JHVEPhoto

Earnings of Hancock Whitney Corporation (NASDAQ:HWC) will continue to surge this year and the next on the back of robust loan growth. Further, the topline will benefit from a rising interest-rate environment. On the other hand, higher provisioning for expected loan losses will curtail bottom-line growth. Overall, I’m expecting Hancock Whitney Corp to report earnings of $5.54 per share for 2022, up 6% year-over-year. For 2023, I’m expecting flattish earnings growth, leading to earnings of $5.56 per share. The year-end target price suggests a high upside from the current market price. Therefore, I’m adopting a buy rating on Hancock Whitney Corporation.

Management’s Efforts, External Factors To Drive Loan Growth

Hancock Whitney Corporation’s loan portfolio grew by a remarkable 2.5% in the second quarter of 2022, or 10% annualized. As mentioned in the second quarter’s earnings presentation, the management expects 6% to 8% loan growth for 2022, which is on the higher side of the historical trend. In previous years, loan growth has hovered in the low to mid-single-digit range. However, this target is still achievable due to the second quarter’s remarkable performance.

Further, the management’s team expansion plans are likely to act as a catalyst for loan growth. Hancock Whitney Corporation has already added seven new bankers in the second quarter of 2022. The management plans to continue to hire in the second half of this year, as mentioned in the presentation.

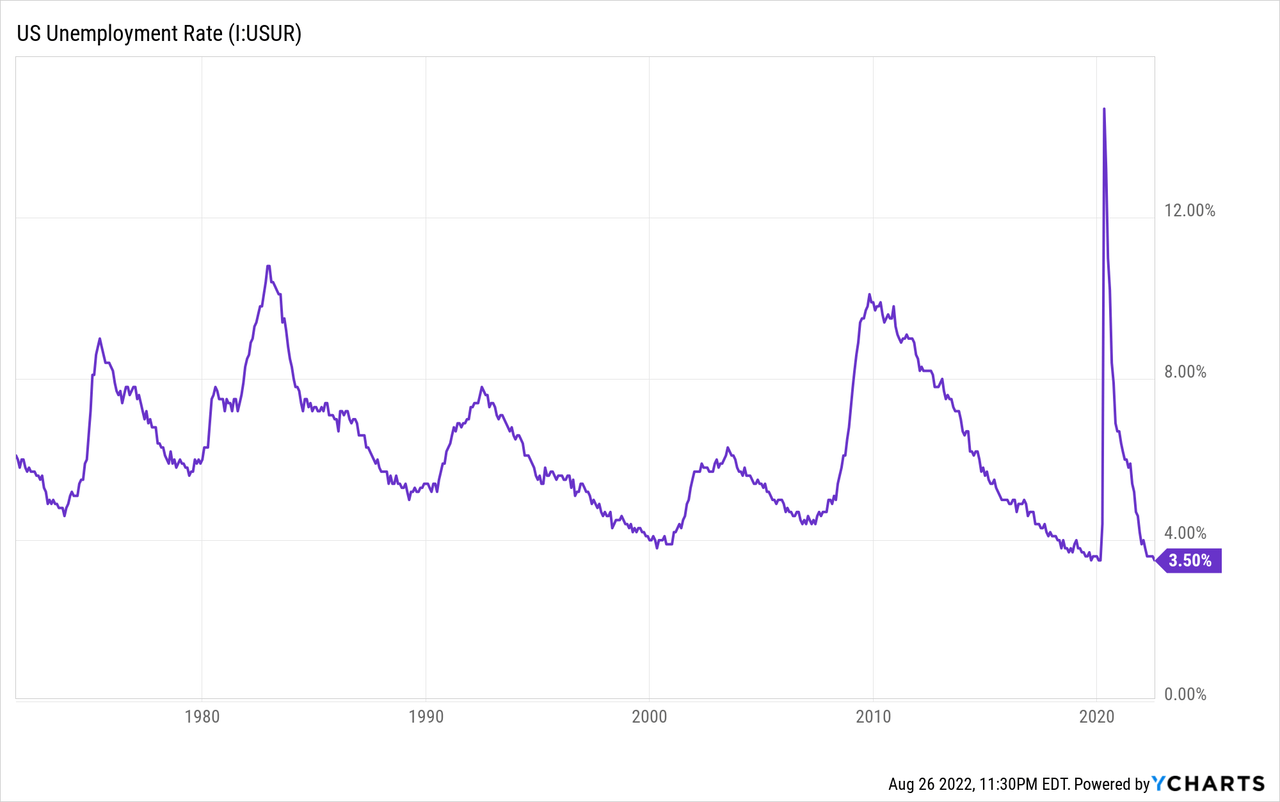

Hancock Whitney mostly operates in southern states, namely Mississippi, Alabama, Florida, Louisiana, and Texas. These states have economies that are quite different from each other; therefore, it’s advisable to consider national averages to determine future product demand. The country currently has a record low unemployment rate, which bodes well for future loan growth, especially consumer loans.

Considering these factors, I’m expecting the loan book to grow by 6.7% in 2022. For 2023, I’m expecting loan growth to continue at a similar rate. Meanwhile, growth of other balance sheet items will likely trail loan growth. The equity book value per share will face pressure from rising interest rates because they will reduce the market value of fixed-rate, available-for-sale securities. This unrealized loss will skip the income statement and go directly into the equity account. The following table shows my balance sheet estimates.

| FY18 | FY19 | FY20 | FY21 | FY22E | FY23E | |

| Financial Position | ||||||

| Net Loans | 19,832 | 21,022 | 21,340 | 20,792 | 22,189 | 23,550 |

| Growth of Net Loans | 5.6% | 6.0% | 1.5% | (2.6)% | 6.7% | 6.1% |

| Other Earning Assets | 5,810 | 6,409 | 8,826 | 12,476 | 9,542 | 9,734 |

| Deposits | 23,150 | 23,804 | 27,698 | 30,466 | 30,467 | 31,704 |

| Borrowings and Sub-Debt | 1,814 | 3,076 | 2,176 | 2,031 | 999 | 1,019 |

| Common equity | 3,081 | 3,468 | 3,439 | 3,670 | 3,541 | 3,927 |

| Book Value Per Share ($) | 36.0 | 40.0 | 39.7 | 42.2 | 41.0 | 45.5 |

| Tangible BVPS ($) | 25.7 | 28.9 | 28.9 | 31.5 | 30.4 | 34.8 |

|

Source: SEC Filings, Author’s Estimates (In USD million unless otherwise specified) |

Earnings To Benefit From The Moderately Rate-Sensitive Margin

Hancock Whitney Corporation’s net interest margin surged by 23 basis points in the second quarter of 2022 partly because yields rose as market interest rates increased. Further, there was a lag in deposit cost hike, as mentioned in the presentation. Moreover, Hancock Whitney was successful in deploying a large part of its excess cash into higher-yielding assets during the second quarter, which contributed to the margin expansion.

Going forward, the margin will likely expand further due to the rising rate environment. The average loan yield is quite sensitive to interest rate hikes as around 58% of the portfolio is made up of variable-rate loans. According to details given in the earnings presentation, the fixed-rate loans Hancock Whitney originated in the second quarter had higher yields than the average portfolio yield. Therefore, loan additions will also help the margin in the coming quarters.

The deposit mix is also favorably positioned for a rate hike. Non-interest-bearing deposits made up 49% of total deposits at the end of June 2022, which will weigh down the average deposit cost as interest rates rise.

However, the securities portfolio is likely to limit the margin’s growth. Hancock Whitney has a large securities portfolio that made up a quarter of total earning assets at the end of June. The effective duration of this portfolio was quite long at 4.93 years. Therefore, only a small part of the portfolio can be expected to mature and re-price this year.

The management mentioned in the presentation that it expects the margin to widen by four to six basis points for every 25 basis points move in the federal funds rate. I’m expecting a 75-basis point hike in the federal funds rate in the remainder of this year before rates plateau. I’m expecting interest rates to start declining by the mid of next year.

Considering the factors given above and management’s guidance, I’m expecting the margin to expand by 20 basis points in the second half of 2022 and then remain stable for 2023.

Higher Provisioning To Curb Earnings Growth

Like in 2021, Hancock Whitney continued to release large parts of its loan loss reserves throughout the first half of 2022. The management doesn’t expect further reserve releases. Despite the large releases, the reserve level was still quite high relative to the credit risk at the end of June 2022. Nonperforming loans were 0.19% of total loans, while allowances were a much higher 1.41% of total loans. This provision coverage seems high and is therefore likely to keep further provisioning subdued.

On the other hand, loan additions will require further provisioning for expected loan losses. Moreover, the high inflationary environment is likely to make some borrowers struggle financially, which could worsen the credit quality of their loans. Further, the increase in borrowing costs for variable-rate loans, and the threats of a recession, can put further stress on asset quality.

Overall, I’m expecting the net provision expense to average 0.04% (annualized) of total loans in the second half of 2022, and 0.17% in 2023. In comparison, the net provision expense averaged 0.24% from 2017 to 2019.

Expecting Earnings To Grow By 6%

Robust loan growth will likely be the biggest earnings driver till the end of 2023. Further, the bottom line will receive support from anticipated margin expansion. On the other hand, higher provisioning will likely restrict earnings growth. Overall, I’m expecting Hancock Whitney Corp to report earnings of $5.54 per share for 2022, up 6% year-over-year. For 2023, I’m expecting the company to report earnings of $5.56 per share, up by just 0.3% year-over-year. The following table shows my income statement estimates.

| FY18 | FY19 | FY20 | FY21 | FY22E | FY23E | |||||

| Income Statement | ||||||||||

| Net interest income | 849 | 895 | 943 | 933 | 990 | 1,069 | ||||

| Provision for loan losses | 36 | 48 | 603 | (77) | (26) | 40 | ||||

| Non-interest income | 285 | 316 | 324 | 364 | 345 | 371 | ||||

| Non-interest expense | 716 | 771 | 789 | 807 | 751 | 790 | ||||

| Net income – Common Sh. | 318 | 322 | (47) | 454 | 479 | 480 | ||||

| EPS – Diluted ($) | 3.72 | 3.72 | -0.54 | 5.22 | 5.54 | 5.56 | ||||

|

Source: SEC Filings, Earnings Releases, Author’s Estimates (In USD million unless otherwise specified) |

||||||||||

Actual earnings may differ materially from estimates because of the risks and uncertainties related to inflation, and consequently the timing and magnitude of interest rate hikes. Further, a stronger or longer-than-anticipated recession can increase the provisioning for expected loan losses beyond my estimates.

HWC Is Currently Trading At A Large Discount To The Target Price

Hancock Whitney is offering a dividend yield of 2.2% at the current quarterly dividend rate of $0.27 per share. The earnings and dividend estimates suggest a payout ratio of 19% for 2023, which is below the 2017-2021, ex-2020, average of 29%. The below-average payout ratio suggests that there is room for a dividend hike. Nevertheless, I’m not expecting any change in the dividend level as Hancock Whitney does not change its dividend often. The company has maintained its dividend at $0.27 per share since the third quarter of 2018.

I’m using the historical price-to-tangible book (“P/TB”) and price-to-earnings (“P/E”) multiples to value Hancock Whitney. The stock has traded at an average P/TB ratio of 1.51 in the past, as shown below.

| FY17 | FY18 | FY19 | FY20 | FY21 | Average | |

| T. Book Value per Share ($) | 24.1 | 25.7 | 28.9 | 28.9 | 31.5 | |

| Average Market Price ($) | 47.0 | 48.8 | 40.2 | 25.3 | 45.1 | |

| Historical P/TB | 1.95x | 1.90x | 1.39x | 0.88x | 1.43x | 1.51x |

| Source: Company Financials, Yahoo Finance, Author’s Estimates | ||||||

Multiplying the average P/TB multiple with the forecast tangible book value per share of $30.4 gives a target price of $45.8 for the end of 2022. This price target implies a 7.4% downside from the August 26 closing price. The following table shows the sensitivity of the target price to the P/TB ratio.

| P/TB Multiple | 1.31x | 1.41x | 1.51x | 1.61x | 1.71x |

| TBVPS – Dec 2022 ($) | 30.4 | 30.4 | 30.4 | 30.4 | 30.4 |

| Target Price ($) | 39.7 | 42.8 | 45.8 | 48.9 | 51.9 |

| Market Price ($) | 49.5 | 49.5 | 49.5 | 49.5 | 49.5 |

| Upside/(Downside) | (19.6)% | (13.5)% | (7.4)% | (1.2)% | 4.9% |

| Source: Author’s Estimates |

The stock has traded at an average P/E ratio of around 12.9x in the past, as shown below. (I have excluded 2020 from the calculation).

| FY17 | FY18 | FY19 | FY20 | FY21 | Average | |

| Earnings per Share ($) | 2.48 | 3.72 | 3.72 | (0.54) | 5.22 | |

| Average Market Price ($) | 47.0 | 48.8 | 40.2 | 25.3 | 45.1 | |

| Historical P/E | 18.9x | 13.1x | 10.8x | NM | 8.6x | 12.9x |

| Source: Company Financials, Yahoo Finance, Author’s Estimates | ||||||

Multiplying the average P/E multiple with the forecast earnings per share of $5.54 gives a target price of $71.4 for the end of 2022. This price target implies a 44.3% upside from the August 26 closing price. The following table shows the sensitivity of the target price to the P/E ratio.

| P/E Multiple | 10.9x | 11.9x | 12.9x | 13.9x | 14.9x |

| EPS 2022 ($) | 5.54 | 5.54 | 5.54 | 5.54 | 5.54 |

| Target Price ($) | 60.3 | 65.8 | 71.4 | 76.9 | 82.4 |

| Market Price ($) | 49.5 | 49.5 | 49.5 | 49.5 | 49.5 |

| Upside/(Downside) | 21.9% | 33.1% | 44.3% | 55.5% | 66.7% |

| Source: Author’s Estimates |

Equally weighting the target prices from the two valuation methods gives a combined target price of $58.6, which implies an 18.5% upside from the current market price. Adding the forward dividend yield gives a total expected return of 20.6%. Hence, I’m adopting a buy rating on Hancock Whitney Corporation.

Be the first to comment