Paula Bronstein

Gravity (NASDAQ:GRVY) is a 22-year-old South Korean video game company with a strong financial position and consistent cash flows that has been battered by the recent tech downturn and a lack of investor faith in future earnings. The stock is now too cheap to ignore relative to its domestic peers and historic price multiples. With several potential catalysts on the horizon and what I believe to be fundamental misunderstanding amongst investors, a long investment offers an attractive asymmetric risk-reward profile.

Gravity is primarily known for its franchise, Ragnarok. Despite distributing globally, it has mostly seen success in Asia where it maintains a strong fanbase for its flagship game as well as periodic bumps in sales on the back of new releases for both online and mobile platforms. Gravity is the only Korean gaming stock to be listed directly on the NASDAQ with most competitors opting to list domestically.

Sitting on a pile of cash

Over the last 5 years, Gravity has achieved tremendous revenue and earnings growth with an annual CAGR of ~52% and ~123% respectively, resulting from the development of their mobile gaming segment. While this growth does not appear to be sustainable, margins have more than doubled in the same time period, creating a healthy source of free cash flow.

The balance sheet is incredibly strong with no debt and a large cash position. However, It is not clear what the company expects to do with the growing cash pile. Whether they hope to fund a large acquisition, pay a dividend to shareholders or initiate buybacks, management has not been forthcoming about their plans.

A cause for concern

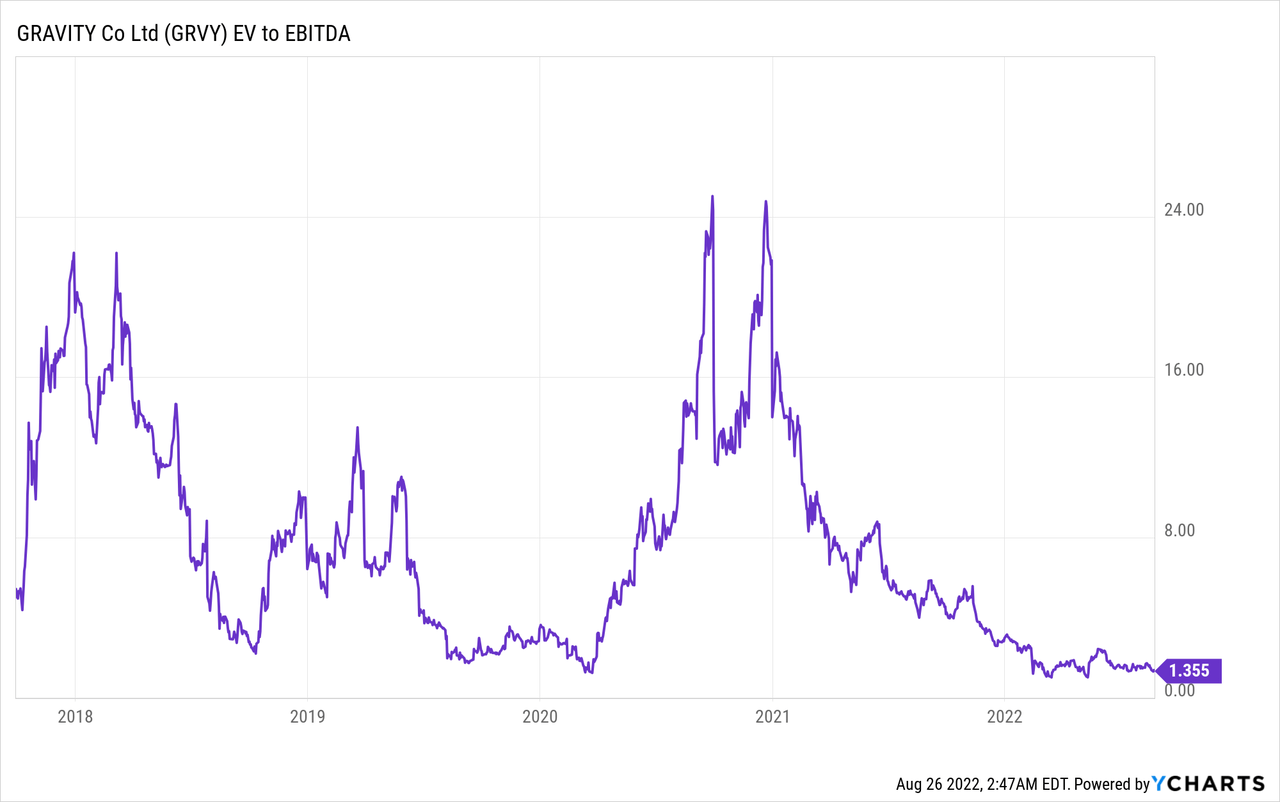

In January 2021, the stock price peaked at around $214 before becoming a victim of the broad market downturn and plummeting almost 80% to where it now languishes around $45. By all metrics, the stock appears to be oversold and undervalued.

Though the cause of the massacre might not be readily apparent looking purely at the financials, there are several issues that are weighing heavily on investors’ minds.

Firstly, since last year the Chinese government has been implementing policies in an effort to crackdown on youth “gaming addiction.” While some companies have been more affected than others by efforts to limit the number of hours young people spend gaming and freezing the issuance of new game licenses, firms such as Gravity, with only a small exposure to the China have also been punished by the market.

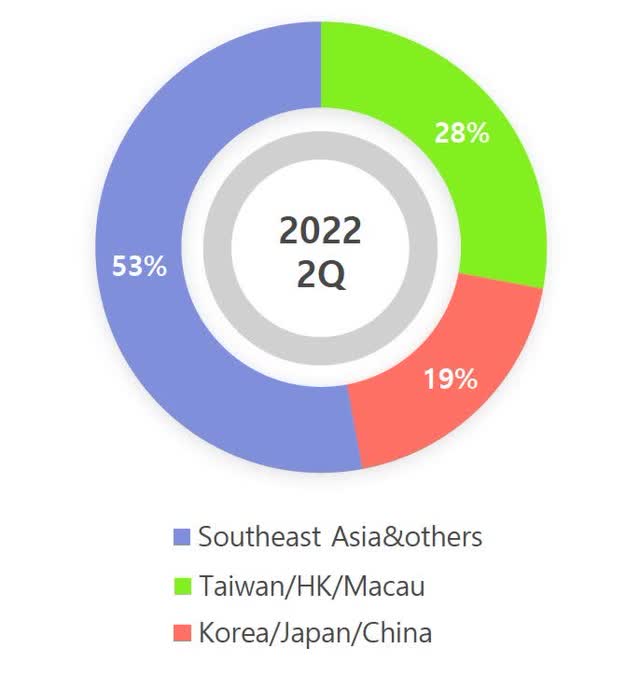

Revenue breakdown by region (Gravity 2022 Q2 IR Presentation)

We can see that Gravity’s key regions are outside of China and thus business impact has been minimal. That said, earlier this year the Chinese government recommenced issuing game licenses which does bode well for any future releases planned in the region.

Another issue is that 59.31% of Gravity stock is held by a single Japanese company, GungHo Online, thereby giving them control over any future shareholder initiatives. With a history of not paying dividends or buying back shares, it seems unlikely that minority shareholders will be able to unlock value in the near term unless there is a significant change to the status quo. What’s more, with such a large proportion of the relatively small pool of shares outstanding removed from the float, volume is constricted leading to excess volatility.

The power of intellectual property

The other key concern is Gravity’s reliance on their signature IP, Ragnarok, with their flagship game, Ragnarok Online, and other games derived from the franchise accounting for 17.4% and 75.9% of revenues in 2021, respectively. It is on this point which I believe the market may be misunderstanding and thus mispricing the stock. Although it is true that the company continues to be reliant on the continued popularity of the IP, their sales are actually diversified across a variety of differentiated Ragnarok themed games, on various platforms and regions.

Since Gravity is listed on the NASDAQ, it often comes under scrutiny from Western investors unlike its KRX listed peers. It makes sense that they may underestimate the value of the Ragnarok IP due to a lack of familiarity. Many gaming companies have been successful in the past despite relying on a single franchise or have gone on to become acquisition targets for larger firms looking to diversify their own catalogue. CD Projekt Red with The Witcher series and Mojang with Minecraft are both examples of this. Over longer periods, as entertainment companies release sequels, remakes and spin-offs, younger generations will experience the IP for the first time, reducing a perceived reliance on nostalgic, legacy users. This effect is especially apparent in the movie industry. Some IP is successful for a reason and continuing to exploit a tried and tested formula negates the risk of new ventures.

However, Gravity is actually exploring alternative IP, with titles such as NBA RISE TO STARDOM and a plethora of new indie games scheduled for release in 2022. In addition, they are innovating around their regular spate of Ragnarok titles, including Ragnarok Labyrinth NFT, a mobile blockchain based game which has shown promising results since launch. Management is aware of the IP risk and well positioned to actively explore new ideas and strategies, while continuing to milk their cash cow. It is just a matter of time before they strike gold with a new title or even deploy their accumulating cash balance on an accretive acquisition.

With these concerns covered, the valuation outlined below indicates a substantial margin of safety, meaning that even if these assumptions are incorrect, investors do not stand to lose much.

Oversold and undervalued

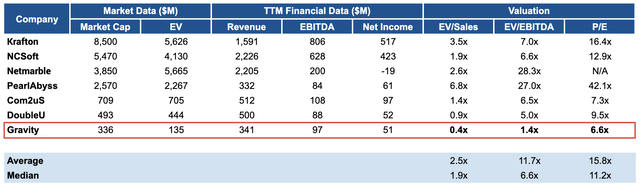

By simply calculating EV and price multiples for other public listed Korean gaming companies we can see that Gravity is relatively undervalued across the three metrics: EV/Sales, EV/EBITDA & P/E.

Comparative company analysis for Korean Gaming companies (Me)

Not only is Gravity attractively priced in comparison to its peers but looking at historical EV/EBITDA for the past 5 years, we can see that it is at a relative low point since peaking in January 2021.

The company’s EV is low due to the lack of debt and a surplus of cash on the balance sheet, so using P/E multiples yields a more conservative price target. Taking the peer median of 11.2x vs 6.6x for Gravity and holding all else equal with respect to future earnings, we obtain a potential upside resulting from multiple expansion of (11.2/6.6)-1 = 69.7% and a price target of ~$77.

Unlocking the value

There are numerous near term catalysts which might spark renewed interest in the stock and a convergence to its peers. Firstly, Gravity’s current market price and recent consolidation in the gaming industry make it an obvious target for acquisition.

The stock is also undercovered relative to other US listed gaming companies (0 analysts listed vs. 8 for similarly sized US gaming company Skillz on Yahoo Finance). Should analysts become aware of the apparent value proposition, a small increase in coverage could lead to significant interest and a subsequent repricing. If there is a continued drawdown, with market cap quickly converging to the value of cash on the balance sheet, the stock will be too cheap to ignore as it begins to pop up on deep value screens and eventually becomes a net-net. The initiation of a dividend or share buyback program may yield a similar result.

Another catalyst might be a turnaround in broad market sentiment. From its COVID low of around $23 in March 2020, the stock outperformed competitors and indexes with a 9.3x return, peaking in January 2021. This shows that once volume starts to flow back into the tech sector, the stock should benefit disproportionately.

Since Gravity’s valuation implies that the market is expecting future earnings decline, any disruption to this prediction will ignite a repricing. Whether from yet another Ragnarok title, alternative IP or a new business segment, such as NFT gaming, Gravity has an abundant pipeline of planned future releases across numerous markets, any of which stand a chance of unanticipated success.

Management must continue to execute

As the valuation is reliant on earnings multiples, a failure by management to continue generating a profit from existing and future games will result in multiple correction, making today’s price less attractive over time.

As outlined earlier in the article, one of the main concerns for investors is concentrated ownership risk. If GungHo Online ever decides to wind down their investment in Gravity, the impact on stock price would be devastating. The other key issue, a reliance on Ragnarok IP, could also justify current valuations if popularity begins to waiver and new releases are not well received by fans. Management inaction regarding their growing cash position and the previously mentioned risks may lead to the stock continuing to trade at depressed multiples in the long term until there is a material change. It may even act as a signal to the market that the company expects rainy days ahead.

The only way is up

In conclusion, Gravity is significantly undervalued with respect to its peers in the South Korean gaming industry as well as its own historic multiples. With a growing cash pile and no debt, the company stands to see substantial share price appreciation assuming they can continue to exploit their core IP or successfully diversify into new franchises. It does not seem likely for the stock price to fall any more than it already has, unless there is a sharp decline in profitability, presenting a promising investment opportunity with a wide margin of safety.

Be the first to comment