Hector Vivas/Getty Images News

Grupo Televisa, S.A.B. (NYSE:TV), a Mexico-based media and telecom company, continues to see encouraging growth in its cable businesses, as investments in network expansion and upgrades drive subscriber growth. The challenged Sky Satellite business turnaround is a work in progress, but TelevisaUnivision (UVN), in which Televisa owns a 45% stake, has shown surprising resilience even against a softening macro. The operational momentum has been accompanied by margin pressures, though, and risks around the Sky turnaround remain elevated. Yet, management has been prudent with its balance sheet management, paying down ~$800m of debt with cash on hand, leaving ~80% of the debt stack at a fixed rate. This leaves ample room for more stock buybacks at the current historically cheap valuation (see my prior take on the valuation here), setting up for a strong year ahead.

Operating Momentum Picks Up in Cable

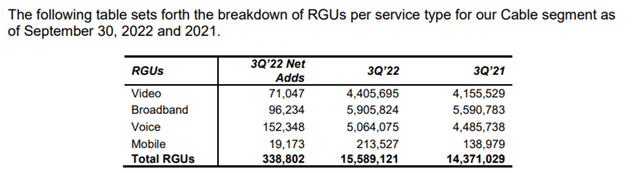

Televisa’s cable business delivered better than expected subscriber additions in Q3, supported by strong execution on its triple-play bundle (i.e., broadband, television, and landline). In particular, the izzi residential cable business continues to be a bright spot, gaining share across fiber to the home (~2m incremental homes last year) and in legacy markets. Pay-TV has also outperformed alongside fixed voice, although competitors’ ongoing upgrade cycles have helped. Key cable peer Megacable (OTCPK:MHSDF), for instance, is making up for previously underinvesting in its infrastructure, while all-fiber peer Totalplay is also in the midst of major upgrades (albeit in select areas).

Broadband was another bright spot, accelerating to 96k adds during the quarter (well above the 78k adds in Q2 2022 and the highest rate of additions since the 104k adds in Q1 2021). This trend was echoed at Megacable, which also accelerated to 101k adds, although América Móvil (AMX) lagged this quarter. Similarly, mobile saw a strong +19k net adds in Q3, driving the overall mobile subs contribution to ~5% of video subs. The key question, in my view, is the sustainability of these strong net adds. Given the company held off on taking price increases this quarter due to the weak macro environment, the ‘stickiness’ of these subs could be less than expected. Still, Televisa deserves credit for also increasing its penetration in new locations (large cities and smaller ones), driving more net adds, and supporting average revenue per user (ARPU) trends going forward.

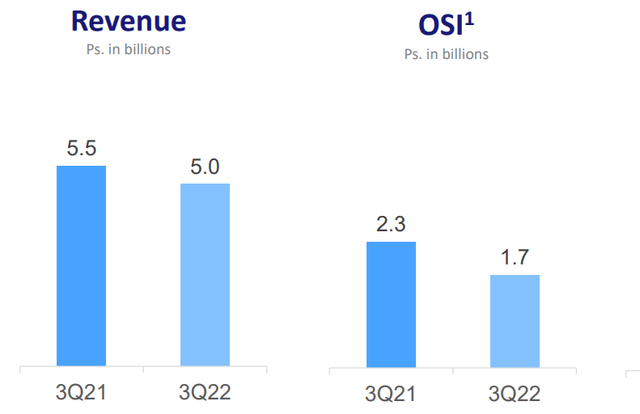

Sky Turnaround in Progress

Sky saw more video disconnections in Q3 at 381k, outpacing even the 225k net disconnection rate seen in Q2. It is worth considering the context, however, with management citing that 204k of these losses were related to the clean-up of the base. All in all, revenues were down ~9% YoY due to subscriber declines, and lower prepaid recharges, while headline operating segment income (OSI) declined ~25% YoY. Adjusted for the impact of the amortization of World Cup-related transmission rights, however, operating income would have declined by a more gradual ~13% YoY.

Importantly, the turnaround is on track, with management now focused on improving sales quality and increasing the ARPU of the client base. From here, execution will be key – as long as churn rates stay well-managed, the unit could see lower investment needs going forward, presenting an upside to current estimates.

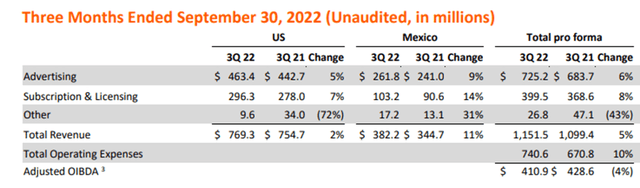

TelevisaUnivision Defies the Economic Headwinds

Also outperforming expectations was TelevisaUnivision, which posted advertising revenue growth of +6% YoY on strong advance sales in the US and Mexico, as well as new client additions. The +8% YoY growth in subscription & licensing was also impressive, all things considered, helped by the launch of the ViX+ streaming offering this quarter. While profitability was down this quarter, with the adj operating income declining by ~4%, much of the delta was down to incremental marketing costs for the ViX+ launch and related content amortization from the streaming service.

As the streaming-driven investment cycle winds down and the benefits of a record upfront performance (mainly streaming-related commitments) flow through to the P&L, the company looks primed for Q4 2022 growth. Plus, KPIs from the recently launched streaming video-on-demand service ViX+ have not been disclosed yet, so improved visibility presents an upside to the earnings growth trajectory. Beyond the near-term, planned launches with regional distribution partners such as Millicom (TIGO) and additional soft launches throughout Latin/South America also add to the optimistic outlook.

Gearing Up for a Solid Year Ahead

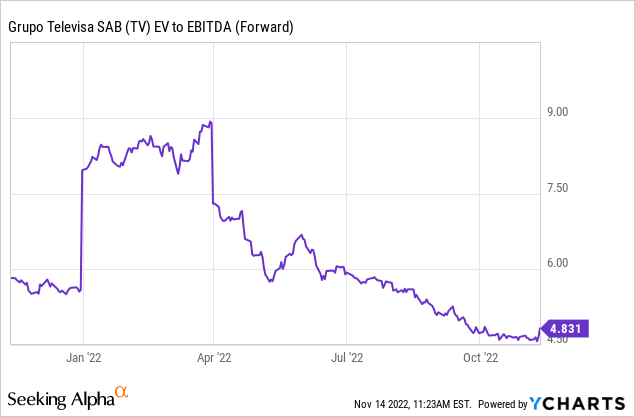

Coming off a strong Q3, things are looking up for Televisa. Operational momentum has been gaining traction, while streaming is on track to turn profitable as soon as end-2023 (the first full year of operation) despite a challenging macro backdrop. In the meantime, management has done well to de-risk the balance sheet, having paid down ~$800m of debt with its cash balance, paving the way for more stock buybacks in the coming quarters.

Overall, I remain bullish on the Televisa investment case, particularly with the current valuation embedding pessimistic views of its Pay TV business and streaming initiative through TelevisaUnivision, as well as the Sky operations. Key near-term catalysts include advertising tailwinds from the US midterm elections and the upcoming World Cup in Qatar.

Be the first to comment