da-kuk/E+ via Getty Images

Investment Thesis: While Hanover Insurance Group (NYSE:THG) faces the risk of greater catastrophic losses across its commercial lines – continued growth in premium demand across this segment should help to mitigate this risk.

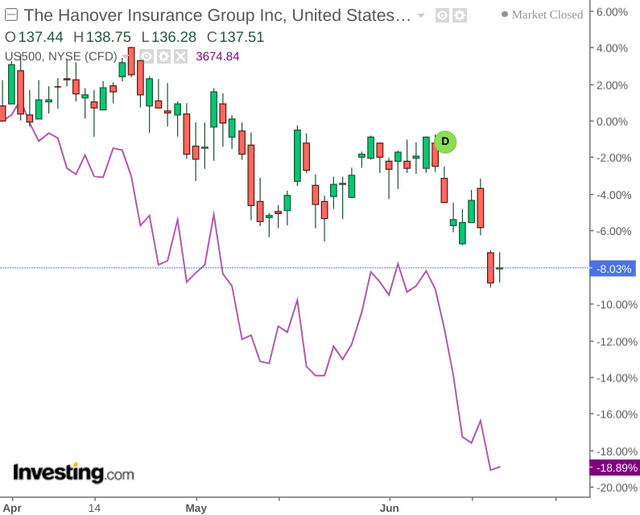

In a previous article back in April, I made the argument that Hanover Insurance Group could see further upside going forward as a result of continued net premium growth and the company managing its inflation risk.

Since then, we have seen a decline in the stock (albeit less than that of the S&P 500):

Particularly, I made the argument that strong performance within the US private auto sector could be a key growth driver for the company going forward. The purpose of this article is to reassess this assumption in light of recent performance.

Performance

To get a more holistic view of combined ratio performance for Hanover Insurance Group, I decided to analyze historical quarterly data for both commercial lines and personal lines for the company in further detail. Specifically, I decided to calculate the average combined ratio by year across these two lines.

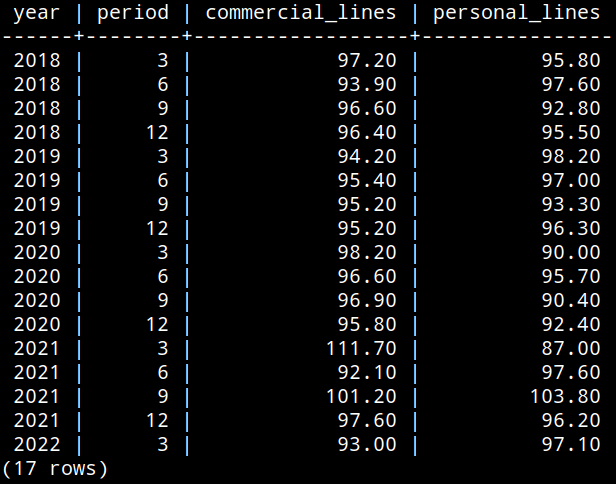

Here are the original combined ratios by quarter:

Figures sourced from previous quarterly financial reports for Hanover Insurance Group.

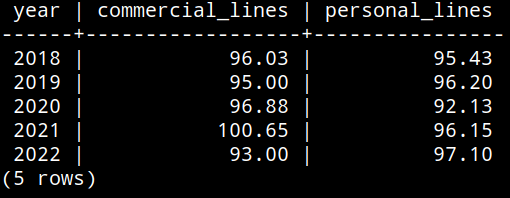

Here are the ratios when averaged by year:

Calculations made by author using SQL.

When averaging the combined ratios across each quarter by year – we can see that 2021 showed a significant increase in this ratio across both commercial and personal lines. Note that the 2022 ratios only represent the first quarter – and the average ratios for the whole of this year could differ significantly.

Previously, I made the argument that the company’s exposure to the private auto sector – particularly in Michigan and Massachusetts which represented the two largest states by net premiums written for 2021 – would limit the risk of over-exposure to Property & Casualty if premium demand falls as a result of rising inflation.

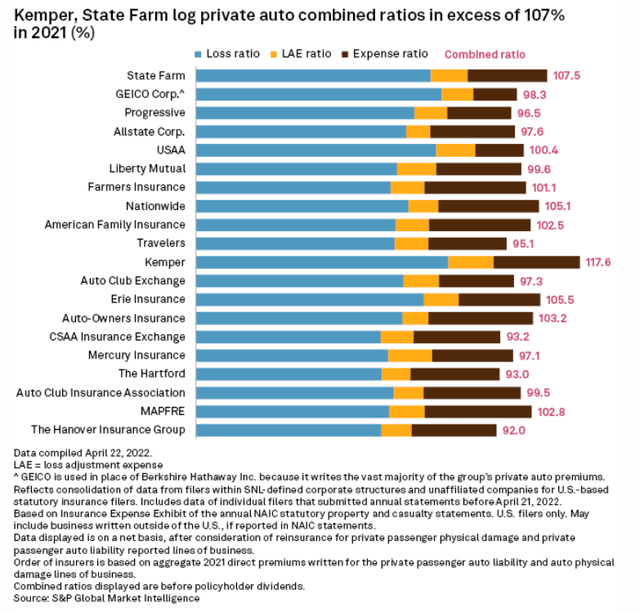

When considering the combined ratio across the private auto industry in the United States, it was recently reported by S&P Global (SPGI) that Hanover Insurance Group showed the lowest combined ratio of 92% among the top 20 insurers, which is quite impressive when one considers that the combined ratio for US private auto as a whole rose above 100% in 2021.

S&P Global Market Intelligence

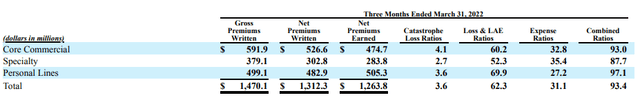

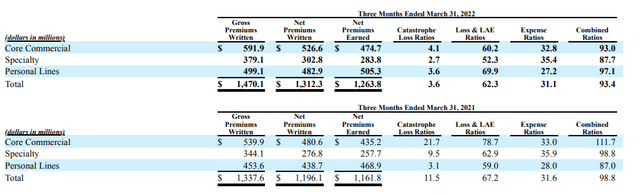

While this is impressive, we can see that Core Commercial still accounts for the largest portion of premiums written, both on a gross and net basis.

Hanover Insurance Group: Form 10-Q Q1 2022

Specifically, we saw that the combined ratio across commercial lines (100.65) was higher than that of personal lines (96.15) in 2021. Therefore, while the performance across the US private auto industry is encouraging – one would want to see a fall in the combined ratio across commercial lines to drive overall profitability going forward.

Commercial vs. Personal Lines

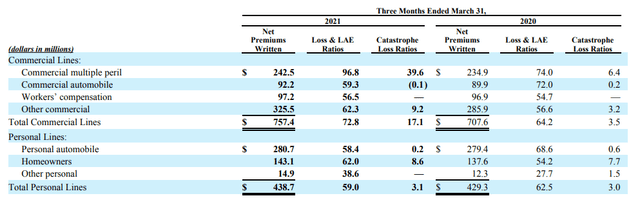

With commercial multiple perils and commercial automobile forming a significant portion of the company’s overall commercial lines, we can see that the catastrophe loss ratio was significantly higher for Q1 2021 at 17.1 as compared to the ratio for total personal lines.

Hanover Insurance Group: From 10-Q Q1 2021

We can see that the catastrophe loss ratio for commercial multiple perils was particularly high at 39.6 for the quarter in question.

With this segment insuring businesses against third party general liability for accidents, as well as damage to business property – this segment, in particular, can be impacted by damage resulting from extreme weather events – as we saw in Texas in February 2021, when a winter storm resulted in the closure of many businesses due to associated property damage.

From this standpoint – while commercial multiple perils will continue to bring in a large portion of premiums for commercial lines as a whole – the segment can potentially see higher catastrophic losses than those across personal lines. With climate change an ongoing concern – an increase in the frequency of extreme weather events going forward could have the effect of increasing the overall combined ratio for commercial lines, and a lower combined ratio across personal lines would be limited in mitigating against commercial losses.

However, in terms of net premiums earned – we can see that growth for core commercial is up by just over 9%, while that of personal lines is up by just over 7%.

Hanover Insurance Group: Form 10-Q Q1 2022

In this regard – while core commercial may have more risk attached to the segment – the fact that we have continued to see strong growth in net premiums is encouraging, which helps to compensate for such risk. What would be concerning is if Hanover Insurance Group was seeing little to no growth in premiums across core commercial – while at the same time being exposed to catastrophic losses across the segment. However, that does not appear to be the case here.

Conclusion

To conclude, while Hanover Insurance Group has seen strong performance across the private auto industry – a further analysis shows that catastrophic losses across commercial multiple perils have the potential to be quite substantial.

However, the fact that premium demand for commercial lines continues to be strong is encouraging and helps to mitigate against the increased risk.

I take the view that Hanover Insurance Group could potentially see some downside in the short to medium term, as a risk-off sentiment by the broader market may lead to a lower appetite for stocks in the insurance industry as a whole given the risk exposure. However, should we see continued growth in premium demand across both commercial and personal segments, then the stock could see a significant rebound in growth once market sentiment starts to become more bullish.

Be the first to comment