LeManna/iStock via Getty Images

Intro

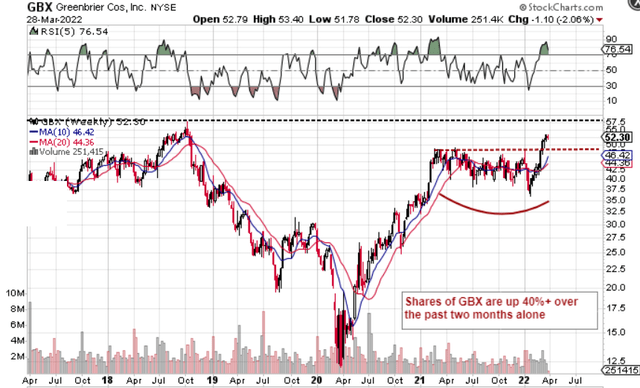

If we look at a technical chart of The Greenbrier Companies, Inc. (NYSE:GBX), we can see that shares have broken out of the consolidation pattern they had been undergoing for the best part of 12 months. Trend followers will be watching GBX closely due to its excellent performance over the past two months or so. Due to Greenbrier’s current strong momentum, shares should now at least test their 2018 highs of approximately $60 a share, so it will be interesting to see if indeed shares break out above that resistance level.

Greenbrier Momentum Continues (StockCharts.com)

To get some insights on how strong Greenbrier’s fundamentals really are, we can turn to the strength of its dividend. The reason being the key financial metrics that make up the dividend are found on all three financial statements. Suffice it to say, normally a strong growing dividend with bullish trends across multiple key metrics is a vote of confidence for the company’s forward-looking fundamentals as long as internally generated cash flow is fueling the increases.

Dividend Yield

Greenbrier’s dividend yield comes in at 2.07% which is roughly 25% below the company’s 5-year average. This is understandable given the strong momentum shares have delivered over the past two months or so which actually led to the breakout. Dividend yields are coming in for extra scrutiny at present due to how bond yields have been rising in recent months. The 10-year US bond, for example, is now returning almost 2.5% per year, so investors straight off the bat here are actually losing purchasing power by investing in GBX for income.

Dividend Growth

This brings us to growth in the pay-out and here we see that management has not grown the dividend since January 2020 when we saw a $0.02 quarterly increase. Growth fosters confidence with respect to future profitability plus it also protects one’s purchasing power as alluded to earlier. Greenbrier has paid the dividend for almost eight years now and has not missed a payment since the dividend was enacted. Given the high fixed cost nature of this industry and the ongoing ramifications of the pandemic/epidemic, this is a feat in itself.

Dividend Pay/Out Ratio

Over the past four quarters, Greenbrier actually spent $246 million of operating cash flow and spent a further $252 million on investing initiatives. Suffice it to say, the company did not generate any free cash flow over the past 12 months and had to issue debt as well as resort to other financing activities in order to keep the cash balance elevated. Cash still fell by $234 million in Q1 and by close to $300 million over the past 12 months to finally rest at $438 million at the end of the first quarter

Debt To Equity Ratio

Short-term debt increased to $516 million at the end of the first quarter and long-term debt came in at $896 million. Shareholder equity totaled $1.237 billion at the end of the first quarter which means the company’s debt to equity ratio currently comes in at 1.14. In terms of trends, this number (all be it well over 1) is actually on the low side for Greenbrier when we look at the company’s historic ratios. However, when we take the transportation industry into account as a whole, the industry median comes in at a much lower 0.63. The current ratio at the end of Q1 came in at 1.53 so for the most part and working off former trends, Greenbrier’s solvency and liquidity appear to be in solid shape.

Interest Coverage Ratio

To see how this interest-bearing debt has been affecting earnings over the past 12 months, we go to the income statement. $46.1 million of operating profit was generated in this time period, of which $45.5 million went towards servicing the debt load. Here is where we see the ramifications of taking on that extra debt in recent quarters. Suffice to say, in the near term, it is unlikely that the dividend will be increased as practically all of the company’s EBIT has been servicing the debt payments.

Projected Earnings Growth

Here is where we see strong validation with respect to how management has invested capital in recent times. Company assets, for example, have increased by more than $420 million over the past four quarters and these very same assets are expected to increase sales by 47% ($2.58 billion projection) and bottom line earnings by 104% ($2.25 EPS projection) in fiscal 2022 (Finishing August this year). These trends are expected to deliver positive operating cash flow (Fwd Price To Cash Flow of 25.63) this year which is obviously bullish for the dividend and balance sheet, respectively.

Conclusion

Therefore, to sum up, Greenbrier’s dividend looks stable at present due to the company’s liquidity and strong earnings growth which is projected this year. It must be acknowledged that the yield, as well as the dividend’s growth profile, will not turn many heads but management none the same continues to reward shareholders. Furthermore, because of the solid returns shareholders have made in recent months in GBX, the dividend has only been a side issue really as it only has made up a small percentage of those returns. Let’s see if estimates can be met in Q2. We look forward to continued coverage.

Be the first to comment