RossHelen

Author’s Note: This article is an abridged version of an article originally published for members of the Integrated BioSci Investing marketplace on July 21, 2022.

Guardant Health

Be fearful when others are greedy. Be greedy when others are fearful. – Warren Buffett

When you invest in biotech stocks, it can be easy for you solely to focus on the stock ticker. Be that as it may, there is a business behind all tickers. By focusing on the business fundamentals, you are much better prepared to take advantage of changing market conditions. That is to say, you should consider buying more shares of a company that is enjoying fundamental improvement while the share price traded southbound.

That being said, I’d like to revisit a stock that was hit hard during the recent Biotech Bear Market of 2021/2022 known as Guardant Health (NASDAQ:GH). In this research, I’ll feature a fundamental analysis of Guardant and share with you my expectation of this intriguing growth equity.

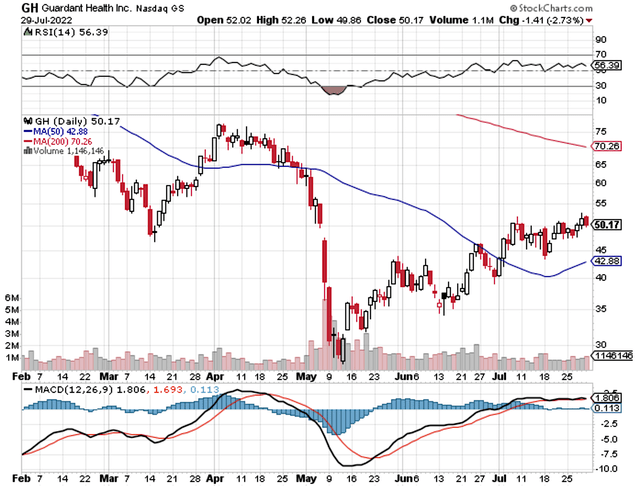

Figure 1: Guardant Health chart

About The Company

As usual, I’ll deliver a brief corporate overview for new investors. If you are familiar with the firm, I suggest that you skip to the subsequent section. Based in Redwood City, California, Guardant Health dedicates its efforts to the innovation and commercialization of novel medical diagnostics. In unlocking the power of precision medicine, the company offers genetic profiling to enhance the treatment outcomes for various cancers.

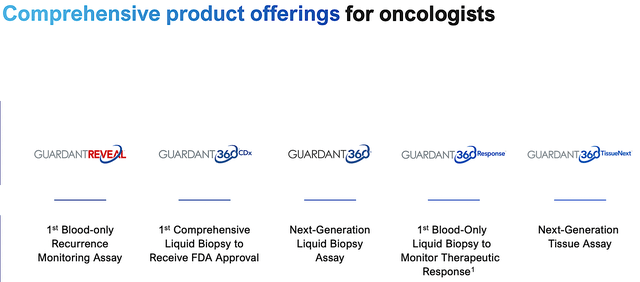

Figure 2: Diagnostic pipeline

I noted in the prior article,

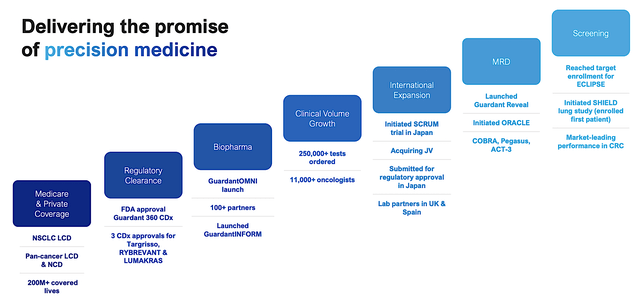

Through its Guardant Health Oncology platform, the company successfully launched various liquid biopsy tests like Guardant360 to catch all stages of cancers. Being a company that follows through, Guardant has successfully executed different milestones to enhance shareholder’s value while delivering hope to countless patients over the years.

Figure 3: Business milestones

EMA Joint Venture

Back in May 2018, Guardant and SoftBank Vision Fund embarked on a joint venture to expand Guardant’s liquid biopsy in the Asia, Middle East, and Africa (AMEA) regions. Interestingly, Guardant announced on June 13 that the company purchased all the remaining shares of Guardant Health AMEA, Inc. that were held by SoftBank and its affiliates. As such, Guardant can now have full operational control throughout 41 countries in the aforesaid regions.

Given that more than 50% of all new cancer cases arise in the AMEA, the acquisition would enable Guardant to deliver its diagnostic services to help catch these deadly conditions early. That is great news for patients. After all, diagnosing cancers in their earliest stage is the holy grail to improving survival.

In terms of the deal size, Guardant had to pay only $177.8M for all the shares. Therefore, you can see that this is a great deal for Guardant and SoftBank. First, SoftBank is unlikely to have the expertise to deliver the liquid biopsy by itself. Second, Guardant can reap the most value by expanding the global footprints for its liquid biopsy.

As to launch, Guardant will strategically commercialize its liquid biopsy in Japan initially. After all, the company already gained marketing authorization from the Japanese Ministry of Health, Labour, and Welfare back in March 2022 (for use of its tests in profiling patients with advanced solid tumors). Commenting on the recent development, the Chairman and Co-CEO (Dr. Helmy Eltoukhy) remarked,

By acquiring the remaining shares of Guardant Health AMEA, we can focus on creating a unified and centralized global organization that delivers on our promise to help conquer cancer and improve patient outcomes. We believe our blood-based tests can play a significant role in helping address the growing incidence of cancer in the region, and we look forward to continuing to support patients facing cancer diagnoses as we expand our operations in these markets.

EPIC Deal

As you know, Guardant recently inked a deal with the premier electronic medical record platform dubbed EPIC. The said deal doesn’t seem significant at first glance. Notwithstanding, you can bet that it’ll generate much more revenues for Guardant than what you might believe.

I remember back in the day when I was a newly graduated physician. We were all using EPIC in various hospital systems. Over the years, I believe that the number of docs using EPIC must have increased substantially. Long gone were the days when clinicians use paper charts.

As most docs nowadays harnesses the power of EPIC to deliver stellar care for patients, Guardant can have access to those 250M patients. Now, that does not mean docs will order Guardant’s diagnostic for all those 250M. However, a small fraction, says 20M patients using the test would translate into hundreds of millions of dollars in additional revenue for Guardant. Riding strong development, you can expect the next quarter revenues to increase robustly.

Operational Highlights

Shifting gears, let us see how all the fundamental advancements translate into higher sales results. In the latest financial filing, Guardant reported 27K tests to patients and 5.1K tests to biopharma companies. Hence, those figures correspondingly represent 47% and 45% year-over-year (YOY) sales growth, respectively. The more customers/patients are using these tests, the higher the revenues growth for the company.

Asides from its strong utility, Guardant also launched the Laboratory Developed Test (i.e., LDT) which is the first blood-based test for the detection of early-stage colorectal cancer. This is huge for patients because catching cancer in their earlier stage, again, is paramount to survival. Moreover, LDT would also contribute to the rapidly rising revenues.

Financial Assessment

Just as you would get an annual physical for your well-being, it’s important to check the financial health of your stock. For instance, your health is affected by “blood flow” as your stock’s viability is dependent on the “cash flow.” With that in mind, I’ll assess the 1Q 2022 earnings report for the period that ended on March 31.

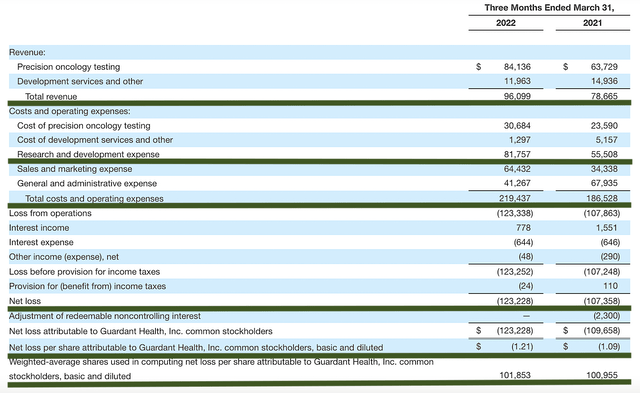

As follows, Guardant procured $96.0M in total revenue compared to $78.6M for the same period a year prior. Of the total revenue, precision oncology testing comprised the bulk sales (i.e., $84.1M). As such, you can see that the net sales increased by the remarkable 22.1% year-over-year (YOY).

That aside, the research and development (R&D) for the respective periods registered at $81.7M and $55.5M. I view the 47.2% R&D increase positively because the capital invested today can turn into billions of dollars in profits in the future.

Additionally, there were $123.2M ($1.21 per share) net losses and $107.2M ($1.09 per share) net decline for the same comparison. As you can see, it makes sense for the bottom line depreciation to widen because Guardant invested more capital into R&D.

Figure 4: Key financial metrics

About the balance sheet, there were $1.6B in cash, equivalent, and investment. On top of the $96.0M revenue (and against the $219.4M quarterly OpEx), there should be adequate capital to fund operations for another 7 quarters. That is to say, the cash runway would last into 4Q2024. Simply put, the cash position is robust relative to the burn rate.

While on the balance sheet, you should check to see if Guardant is a “serial diluter.” After all, a company that is serially diluted will render your investment essentially worthless. Given that the shares outstanding increased from 100.9M to 101.8M, my math reveals a 0.8% annual dilution. At this rate, Guardant easily cleared my 30% cut-off for a profitable investment.

Valuation Analysis

It’s important that you appraise Guardant to determine how much your shares are truly worth. Before running our figure, I liked to share with you the following:

Wall Street analysts typically employ a valuation method coined Discount Cash Flows (i.e., DCF). This valuation model follows a simple plug-and-chug approach. That aside, there are other valuation techniques such as price/sales and price/earnings. Now, there is no such thing as a right or wrong approach. The most important thing is to make sure you use the right technique for the appropriate type of stocks.

Given that developmental-stage biotech has yet to generate any revenues, I steer away from using DCF because it is most applicable for blue-chip equities. For developmental biotech, I leverage the combinations of both qualitative and quantitative variables. That is to say, I take into account the quality of the drug, comparative market analysis, chances of clinical trial success, and potential market penetration. For a medical diagnostic device, I focus on market penetration and sales. Qualitatively, I rely heavily on my intuition and forecasting experience over the decades.

|

Molecules and franchises |

Market potential and penetration |

Net earnings based on a 25% margin |

PT based on 101.0M shares outstanding and 10 P/E |

“PT of the part” after appropriate discount |

|

Guardant diagnostic platform |

$6B (estimated based overall $80B market) | $1.5B | $148.51 | $133.66 (10% discount because uncertainty in market penetration) |

| Others | N/A | N/A | N/A | N/ |

|

The Sum of The Parts |

$133.66 |

Figure 5: Valuation analysis

Potential Risks

Since investment research is an imperfect science, there are always risks associated with your stock regardless of its fundamental strengths. More importantly, the risks are “growth-cycle dependent.” At this point in its life cycle, the main concern for Guardant is whether the company can continue to materialize various fundamental developments into higher revenues.

The integration of liquid biopsy diagnostic into EPIC might be slow in delivering progress. It takes time for physicians to become familiar with new tests. Despite the large incidence of new cancer cases in the area, the AMEA launch might be much slower than what you anticipated. Guardant might also expand too rapidly to continue incurring more bottom-line losses. The company could also be a subject of new future lawsuits which further increases its OpEx.

Conclusion

In all, I maintain my buy recommendation on Guardant Health with the 4.8 out of five stars rating. Guardant Health is a biotech growth story success. With the industry tailwind favoring precision medicine diagnostics, you can bet the business is booming for Guardant. The company continues to garner new approval for its liquid biopsy panels for the detection of all stages of cancer. Revenues continue to increase aggressively year after year. Meanwhile, Guardant is penetrating into new territories like the AMEA. The company also continues to find new businesses like the integration of its liquid biopsy into EPIC.

As usual, I’d like to remind investors that the choice to buy, sell, or hold is ultimately yours to make. In my view, you should either hold your shares “as is” or average down on a pullback. At nearly $5B in market cap, there is less upsides yet the profit potential is still substantial.

Be the first to comment