Brandon Bell/Getty Images News

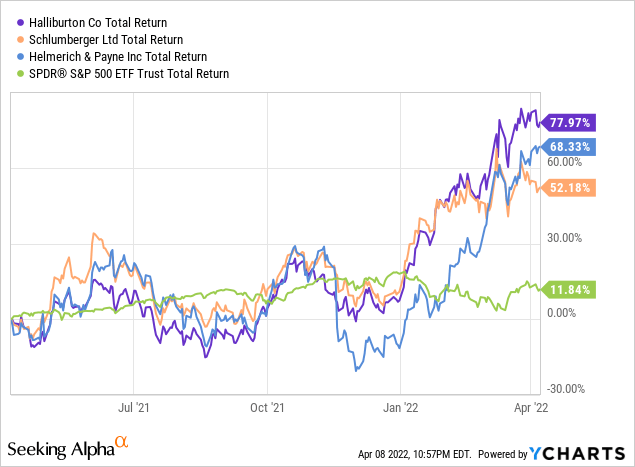

Over the last twelve months, Halliburton (NYSE:HAL) has been on a tear, yielding a total return of 78%. This outperformed Schlumberger (SLB) by ~2,500 bps and Helmerich & Payne (HP) by ~1,000 bps. For context, the S&P 500 has “only” gained ~12% during that time. In general, the company’s capitalization on digital uptiering (it is a leading software provider in oilfield services), capital efficiency, and product breadth across the well lifecycle has paid dividends. With 58% of revenue generated abroad, Halliburton has also benefited from the improvement in margins. Solid operating execution and an improved economy have resulted in outperformance.

According to Seeking Alpha data, the Street is highly bullish on the stock. 13 of 27 analysts rate the stock a “strong buy” and 8 rate it a “buy”. Even as the stock has been on a tear, the Street has become increasingly optimistic on its prospects. Just back at the start of last year, the Street was roughly split, with 50% rating Halliburton a “hold”. At 16.9x forward earnings, the stock trades at a premium to industry leader Schlumberger (16.3x). Halliburton has slightly weaker operating margins of 11.8% (vs. 12.1% for SLB) but has a healthy balance, as reflected in the quick ratio of 1.8. All things considered, the PEG ratio at 0.39 suggests the business is being highly discounted for all the macro uncertainty in oil & gas.

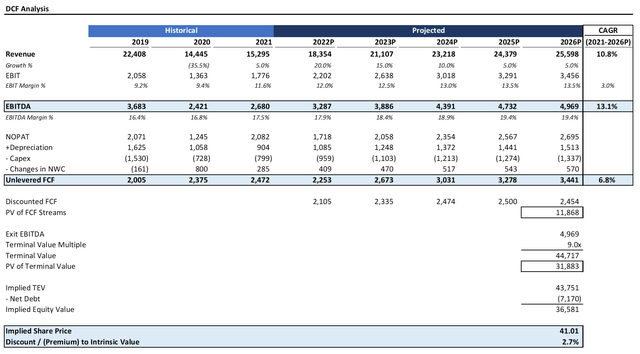

DCF Analysis Indicates Fair Valuation

To get a sense of the company’s intrinsic value, I ran a DCF analysis. No DCF analysis can provide a perfect picture of future returns for shareholders; however, they can provide an illustrative “story” of the likelihood of different scenarios. I forecasted 20% growth in 2022, in-line with Street guidance, tapering to 5% by 2026. I assumed margins expanding minimally by 200 bps into 2026 to 13.5%. Capex, increase in net working capital, depreciation, and taxes were flat-lined for simplicity. By 2026, I have EBITDA at just shy of $5.0 billion.

Source: Created by author using data from Yahoo! Finance

Assuming a terminal EBITDA multiple of 9x and a discount rate of 7%, the stock is more or less fairly valued. Over the last 15 years, the stock has generally traded in the 7-12x range, so I believe my estimate is reasonable. For context, Schlumberger has generally traded in the 10-12x region, so there is material room for upside should Halliburton continue its broadening towards its larger peer.

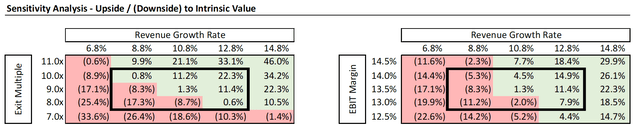

Source: Created by author using data from Yahoo! Finance

Looking at the sensitivity analysis, it’s a mixed bag. Unfortunately, Halliburton has a high beta of 2.43, which reflects its greater volatility to the broader macro environment, as upstream producers scale back and ramp up production. Don’t just think that the price of oil over the last two years is an aberration; this commodity swings in unpredictable ways, and both the Street as well as commodity future traders have been wildly off in forecasting its future. With that in mind, I would look at a wide range for multiples to get a sense of valuation returns. At a 7x exit multiple, the stock has ~19% downside vs. 21% upside if it expands closer to Schlumberger’s historical range. In light of the 7% annualized returns implicit in my discount rate, I believe this makes the risk/reward, on the surface, at least favorable.

Upside Catalysts

There are several factors that I believe will cause Halliburton to continue to outperform. Beyond continued earnings beats, the company has a tremendous play in uptiering its technology. The launch of Halliburton 4.0, complete with subsurface, well construction, reservoir recovery, and enterprise technology will enable operators to optimize capacity and automate drilling. With the maturation of many of the shale plays, operators are under increasing pressure to actually generate positive free cash flow. By leveraging its strength across the entire well lifecycle and translating it from drill bits and pressure pumping to technology, Halliburton could justify multiple expansion. In 2021, the company brought over 50 new technologies to market, including the iStar intelligent formation evaluation platform.

The company also needs to improve its free cash flow conversion and demonstrate an ability to expand margins in a competitive environment. Management is targeting lowering capex to 5-6% of revenue through changing portfolio mix and higher asset velocity, but this remains to be seen. In the fourth quarter, the company expanded operating margins in its flagship Completion & Production division to 15% driven by activity improvement offsetting inflationary pressures.

Lastly, I am also bullish about the company’s potential internationally. Drilling activity is ramping up abroad, and Halliburton has unique potential in specialty chemicals and artificial lift. The pipeline of opportunities in this segment are longer cycle and come with the added boost of enhanced margins. These should help further expand Halliburton’s multiples.

Risks

With a sky high beta of 2.43, Halliburton is not for the faint of heart. This is a stock that lost 75% of its value during the first month of the pandemic in March 2020. Yes, that is history, and the stock has increased eight-fold since then, but the geopolitical environment remains highly precarious.

This is especially of concern in light of the company’s debt position. The company has total debt of $10.3 billion for a Debt/EBITDA ratio of ~4.0x. Add in thin operating margins and a general oversupply of pressure pumping technology, and the company does have meaningful room for downside. The company’s prior investments in deepwater equipment back in early 2010s proved poorly timed, and a stark reminder to investors this go around.

Conclusion

Halliburton is a risky stock, but with the current highly actionable growth catalysts in international, technology expansion, and margin expansion, I believe it is positioned more for the upside. I wouldn’t recommend Halliburton for investors looking for the quick buck or to make a tremendous “value play”, but I think it could be a good long-term winner for those willing to stick through thick and thin the next ten years. Performance will continue to be volatile, but the secular tailwinds are there for Halliburton to continue to broaden its portfolio mix and steal share from Schlumberger. In the process, I believe it is positioned to further expand multiples and attract back some on the fence that were scared off over the last two years.

Be the first to comment