FatCamera/E+ via Getty Images

Intro

We wrote about Grand Canyon Education, Inc. (NASDAQ:LOPE) back in February of this year when we stated we were still waiting for lower prices before entering into a long position here. Although shares have risen roughly 8% since that February article (which is an excellent return considering the S&P is down roughly 8% in the same period), there were some worrying signs in the company‘s recent second-quarter earnings report which makes us still think that lower prices are ahead of us.

Although earnings per share of $0.85 met consensus in the quarter, sales ($199.75 million) did not, but probably the brunt of the post-earnings decline in shares came from management‘s weaker guidance for the latter part of this year. Partner enrollments (96,029) in Q2 came in almost 6,000 lower compared to the same period of 12 months prior. Q3 service revenue is now expected to come in at approximately $206 million, roughly $8 million down from the originally guided $214 million. This downward trend is also expected in the fourth quarter with $254 million being the new top-line estimate which itself is down roughly $6 million from the company‘s most previous guided number.

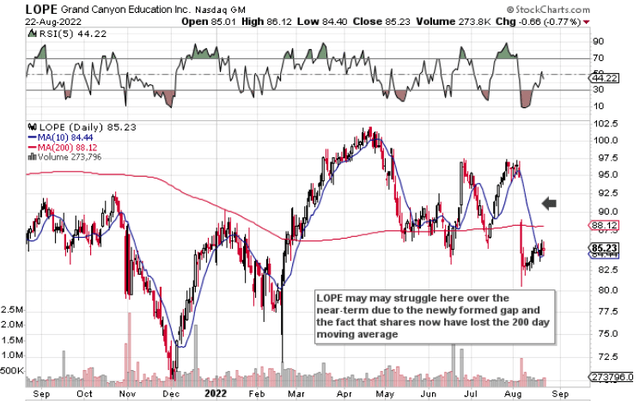

As we can see from the technical chart below, the market did not take favorably to the guidance cuts. The post-earnings drop in the share price means shares are now trading well below their 200-day moving average of $88.12 which is right in line with the fresh gap on the technical chart (which will also act as overhead resistance).

Lower Lows On LOPE‘s Technical Chart (Stockcharts.com)

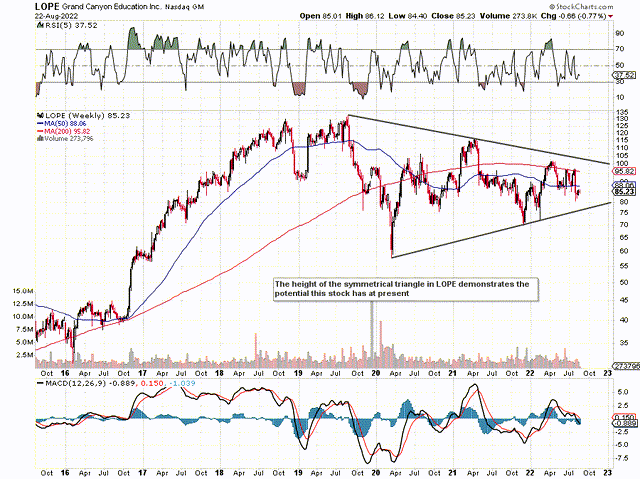

Suffice it to say, this is why we believe the symmetrical triangle on the long-term chart (most often a continuation pattern) has high odds of playing itself out here in due course for profitability reasons we discuss below. Furthermore, the height of LOPE‘s symmetrical triangle clearly demonstrates the potential in this play once we register a firm bottom.

LOPE Symmetrical Triangle (Stockcharts.com)

Gross Margin

Although earnings revisions continue to get dialed down, Grand Canyon Education continues to work off a strong gross margin metric which is encouraging. The company‘s gross margin metric comes in at 55.5% over a trailing twelve-month average compared to LOPE‘s 5-year average of 53.87%. In fact, since the end of fiscal 2019, LOPE‘s gross profit (over a trailing annual basis) has remained above 50% which is a metric that definitely has changed for the better compared to previous years. Suffice it to say, the more elevated and the steadier the company‘s gross profit margin, the better the business.

Gross profit came in just under 48% in LOPE‘s second quarter which resulted in a gross profit of $95.5 million. Although operating expenses came in lower than expected in the second quarter, net profit still totaled $25.6 million for the three-month period. Suffice it to say, although Wall Street will bemoan the clear lack of bottom-line growth, LOPE‘S strong margins ensure profitability will remain elevated at LOPE.

In fact, based on the generation of almost $76 million of operating cash flow in Q2, management bought back over $128 million of its own stock in the quarter. This sizable number clearly demonstrates how management views the current valuation (undervalued).

Return On Capital

Taking into account how LOPE‘s earnings and sales forward-looking estimates have been dialed down in recent times, shares now trade with a forward GAAP earnings multiple of 15.50 and a forward sales multiple of 2.96. Valuing LOPE at present is tricky (despite the fact that these multiples come in well below LOPE‘s 5-year averages) because market conditions in 2022 are definitely not the same as pre-Covid for example. However, when we see the company‘s return on capital profitability metric of 13.5% over the past four quarters, it becomes evident that this company continues to have the wherewithal to invest its money at high rates of return. Suffice it to say, a forward earnings yield of approximately 6.5% with that 13.5% ROC number should drive investors to this play especially if we drop down to the long-term support level depicted above.

Conclusion

Although the market did not take kindly to LOPE‘s recent second-quarter earnings report where the top and bottom-line guidance was cut, the company continues to generate strong cash flows and elevated return on capital numbers. Let‘s see what Q3 brings. We look forward to continued coverage.

Be the first to comment