InfinitumProdux/iStock via Getty Images

Grindrod Shipping (NASDAQ:GRIN) is a dry bulk shipping company that has seen a spectacular turnaround in its earnings over the past year as charter rates recovered. The company has used those earnings to pay down debt, giving it a healthy balance sheet, and improve shareholder returns with a new dividend policy. With the recent retirement of the company’s CEO, Grindrod may be positioning itself to be acquired—which could bode well for shareholders.

Earnings Outlook

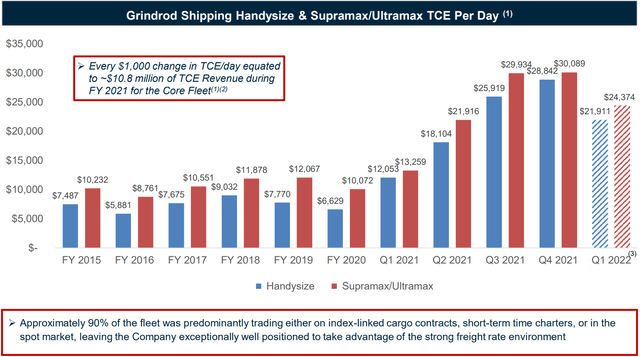

Grindrod had a great year in 2021 with record net income from the company’s fleet of 31 vessels. The company reported diluted EPS per share of $6.12, adjusted for discontinued operations. The company also saw strong revenue of $455 million. This was primarily driven by a recovery in spot rates for dry bulkers, which grew significantly throughout the year.

Grindrod Shipping March Presentation

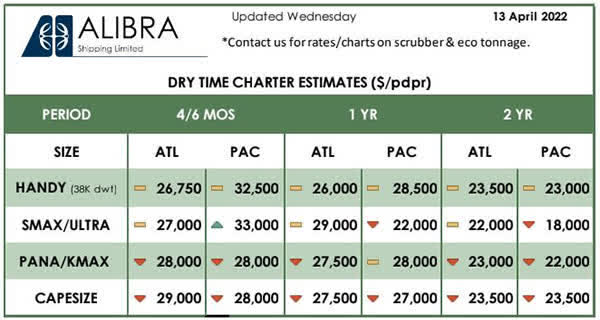

The question now is whether going forward, Grindrod will be able to see similarly high rates necessary for it to turn a strong profit as in 2021. At the moment, the situation is looking good. According to the most recent charter rate data from various sources, rates have risen from $21,911 for Handysize and $24,374 for Supra/Ultramax as outlined in Grindrod’s presentation.

Hellenic Shipping News

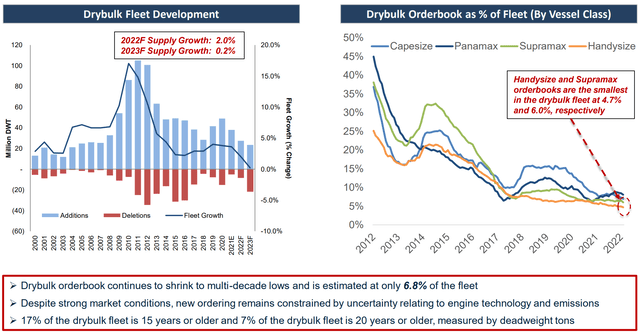

Furthermore, the orderbook for dry bulkers is at historical lows, representing only 6.8% of the global dry bulk fleet.

Grindrod Shipping March Presentation

This means that barring a significant drop in demand, there is no imminent supply boom to ruin the party of rising rates. And Grindrod is uniquely well-positioned with its younger-than-average fleet with a tonnage-weighted age of 6 years between its 15 Handysize and 16 Supra/Ultramax vessels. With 22 of these vessels being eco-spec, the company should be able to utilize its existing vessels for many more years even with pending environmental regulations.

Potential Takeover Noise

With the recent announcement that Grindrod Shipping’s longstanding CEO is stepping down, there have been some rumblings that the company may be positioning itself to be acquired. Supposedly the company is not looking for a long-term replacement for its current CEO, rather appointing its current CFO to the position. This has driven speculation that the company may be seeking to merge or be acquired at this time. One obvious suitor might be Taylor Maritime, which has built up a 26.6% stake in Grindrod over the past year. However, the two companies have roughly the same market cap (Taylor Maritime is worth $6 million more) which makes the terms of the deal a bit harder lest Taylor Maritime figure out a generous debt deal.

Any such deal would likely be advantageous to shareholders since an offer would probably come in significantly over the current share price. Grindrod’s net asset value was estimated at around $30 per share in February by analyst Poe Fratt. To make any deal attractive, the acquiring company would be wise to offer above that level, giving shareholders an upside of over 20%.

Balance Sheet

Grindrod’s balance sheet has meaningfully improved over the past year as the company has become flush with cash. It has used some of that cash from higher rates to pay down its debt. This has brought the company’s total debt from $329.7 million at year-end 2020 to $278.9 million at year-end 2021. Conversely, the company’s cash balance rose from $41.3 million to $107.1 million. This gives the company a net debt of $171 million which is more than manageable at 1.4 times trailing earnings. The company now has a very healthy debt to equity ratio of 0.87—a ratio of less than 1 that is a pleasure to see in a shipping company.

It is worth also noting that the company’s remaining debt is on a schedule that looks far from ambitious to pay off and with current rates, I see no reason to be concerned about the company’s solvency.

Dividend/Buyback Policy

Amidst soaring earnings for the company, Grindrod announced a new dividend policy that aims to distribute 30% of its adjusted net income to shareholders—primarily in the form of dividends. For the past two quarters that has meant a $0.72 dividend each and a combined $11.6 million in buybacks. With projected earnings for 2022 at $5.67 per share, this level of dividend is more along the lines of 50% rather than 30%, which suggests we may see a cut back in payout per quarter. Nonetheless, at 30% of 2022 projected earnings, we get a dividend of around $1.7 for the year—a yield of 6.8%. Since the company only announced its dividend policy in the third quarter of 2021, added visibility to the yield and stability of the company’s payout in 2022 should be good news for shares since a current trailing yield puts the company at only 2.91%—far lower than the forward yield will be.

Risks

The dry bulk industry is known for its ups and downs and the primary risk to the company is that rates take a nosedive. As I covered earlier, I do not think this is highly likely given the tight supply-side situation. That said, amidst rising inflation and uncertainty in the economy, we could see demand start to take a more significant hit over the coming year which could in turn drive down charter rates as the demand side for raw materials that need to be transported on bulkers decreases.

The question of incoming environmental emissions regulations is also one that could be decisive for the future of the industry. Grindrod has been building its ships to high ecological standards however there is a chance that new guidance may mean the company has to phase out the fleet or engage in retrofits that could end up expensive. On the flip side, if its ships remain on the good side of the new regulations, the company will benefit from other firms having to take their older less-efficient vessels off the water.

Valuation

As previously discussed, the company is trading below its net asset value of $30 per share. Grindrod has only been publicly traded since 2018, but comparing the five-year average forward price to earnings ratio of one of its longer-standing peers Safe Bulkers (SB) of 11.95 to Grindrod’s forward price to earnings ratio of 4.37 we see that the company is trading cheaply relative to earnings. I think that if rates hold and the company is able to capitalize on them successfully in the coming year, we could see a price to earnings ratio nearer to that 11.95—possibly 8 times earnings, which would put shares at $45, for an upside of 80%.

Conclusion

The next year should be a good one for shareholders of Grindrod Shipping. Whether the company is acquired or simply continues to operate independently under a new dividend policy, there should be further upside ahead. Greater visibility for the company’s higher earnings and new dividends should attract new investors to the company. Additionally, further debt reduction will leave the company superbly positioned going forward. In the case that the company does get acquired, it should be at a significant premium to current share prices—good news for investors.

Be the first to comment