seewhatmitchsee

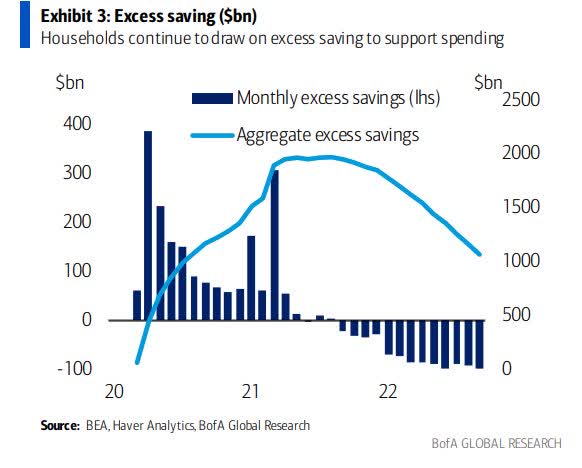

Retail stocks have been holding their own since May despite market volatility and a weakening consumer landscape. While folks are still spending, it appears excess savings is sharply on the decline as credit card usage rises. One once-popular internet marketing name with ties to the retail industry has fallen from grace. Will a positive Q3 earnings report turn the tide on Groupon, Inc. (NASDAQ:GRPN)? Let’s weigh the evidence.

Household Spending Up, Savings Down

BofA Global Research

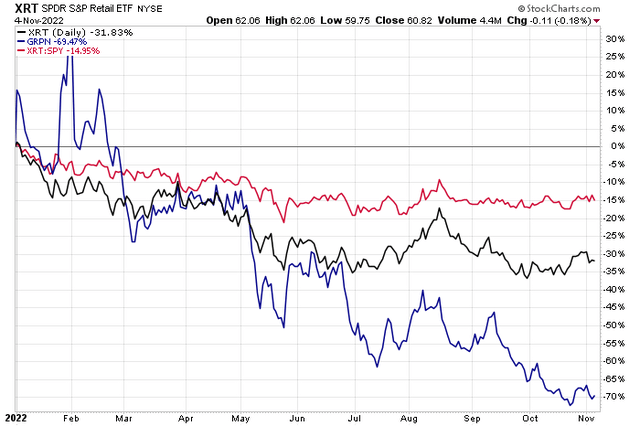

Retail Stocks Holding Up Vs. SPY, But Not Groupon

Stockcharts.com

According to Fidelity Investments, Groupon, together with its subsidiaries, operates a marketplace that connects consumers to merchants. It operates in two segments, North America and International. The company sells goods or services on behalf of third-party merchants; and first-party goods inventory. It serves customers through its mobile applications and websites.

The Chicago-based $214 million market cap Internet & Direct Marketing Retail industry company within the Consumer Discretionary sector has negative trailing 12-month earnings and does not pay a dividend, according to The Wall Street Journal. Importantly, ahead of earnings Monday night, the stock has a massive 50.7% short interest, according to Seeking Alpha.

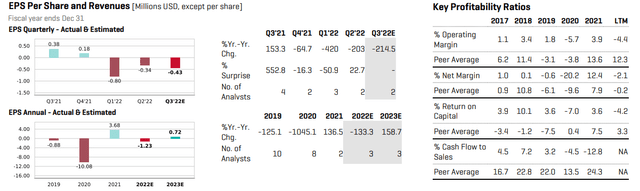

On earnings and valuation, CFRA Research shows a consensus EPS forecast of a loss of $0.43 per share for this week’s earnings release. Per-share profits are seen as being in the red for the full year, but a turn higher in net income is expected in 2023.

What I don’t like to see is such a weak revenue trend. Actual sales are sharply lower year-on-year. Meanwhile, the company has a negative operating margin, indicated by Seeking Alpha’s D Profitability rating. Following last quarter’s report, the company announced job cuts. I would not be surprised to hear the same tonight.

I see risks to the company’s operations from rising labor costs and a weakening consumer. Moreover, other larger competitors will likely continue taking market share.

Groupon: Earnings Per Share & Revenue Outlooks, Key Ratios

CFRA Research

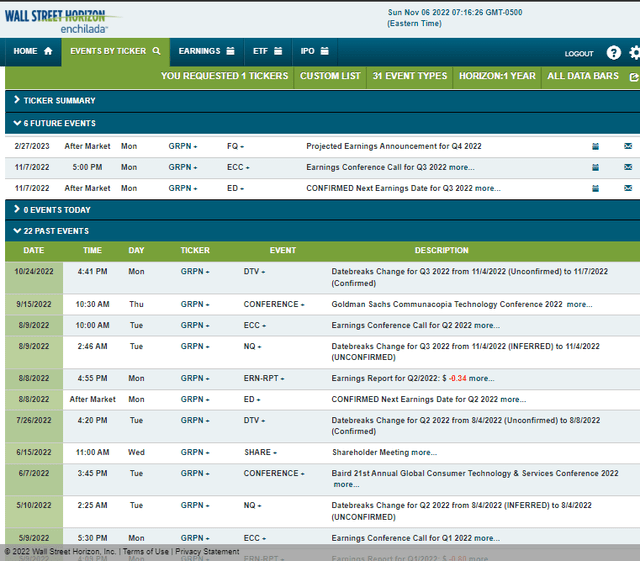

Looking ahead, data from Wall Street Horizon show a confirmed Q3 earnings date of Monday, November 7 AMC with a conference call immediately after results cross the wires. You can listen live here.

The corporate event calendar is light aside from the quarterly report.

Corporate Event Calendar

Wall Street Horizon

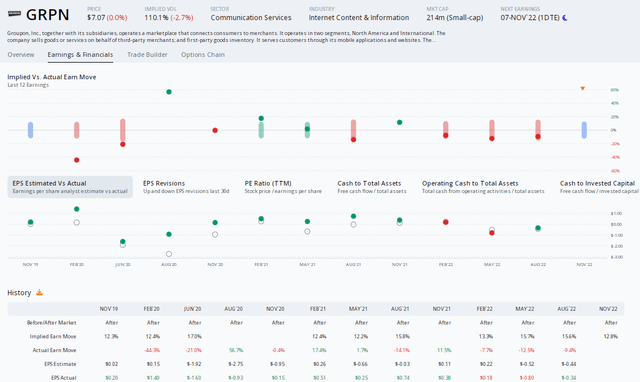

The Options Angle

Digging into the upcoming earnings report, data from Option Research & Technology Services (ORATS) show an implied post-earnings stock price swing of 12.8% using the nearest-expiring at-the-money straddle. Options traders expect a big move, but Q2’s straddle is priced slightly cheaper compared to recent quarters. Those options might be on the cheap side, judging from some large historical stock price moves.

Unfortunately for the bulls, shares have traded lower post-reporting in the last three quarters, and the company has missed bottom-line estimates in two of the past three instances. Overall, the options appear properly priced, but buying puts ahead of earnings might still work out. You can always sell a lower strike put to help finance the trade.

GRPN: A Big Swing Seen Post-Earnings

ORATS

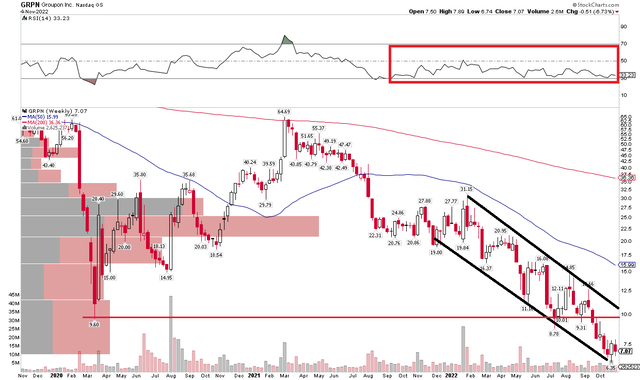

The Technical Take

GRPN is mired in a steep downtrend that is confirmed by a very weak weekly RSI range. It’s thought that the 20 to 60 range in RSI indicates a downtrend in the stock price, and that aligns with what I see in Groupon stock.

The bulls must see a price reversal from a bearish channel that has taken GRPN from above $30 to under $7 recently. What’s more, the March 2020 low has now been taken out, adding to more downside risks.

There is always the chance we could see a major short-covering rally given its noted high short interest. Also, the stock is now more than 50% under its falling 50-week moving average – a historically big amount. So, mean reversion could be a friend to the bottom-pickers here.

Overall, though, the stock is obviously in a bearish trend and does not show imminent signs of stabilization or reversing higher.

GRPN: Downtrending Stock Price Confirmed by Momentum

Stockcharts.com

The Bottom Line

With an earnings per share drop expected ahead of Groupon’s Q3 report Monday night and the stock stuck in a very pronounced downtrend, I am bearish on shares near and long term.

Be the first to comment