Tim Boyle/Getty Images News

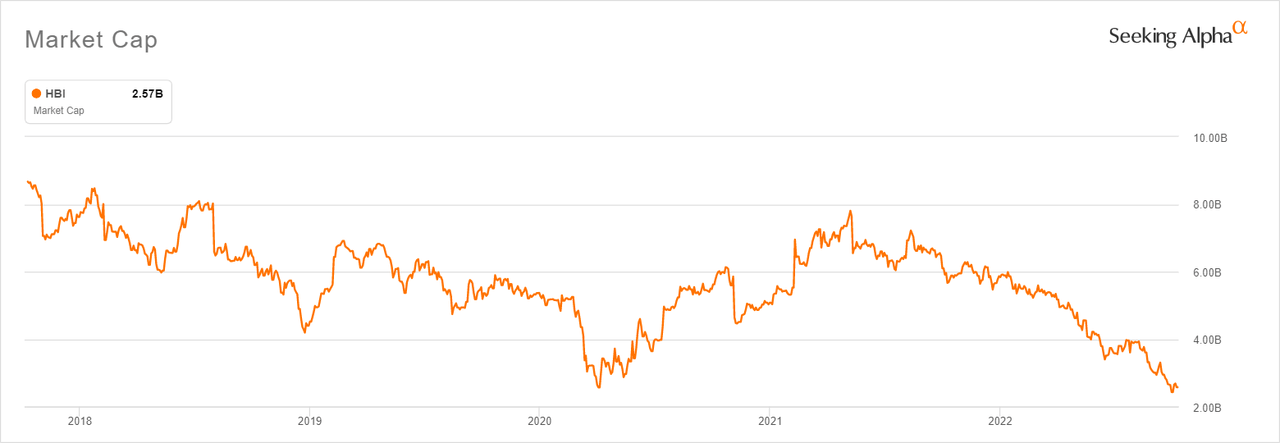

The bearish sentiment surrounding Hanesbrands Inc’s (NYSE:HBI) stock has reached extreme levels if the current market cap is anything to go by. The stock, which is down a painful 54% YTD, is presently trading at a market cap of $2.6 billion. The only other time it has traded at these levels in the past five years was in the wake of the global stock market crash that occurred in March 2020 after the World Health Organization (WHO) declared Covid-19 a global pandemic.

HBI’s market cap over the past five years (Seeking Alpha)

The current downturn in HBI’s stock started in August 2021 and has gained momentum ever since amid headwinds such as record inflation, multiple interest rate hikes by the Fed, and the rising specter of a recession. These macro headwinds have led to sharp declines in stocks in the consumer discretionary sector.

However, macro factors alone do not account for HBI’s poor stock performance. The apparel retailer, which designs, manufactures, sources and sells a broad range of basic apparel such as T-shirts, bras, panties, shapewear, underwear, socks and activewear, has in recent quarters had its fair share of company-specific issues that have unnerved investors.

Cocktail of negative catalysts

HBI’s topline is stagnating at a time when margins are coming under pressure due to cost pushes brought about by inflation. The company’s liquidity is also constrained due to historically low levels of cash, rising inventories and a huge debt load that has remained largely unchanged over the past year even as more than 35% of it comes due in FY2024. This cocktail of negative catalysts explains the stock’s atrocious performance in recent quarters.

Let’s start with the discussion on its topline. Known for popular brands such as Hanes, Champion, Bonds, and Bali, HBI reported revenues of $1.51 billion in Q2, a 14% year on year dip. It further cut its guidance for the full year. It expects revenue of between $6.45 billion and $6.55 billion for the year compared with its prior outlook of $7 billion to $7.15 billion and 2021 actual revenue of $6.8 billion. It’s worth noting that the Q2 performance fell short of analysts’ expectations for both top line and EPS.

The company’s management blamed the difficult operating environment for the disappointing Q2 performance. It also blamed a ransomware attack, but the CFO Michael Dastugue, admitted in the Q2 earnings call that the company’s performance would still have fallen below expectations in the absence of the cyber attack. “In total, we estimate the cyber event negatively impacted the second quarter by approximately $100 million in sales, $35 million in operating profit and $0.08 in EPS. Absent the cyber event, we estimate sales for the quarter would still have been below our forecast,” he said.

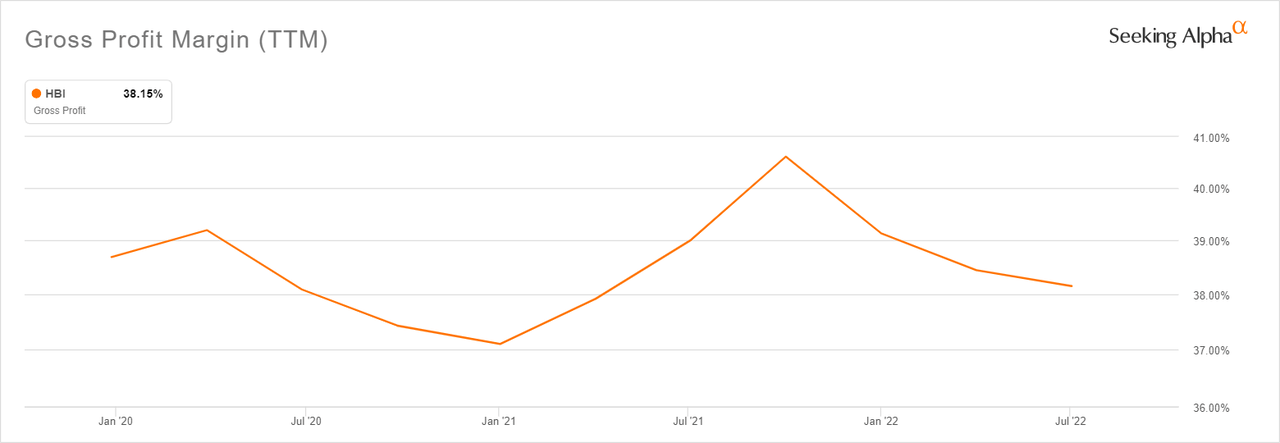

Another negative catalyst is that margins declined in Q2, continuing a worrying trend that started in October 2021. Adjusted gross margin in the quarter declined 120 basis points over prior year to 37.8%, driven by lower sales volume, input cost inflation, the incremental costs associated with the cyber event and exchange rates.

HBI’s gross profit margins are on a downtrend (Seeking Alpha)

Looking at HBI’s balance sheet for its most recent quarter, it’s clear that it has an uphill task ahead considering cash from operations are constrained by the slowing revenue growth and compressing margins.

For the period ended July 2, 2022, HBI had $237.92 million in cash versus $667.29 million a year ago. Inventories for this period ballooned to $2.09 billion from $1.53 billion a year earlier, which is tying up cash at a critical time. Meanwhile, the company’s long-term debt has remained largely unchanged at $3.62 billion vs $3.64 billion a year earlier. Around $1.46 billion of its debt (more than 35% the current long term debt) will be due in FY2024, as per its latest 10-K. We expect the company to have no serious challenges refinancing this debt but believe it will do so at less favorable terms given it is unlikely interest rates will come down in 2024 (even though the Fed’s hikes could have ended by end of 2024, and that’s debatable).

The positives

In light of these negative catalysts, it’s no surprise that the short interest in HBI stands at 11.43%, which is high, reflecting investors’ pessimism about the future. However, we believe that the worst has already been priced in and there’s limited downside risk at current share prices.

The pain (most of it at least) is now in the rear view mirror and investors can start building a position now when valuations are still compelling. The bull case is convincing but the present share price doesn’t yet reflect this. It is still on a downtrend and is 15% below is 50D SMA. If you are bullish but are held back by fear and postpone buying, you could miss the big move up as the bull case is pretty convincing when you look at it.

Basically, HBI is a successful US company that marked its centenary celebrations two decades ago at the turn of the new millennium, and is known for producing quality and loved brands that millions of men, women and children in the US and elsewhere around the world put on every day. HBI employs the most people in its sector, with 58,800 employees as per Seeking Alpha data. PVH Corp (PVH), which sells popular brands such as Tommy Hilfiger and Calvin Klein has 25,000 employees. Carter’s Inc (CRI), which makes branded child ware, has 15,900 employees while Under Armour Inc (UAA), which sells eponymous performance apparel, footwear and accessories, has 12,400 employees.

To bet against HBI – which is essentially a category leader and dominant player in a staple-like category of apparel – based on transitory short term headwinds affecting the entire sector isn’t the best move to make this late into the stock’s move to the downside. The short sellers that caught HBI’s move down in recent quarters have made money, but those that expect sustained and significant declines from here could be squeezed. I think the worst is over and long-term investors can start building a position from here when the upside is still reasonable and there’s a huge margin of safety in terms of downside risk.

Another reassuring factor that strengthens the bull case is HBI’s financials relative to its current valuation. HBI’s balance sheet and financial performance have taken a rough beating amid the circumstances that have shaped 2022, like the global political crisis caused by the Russia-Ukraine war, record inflation, rising risk of recession, a widespread sell off in retail sector stocks, and an unforgiving bear market that has wiped trillions off portfolios.

Despite recent degradation of the balance sheet and weak financial performance, HBI is financially stable and is not a company on the verge of financial collapse. However, it is valued as one.

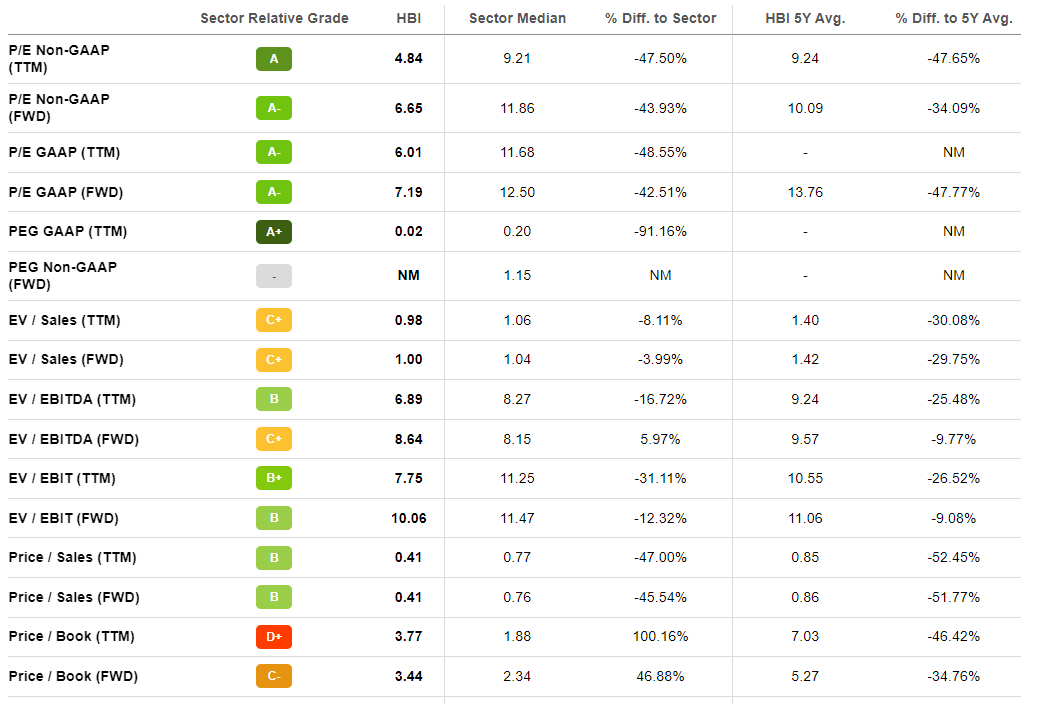

Investors should take advantage of this low valuation, which is historically low going by the five year averages as shown in the screenshot below from Seeking Alpha. The company’s current P/E GAAP (fwd) is close to 50% below the five year average. All things held constant, the stock is basically on sale at almost half its five year average price.

HBI Valuation (Seeking Alpha)

The best part about HBI’s bull case is that you’ve got a juicy dividend that yields a strong 7.8%. The dividend pay out can be sustained over the next year despite recent financial challenges and operating headwinds. HBI currently has a dividend payout ratio of 37.74% and has paid a dividend of $0.15/share on a quarterly basis since the first quarter 2017. It has been paying different amounts in previous years before 2017 as the company’s dividend history shows. The company has a clear practice of returning cash to shareholders through dividends and we don’t see this changing because of current head winds.

With such a high yield of 7.8% – and a dividend payout that will likely be there next year just like it has been there this year and was there the year before – a decline in HBI’s share price is only likely to build in buying pressure into the stock. The yield is likely to attract buy and hold dividend investors who will likely buy more if it dips for reasons unconnected to the company’s fundamentals.

HBI is an income investor’s dream come true – high yield and safety in one place. HBI also compares favorably to peers when it comes to dividends. UAA does not currently pay a dividend, CRI yields 4%, and PVH yields a paltry 0.31%.

Another upside catalyst worth considering is the high short interest of 11.43%, which builds in buying pressure as shorts must eventually cover their positions. The potential for HBI to surprise on the upside cannot therefore be ruled out.

Moreover, when you think of the general economy, we are convinced the headline “food prices hit another record high” no longer scares anyone on Main Street or Wall Street. A lot of the scary stuff is now in the past. If anything, inflation pressures are cooling. The Fed is also actively trying to slam the breaks and stop inflation.

There has in recent quarters been pain in households but the consumer will come back, and arguably bigger than before given the average American has gotten richer in absolute terms in the past few years. According to Bloomberg, an analysis of Fed data shows the average household in the bottom 50% saw its net worth rise to $57,346 at the end of 2021, from $30,378 at the end of 2019.

The consumer will likely come back in my opinion and HBI’s operational recovery is a matter of when and not if. On its part, HBI’s management isn’t passively watching events unfold from the sidelines. It has taken steps to reinvent the business through its Full Potential Plan that was launched in May 2021 with a target of turning around key performance indicators by 2024. The plan has seen the business make strategic investments into its brands, particularly the Champion brand. As part of this turnaround plan, it’s also streamlined its supply chain, expanded its e-commerce presence and made investments in improving its financial shape.

The goal under the Full Potential Plan is to self-fund strategic investments to grow sales to more than $7.4 billion in 2024 . While the process of meeting this goal may have started off slow due to economic challenges experienced from H2 2021 onwards, we feel the company’s overall direction in terms of management execution is okay. There’s certainly room for improvement and investor sentiment has been hurt by surprises such as the ransom war attack. However, it’s not like the management is running the company into the ground.

Conclusion

HBI has had a terrible year but investing is about looking to the future. Buying HBI amid the present stock weakness gives you a chance to buy a stable and dominant company with strong brands playing in a staple-like category at half the usual price (given how low multiples are today relative to the five year average). The best part is that, even if a few painful months are still left ahead in terms of the stock price continuing on its downturn, you get to enjoy a high dividend yield as you wait for take off. This is a good deal that we are taking in my opinion.

Be the first to comment