Hreni/iStock via Getty Images

Welcome to the June edition of the graphite miners news.

June saw repeated concerns over the supply shortages of battery metals forecast for the decade ahead. It also saw a solid month of news and very good progress by the graphite miners, especially the juniors.

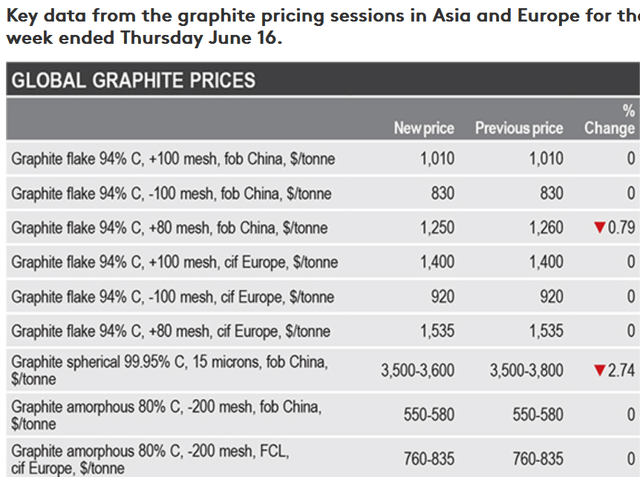

Graphite price news

During the past 30 days, the China graphite flake-194 EXW spot price was up 0.37%, and is up 19.39% over the past 360 days. Note that 94-97% is considered best suited for use in batteries; it is then upgraded to 99.9% purity to make “spherical” graphite used in Li-ion batteries. The spherical graphite 99.95% min EXW China price was up 1.58% the past 30 days.

Fastmarkets (see below) shows China graphite flake 94% C (-100 mesh) prices at US$830/t and Europe graphite flake 94% C (-100 mesh) prices at US$920/t.

Fastmarkets graphite prices the week ending June 16, 2022

On June 23, Gratomic Inc. announced:

Gratomic provides global natural graphite pricing update. Gratomic Inc. reports that global natural graphite pricing has increased significantly over the course of the last year, with demand continuing to outstrip supply. This trend is expected to continue as the electric vehicle market experiences rapid growth. According to Benchmark Mineral Intelligence (benchmarkminerals.com), graphite prices have continued to increase steadily since January 2021 on all types of graphite with fines increasing 44.50% from USD $500/ton in January 2021 to USD $723/ton in May of 2022. Large flake graphite increased 19.85% from USD $983/ton in January of 2021 to USD $1,187/ton in May of 2022. Spherical graphite increased 8.39% from USD $2,958/ton in January 2021 to USD $3,207/ton in May of 2022.

Note: You can read about the different types of graphite and their uses here.

A reminder of a 2016 Elon Musk quote:

Our cells should be called Nickel-Graphite, because primarily the cathode is nickel and the anode side is graphite with silicon oxide.

Graphite demand and supply forecast charts

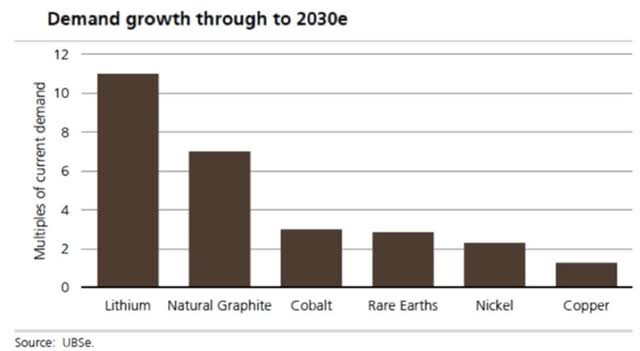

UBS’s EV metals demand forecast (from Nov. 2020)

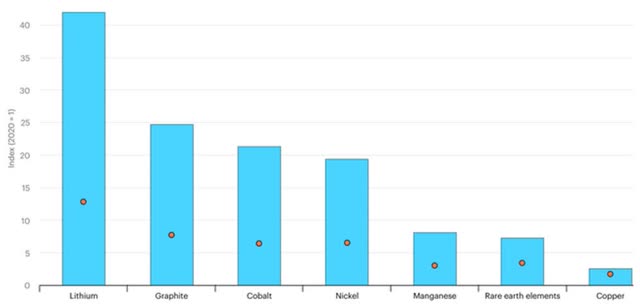

2021 IEA forecast growth in demand for selected minerals from clean energy technologies by scenario, 2040 relative to 2020 – Increases Of Lithium 13x to 42x, Graphite 8x to 25x, Cobalt 6x to 21x, Nickel 7x to 19x, Manganese 3x to 8x, Rare Earths 3x to 7x, And Copper 2x to 3x

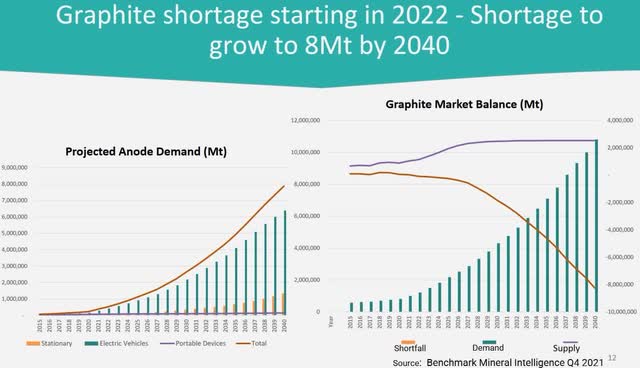

BMI forecasts graphite deficits to begin from 2022 as demand for graphite grows strongly

Graphite market news

On June 6, Investing News reported:

Top 10 graphite-producing countries (Updated 2022)…..According to Benchmark Mineral Intelligence, demand for graphite from the battery anode segment could increase by seven times in the next decade as surging electric car sales and the energy storage trend continue to drive the construction of lithium-ion battery megafactories……the top graphite-producing countries of 2021. All stats are based on the most recent data from the US Geological Survey. 1. China Mine production: 820,000 MT….2. Brazil Mine production: 68,000 MT…..3. Mozambique Mine production: 30,000 MT…..4. Russia Mine production: 27,000 MT……5. Madagascar Mine production: 22,000 MT………

On June 7, The Washington Post reported:

How a battery metals squeeze puts EV future at risk…….Factory lines churning out power packs to fuel a clean energy future are being built faster than strained supply chains can keep up. A global rush to lock in stocks of lithium, nickel, cobalt and other key ingredients from a handful of nations has sent prices hurtling higher…….While factories can be built in about 18 months, mines can typically take seven years or longer to come online.

On June 8, Fastmarkets reported:

South Star, Graphex plan battery anode material JV. South Star Battery Metals of Canada has announced a proposed joint venture with Graphex Technologies to develop a unit for the manufacture and processing of battery anode material.

On June 9, Fastmarkets reported:

Rising costs, tight supply of graphite flake balances patchy demand. • China’s flake graphite market remained stable amid supply tightness and low liquidity. • A gradual restart of production in the Luobei region, following suspensions due to environmental inspections.

On June 21, Seeking Alpha reported:

Tesla supply chain problems are paramount concern – Musk…..He explained that production has been hindered by raw material shortages and shutdowns of assembly lines in China.

On June 21 Mining.com reported:

Trudeau’s energy chief unveils low-carbon industrial strategy……In British Columbia, officials are particularly interested in hydrogen, critical minerals and the electrification of heavy industry, Wilkinson said. In Quebec, it’s battery manufacturing and how the critical mineral supply chain can feed into it. In Ontario, electric vehicle production is likely to get attention. And in oil-rich Alberta, carbon capture projects will be key…..He pointed out that one tool the government wields is, of course, money, with C$3.8 billion ($2.9 billion) already earmarked for critical minerals in the April budget. On top of that, “we have a billion and a half dollars in the Clean Fuels Fund, we have eight billion dollars in the Net Zero Accelerator, we’re setting up the Clean Growth Fund, we have the Canada Infrastructure Bank,” he said.

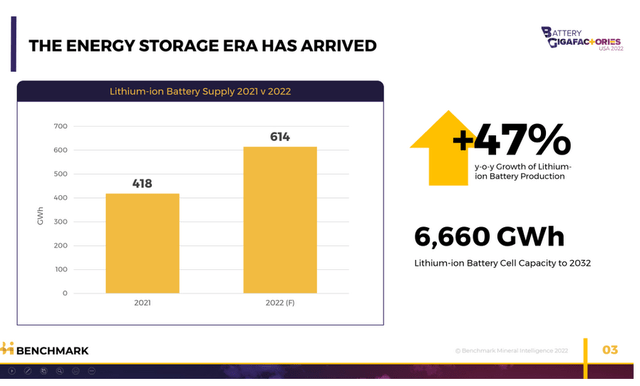

On June 23, Benchmark Mineral Intelligence reported:

The energy storage revolution has arrived……but who will have dominion over the megatrend of our times?…..In 2022, lithium ion battery demand is growing at its fastest ever rate and is on course for 50% year-on-year growth…….The raw materials fuelling these gigafactories have also witnessed a coming of age moment.

Lithium supply has increased nearly three-and-a-half times and will be over a 600,000 tonne industry in 2022 – the first time it has topped the half a million tonne mark.

Cobalt demand from the battery industry will reach over 70% of total global volume in 2022, the highest proportion of demand of any of the battery minerals, followed closely by lithium.

Nickel sulphate supply, the battery chemical needed by the lithium ion battery industry, will approach 500,000 tonnes in 2022, more than a 3.5x increase over a 5 year period.

Graphite remains the highest intensity mineral in the lithium ion battery by weight with over 570,000 tonnes of natural flake to be consumed in 2022.

Yet, consumer demand for electric vehicles surpasses our ability to supply them. Waiting times for EVs are lengthening, a lithium ion battery shortage is hitting many automakers, and, most crucially, key raw material prices are at all time highs.

Graphite miners news

Graphite producers

I have not covered the following graphite producers as they are not typically accessible to most Western investors. They include – Aoyu Graphite Group, BTR New Energy Materials, Qingdao Black Dragon, National de Grafite, Shanshan Technology, and LuiMao Graphite.

Note: AMG Advanced Metallurgical Group NV [NA:AMG] [GR:ADG] (OTCPK:AMVMF) is also a “diversified producer”, producing graphite and lithium. SGL Carbon (OTCPK:SGLFF) is a synthetic graphite producer and Novonix [ASX:NVX] (OTCQX:NVNXF) is commercializing their synthetic graphite product. Graphex Group Limited [HK:6128] (OTCQX:GRFXY) makes spherical graphite.

Syrah Resources Limited [ASX:SYR][GR:3S7]( OTCPK:SYAAF)(OTC:SRHYY)

Syrah Resources Limited owns the Balama graphite mine in Mozambique. Syrah is also working to become a vertically integrated producer of natural graphite Active Anode Material (“AAM”) at their Vidalia facility, Louisiana, USA.

On June 17, Syrah Resources announced: “Syrah recommences Balama logistics movements.” Highlights include:

- “Syrah has lifted a temporary suspension on logistics and personnel movements on its primary transport route in Mozambique.

- Syrah suspended travel on the road for a week due to security concerns in Cabo Delgado province, about 200km from the Balama Mine.

- Balama operations were not affected by the travel restrictions and have continued as normal.”

You can view the latest investor presentation here.

Catalysts:

- September 2023 quarter – 11.25ktpa AAM Vidalia facility targeted to start production.

Ceylon Graphite [TSXV:CYL] [GR:CCY] (OTC:CYLYF)

Ceylon Graphite has ‘Vein graphite’ production out of one mine in Sri Lanka with 121 square kilometers of tenements.

On June 22, Ceylon Graphite announced:

Ceylon Graphite announces market making agreement…..subject to regulatory approval, it has retained Venture Liquidity Providers Inc. [VLP] to initiate its market-making service to provide assistance in maintaining an orderly trading market for the common shares of the company……For its services, the Company has agreed to pay VLP C$5,000 per month for a period of 3 months. Following the initial term, this agreement will automatically renew for successive additional 1-month terms. The agreement may be terminated at any time by the corporation or VLP…..

Mineral Commodities Ltd. (“MRC”) [ASX:MRC]

Skaland Graphite is 90% owned by MRC. Skaland is the highest grade flake graphite operation in the world and largest producing mine in Europe; with immediate European graphite production of up to 10,000 tonnes per annum with regulatory approval to increase to 16,000. MRC plans to demerge its Norwegian graphite assets into a newly incorporated Norway company branded as Ascent Graphite.

On May 30, Mineral Commodities Ltd. announced: “CRC-P Project completion and CSIRO collaboration update.” Highlights include:

- “CRC-P project successfully completed with battery grades achieved at increasing scale by Australia’s national science agency, CSIRO.

- Initial samples produced for customer qualification with positive feedback.

- Additional customer qualification samples (including for the Mitsubishi collaboration1 and Traxys agency agreement2) in production in the mini-pilot plant developed in the CRC-P project.

- MRC successful in Critical Minerals Acceleration Initiative (CMAI) grant application.

- MRC and CSIRO to broaden collaboration in CMAI project to include graphite shaping (spheronisation) and anode coating, as well as larger scale piloting of the successful purification process developed in CRC-P project, to produce high-value coated purified spherical graphite (CPSG).”

On June 6, Mineral Commodities Ltd. announced: “Mitsubishi Chemical Holdings Group announces Enhancement Strategy.”

Tirupati Graphite [LSE:TGR]

On June 22, Tirupati Graphite announced: “Operational update.” Highlights include:

Key Operating results

- “In Q4 FY 22 (January to March 2022), the Company recorded its highest quarterly shipment and sales of 1,137 metric tonnes [MT] at its highest average realisation of US$866 per MT.

- During FY 22 (covering the period April 2021 to March 2022), total production was 2,996 MT (FY 21 1,718 MT) and sales were 2662 MT (FY 21 1,857 MT).

- Vatomina operations, post start-up, were stabilised by end of May 2022 following debottlenecking and improving preparedness for weather conditions.

- Head grade at Vatomina currently remains at approximately 3% as against project target of 4-4.5%……

- Over the rest of 2022, TG’s efforts will be directed to progressively increase Vatomina’s production to rated capacity……”

Exploration activities

- “New discoveries continue to be made in both the Vatomina and Sahamamy projects, as exploration activities are undertaken concurrent with development.

- an updated mineral resource statement for the two projects is expected to be released by SRK……”

Next steps

- “We continue to remain focussed on developing the Madagascar primary flake graphite operations to achieve the globally significant milestone of 30,000 tons rated capacity up from the current 12,000 tpa capacity and achieve expected positive bottom line from the current financial year being 1 April 2022 to 31 March 2023.”

Northern Graphite [TSXV:NGC][GR:ONG] (OTCQX:NGPHF)

Northern Graphite has agreed to purchase from Imerys the Lac des Iles producing graphite mine in Quebec and the Okanjande graphite deposit/Okorusu processing plant in Namibia. They also own the Bissett Creek graphite project located 100km east of North Bay, Ontario, Canada and close to major roads and infrastructure. The Company has completed an NI 43-101 Bankable final Feasibility Study and received its major environmental permit.

On June 8, Northern Graphite announced:

Northern Graphite appoints new Chief Executive Officer…..Mr. Hugues Jacquemin B.Sc. (hons) Dip. Esp. has been appointed Chief Executive Officer (“CEO”) of the Company. Mr. Jacquemin will also be nominated for election to the Company’s Board of Directors at the next Annual Meeting. Greg Bowes, the former CEO, has been appointed Executive Chairman and will continue to provide support and assistance to Mr. Jacquemin and the management team during a transition period……

On June 23, Northern Graphite announced:

Northern Graphite announces May operating results. During the month of May, Northern shipped 1,085 tonnes and 965 tonnes were sold for total revenue of US$1,537,356 at an average price of US$1,593 per tonne. Although most of the volume from the Lac des Iles mine is contracted on an annual basis, in early June, Northern received a spot order for 152 tonnes of its 80×150/95 grade at US$1,900MT to be shipped in July. This shows the market is tightening for this type of product in North America. Currently Northern has a backlog of orders for 880 tonnes with a value of US$1,528,000. At the Lac des Iles mine and processing plant, 19,701 tonnes of ore were processed with a graphite recovery of 89.5% to produce 1,281 tonnes of final concentrate. The plant currently operates on a 24 hour/day, 5 days/week cycle. In May plant availability was 87.2%, primarily due to shutdowns for the replacement of the crusher feed bin grizzly and repairs to one of the cleaner flotation circuits. With improved maintenance, elimination of a few small bottlenecks, and a seven-day operation, Northern believes the plant can produce up to 25,000 tonnes per year (tpy) of concentrate…..

You can view the latest investor presentation here and the latest Trend Investing article on Northern Graphite here or the very recent and excellent Trend Investing CEO interview here.

Graphite developers

Talga Group [ASX:TLG] [GR:TGX] (OTCPK:TLGRF)

Talga Group is a technology minerals company enabling stronger, lighter and more functional materials for the multi-billion dollar global coatings, battery, construction and carbon composites markets using graphene and graphite. Talga 100% owned graphite deposits are in Sweden, proprietary process test facility is in Germany.

On May 27, Talga Group announced: “Talga’s battery anode growth ambitions boosted with 54% graphite resource increase. Critical mineral source grows to secure EU Li-ion battery supply chain.” Highlights include:

- “Vittangi Graphite Resource boosted by 54%, adding more than 10 million tonnes to Europe’s largest graphite resource, a critical mineral for lithium-ion batteries.

- Graphite resource growth is a key pillar in Talga’s mine-to-anode strategy and scale-up to become a significant supplier of the world’s greenest lithium-ion battery anode.

- Further resource update planned for late H2 2022 following recently completed drilling program.”

On May 31, Talga Group announced: “Talga commences graphite trial mine at Niska.” Highlights include:

- “Final phase of trial mining at the Niska South deposit commences with plan to extract balance of 25,000 tonnes of graphite ore starting early June 2022.

- Following refining, extracted graphite will be finished and coated into Talnode®-Canode at Talga’s Luleå Electric Vehicle Anode plant for advanced customer testing.”

On June 14, Talga Group announced: “Talga advances anode project development and finance. European financial institution support received as Talga progresses Vittangi Anode Project financing strategy and value engineering.” Highlights include:

- “Letter of Interest received from Nordic Investment Bank for Vittangi Anode Project funding.

- Talga and process technology partner ABB received Letter of Support from Swiss Export Risk Insurance, the official Export Credit Agency of Switzerland.

- Project optimisation and formal value engineering nears completion with Project partner Worley.

- Burn Voir appointed as specialist financial advisor.”

On June 20, Talga Group announced:

Positive permitting progress for Vittangi…..Talga’s environmental permit application is currently progressing through the standard permitting process with the Swedish Land and Environment Court in Umeå (“Court”).

You can view the latest investor presentation here.

South Star Battery Metals [TSXV:STS] (STSBF)

South Star Battery Metals owns the Santa Cruz Graphite Project in Brazil with a Phase 1 commercial production target for Q4 2022. Plus the right to earn-in to up to 75% for the Graphite Project in Coosa County, Alabama.

On June 7, South Star Battery Metals announced:

South Star Battery Metals announces proposed joint venture with Graphex Technologies, LLC to develop a manufacturing and processing facility for battery anode material. The joint venture will allow for a centrally located, vertically integrated supply chain for active battery anode material supplied by two high-quality, scalable graphite operations in two strategic and stable jurisdictions in the Americas.

Westwater Resources (NYSE:WWR)

Westwater Resources Inc. is developing an advanced battery graphite business in Alabama. The Coosa Graphite Plant (2023 production start) plans to source natural graphite initially from non-China suppliers and then from the USA from 2028.

On June 8, Westwater Resources Inc. announced:

Westwater Resources receives air permit for Kellyton graphite processing plant. “The receipt of our air permit is another significant achievement by the Westwater team and allows us to continue to advance the construction of our Kellyton graphite processing facility. With the receipt of this permit, Westwater has received all necessary permits for the construction of our processing facility……

You can view the latest investor presentation here.

Gratomic Inc. [TSXV:GRAT] [GR:CB82 ] (OTCQX:CBULF)

Gratomic’s Aukam Graphite Project is located in Namibia, Africa. The Project is undergoing ‘operational readiness‘. Gratomic also 100% own the Capim Grosso Graphite Project in Brazil. Gratomic is also collaborating with Forge Nano to develop a second facility for graphite micronization and spheronization.

On June 13, Gratomic Inc. announced:

Gratomic acquires 100% interest in 3 exploration licences in Brazil…..it has acquired 100% of the rights and interests in and to the properties known as the “Jacobina Prospect” and the “Igrapiuna Prospect”….(2,782.01 Ha) located in the State of Bahia, BA, Brazil (the “Property”). The Property is within 30 kilometres of its Capim Grosso graphite project located within the Bahia State of Brazil….

Black Rock Mining [ASX:BKT]

No news for the month.

NextSource Materials Inc. [TSX:NEXT] [GR:1JW] (OTCQB:NSRCF)

NextSource Materials Inc. is a mine development company based in Toronto, Canada, that’s developing its 100%-owned, Feasibility-Stage Molo Graphite Project in Madagascar. The Company also has the Green Giant Vanadium Project on the same property. The Molo mine is fully-funded and scheduled to commission in March, 2022.

No news for the month.

Investors can view the latest company presentation here or the latest Trend Investing article here.

Nouveau Monde Graphite [TSXV:NOU] (OTCQX:NMGRF) (NYSE:NMG) and Mason Graphite [TSXV:LLG] [GR:M01] ( OTCQX:MGPHF)

Nouveau Monde Graphite (“NMG”) own the Matawinie graphite project, located in the municipality of Saint-Michel-des-Saints, approximately 150 km north of Montreal, Canada. NMG (51%) and Mason Graphite (49%) have agreed to JV (subject to approvals) on the Lac Guéret Project.

On June 14, Nouveau Monde Graphite announced: “NMG provides project finance update: Expressions of interest received and appointment of Société Générale as the sole coordinating mandated lead arranger.” Highlights include:

- “Strong interest shown towards senior debt from Western World ECAs and governmental bodies, which is estimated to cover up to approximately 70% of NMG’s total funding required for its Phase-2 growth, subject to standard project finance conditions…..

- Amid increasing demand from battery and EV manufacturers, NMG advances commercial discussions and technical product qualification with a view towards securing an anchor customer agreement with a potential financial participation.

- NMG is developing a robust financing structure to fund its integrated Phase 2, the Bécancour Battery Material Plant and the Matawinie Mine, focusing on medium-term capital to be secured over time.

- ECA and governmental intended backing denotes NMG’s attractive and timely business model, underpinned by strong ESG principles and proprietary technologies.”

On June 17, Nouveau Monde Graphite announced: “NMG starts commissioning its coating line completing its integrated anode material production & discloses annual general meeting voting results.” Highlights include:

- “Construction of NMG’s coating unit essentially completed safely and on budget; cold commissioning is now underway.

- The only operational integrated North American natural graphite production, from mine to battery material: NMG now has the facilities to fully support the anode material qualification with its potential customers.

- The coating line completes the development of NMG’s Phase 1, providing a strong foundation for the scale up to full commercial operations for 100,000 tpa of high-purity flake graphite at the Matawinie Mine and 42,000 tpa of CSPG at the Bécancour Battery Material Plant.”

You can view the latest investor presentation here.

Greenwing Resources Limited [ASX:GW1] (OTCPK:BSSMF) (formerly Bass Metals [ASX:BSM]

On June 22, Greenwing Resources Limited announced: “Greenwing characterise graphene to ISO standards.”

You can view the latest company presentation here.

Triton Minerals [ASX:TON][GR:1TG]

Triton Minerals Ltd. engages in the acquisition, exploration and development of areas that are highly prospective for gold, graphite and other minerals. The company was founded on March 28, 2006 and is headquartered in West Perth, Australia. Triton has two large graphite projects in Mozambique, not far from Syrah Resources Balama project.

On June 14, Triton Minerals announced:

Update on security incident at the Ancuabe Graphite Project….Triton is advised that on Wednesday 8 June the Ancuabe site came under attack from insurgents. Triton has now been able to establish that, as a consequence of the attack, two of our Security/Caretaker staff were fatally injured.

You can view the latest investor presentation here and the latest article on Trend Investing here.

Magnis Energy Technologies Ltd. [ASX:MNS] (OTCPK:MNSEF)

Magnis is an Australian based company that has rapidly moved into battery technology and is planning to become one of the world’s largest manufacturers of lithium-ion battery cells. Magnis has a world class graphite deposit in Tanzania known as the Nachu Graphite Project.

On June 1, Magnis Energy Technologies Ltd. announced: “David Taylor appointed as Chief Executive Officer.”

On June 22, Magnis Energy Technologies Ltd. announced: “New York lithium-ion battery plant update.” Highlights include:

- “New York battery plant status at the end of May – 78% complete.

- Fully Automated Production expected to commence within the next 5 weeks.

- Electrolyte filling machine has been commissioned.

- Safety – Zero incidents in May.”

Eagle Graphite [TSXV:EGA] (OTCPK:APMFF)

The Black Crystal Project is located in the Slocan Valley area of British Columbia, Canada, 35km West of the city of Nelson, and 70km North of the border to the USA. The quarry and plant areas are the project’s two main centers of activity.

On May 7, Yahoo Finance reported:

Eagle Graphite reaches extension agreement with debt holder. Eagle Graphite Incorporated (TSXV:EGA) (“Eagle Graphite”, “Eagle”, “We”, or the “Company”) has entered into a binding Letter of Intent (“LOI”) restructuring the terms of approximately US$2.4 mln of secured debt associated with a supply agreement that has remained unfulfilled since 2013.

SRG Mining Inc. [TSXV:SRG] [GR:18Y] [Formerly SRG Graphite Inc.]

SRG is focused on developing the Lola graphite deposit, which is located in the Republic of Guinea, West Africa. The Lola Graphite occurrence has a prospective surface outline of 3.22 km2 of continuous graphitic gneiss, one of the largest graphitic surface areas in the world. SRG owns 100% of the Lola Graphite Project.

No significant news for the month.

You can view the latest investor presentation here.

Leading Edge Materials [TSXV:LEM] (OTCQB:LEMIF)

Leading Edge Materials Corp. is a Canadian company focused on becoming a sustainable supplier of a range of critical materials. Leading Edge Materials’ flagship asset is the Woxna Graphite Project and processing plant in central Sweden. The company also owns the Norra Karr REE project, and the 51% of the Bihor Sud Nickel-Cobalt exploration stage project in Romania.

On June 21, Leading Edge Materials Corp. announced:

Leading Edge Materials to apply for Natura 2000 permit and retracts appeal against mining lease rejection for Norra Karr. Filip Kozlowski, CEO of the Company states: “It is now clear what the legal framework for mining lease applications is and we adapt accordingly in order to progress our important project. Both the Swedish Parliament and the Government have recognized that this framework is prohibitive of efficient permitting processes for mining projects that could support more sustainable and secure raw material supplies needed for the energy transition. We will continue to adapt our path should the legal framework evolve going forward.”

On June 22, Leading Edge Materials Corp. announced: “Leading Edge Materials reports quarterly results to April 30, 2022.” Highlights include:

During the three months ended April 30, 2022:

- “The Company commenced an evaluation to restart graphite production at Woxna Mine due to improved market conditions.

- Norra Karr Exploration License Remains in Full Force After Court Decision….”

Subsequent to April 30, 2022:

- “On May 17, 2022 the Company signed Bihor Sud Exploration License between the Company’s subsidiary LEM Romania SRL and National Agency for Mineral Resources, Romania…..”

Investors can view the latest company presentation here.

Renascor Resources [ASX:RNU]

Renascor Resources Ltd. is an Australian exploration company, which focuses on the discovery and development of economically viable deposits containing uranium, gold, copper, and associated minerals. Its projects include graphite, copper, precious metals, and uranium.

On June 16, Renascor Resources announced:

More high-grade graphite from drilling at Siviour. Drill results expected to support improved and accelerated mining schedule in updated battery anode material study.

You can view the latest investor presentation here.

EcoGraf Limited [ASX:EGR] [FSE:FMK] (ECGFF)

On June 14, EcoGraf Limited announced:

German Research Institute confirms recycled graphite performance. EcoGraf HFfree™ purified graphite from used lithium-ion batteries matches the electrochemical performance of newly manufactured commercial battery graphite…..

You can view the latest investor presentation here.

Lomiko Metals Inc. [TSXV:LMR] (OTCQB:LMRMF)

Lomiko has two projects in Canada – La Loutre graphite Project (flagship) (100% interest) and the Bourier lithium Project (70% earn in interest).

No news for the month.

Zentek Ltd. [TSXV:ZEN] (ZTEK)(OTCPK:ZENYF) (formerly ZEN Graphene Solutions Ltd.)

On May 26, Zentek Ltd. announced: “Zentek announces opening of its industrial scale ZenGUARD™ production facility in Guelph, Ontario.”

On June 1, Zentek Ltd. announced: “Zentek retains halteres associates to support commercialization of its rapid detection technology.”

On June 6, Zentek Ltd. announced:

Zentek provides update on ZenGUARD™ patent status. “Our company continues to invest in Intellectual Property protection to provide long-term shareholder value” said CEO Greg Fenton. “Our team, working with our patent attorneys have mapped out a strong strategy to protect not only our ZenGUARD™ technology but all the technologies we are developing including our icephobic, fuel, battery, fire-retardant, and other innovations.”

Sovereign Metals [ASX:SVM] [GR:SVM][LSE:SVML]

Sovereign Metals Ltd. is an exploration company, which engages in the explorations of graphite, copper and gold resources. It operates through the Queensland, Australia and Malawi geographical segments. Sovereign Metals has world’s biggest graphite saprolith resource of 65m tonnes at 7.1% TGC at their Maligunde Project in Malawi.

On May 25, Sovereign Metals announced: “ESG framework advances social initiatives in Malawi.”

On June 1, Sovereign Metals announced: “Sovereign initiates major PFS drill program at Kasiya.”

On June 10, Sovereign Metals announced: “Leading global market position beckons for Kasiya’s low cost flake graphite co-product.” Highlights include:

- “Graphite planned to be produced as a co-product from the Kasiya rutile operation is estimated to sit at the lowest end of the global flake graphite cost curve.

- As one of the world’s largest flake graphite deposits, Kasiya has potential for a dominant market position due to production scale of a coarse flake, high purity and highly crystalline product which should be suitable for lithium-ion batteries and wider traditional industrial uses.

- Kasiya’s graphite flake size distribution compares favourably to industry peers suggesting potential to achieve a high graphite basket price…..”

On June 16, Sovereign Metals announced:

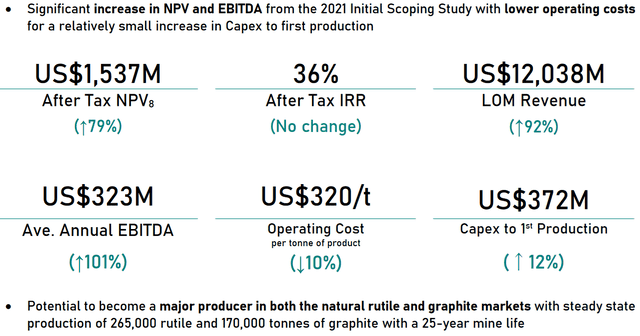

Kasiya expanded scoping study results. Exceptional economics confirm Kasiya as an industry-leading source of critical raw materials….. Sovereign’s Expanded Scoping Study for Kasiya is based on the updated MRE reported in April 2022, of 1.8Bt containing 18Mt rutile at 1.01% and 23.4Mt graphite at 1.32%. The Study envisages a 25-year mine life during which time both rutile and graphite are produced during two stages……

Expanded Scoping Study highlights for the Kasiya Rutile Project in Malawi

You can view the latest investor presentation here.

Other graphite juniors

Armadale Capital [AIM:ACP], BlackEarth Minerals [ASX:BEM], DNI Metals [CSE:DNI] (OTCPK:DMNKF), Eagle Graphite [TSXV:EGA] [GR:NJGP] (OTC:APMFF), Electric Royalties [TSXV:ELEC], Focus Graphite [TSXV:FMS][GR:FKC] (OTCQB:FCSMF), Graphite One Resources Inc. [TSXV:GPH] [GR:2JC] (OTCQX:GPHOF), Green Battery Minerals Inc. [TSXV:GEM] (OTCQB:GBMIF), International Graphite [ASX:IG6], Metals Australia [ASX:MLS], New Energy Metals Corp. [ASX:NXE], Volt Resources [ASX:VRC] [GR:R8L], Walkabout Resources Ltd [ASX:WKT].

Synthetic Graphite companies

- SGL Carbon

- Novonix Ltd [ASX:NVX](OTCQX:NVNXF)

Graphene companies

- Archer Materials [ASX:AXE]

- Elcora Advanced Materials Corp. [TSXV:ERA](OTCPK:ECORF)

- First Graphene [ASX:FGR] (OTCQB:FGPHF)

- Graphene Manufacturing Group Ltd [TSXV:GMG]

- NanoXplore Inc. [TSXV:GRA] (OTCQX:NNXPF)

- Strategic Elements Ltd [ASX:SOR]

- Zentek Ltd. [TSXV:ZEN] (ZTEK)(OTCPK:ZENYF)

Conclusion

June saw slightly higher flake and spherical graphite prices.

Highlights for the month were:

- BMI: Demand for graphite from the battery anode segment could increase by seven times in the next decade.

- How a battery metals squeeze puts EV future at risk.

- Canada’s South Star and Graphex Technologies plan battery anode material JV.

- China: Rising costs, tight supply of graphite flake balances patchy demand.

- Tesla supply chain problems are paramount concern – Musk.

- Trudeau’s energy chief unveils low-carbon industrial strategy for Canada.

- BMI: The energy storage revolution has arrived.

-

Syrah recommences Balama logistics movements after a temporary suspension due to security concerns in Mozambique.

- Mineral Commodities CRC-P project successfully completed, battery grades achieved at increasing scale by Australia’s national science agency, CSIRO.

- Northern Graphite received a spot order for 152 tonnes of its 80×150/95 grade at US$1,900MT to be shipped in July. The Lac des Iles mine and processing plant aims to produce up to 25,000tpa graphite concentrate.

- Talga Group Vittangi Graphite Resource boosted by 54%,adding more than 10m tonnes to Europe’s largest graphite resource. Talga commences graphite trial mine at Niska.

- South Star Battery Metals announces proposed JV with Graphex Technologies, LLC to develop a manufacturing and processing facility for battery anode material.

- Westwater has received all necessary permits for the construction of processing facility.

- Gratomic acquires 100% interest in 3 exploration licences in Brazil.

- Nouveau Monde Graphite starts commissioning its coating line completing its integrated anode material production.

- Magnus Energy Technologies – New York battery plant status at the end of May – 78% complete.

- Leading Edge Materials to apply for Natura 2000 permit and retracts appeal against mining lease rejection for Norra Karr.

- Renascor Resources achieves more high-grade graphite drilling at Siviour.

- EcoGraf – German Research Institute confirms recycled graphite performance.

- Zentek announces opening of its industrial scale ZenGUARD™ production facility in Guelph, Ontario.

- Sovereign Metals reports significantly improved Expanded Scoping Study results at their Kasiya Rutile & Graphite Project in Malawi.

As usual all comments are welcome.

Be the first to comment