coffeekai

Instead Of An Investment Thesis

Recently, more and more information is emerging about a new wave of coronavirus that could dampen demand for raw materials for heavy industry companies, as it did in 2020 – which is probably why shipping stocks are falling so sharply.

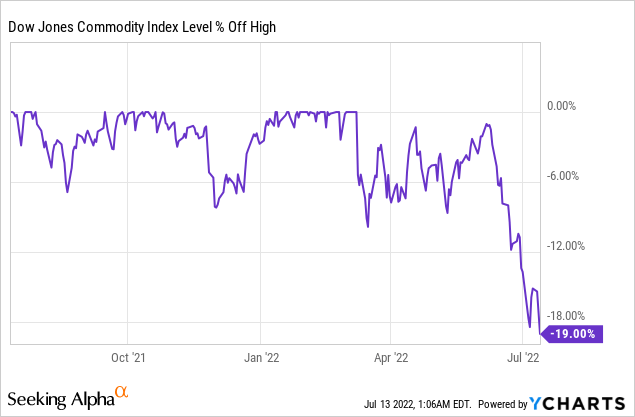

We see the same in commodity prices – the Dow Jones Commodity Index, which tracks a broad range of 28 different commodity futures contracts, including metals, agricultural products, and energy commodities such as oil and gas, is down 19% from its highs:

In my opinion, however, these fears are somewhat exaggerated – yes, the slowdown in Chinese economic activity is a new reality, but it does not cancel out the demand for the active use of bulk carriers in world trade.

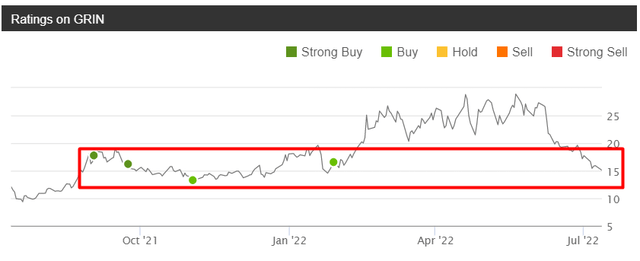

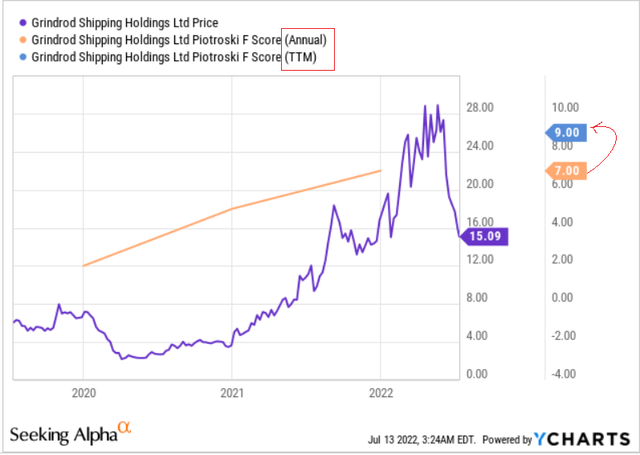

An example of a high-quality dry bulk shipping company that has become oversold is Grindrod Shipping Holdings Ltd. (NASDAQ:GRIN), which I cover regularly here on Seeking Alpha. Now the share price has approached the price level from which I published all my bullish articles:

My rating on GRIN with notes, Seeking Alpha

Since not much has changed structurally in this shipping industry, I think GRIN is attractive enough for both a short-term speculative buy and a longer-term dividend buy – the bull cycle in shipping is not over yet.

My General Reasoning

Everyone is afraid of the state of the Chinese economy and the fact that steel production could drop significantly due to the danger of the property crisis slipping out of the CCP’s control. A drop in demand for steel will lead to a drop in demand for iron ore, one of the main transport products for bulk carriers.

Since this really makes sense – no one has canceled the property debt crisis in China as well as slowdown in the global economy – I believe that not everything is so bad and that we should not only look at the demand side but also the supply side.

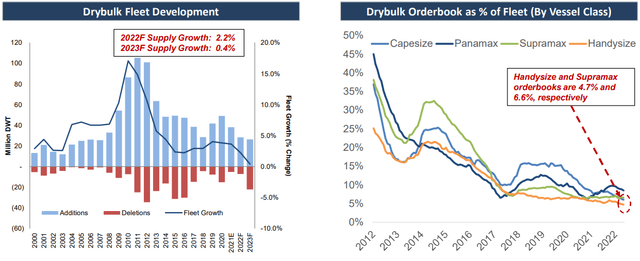

The dry bulk shipping market differs from the container shipping market in many ways, but one of the most important differences, in my opinion, is the size of the orderbook. Dry bulk carriers make up 21 percent of the world’s merchant fleets, and it takes years to build a single vessel. So, everyone is looking at the order book to see how many new ships will be at sea in the coming years.

So far, the order book for dry bulk carriers looks quite good for the industry, accounting for only 4.7% and 6.6% of the total Handysize and Supramax fleets respectively. At the same time, the number of vessels is expected to increase the fleet by 2.2% and 0.4% in 2022 and 2023, respectively – most new orders could set sail in mid-2024 at the earliest, according to Grindrod Shipping Holdings’ management.

At the same time, according to Splash, the order book of container ships is reaching an all-time high – the ratio of orderbook-to-fleet is currently 25% (or 27% if orders under negotiation and those not yet confirmed are included).

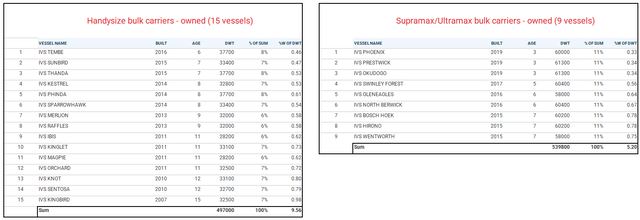

Back to bulk carriers: according to GRIN, 22% of the bulk fleet is 15 years or older and 11% of the bulk fleet is 20 years or older, measured by deadweight tonnage ((dwt)). Approximately the same conclusion was reached by the management of Precious Shipping in February this year with a small addition – ship recycling decreased by 64% in 2021 compared to 2020, despite the increase in vessel utilization. This was a consequence of high demand, but at the same time also of necessity on the supply side – if new ships do not appear for a few years, the old ones have to be used actively. There are operational risks to this approach – if your fleet is relatively old, you will need to repair it more frequently after more intensive use – this will affect fleet utilization and asset turnover. Therefore, those with a relatively new fleet are in a better position. GRIN is one such company, with 15 Handysize and 9 Supramax/Ultramax vessels, which are on average 9.56 and 5.2 years old respectively (dwt-weighted):

Author’s calculations, based on GRIN’s data

The age of 7 chartered – in Supramax/Ultramax bulk carriers are also quite young – is about 5.5 years (also dwt-weighted). Due to limited supply in the bulk carrier market, Handysize and Supra/Ultramax vessel prices have risen 10% since the beginning of this year (last quarter data). We are now seeing bulk carrier stocks trading significantly lower than YTD, although their assets should be positively revalued (especially newer assets like GRIN’s).

The dynamics of the fundamental operational indicators also speak for the medium-term growth potential of GRIN. For this assessment, I like to use Piotroski’s F-score – this criterion comprises 9 ratios showing a company’s creditworthiness, profitability, and operational efficiency. In recent years, this criterion for GRIN has increased but has not reached the maximum score of 9. This was the case until recently – now the TTM score of this criterion indicates a continued improvement in the company’s business dynamics:

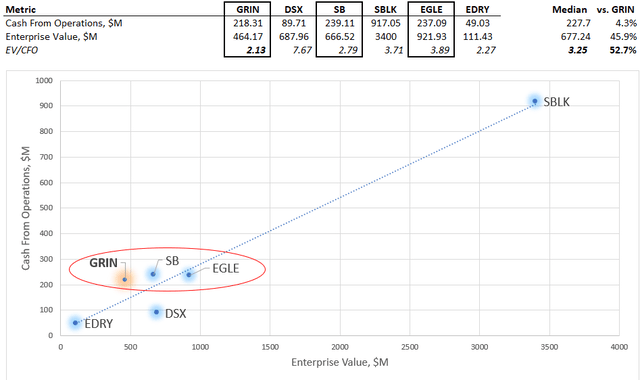

A few words about valuation. It is quite difficult to make predictions in a cyclical industry, but looking at the recent past, I realize that GRIN should be valued at about the same level as Safe Bulkers (SB) or Eagle Bulk Shipping (EGLE) given its operating efficiency (in terms of cash flow generation – CFO), which implies a share price upside of 30-80% (rough calculation based on EV/CFO ratios comparison):

Author’s calculations, based on SA data

Some Signs Of GRIN’s Oversold-ness

Now a few words about how I see the technical picture of GRIN.

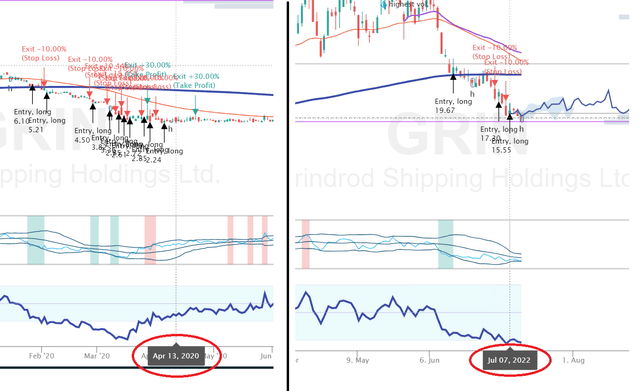

Before any serious talk of the “new destructive wave of the coronavirus,” the stock was following the RSI almost perfectly – local oversold and overbought levels were actively bought and sold, allowing speculators to earn on the medium-term upward movement of the price. At some point this no longer worked – liquidity began to dry up sharply and the breach of the RSI level at 35 did not lead to recovery as in previous periods. On the contrary, since then the share has fallen by another 25% and continues to fall now.

Investing.com, GRIN, author’s notes

Now the RSI is already at a level just above 28, having crossed the critical threshold of 30 on 6 July and also not leading to an appropriate bounce back.

In my opinion, for speculative purposes you can open a LONG position now – the price has yet to fall to a strong support level of around 7-9% and we cannot know when a reversal will occur. If you open a 1/3 position now and leave the rest in case of a further fall, you can get a good average purchase price that can be realized on a pullback.

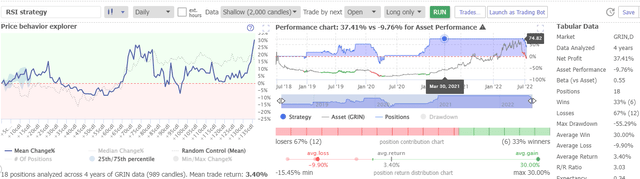

Historically, a speculator who bought GRIN at an RSI of 35 or less, with a take profit of 30% and a stop loss of 10% (risk/reward = 1/3) has earned an average of 3.4% per trade over the last ~4 years (18 trades in total with a win rate of 33%):

TrendSpider software, GRIN, RSI testing

Author’s note: Special thanks to fellow SA contributor Danil Sereda (see our association in my bio description) for running the TrendSpider software to obtain the above information.

By evenly adding to the position at such oversold price levels, the investor partially eliminates the risks of a deep drawdown and increases the probability of making money on each new purchase, in my view.

For investors, not speculators, buying GRIN is a good opportunity to take a stake in a company whose assets have risen in price since the beginning of the year, whose fleet is relatively young, and whose valuation has comfortable upside potential.

Risks To Consider And Final Thoughts

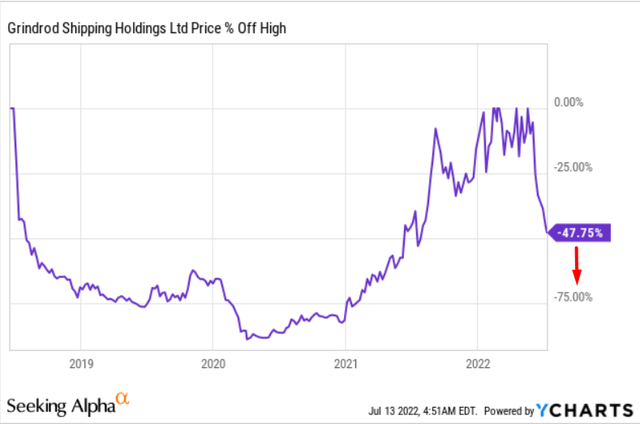

I am aware that I may be wrong in underestimating: a) the cyclical phase; and b) the problems with the threat of recession and falling Chinese demand. In the medium term, a recession or a reversal of the market cycle can be very painful – a 48% decline from the peak will then seem to be just the beginning:

YCharts, GRIN (% off high), author’s notes

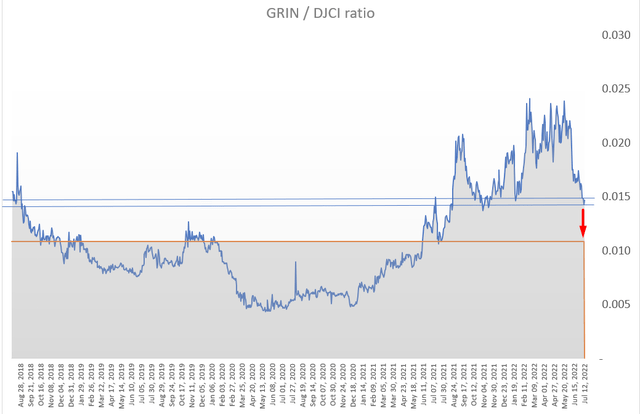

If we compare GRIN with the broader Dow Jones Commodity Index, we see that despite the strong recent correction, the stock is still far from its historical levels:

Author’s calculations, based on Investing.com’s data

Moreover, in valuing the company, I have used actual past results, not forward ones – the future is nebulous, especially in such a cyclical industry.

The conclusions of my technical analysis may be wrong – this is not a science but art in investing/trading. Backtesting the “low RSI buying strategy” also suggests that dip buyers can get burnt out during downtrends until a stock finds its bottom and changes trend.

TrendSpider software, RSI backtesting in 2020 and 2022 with author’s notes

Despite the considerable risks involved in my bullish thesis, I believe that at current levels one can gradually buy shares in Grindrod Shipping both for speculative purposes and medium-term investment purposes.

I’d love to read your thoughts on this in the comments below!

Be the first to comment