vitranc/E+ via Getty Images

“Force and fraud are in war the two cardinal virtues.”― Thomas Hobbes

Higher mortgage rates have had significant impacts to the housing sector in 2022. That will eventually create some bargains in the space. Today, we take a deeper look at a housing concern that has prime developments in states that are seeing high migration into. An analysis and recommendation follow below.

Company Overview

Green Brick Partners, Inc. (NYSE:GRBK) is a Plano, Texas based diversified homebuilding and land development firm, owning or controlling 26,088 home sites in Dallas Fort-Worth, Atlanta Metro, and Treasure Coast, Florida markets with construction scheduled to commence in Austin, Texas in early 2023. The company acquires land and then provides construction capital to seven builders in which it either wholly owns or has a controlling financial interest – as well as one unconsolidated builder – with whom it shares in the profits. Green Brick was formed in 2008 and went public in 2014, when co-founder David Einhorn of Greenlight Capital arranged a reverse capitalization transaction into failed ethanol concern BioFuel Energy. After a January 2021 public offering during which it disposed of 6.7 million shares at $20.55, Greenlight still maintains a 37% ownership interest in the firm. Shares of GRBK trade near $21.50 a share, equating to a market cap of $990 million.

Unlike most of its competitors, Green Brick works on a decentralized model, where, after it purchases and develops land – or after optioning lots from third-party developers – its team of controlled builders take over and are in charge of zoning, land use, and other building decisions. Branding is at the local level. That is not to say that Green Brick is not engaged in all aspects of the homebuilding process, providing operational and human resource management support to its builders as well as other ancillary services at the retail level, but relative to a PulteGroup (PHM) or Lennar (LEN) – which integrate acquired builders into one brand – there is significantly more local builder autonomy. That said, management engages in a pro-active metering approach where it withholds homes for sale to avoid construction costs misaligning with pre-sold backlogs.

August Company Presentation

Trophy Signature Homes

Its measured approach notwithstanding, a big part of Green Brick’s recent success is a function of its expansion into entry-level and first time move-up single-family homes with the launch of Trophy Signature Homes in Dallas Fort-Worth, which commenced selling in 1H19. Trophy’s more affordable homes, quicker inventory turns, more cookie cutter-like model, and smaller lot sizes have allowed the firm to generate significantly more net new order volumes and income relative to its other community offerings. This transition has helped the homebuilder grow revenue from home closings 41% from $923.9 million in FY20 to $1.31 billion in FY21, which was a function of a 28% increase in the number of homes delivered and a 10% increase in home prices. Because of its success, Green Brick is expanding the Trophy concept into its other markets.

Other Tailwinds

Another contributing factor to its success is demographics. The four states in which it operates – Green Brick also has a non-controlling financial interest in a builder in Colorado Springs – represent four of the top seven states for population growth during the 2010s, all experiencing double-digit rises per the 2020 census. That trend should continue, with Baby Boomers retiring to the Sun Belt, as well as the recent exodus from northern urban centers and the relocations of many large companies to more tax-friendly states. Add in four million Millennials entering their prime homebuying years with private equity’s seemingly insatiable appetite for residential properties and the recipe is in place for the lowest housing inventory in at least two generations.

August Company Presentation

In January and February 2022, there were only 850,000 homes for sale in the entire country versus more than 4 million at the start of the housing crisis in 2008. Obviously, rising rates have acted as a headwind with housing inventory somewhat rebounding to 1.31 million in July 2022, but with ~80% of its revenue derived from infill locations, where development is land and lot constrained, Green Brick’s home prices should not face as much downward pressure.

August Company Presentation

2Q22 Results

This dynamic, as well as the other positive demographic undercurrents, were on display when the firm issued its 2Q22 financial report on August 3, 2022. It announced GAAP EPS of $2.08 on revenue of $525.1 million versus earnings of $1.02 a share (GAAP) on revenue of $373.8 million in 2Q21, representing 104% and 40% improvements, respectively. The bottom line blew away Street expectations by $0.84 a share and the top line was $115.9 million better than consensus estimate.

August Company Presentation

Home closing revenue of $510.5 million was up 54% year-over-year while the number of new homes delivered in the quarter grew 16% to a record 881. Gross homebuilding margin improved 550 basis points year-over-year to 32.3%, which was largely a function of a 32% increase in average selling price to $579,500. This metric was best in its peer group, whose average gross margin was 28.1%. YTD annualized return on equity was 37.4% versus 25.9% in FY21. These results were delivered in an environment still affected by supply chain issues and labor market tightness.

Despite the phenomenal quarter, there were signs that its markets are beginning to erode under the weight of higher mortgage rates. Green Brick’s cancellation rate increased each month during the quarter to average 11.4% versus 7.6% in the prior year period as mortgage disqualifications grew. Backlog units decreased 42% year-over-year to 1,087 homes due in part to a moderation of demand in the second half of 2Q22, as well as closing a record number of homes in the quarter.

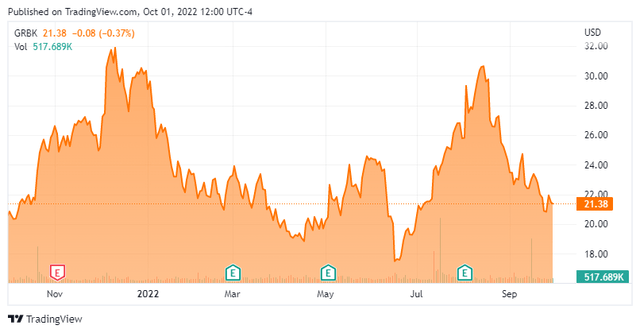

Despite these warning signs, the market focused on the outstanding 2Q22 execution and initially rallied shares of GRBK 14% in the subsequent trading session to $29.32, eventually cresting above $30 in mid-August. The shares have since pulled back hard since as mortgage rates continue to rise.

Balance Sheet & Analyst Commentary

The other positive point of emphasis for the market is Green Brick’s strong balance sheet, which reflected the second lowest debt-to-total capital ratio amongst its peers at 28.9% (Meritage Homes (MTH) 25.3%), despite purchasing nearly 10% of its shares outstanding YTD through July 2022 at an average price below $21 per share. The homebuilder currently has ~$47 million remaining on its authorization. As of June 30, 2022, Green Brick held unrestricted cash of $66.8 million and debt of $384.9 million with a weighted average interest rate of 3.4%. An insider bought nearly $1 million worth of stock at the end of March. That is the only insider activity in the stock so far in 2022. Approximately 15% of the outstanding float is currently held short.

Despite the blowout quarter, two Street analysts (JMP Securities and Wedbush) used the opportunity to downgrade its stock from an outperform to a hold, putting all four covering Green Brick in the ‘not bullish‘ camp, featuring three holds and one underperform rating with a median price target of $26. On average, they expect Green Brick to earn $5.90 a share on revenue of $1.67 billion in FY22, followed by a decline to $4.32 a share on revenue of $1.45 billion in FY23. The lingering impact of these downgrades and the continuing macroeconomic negativity have caused shares of GRBK to fall 30% since mid-August.

Verdict

Despite its excellent operational run, significant demographic tailwinds, solid management – all while trading at price-to-book of under 1.1 and a PE ratio to FY22E EPS of under four – Green Brick is in a cyclical, commoditized industry that is exaggeratedly valued on expectations more than metrics. Perceptions regarding interest rates will act as a headwind to Green Brick’s valuation, but when those perceptions turn, its stock has solid upside. As such, a covered call strategy is recommended as the firm’s aggressive share repurchase program and cheap metrics should put a floor in its share price.

“The most common sort of lie is that by which a man deceives himself: the deception of others is a relatively rare offense.”― Friedrich Nietzsche

Be the first to comment