Vertigo3d

Gulfport Energy (NYSE:GPOR) is dealing with some cost inflation issues plus the potential for massive hedging losses over the next couple years. Despite that, it still appears capable of generating close to $1 billion in positive cash flow by the end of 2023. In 2024, it could generate over $700 million in positive cash flow at current strip, before the potential impact of cash taxes as it uses up its net operating loss carryforward.

Updated 2022 Outlook

At current strip prices (including approximately $7.05 NYMEX gas) for 2022, Gulfport could generate $2.603 billion in oil and gas revenue before hedges. Gulfport’s 2022 hedges have approximately $1.2 billion in negative value at those prices as it is has hedges covering most of its natural gas production. With the rise in natural gas prices after Q1 2022, Gulfport’s natural gas hedges for Q2 to Q4 2022 have a swap/ceiling/sold call price averaging close to $5 below strip.

| Type | Units | $/Unit | $ Million |

| Natural Gas [MCF] | 330,325,000 | $6.85 | $2,263 |

| NGLs (Barrels) | 4,136,667 | $45.00 | $186 |

| Oil (Barrels) | 1,642,500 | $94.00 | $154 |

| Hedge Value | -$1,200 | ||

| Total Revenue | $1,403 |

Gulfport built in around 10% cost inflation into its 2022 D&C capital expenditure budget initially, and now expects a further 10% increase. This pushes its total capital expenditure budget up to around $400 million.

| Expenses | $ Million |

| Transportation, Gathering, Processing and Compression | $343 |

| LOE | $62 |

| Taxes Other Than Income | $85 |

| Cash G&A | $43 |

| Interest and Preferred Dividends | $52 |

| Capex | $400 |

| Total Expenses |

$985 |

Gulfport is thus now projected to generate $418 million in positive cash flow in 2022 at current strip prices.

This would allow Gulfport to reduce its net debt to $356 million by the end of 2022 before any further share repurchases (beyond the $63 million it spent to repurchase shares in 2022 up to May 2). Gulfport is currently authorized to repurchase up to $200 million in common stock by the end of 2022.

Updated 2023 Outlook

Gulfport’s presentation suggests that it may be able to average around 1.0625 Bcfe per day in production during 2023. At current strip of $5.70 NYMEX gas for 2023, Gulfport would then be able to generate $2.232 billion in oil and gas revenues before hedges in 2022.

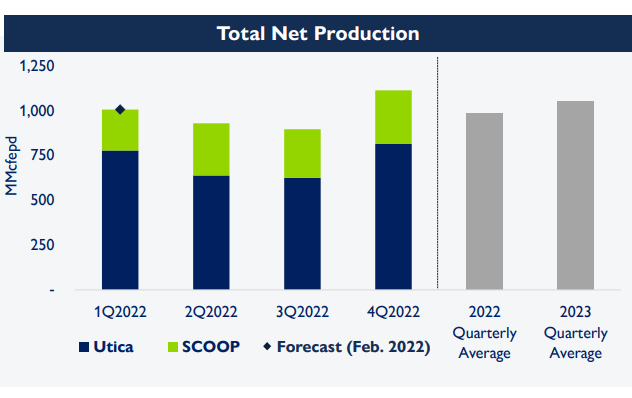

Projected Production (gulfportenergy.com)

Gulfport still has most of its natural gas production hedged for 2023, and this is expected to result in a realized hedging loss of $652 million based on current strip.

| Type | Units | $/Unit | $ Million |

| Natural Gas [MCF] | 350,970,313 | $5.50 | $1,930 |

| NGLs (Barrels) | 4,395,209 | $37.00 | $163 |

| Oil (Barrels) | 1,745,156 | $79.50 | $139 |

| Hedge Value | -$652 | ||

| Total Revenue | $1,580 |

Gulfport’s capital expenditure budget is now projected to be around $415 million for 2023. This results in the expectation that it could generate $565 million in positive cash flow at current strip in 2023.

| Expenses | $ Million |

| Transportation, Gathering, Processing and Compression | $364 |

| LOE | $66 |

| Taxes Other Than Income | $77 |

| G&A | $43 |

| Interest and Preferred Dividends | $50 |

| Capex | $415 |

| Total Expenses |

$1,015 |

This would result in Gulfport having around $72 million in net cash at the end of 2023 if it completed its $200 million share repurchase program.

Other Notes

Gulfport’s hedging situation gets significantly better in 2024. At current strip of approximately $4.70 NYMEX gas in 2024, it would end up with around $113 million in realized hedging losses. This should allow it to generate over $700 million in positive cash flow in 2024 at that natural gas price.

At a lower natural gas price (such as $4 NYMEX gas), Gulfport should still be able to generate around $550 million in positive cash flow in 2024, which would be over $20 per share.

Those numbers are before the impact of cash taxes though, and it seems likely that Gulfport will start paying cash taxes by 2024 based on strip.

Conclusion

Gulfport is not gaining much additional benefit from rising 2022 and 2023 natural gas prices since it has hedges covering most of its natural gas production during that time frame. It is also dealing with some cost inflation caused by the strength in commodity prices.

Despite these issues, Gulfport is still capable of generating close to $1 billion in positive cash flow in 2022 and 2023 combined, and could generate over $700 million in positive cash flow in 2024 at current strip (before the impact of cash taxes).

At $83 to $84 per share, Gulfport’s market cap is approximately $2.1 billion, including the effect of the conversion of its preferred shares to common shares. Thus I continue to view it as relatively undervalued given its strong potential for cash generation (despite projected massive hedging losses) over the next few years.

Be the first to comment