Jonathan Ross

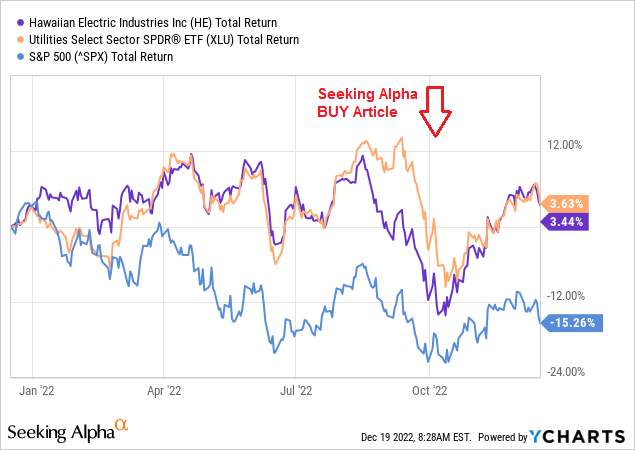

In October, I suggested that the significant sell-off in shares of Hawaiian Electric (NYSE:HE) created an excellent buying opportunity for investors (see Wicked Sell-Off In Hawaiian Electric Creates 4% Yield). The stock has returned 18-plus since then – greatly outpacing the S&P 500, but in line with the SPDR Utilities ETF (XLU) (see below). The company, which also owns American Savings Bank (32% of LTM earnings), is an environmental leader and committed back in 2008 to derive 40% of its power generation capacity from renewables by 2030. In 2015, it increased that goal to 100% by 2045. As of July of this year, that number was 31%, so HE obviously still has a long way to go to clean up its power generation capacity. However, it reached a significant milestone in September when a coal contract expired – and ended the company’s coal generation capacity. However, given the stock’s big returns since October, has it run too far too fast? Let’s take a closer look.

YCharts

Earnings

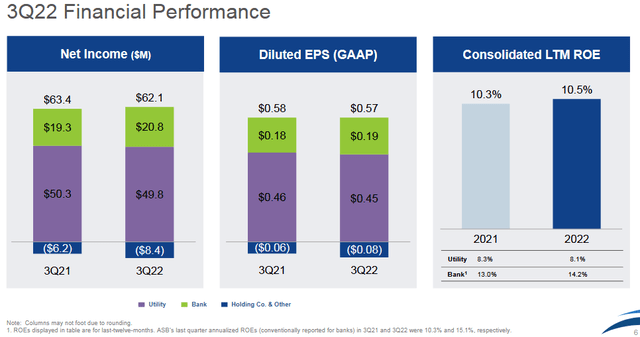

In the first week of November, HE released its Q3 earnings report, and while EPS of $0.57/share was down a penny yoy, the results were considered a beat on the top and bottom lines. Revenue of $955.97 million (+40.7% yoy) was a $210.46 million beat. Bottom line EPS was a $0.02/share beat.

The slide below was taken from the Q3 Presentation:

As can be seen, the Bank Segment grew net income (+7.8% yoy) while the Utility Segment was slightly lower. Overall, return-on-equity improved 20 basis points to a relatively strong 10.5%. On the Q3 conference call, the company reported that Utility ROE was in-line despite the negative impact from higher fuel prices – which contributed a 50 basis point drag on ROE. Bank ROE remained very strong at 14.2% on a trailing 12 months basis.

The Bank Segment benefited from a number of factors:

- At quarter’s end, total loans were $5.7 billion – up 9.3% from year-end 2021, “reflecting growth across nearly the entire portfolio year to date.”

- At quarter’s end, total deposits were $8.3 billion – an increase of 1.1% from year-end 2021.

- Net interest margin (“NIM”) expanded to 2.96% in Q3 vs. 2.85% in Q2, up 13 basis points.

NIM will likely rise again in Q4, given the Federal Reserve’s recent 50 basis point rate increase. However, loan growth will likely slow going forward due to higher rates – so the mortgage banking income is likely to be lower.

The Utility Segment had some headwinds:

- Higher operating and maintenance expenses (i.e., higher fuel costs).

- Higher depreciation expenses due to increased investments.

- Higher interest expense.

In generation development, Hawaii’s largest solar+storage power project came online during the quarter, with more capacity going in-service in the coming months. Meantime, customers continue to contribute toward the renewable energy transition with adoption of roof-top solar. On the previously referenced Q3 conference call, President and CEO Scott Seu said:

We also continue to expand customer resources and programs. Rooftop solar continues to grow and their strong interest in our battery bonus program, which received 1,400 applications totaling 10.9 megawatts in September alone. We’re advancing EV charging as well, recently launching our charge up commercial, make-ready commercial charging infrastructure pilot, and our public charging expansion proposal is under PUC review.

Going Forward

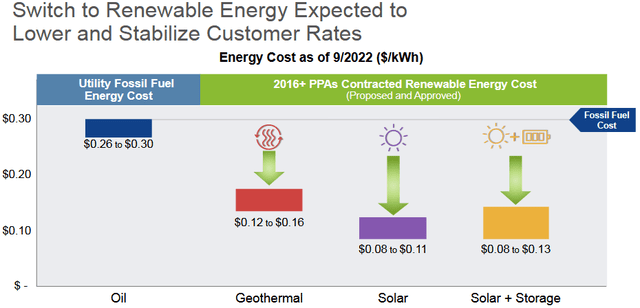

Seu also reported that the state’s largest solar+storage project is “generating energy at less than half the cost of oil” and that three more solar+storage projects are slated to come online in early 2023 with several more going in-service in 2024.

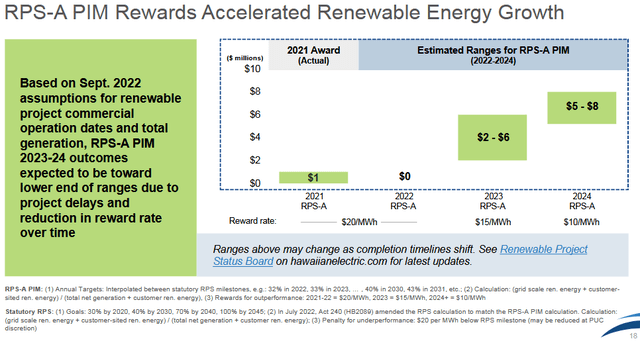

Indeed, Renewable Project Status (“RPS”) and Performance Incentive Mechanisms (“PIMs”) rewards will accelerate in 2023 and 2024:

As you can see from the graphic, while the company said rewards are “expected to be toward the lower end ranges due to project delays,” the rewards are still considerable: Even at the bottom end of the ranges, the rewards would amount to $7 million over the two years. These are mainly the results of HE’s large solar-plus-storage projects that will be coming online.

The company raised the low end of its FY22 consolidated earnings guidance to a range of $2.08-2.20/share. At the midpoint ($2.14/share), that would compare to $2.25/share in FY21, or down ~5% – mostly due to the big spike in oil prices throughout the past year.

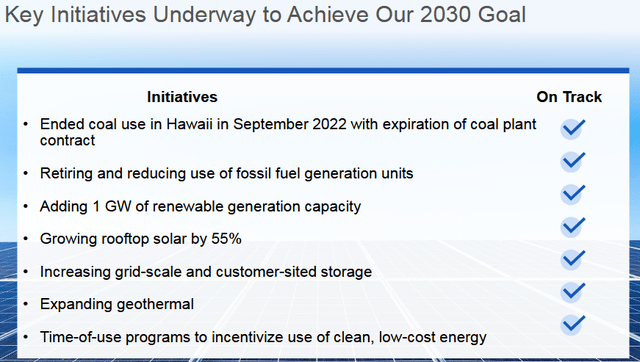

As mentioned in the bullets, Hawaiian Electric has been an early adopter of significant emissions reduction targets:

- 40% renewables, 70% reduction in emissions (compared to 2005) by 2030.

- 100% renewable portfolio by 2045.

Not surprisingly, the company continues to work rapidly toward those goals, reaching a major milestone when it stopped all coal use in September:

As you can see in the graphic, the company is on track to add 1 GW of renewable (mostly solar/battery-backup/geothermal) while continuing to reduce fuel-oil power generation.

While some investors might think the company this will lead to higher power generation costs, the opposite is the case given the very high cost of fossil fuels as compared to renewables power generation:

As can be seen in the graphic, geothermal power generation is less than half the cost of fossil-fuel power, while solar and solar+storage are roughly one-third the cost.

However, the renewable transition requires investment. HE has a large battery storage project expected to go into service on Oahu by mid-2023, and it has 400 MW of renewable capacity and 2+ gigawatt hours of battery storage approved and active under Stage 1 and 2 RFPs. The company’s Stage 3 RFPs seek an additional 1,600 GW hours annually of variable renewable and dispatchable energy, and between 540-740 MW of renewable firm capacity.

That being the case, HE estimates capex this year will come in around $350-$375 million. That grows to ~$390 million next year (at the midpoint of guidance). So while the company’s bottom line cost of generation will decrease over the coming years, customer bills may increase in the short term to help pay for the renewable transition – which they will benefit from in future years.

Risks

With the rebound in the stock price since my initial BUY article on Seeking Alpha in October, HE’s yield has dropped from 4% to 3.48%. The TTM P/E = 16.5x with a forward P/E = 18.7x, per Seeking Alpha.

HE’s P/E metric is a significant premium as compared to the XLU Utilities ETF, while HE’s yield is significantly higher than the XLU:

- XLU P/E = 7x

- XLU Yield = 2.84%

I supposed one could argue that the Bank Segment’s outlook might rationalize the P/E premium, but in my opinion, the Bank represents only ~32% of earnings and while the NIM outlook is a positive catalyst, the macroeconomic forecast for the Bank (i.e., stalling housing market and odds of a recession) cancel that advantage out. That’s one big reason that, despite the bullish NIM forecast, the SPDR S&P Bank ETF (KBE) Banking Theme Hasn’t Worked Out As Expected.

Upside risks include HE’s rather unique partnership with the state of Hawaii and its potential for performance adders (and/or penalties). This provides potential upside to HE’s regulated allowed ROE (which is 9.5%) given the actual 8.1% ROE the company achieved in Q3. That said, much of that upside appears to be already fully-priced into the value of the stock, which I view as fairly valued here.

Downside risks would be another big spike in oil prices, given HE’s still heavy reliance on fuel-oil power generation.

Summary and Conclusion

Hawaiian Electric generally depends on the strength of the Hawaiian economy, which remains relatively strong on an employment and tourist standpoint. However, the big run-up in the stock price since October has the stock trading at fair value in my opinion, given its prospects for midterm earnings growth of an estimated ~5% as it continues to invest in renewable power-generation and storage capacity. That should enable dividend growth of 3.5-4% over the coming years.

Bottom line: HE is no longer significantly undervalued in my opinion, and I’m reducing my rating from Buy to Hold. That said, the 3.58% yield is attractive to income-oriented investors that are willing to stick it out over the next 2-3 years of increased capex investment in renewables. After that, this company should deliver strong returns for investors, given it will have a considerably lower cost of electric power generation.

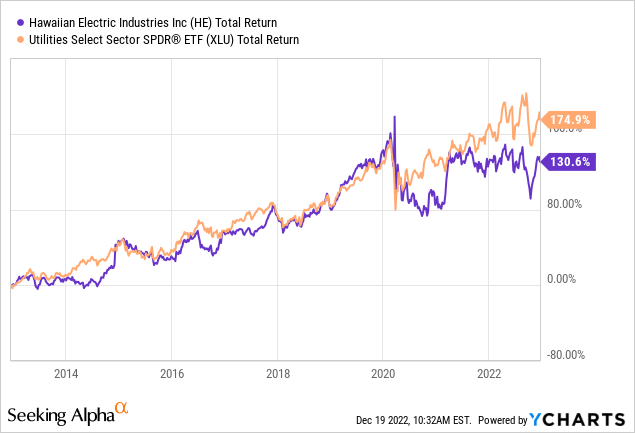

I’ll end with a 10-year total returns chart of HE vs. the XLU ETF, and note that HE stock has lagged relative to the broad utilities index since the 2020 pandemic shock:

Be the first to comment