BanksPhotos/E+ via Getty Images

Earth First Investments 9

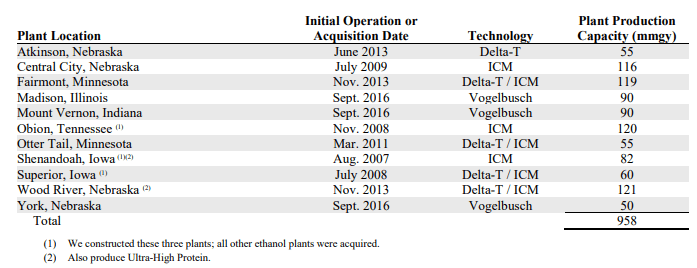

In continuation of my series on sustainable technologies, I will be covering one company with a strong first-mover advantage in the biofuels race: Green Plains (NASDAQ:GPRE). Although the total ~1 billion gallons per year is commendable and outpaces most peers, the facilities are quite old, with an initial acquisition or operation date of 2011. As a result, growth and profitability have faltered, leading to a phase of significant reinvestment losses. I will be discussing the historical and current performance, share price, and financials of the company to allow you to your own conclusions on whether this is a viable turnaround play.

GPRE GPRE

Current Supply and Production

Green Plains’ success mostly depends on the prices of their corn supply. As such, changes in prices or supply will affect the company. The primary production comes from utilizing corn as their feedstock to create the low-grade ethanol. Then, further processes are required to develop products such as industrial grade alcohols and corn oil. This, along with livestock feed from the corn waste, are the current primary revenue segments for the company. It is also the main endpoint for competitors in the ethanol industry, which has become quite saturated. Further, the realization that ethanol is not as groundbreaking of a renewable fuel as anticipated is preventing the demand for fuel products.

Biofuels are included in many proposed strategies to reduce anthropogenic greenhouse gas emissions and limit the mag-nitude of global warming. The US Renewable Fuel Standard is the world’s largest existing biofuel program, yet despite its prominence, there has been limited empirical assessment of the program’s environmental outcomes. Even without considering likely international land use effects, we find that the production of corn-based ethanol in the United States has failed to meet the policy’s own greenhouse gas emissions targets and negatively affected water quality, the area of land used for conservation, and other ecosystem processes. Our findings suggest that profound advances in technology and policy are still needed to achieve the intended environmental benefits of biofuel production and use.

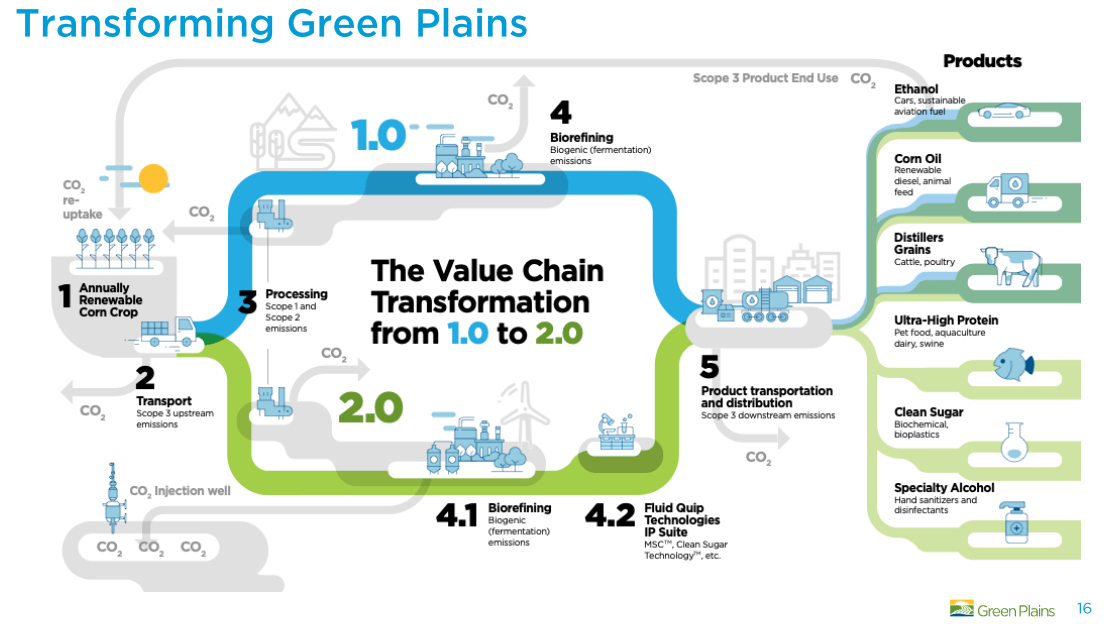

Perhaps there is no potential from using corn as a fuel source, and advancements in alternative fuels will end this industry. Competition exists from areas such as H2, animal and landfill methane/RNG, animal rendering and waste, and electric vehicles utilizing renewable energy sources. I have recently covered companies such as Methanex (MEOH), Gevo (GEVO), Clean Energy Fuels (CLNE), and Darling Ingredients (DAR) who all are set to face competitive pressures from each other. Not to mention most large oil and gas companies have exposure to ethanol production for E15 to E85 applications, with Valero (VLO) being the largest producer. As such, we must understand how Green Plains is shifting their platform to survive.

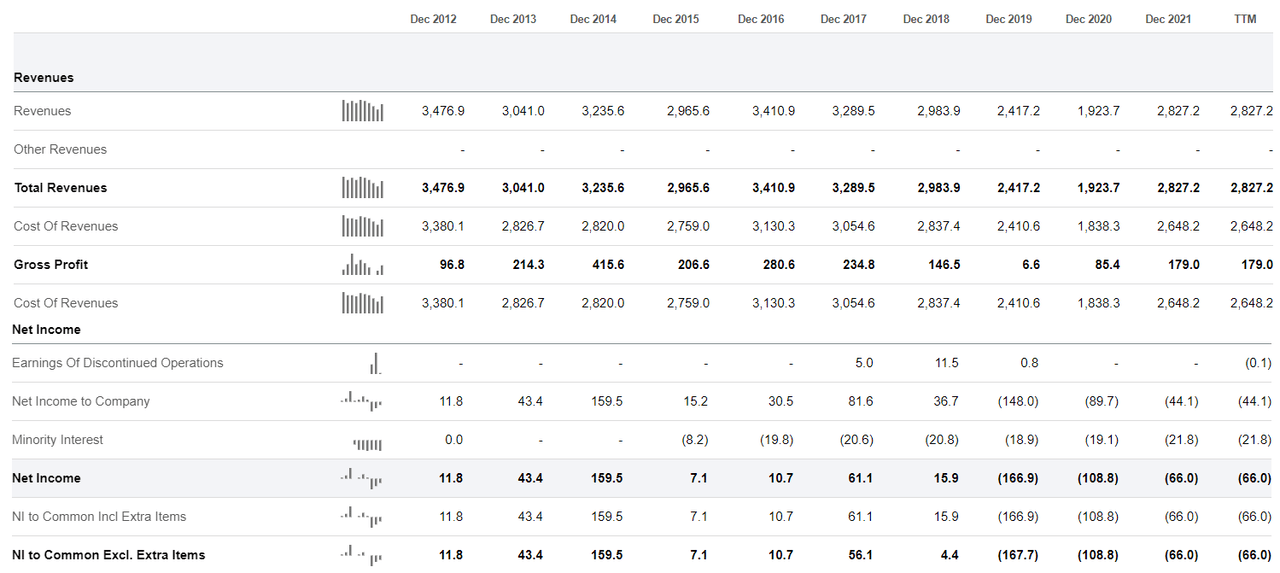

From around 2010 to 2018 the company had fairly consistent net income growth, although volatile. This highlights that early-stage biofuel companies had the potential to be profitable. Cheap money starting in 2019 led to the company beginning a new phase of investment, causing net income to fall to a $166 million loss for the full year. However, that was the highest yearly loss for the company, and the current $66 million loss highlights the potential return to positive net income. I believe the company realized that the volatile supply and prices of corn were a drag because of the few end products. Increasing diversification with new specialized products prevents competition by peers, and may offer higher margins and stability. Long-term contracts also extend the visibility of revenues and may negate the effects of corn prices.

Trading Economics Seeking Alpha

The New Growth Segments

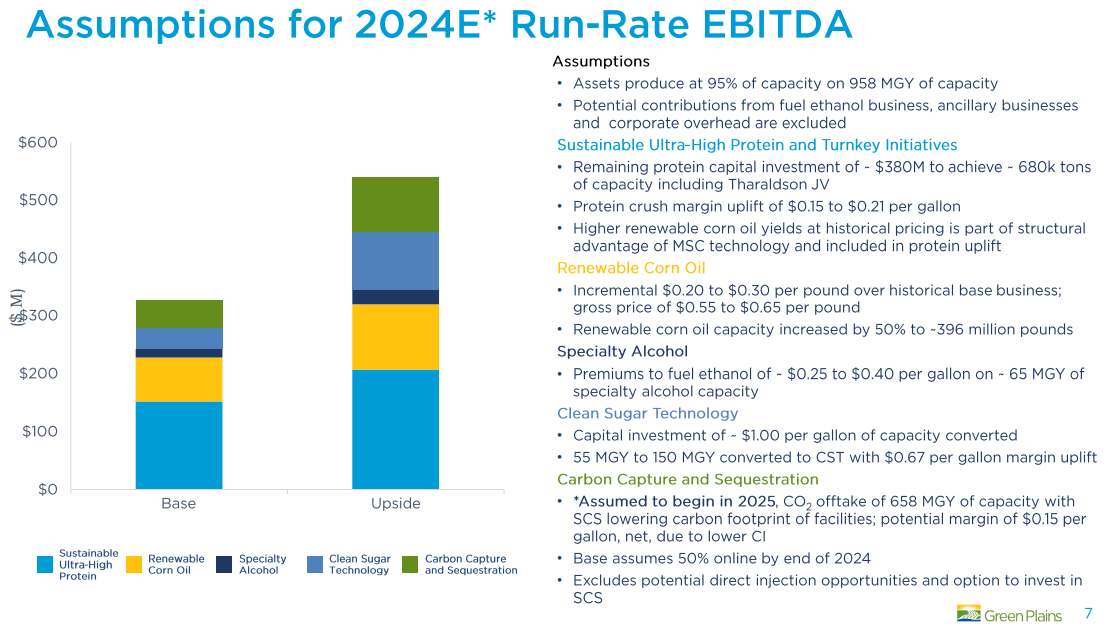

Investments over the past few years have been to develop high-growth areas. Areas include fermentation of corn waste to develop high-protein feed, further renewable corn oil advancements, specialty alcohols that offer a significant premium over ethanol, clean pharmaceutical grade sugar production for science and research, and even carbon sequestration and capture projects all due by 2025. As a result, the company should be reducing investment costs are construction begins leading into the operational period.

With this, the company expects both margins and revenues to increase favorably with these developments, and three facilities have already broken ground with construction underway. Compared to other non-commercial companies, I find Green Plains offers a better financial position as prior facilities, operations, and income will support relatively cheap growth. I would not want to see continual losses, however, as this may be a sign of the new revenue segments failing to provide growth and profitability. Let us look at the current financial situation to see how healthy this growth phase is.

GPRE

Financials

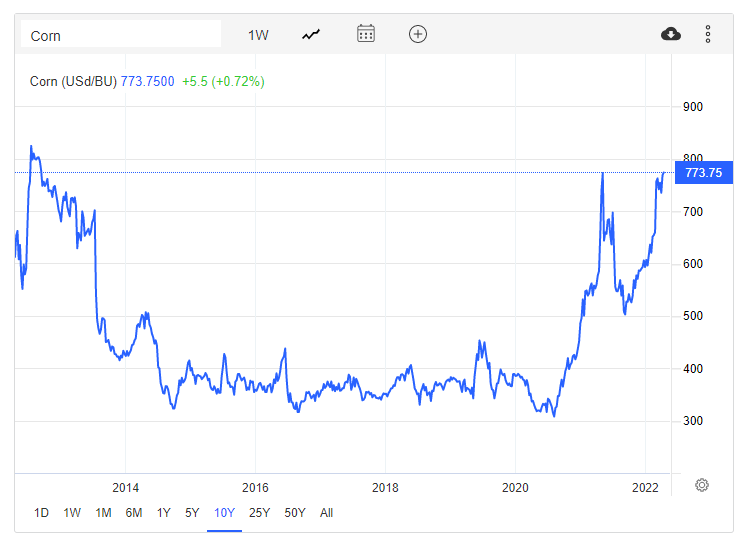

While 2020 saw low prices for biofuels and led to negative revenue growth, 2021 and 2022 have started out strong. The past three quarters, June-September-December, of 2021 saw revenue growth averaging 76.8% YoY. This will continue for the year or so, as elevated were seen for a year or so after corn price highs. While revenues have increased, we can see that corn prices have increased at an equal or higher rate. This shows as a direct impact to the profitability of the company. Net Income Margins are now at -2.33%, compared to the 5-year average of -2.09. I would much rather see profits increase with the increased revenues, but issues with supply costs and continued reinvestments are a concern.

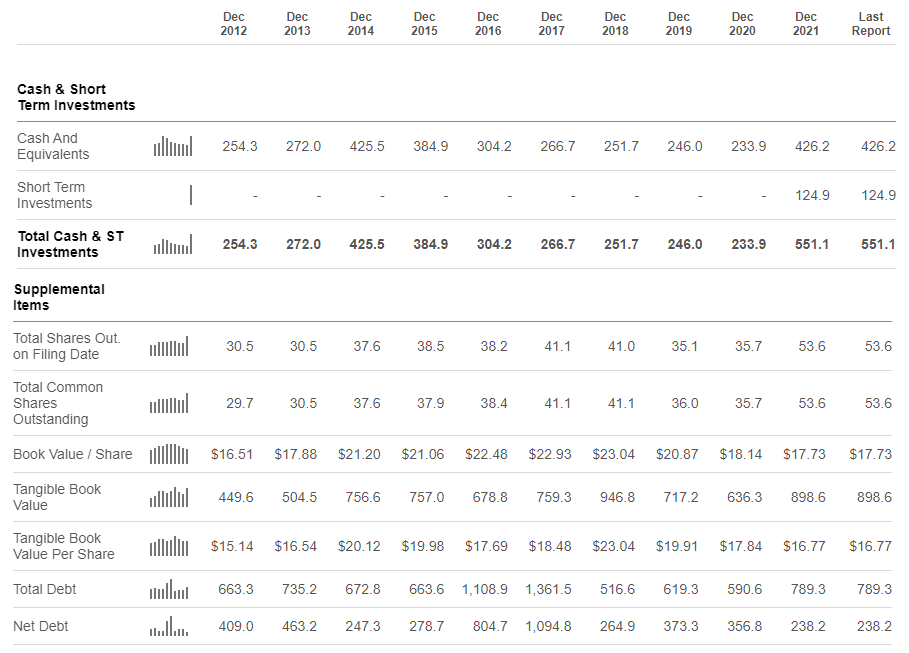

Looking at the balance sheet, we can see that new debt was created last year, to increase Total Debt from $590.6 to $789.3 million. However, cash on hand and short-term investments increased significantly, allowing the company to have a Net Debt level of a manageable $238 million. Shareholders may have felt the weight of these cash creation techniques, as total shares outstanding increased from 35.7 million to 53.6 million. This amount of dilution is bad for current shareholders, but perhaps new shareholders have missed the majority of dilution for this growth phase.

Further, considering the reductions in debt, dilution, and reinvestments into the company, the book value per share has fallen to a 9-year low of $17.73. This can lead to multiple issues: the potential for shareholder losses due to overvaluation indicates that the company is becoming more asset-light, or be a sign that debt will continue to be an issue. Therefore, it will be important to determine whether current investments will increase profitability while using less expensive assets. With a timeline to have most production online by 2025, an investor has time to take these measures into consideration and find a potential favorable entry point down the road.

Seeking Alpha

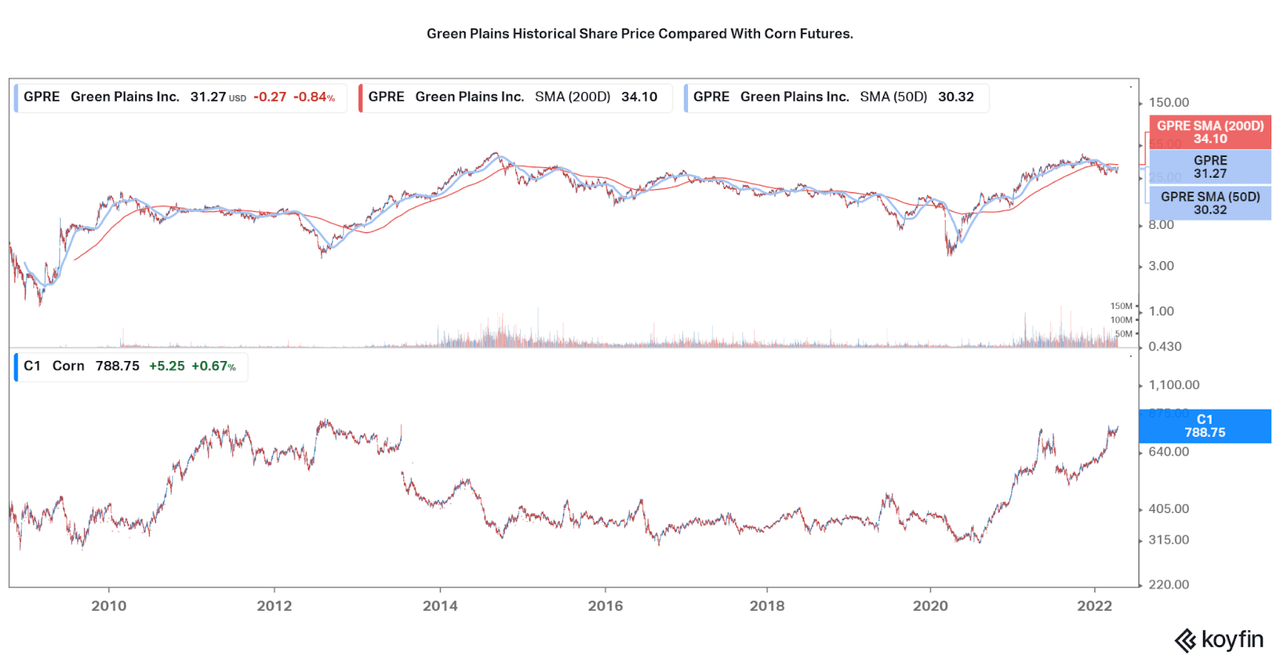

We can also take a look at the valuation from a market standpoint, considering both historical and current performance. Since 2010, the company’s share price has largely followed trends in corn pricing. This is because the company has had most of their production in place since 2011. In turn, corn has increasingly followed energy prices due to the use of corn ethanol. 2022 has been an incredible year for commodities, with corn prices reaching close to all-time highs. While GPRE has certainly returned a significant amount since the 2020 lows, it is hardly reaching new highs like energy and commodity asset peers. This discrepancy may offer an opportunity.

Koyfin

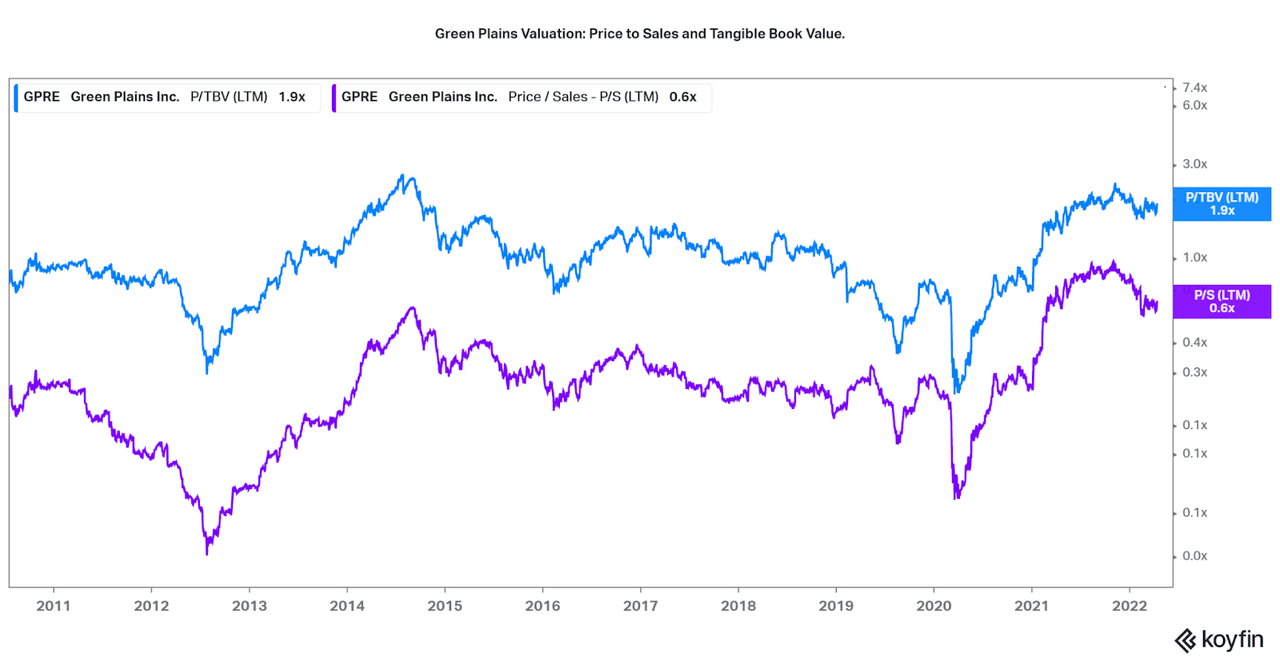

Along with the share price compared to corn prices, there is also the discrepancy between the share price and book value that I discussed earlier. As the Price to TBV is at a high level, one would assume that the price to sales is as well. However, the P/S has fallen significantly over the past few months. While still high compared to the past, this minor variation may play a role in the forward price movement of the company. The current 0.5-0.6 price to sales is quite low, especially compared to others in the industry, and I believe with the success of the reinvestments, there is potential for significant margin expansion. However, it will be important to remember that the company has always held a tepid, 0.3 valuation on average over the past decade or so, and that allows the stock price to fall close to 50% from current prices.

GPRE

Investment Potential and Conclusion

Green Plains seems to be in a tricky position. While the company faces issues with corn supply prices, falling revenues, and losses due to reinvestments, I find that any successful turnaround may offer margin expansion momentum. A similar company one can compare GPRE to is REX American Resources, another corn ethanol producer. REX offers both higher revenue growth and positive earnings but sees a similar price to sales as GPRE. As such, one must be careful that any poor performance will drive GPRE lower from the current levels. In fact, the company has close to 20% short interest, 10x more than REX.

As a result of my research, I find that investors can make their own choice to either pass on GPRE due to the lack of clarity, or look deeper into the chance for a successful turnaround. GRPE would have to commence operations in the multiple new process facilities, see sustainable revenue growth from these new revenue segments, and earn meaningful income, three steps that I find hard to hit on the mark. However, I find the company offers more safety in regards to the potential for loss of capital than other speculative plays, as the company already earns billions in revenues every year. While current profitability is an issue, there will always be something to fall back on if the new markets don’t end up working. This contrasts with start-ups with no or limited physical assets who have the chance to fall to $0. With that, I leave the ball in your court to make your own decision.

Thanks for reading, let me know what you think in the comments.

Be the first to comment