CHUNYIP WONG/iStock via Getty Images

Investment Thesis

Green Plains Partners LP (NASDAQ:GPP) is an American fuel storage and transportation services provider headquartered in Nebraska, United States. In this thesis, I will primarily be focusing on the dividend yield of GPP and its future growth prospects. I will also analyze the financial statements of GPP along with the risks that it faces. I believe GPP is a great investment opportunity for investors looking for a high dividend yield. I assign a buy rating for GPP after considering the high dividend yield along with the favorable risk-reward profile that it provides.

Company Overview

GPP provides ethanol and other fuel storage and transportation facilities to its parent company Green Plains Inc. GGP has a fee-based agreement with its parent company through which it earns the revenue. GPP owns or leases a total of 29 ethanol storage facilities along with four fuel terminals in Alabama, Louisiana, Mississippi, and Oklahoma. These 29 ethanol storage tanks have a total capacity of 25.9mmg, and the four fuel terminals have a combined fuel storage capacity of 6.9mmg. Along with fuel storage, GPP also provides transportation and delivery services for the fuel. The primary mode of transport used by GPP is the railroads. GPP has leased a railcar fleet consisting of a total of 2300 railcars having a total capacity of 69mmg. GPP also has a fleet of 19 trucks to transport ethanol and other fuels. The fee-based model immunes GPP from a direct impact on the fuel price fluctuations as the firm only provides storage and transportation facility for fuel and doesn’t own the fuel in any way. This is one of the factors that makes GPP a safe option even in a volatile fuel space.

Solid Dividend Yield of 14%

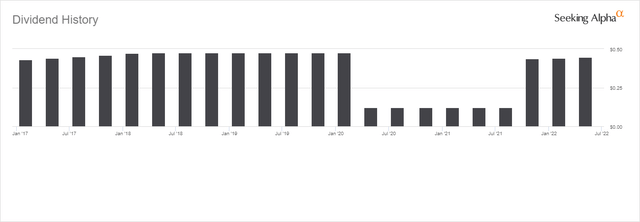

GPP has a history of strong and stable dividend yields. Except for FY20 and FY21, where GPP struggled due to the total shutdown worldwide along with a steep fall in the fuel demand. GPP now seems to be back on track and is getting closer to the pre-Covid19 dividend payout level. On July 21, 2022, GPP announced a quarterly dividend of $0.45, payable on August 12, amounting to a $1.80 annualized dividend. This gives us an annual dividend yield of a solid 14%. GPP has now delivered four consecutive quarters of dividend payout of over $0.4 in each quarter and is consistently increasing the payout. I believe at the current price level, GPP has a very limited downside risk, and it is a solid investment opportunity for investors looking for high dividend income with limited risk exposure.

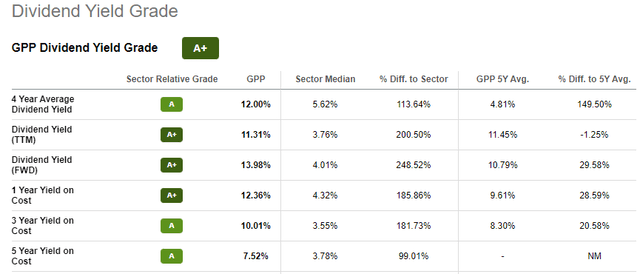

To get a better insight into the dividend yield, let us look at the relative performance of GPP compared to sectoral performance. GPP has the highest overall dividend grade of A+ by Seeking Alpha. As we can see in the chart above, GPP has outperformed the sectoral median on all parameters by a significantly high margin. With the global ethanol demand consistently rising due to its use as a biofuel, this makes me optimistic about the future growth of GPP as it majorly deals with ethanol storage and transportation. I believe this dividend yield is sustainable over a longer period of time, therefore.

Financials

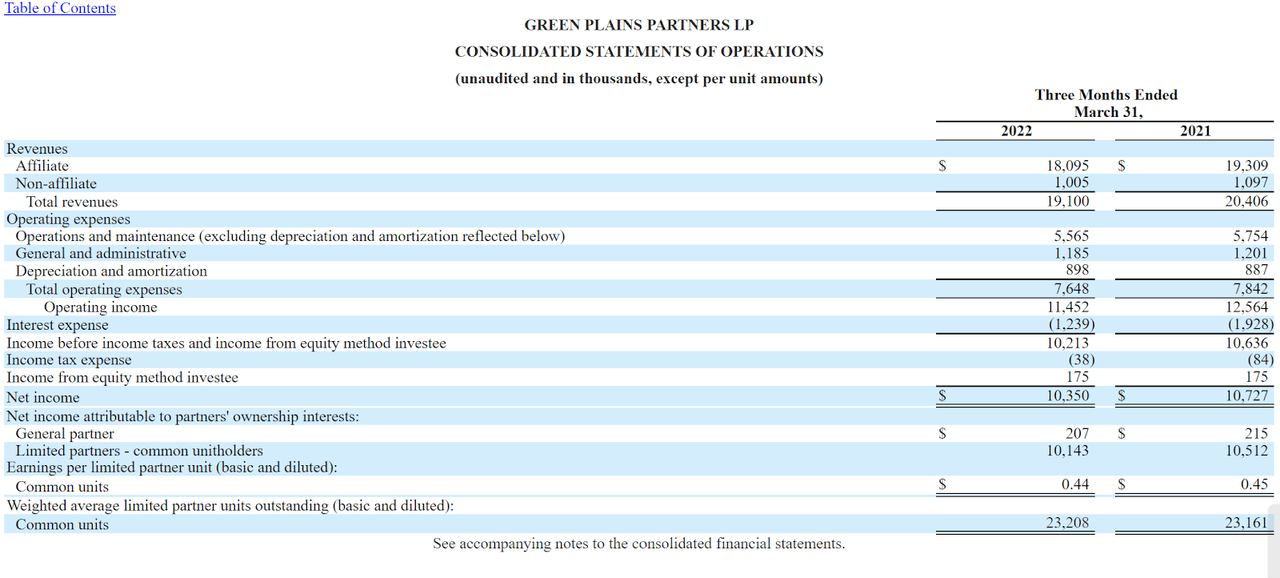

SEC: 10Q GPP

GPP has recently announced the results of the Q1 FY2022. It has reported revenue of $19.1 million, which is a decrease of $1.3 million or 6.4% as compared to $20.4 million of the Q1 FY2021. It has reported a revenue decrease of $0.7 million in storage and throughput services driven by a decline in the contracted minimum volume due to the sale of Ord ethanol plant. Revenue from railcar transportation services fell by $0.4 million, primarily due to a decline in overall volumetric capacity. Trucking and other income fell by $0.3 million, primarily due to lower affiliate freight volume. The revenue from the terminal services has increased by 14% compared to the previous year’s period. Operating expenses decreased by $0.2 million for the Q1 FY2022, compared with the same period of FY2021. GPP reported an adjusted EBITDA of $12.6 million, which is a decrease of 8.7% as compared to $13.8 million of the same period of the previous year. Net income of the Q1 FY2022 is $10.4 million or $0.44 per common unit, which is a 2.8% decrease as compared to $10.7 million, or $0.45 per common unit of the Q1 FY2022. The distributable cash flow of the last quarter is $11.2 million, and the quarterly cash distribution is $0.445 per unit. The distribution coverage ratio for the Q1 FY2022 was 1.06x. The quarterly results were in line with the expectation and I believe going ahead the aggregate fuel volumes will increase given the increased ethanol demand globally. As per my analysis, GPP will perform exceeding well in H2 compared to the H1 performance.

Todd Becker, President, and CEO, Stated –

Green Plains Partners continues to deliver stable financial results, our steady operating results and low leverage provide for consistent cash flow generation allowing the partnership to increase its quarterly distribution for the third consecutive quarter.

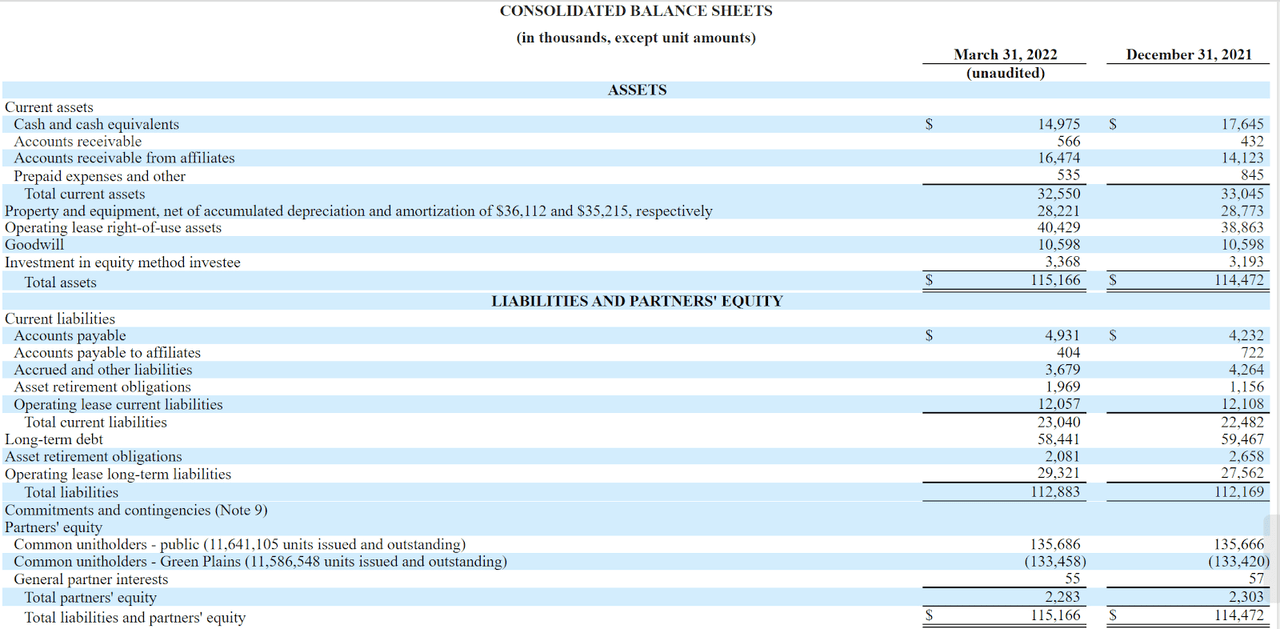

SEC:10Q GPP

As of March 31, 2022, GPP had $15.0 million in cash and cash equivalents. GPP reported a debt amount of $58.4 million. It has managed to reduce the term debt by $1 million and maintain a leverage ratio of 1.15x. I believe the company has healthy financials, and it would help the company to increase its payout ratio in the future.

Valuation

GPP currently trades at $12.67 with a market cap of $294.29 million, and a P/E multiple of the 7.35x. I estimate the full-year EPS for FY22 to be $1.85. I believe GPP has a limited downside risk from current levels as the stock is trading at a fair valuation and in the same range as its peers, and with a dividend yield of 14% the stock looks really attractive.

Conclusion

GPP is currently fairly priced as per the P/E valuation and it has an annual dividend yield of 14%, attractive for all investors looking for a safe income in the coming years. GPP’s dividend payment is currently below the pre-Covid-19 level, which makes me believe that the current dividend yield is sustainable. After considering all these factors, I assign a buy rating for GPP.

Be the first to comment