Mariakray/iStock via Getty Images

Summary

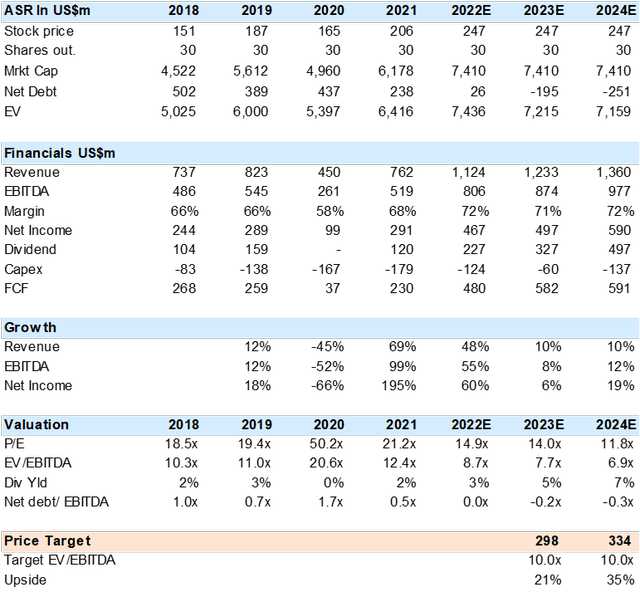

Grupo Aeroportuario del Sureste, S. A. B. de C. V. (NYSE:ASR) which operates the Cancun airport among others, is on track for full recovery from the pandemic in 2020. The company has solid fundamentals with revenue and free cash flow growth coupled with debt reduction. However, the share price valuation is at multi year lows on fears the Tulum airport could eventually take away traffic. This potential competition should be incorporated into the next 5-year master plan (MDP), which safeguards ASR profitability.

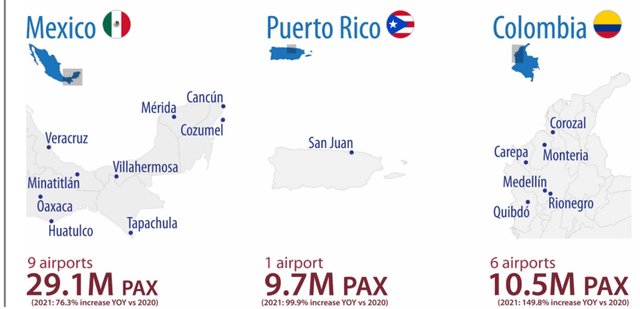

ASR airport assets (Image created by ASR)

Business Model

All of Mexican airports (except Mexico City) are concessions with a 50-year term plus 50-year renewal and operate on a duel till system; infrastructure (terminals, runway etc.) has a regulated return and commercial (retail/restaurant) revenue is not regulated.

Regulated Business: The airport fee charged to passenger as well as other fees to airlines are the main revenue source. This rate is set by a 5-year MDP (master infrastructure capex plan for terminals, runways etc.). This rate carries a 4% to 6% return + Mexico risk free rate + construction inflation which totals between 12% to 15% (in MXN). The companies have traffic risk i.e., if passenger/cargo traffic is lower than estimated they earn a lower rate and vice versa.

Not Regulated: Commercial revenue are generally rents on restaurants, duty free and retail stores. The key to this revenue source is that the regulated business “paid” for the infrastructure/store or restaurant space. Thus, margins are near 95% and ROIC (return on invested capital) over 60%. International passengers spend 2- or 3-times domestic passengers and thus tourist destination airports, like Cancun, are the most profitable.

Tulum and the Next Master Plan

ASR will begin negotiating, with Mexican Regulators, its next 5yr MDP for 2023 -2028. The construction of the Tulum airport, that is 2 hours south of Cancun will be factored into the discussion. ASR may seek far lower expansion capex, given the 4m passenger capacity of the Tulum airport to safeguard cash flow. The new tariff should see a reasonable increase on a higher risk-free rate i.e. Mexico bond rates that increased to 9% from 7% during the last MDP plus construction inflation of around 10%, but should limit growth with the Cancun Airport near full capacity.

The Tulum airport is a direct government initiative, built and funded by the military and linked to the Maya train development. The viability of this project and speed of construction is uncertain. It would not be out of the question that it is eventually sold to ASR in a change of government.

Puerto Rico and Colombia Airports

ASR acquired the San Juan Puerto Rico (30 yr. left concession) airport in 2013 and Aeroplan, 6 Airports in Colombia (15 yr. concession) in 2017 with the most important Medellin. The concessions do not require mandatory infrastructure investment and for the most part pay a variable concession fee on revenue. The key is to manage the airports in the most efficient manager, stimulate traffic and increase none regulated or commercial revenue.

PAX Growth Key Driver

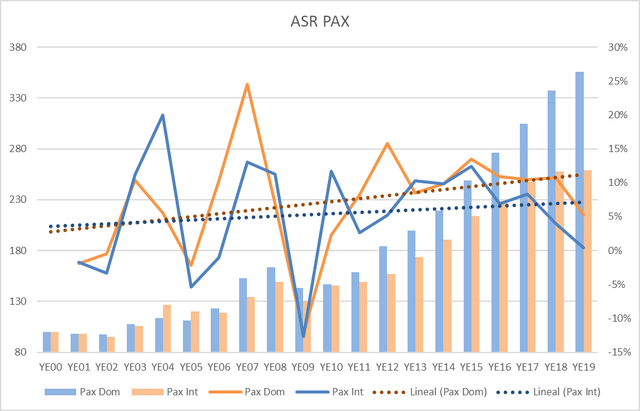

Passenger traffic is key to the fundamentals of the sector. International tourist at ASR grew 5.5% and domestic traffic 7.5% since 2000 both in a general uptrend. Mexico has a significant tourist industry with over 64m visitor spending US$25bn annually. Domestic traffic is on the rise as well. Mexico has a large population, over 120m, who are increasingly switching from bus service to air travel on increased disposable income as well as lower air fare costs driven by the low and ultra-low cost carriers such as Controladora Vuela Compañía de Aviación, S.A.B. de C.V. (VLRS).

Total PAX at ASR has grown on average 6.6% since 2000 and most master plans factor in 5% to 7% PAX growth that would require further expansion at the key Cancun airport. However, given the potential competition of the Tulum airport and near full capacity of Cancun I am modeling 4% PAX growth in 2023 and 3% forward.

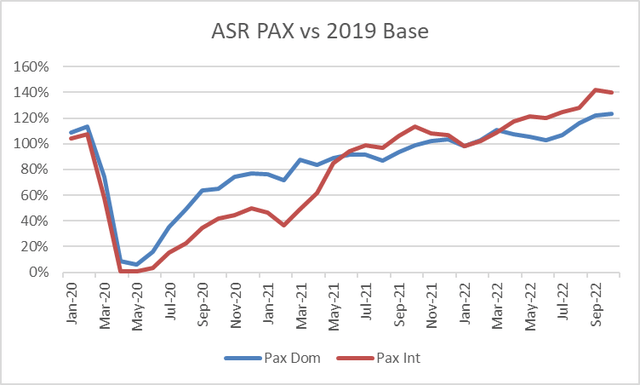

ASR Domestic and International PAX recovery vs YE19 (Created by author with data from ASR) Long Term PAX growth of 6.6% (Created by author with data from ASR)

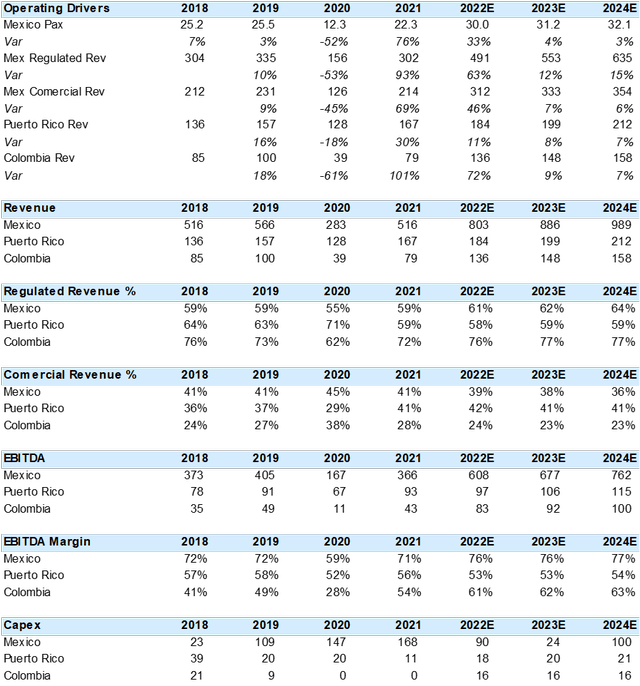

I assume a return to trend growth in 2023 as Cancun, Puerto Rico and Colombia air traffic resumes growth from base 2019 pre pandemic levels. The estimates are in USD with a flat MXN.

Revenue growth is higher than PAX on inflation pass through and increased commercial revenue.

EBITDA margins expand on cost dilution. The pandemic forced ASR, and many companies, to become more efficient. This lower cost structure should benefit margin as PAX and revenue grow.

ASR key operating drivers (Created by author with data from ASR)

Valuation

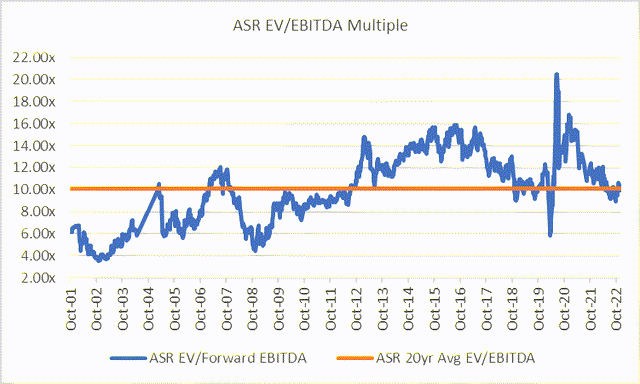

I valued the stock at 10x EV/EBITDA, which is in line with the 20 yr average but below the last 10yr. The market has de-rated ASR on the Puerto Rico and Colombia acquisition given there lower returns vs Mexico assets as well as perceived business model limitations. At present and despite the very strong financial performance post covid, the stock is discounted on the Tulum airport threat as mentioned above.

ASR Summary Financial and Valuation Data (Created by author with data from ASR)

Historic forward EV/EBITDA multiple (Created by author with data Capital IQ)

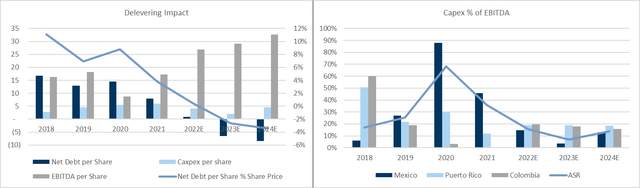

Capex is a key valuation driver, since ASR should build cash or reduce net debt per share and this benefits valuation. If the Tulum airport is built and factored into the next MDP then ASR will likely need far lower investment. Puerto Rico and Colombia assets also require lower capex and the net result is higher free cash flow. The company may then increase dividends or look for other M&A opportunities.

Delevering Impact on ASR Share Valuation (Created by author with data from ASR)

Conclusion

I find ASR discounted on the Tulum airport threat that can be mitigated in the upcoming master development plan. At the same time, all of its airports are fully recovered or above pre-pandemic EBITDA and should generate substantial free cash flow that further adds value to the shares.

Be the first to comment