price paid for a given stock, the greater the investor’s future returns. In order to buy at these cheap prices, you need to buy when the crowd is feeling particularly down in the dumps about a given name. Way back in February, I determined that the shares weren’t cheap enough because they were trading at 17 times earnings, and avoided them. This allowed me to avoid a 4% loss on the stock.

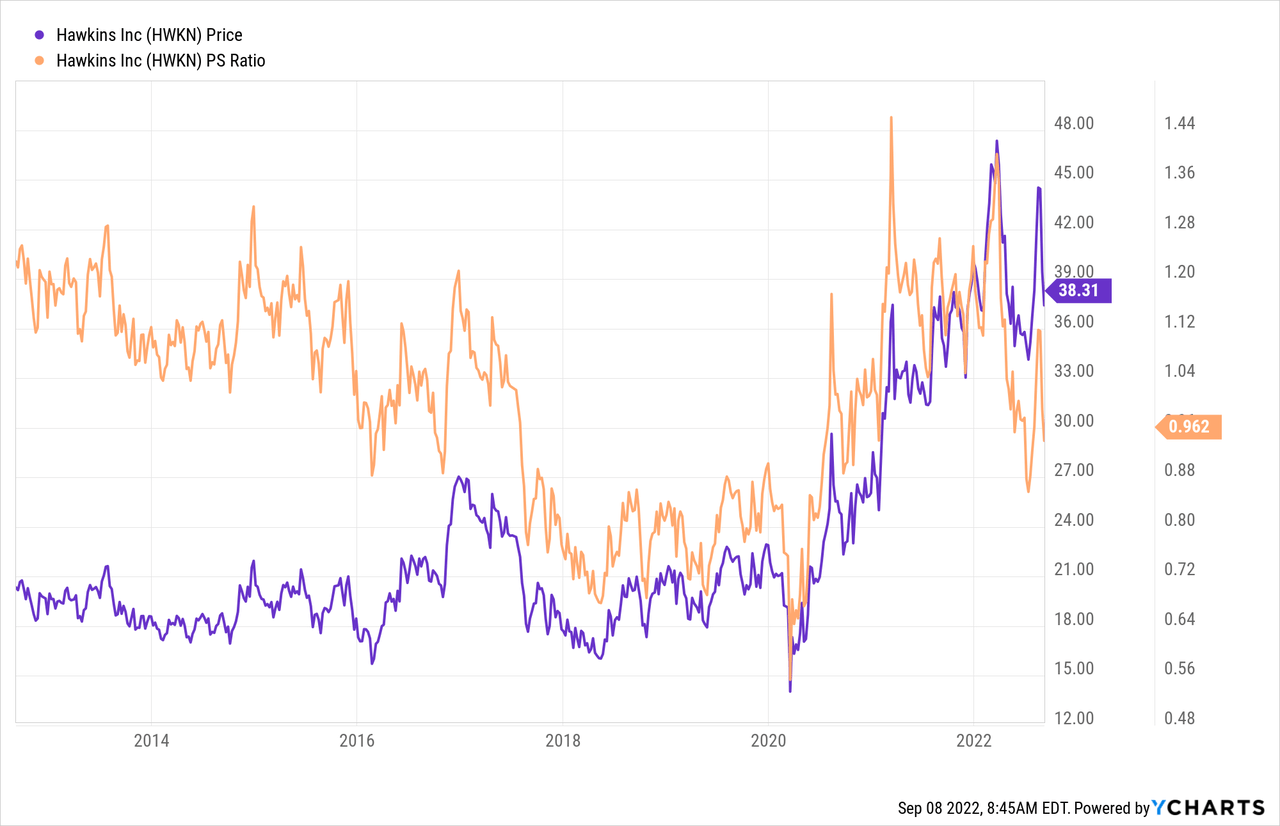

As my regulars know, when judging the cheapness (or not) of a stock, I like to look at the ratio of price to some measure of economic value, like earnings, sales, free cash, and the like. Because I think “cheaper wins”, I want to see a company trading at a discount to both the overall market, and the company’s own history. In case you’ve forgotten, I became excited when Hawkins finally dropped to a PE of 14.5 times, a price-to-sales ratio of 0.966, and a (well-supported) dividend yield of 1.48% back in May. Fast-forward to the present, and the valuation is virtually identical in spite of the recent run-up in price, per the following:

If you know I like cheap stocks, you also know that I want to try to understand what the market is currently “assuming” about the future of a given company. If you read me regularly, you know that I rely on the work of Professor Stephen Penman and his book “Accounting for Value” for this. In this book, Penman walks investors through how they can apply some pretty basic math to a standard finance formula in order to work out what the market is “thinking” about a given company’s future growth. This involves isolating the “g” (growth) variable in this formula. In case you find Penman’s writing a bit dense, you might want to try “Expectations Investing” by Mauboussin and Rappaport. These two have also introduced the idea of using stock price itself as a source of information, and then infer what the market is currently “expecting” about the future.

Anyway, applying this approach to Hawkins at the moment suggests the market is assuming that this company will grow at a rate of ~2.95%, which I consider to be reasonably pessimistic. Given all of the above, I’ll be buying a few more shares of Hawkins this morning.

Options Review

In my previous missive on this name, I suggested simply buying the shares because the premia on offer for put options was too thin. Not much has changed on that score, either. For instance, the December Hawkins puts with a strike of $35 are currently bid at $0. Thus, I am still of the view that the best course of action would be to simply buy the shares. I think this represents the greatest long-term value.

Conclusion

In spite of a nice run-up in price since I finally bought the shares back in May, the stock is as compelling now as it was then. This is obviously because the “E” in PE or the “S” in PS have both grown in lock step with the price. In some sense, this gives investors who didn’t buy in May the opportunity to take a “do-over.” The shares are as compelling now as they were then. Buying previously worked out well, and I expect the results will be similar going forward.

Be the first to comment