necati bahadir bermek

Uncertain Economic Outlook and Rising Volatility Should Favour Gold Investments

When the economic climate is significantly stormy, certain investments tend to be favoured over others. This is because some of them help protect the value of the retail investor’s securities portfolio from the damaging effects of high volatility, which is almost always a measure of heightened uncertainty.

But the universe of these securities is not huge, and while most securities do not act as a safe haven asset, they also introduce greater risk to the portfolio, which could therefore become more vulnerable to sharp fluctuations in market prices.

A risk that should therefore be avoided in times that, like the current one, are not particularly conducive to investing in publicly traded securities.

To erect the barricades of asset protection, many investors turn to precious metals such as gold and gold-backed securities, as these assets typically provide effective protection against headwinds during very uncertain economic times.

There is no doubt that the current period is one of great uncertainty in the financial markets. This has its roots in global geopolitics, with tensions between the US-led western world on the one hand and Russia/China on the other hand bickering almost daily over various issues such as the war in Ukraine and Taiwan independence.

The fact that this is also accompanied by higher than usual volatility is another argument for those who want to strengthen their securities portfolio through targeted investments, for example by being more dependent on changes in the gold price.

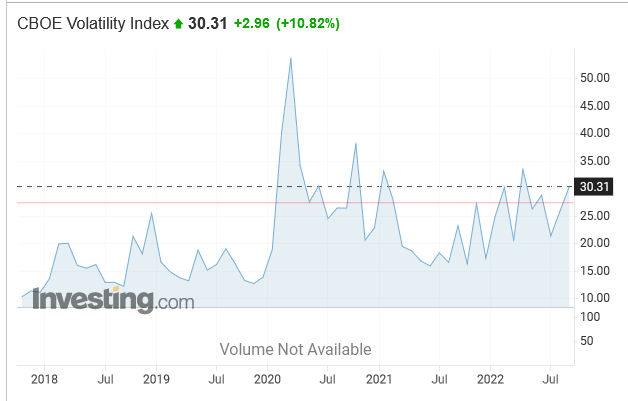

The below chart from Investing.com shows that the curve of the CBOE Volatility Index (VIX), a benchmark index used to measure the US stock market instability, is well above its long-term trend [the red line], indicating that US-listed stocks are seen fluctuating sharply rather than quietly.

investing/indices/volatility-s-p-500

While the value of the index would have to rise above 30 for the volatility to be considered large, it is still true that the index is far from a value of 20, which would instead mean the opposite of market stability or stress-free times in the markets.

Among Gold Stocks, Harmony Gold Mining Company Limited Could Rise Very Quickly When Gold Is in its Bull Market

Many investors prefer to buy shares of US-listed gold producing and exploring companies over other gold-backed assets because gold stocks allow them to benefit much more from rising prices of the yellow metal during its bull markets.

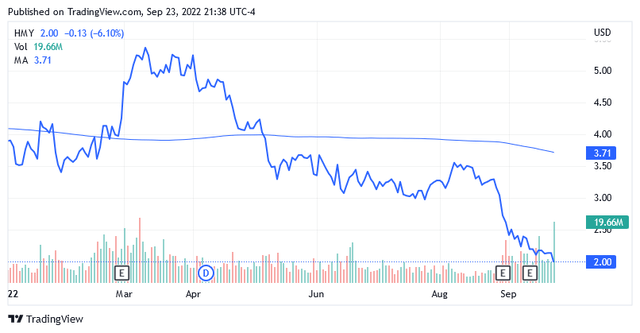

Among the gold stocks, Harmony Gold Mining Company Limited (NYSE:HMY) would be ideal for those investors looking for the highest possible yield to get out of the rising commodity as this stock is proving to be much more volatile compared to gold.

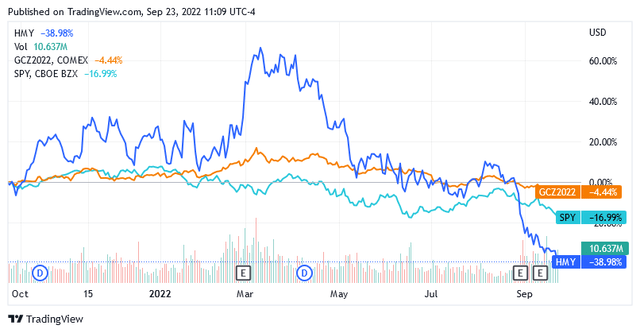

It works something like this: very simply, if an ounce of gold in the market rises or falls by $1, the market price of the shares of Harmony Gold will rise or fall by a significantly wider range, as can be intuitively inferred from the chart below.

The above chart shows that there is much more affinity in terms of the development of the respective curves between Harmony Gold Mining and Gold Futures with maturities in December 2022 (GCZ2) than between Harmony Gold Mining and the SPDR S&P 500 ETF Trust (SPY), with the latter representing the US stock market.

However, the chart also shows that Harmony Gold Mining’s swings are simultaneously much larger than the gold futures (GCZ2) with December 2022 expirations.

Because of this and other characteristics, investors are particularly attracted to Harmony Gold Mining Company Limited, a South African gold mining company headquartered in Randfontein, a well-known gold prospecting location in West Rand, Gauteng Province, due to the gold mining activities that take place there.

What Does Harmony Gold Mining Company Limited Do?

Harmony Gold Mining Company Limited is engaged in gold exploration activities in South Africa and Papua New Guinea, as well as extraction and processing through milling equipment and ore separation technologies.

In South Africa, the company notably operates nine underground deposits in the Witwatersrand Basin in Gauteng Province, manages an open pit mine in the Kraaipan Greenstone Belt in the North West Province and produces the precious metal from beneficiation of tailings across the country.

The South African business segment accounts for 92% to 93% of total revenues.

In Papua New Guinea, Harmony Gold Mining has interests in a gold and silver mine, called Hidden Valley, which extracts the precious metal through open pit techniques, and in the development of a gold mineral project, called Wafi-Golpu, located in Morobe Province.

The Papua New Guinea business segment accounts for 7% to 8% of total revenues.

The company is also exploring mineral deposits in search of silver and copper as well as uranium and molybdenum, but these activities are small-scale.

Currently, Harmony Gold Mining Company Limited’s business relies almost entirely on gold as a source of income and cash flow.

Harmony Gold: Reserves and Latest Annual Operating and Financial Results

The South African mining company’s balance sheet depends on the price of the precious metal and the status of its mining operations.

Of the total proven and probable mineral reserves of 39.8 million ounces of gold and gold equivalent [since Hidden Valley and Wafi-Golpu are currently mining other commodities as well], Harmony Gold mined 1.49 million ounces of gold in the fiscal year ended June 30, 2022 [down about 3.2% yoy], resulting in an all-in sustainable cost [AISC] of $1,709 per ounce [up about 17% yoy].

These reserves have the following gold concentrations in the mineral [6.4 grams per tonne of ore [g/t] from South African underground deposits, 0.26 g/t at surface activities and 0.68 to 1.65 g/t in Papua New Guinea].

At a gold price of $1,829 an ounce [up 6% YoY], Harmony Gold Mining Company Limited sold its produced gold tonnage and reported production profits of $628 million [down 19% YoY] and a total core net income of $0.33 per share [a decline of 49% compared to the previous year].

Despite a higher price, core profits have not increased as the company has produced less gold, which is also reflected in higher operating costs, although none of this surprised management. Production and costs were in line with forecasts.

Operating costs were also impacted by certain expenses related to the construction of a technology that will enable the company’s operations to run on electricity generated by absorbing and converting sunlight.

These higher costs should normalize in the coming months due to an expected improvement in the concentration of the precious metal in the mineral, which could rise to 5.60 g/t in underground deposits in South Africa, from 5.37 g /t in 2022.

If Harmony Gold exceeds this figure, the production and cost implications will be significant, as the underground mines in South Africa account for approximately 75% of the miner’s total gold production.

However, gold production for 2023 is expected to fluctuate between 1.4 million ounces and 1.5 million ounces.

Harmony Gold Mining Company has its catalyst for an improvement in earnings, which would create a very strong reason for the stock price to rise in the US stock market.

The point is that mining, which seems to be on track to become more and more efficient, is not crossing the path that rising gold prices would like.

Gold Is Not In An Uptrend Due To Rising Interest Rates, But There Is A Glimpse Of A Favorable Scenario

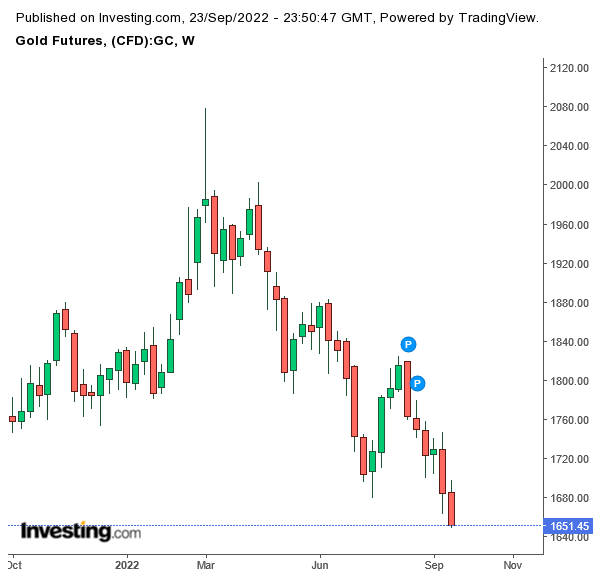

Gold, which has been in free fall since April with multiple dips, will likely continue this downtrend as long as the US Federal Reserve tightens its interest rate policy. This is illustrated in the chart below from Investing.com.

investing/commodities/gold

The letters P in the chart are the candlestick patterns that technical analysts at Investing.com believe have medium to high confidence in predicting a specific market change.

The first P on August 15 shows “Engulfing Bearish”, which is a key bearish reversal signal as the uptrend has definitely been disrupted by more and more bear trading. It had a medium reliability rating.

The second P on August 22 indicates “Three Outside Down Bearish” and confirms the trend reversal due to bearish [the third candlestick] after the engulfed pattern [first two candlesticks]. It had a high-reliability rating.

Return to the beginning of the paragraph. As interest rates rise, fixed income securities like bonds become much more interesting than before, attracting the attention of a larger investor audience, and climbing up the safe-haven hierarchy relative to gold.

That’s being forecast by analysts who expect gold – which is trading around $1,650 an ounce at the time of writing – to continue its current downtrend, bottoming at $1,602 in 52 weeks, under pressure from a strong US dollar currency and tighter monetary policy.

However, there is a glimmer for gold to reverse the trend and provide Harmony Gold Mining with a new catalyst for a greater chance of a strong stock price recovery.

The aim of the rate hike is to bring record inflation [8.3% in August 202] back to the 2% target, the level that will guarantee price stability provided employment remains as high as possible. And the US Federal Reserve will act until there are strong signals from the economy that the inflation problem is on the way to resolution.

But unlike previous implementations of monetary tightening, this time the runaway inflation is not being driven by the rise in the demand for goods and services but by factors over which the central bank has no control, and those are the war in Ukraine and high energy costs.

The hawkish stance cannot be calibrated as precisely as in the past due to the uncertain outlook. And since the resulting outcomes are unpredictable, the Federal Reserve prefers a day-to-day attitude rather than venturing into longer-term projects.

So the next economic recession could be very deep, meaning not only a slowdown in economic growth, which poses a risk for countries that have borrowed heavily to combat the COVID-19 pandemic crisis, but also that many jobs will be lost. At that point, gold would come back into vogue as a means of defense against all the resulting headwinds.

Given the exceptional magnitude of the monetary policy measures implemented [3 consecutive 75 basis point rate hikes and borrowing costs at the highest level over the past 14 years, in just 5 months], it should not take a long time before the above scenario becomes a reality.

The Stock Valuation: Average Target Price Versus Current Market Valuations

Harmony Gold Mining Company is a very risky investment, which means that the stock is more likely to continue to underperform [it fell more than 45% so far this year] than to start rising.

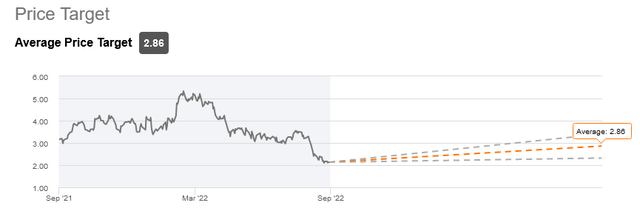

However, if the upside opportunity outlined above is realized, the return from the stock price rally could be as substantial as Wall Street’s sales analysts estimate.

They estimate an average price target of $2.86, which is a 43% increase from current levels.

seekingalpha/symbol/HMY/ratings/sell-side-ratings

Shares were hovering at $2 each as of this writing, for a market cap of $1.29 billion and a 52-week range of $1.94 to $5.50.

The share price trades well below the 52-week range middle point, which is $3.72, and well below the long-term trend of the 200-day moving average of $3.71.

These prices are much lower than those that have characterized the market in the recent past.

Harmony Gold Mining has a 14-day Relative Strength Index of 25.82, which suggests that shares are very close to oversold levels after falling very rapidly in the wake of gold’s downtrend, meaning that shares will continue to fall should gold go down more.

It is advisable to wait for the next inflation data for September [Oct. 13], US Non-farm payrolls for September [Oct. 7] as well as the US unemployment rate for September [Oct. 7] and the final estimate of the US GDP growth rate for the second quarter [Sept. 29] to see how the situation develops [as a result of monetary policy] as we try to understand whether gold can rise again or not.

Conclusion – High Risk Bet as the Rebound Chance Is Low but Very Rewarding in the Event

Due to the macroeconomic framework and geopolitical disputes, there is great uncertainty in the market. One measure of this is volatility, which is not yet as high as it was at the time of the COVID-19 outbreak but is on track. To protect against headwinds, many investors typically increase their exposure to US-listed gold stocks, which tend to rise faster than the safe-haven asset they offer. Harmony Gold Mining might be one of them, but the investment is risky and requires gold on the uptrend. But gold is now falling due to the rise in interest rates, making bonds more attractive than before versus gold. However, the economy is headed for a recession that could be very severe, at which point gold would come back into vogue. Harmony Gold Mining would benefit greatly from it. The possibility is small at the moment but could gain momentum over time.

Be the first to comment