Nicholas Eveleigh/Stockbyte via Getty Images

A few years back, Green Dot (NYSE:GDOT) had a lot of promise for 2021 due to the transformation of the business. As with most corporations, Covid altered a lot of business plans including those for this fintech to grow an already very profitable business. My investment thesis is slightly Bullish on the fintech with the stock trading at only $18 now after a rally to over $50 last year didn’t hold.

Painful Path

New CEO George Gresham started off the Q3’22 earnings call with the primary transformation of the business as the reason the stock is interesting:

We have a lot to cover today, including the recent changes to our management team, you should all now be aware of, and overview of our third quarter results, an update on our key near term priorities as we continue transforming Green Dot into a next generation financial services platform and a brief overview of our longer-term strategic opportunities and priorities. Then we will open it up for questions.

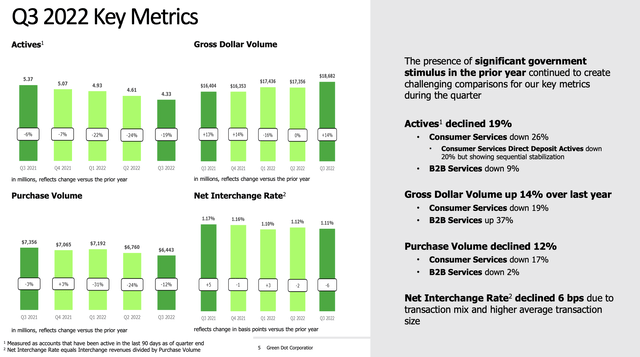

The company is no longer focused on serving the underbanked with a shift towards providing next generation financial services. Green Dot has seen retail active accounts and revenue slip causing total financial metrics to dip while the GO2bank platform remains strong.

Source: Green Dot Q3’22 presentation

The GO2bank product now accounts for 40% of the direct channel revenues and has seen direct deposits increase 58% versus last Q2. Even the revenue per active accounts is up 13% YoY due to the improved mix in the consumer side of the business.

Along with the improving GO2bank product, Green Dot is positioned well in the B2B channel with the BaaS and PayCard products. The weak retail channel and macro headwinds will make for a tough 2023 as the CEO works to transform the business.

In addition, the company has completely changed the management team again with the new CEO taking over on October 14 after only being at the company for 1 year as the CFO. He just announced a new CFO, CRO and COO along with Green Dot recently hiring a new General Counsel meaning the executives will need to execute on the current business plan over most of 2023 before the market will have confidence in the company.

A big part of the story is holding the new executives to signing new BaaS customers. On the earnings call, the new CEO was adamant the big goal is to make more progress in this area with a strong pipeline:

…the pipeline is good in the BaaS business, there are so many opportunities, I think we need to have a much higher set of expectations with respect to the opportunities we can mine out of that opportunity. So we have a good pipeline, the long selling cycle, a long onboarding process. So we need to shorten the selling cycle, shorten the onboarding price process and improve our cost structure.

Huge Profits

While the stock is a 2024 story, Green Dot is already highly profitable. The company guided to 2022 EPS targets of $2.42 to $2.51 per share with net income above $130 million.

Most fintechs are struggling to produce profits regardless of growth rates. Green Dot actually repurchased 1.3 shares in Q3 at a cost of $22.92 per share for ~$30 million.

The company has the ability to expand active accounts with a new plan to open Green Dot bank accounts via the 15 million tax refunds processed on an annual basis starting in 2024. In addition, the company is moving forward with payment and credit solutions for SMBs and consumers via the existing Green Dot network.

Regardless, the company is guiding down EBITDA estimates for 2023 with a target for adjusted EBITDA of $235 million this year. Analysts have cut 2022 EPS targets to $2.26 due to this guidance for the profit hit next year.

The stock is crazy cheap at 8x 2023 EPS targets and 7x 2022 targets. If Green Dot can execute on any of the growth objectives, the stock will see substantial upside from here.

Takeaway

The key investor takeaway is that Green Dot remains a promising fintech, but the company has already struggled to make a full transition to a next generation financial services platform. With a new management team, investors can start building a position here due to the cheap value, but one needs to wait for better executive before becoming aggressive.

Be the first to comment