DancingMan

It has been a tough few years for investors in Canadian intermediate upstream oil producer Gran Tierra Energy (NYSE:GTE)(CA:GTE). While most energy companies soared after a multiyear oil price slump ended as the global pandemic wound down Gran Tierra has struggled to deliver strong gains for investors. The company is being battered by a series of headwinds, the latest being heightened geopolitical risk in Colombia where the country’s first leftist president Gustavo Petro has hiked taxes for the hydrocarbon sector. This along with the release of Gran Tierra’s 2023 budget sparked concern that the driller will struggle to unlock value for shareholders. As a result, Gran Tierra’s market value is suffering with it plunging 20% over the last month creating an opportunity for risk tolerant investors seeking exposure to oil.

Colombia tax reform impacts 2023 budget

The 2023 budget recently released by Gran Tierra indicates that the tax hikes for Colombia’s oil industry, written into law by Congress in early November 2022, will have a material impact on the driller’s financial performance. Using a forecast base case of $85 per barrel Brent for 2023, average oil production of 32,000 to 34,000 barrels per day and capital spending of $230 million (at the midpoint of $210 million to $250 million) Gran Tierra expects free cashflow of $65 million. That free cash flow is significantly lower than the low case forecast, as per in Gran Tierra’s revised 2022 budget, of $100 million to $120 million FCF for full-year 2022, at an average Brent price of $80 per barrel, $230 million capex (at the midpoint) and production of 30,500 to 32,500 barrels daily. Using those numbers, which provide a rough “apples to apples” comparison, Gran Tierra’s projected 2023 FCF of $65 million is 41% lower than 2022.

It is the impact of leftist President Petro’s tax reforms that are predominantly responsible for the sharp decline in free cash flow. The recent tax hikes will impact all upstream drillers operating in Colombia to varying degrees. The severity of the fallout for Gran Tierra has sparked questions as to whether the Colombia government will repeal or at least ease the tax regime, particularly with oil companies looking to cut spending in Colombia and even exit the country. There are two key aspects of Colombia’s new tax regime for oil companies which are significantly impacting their profitability.

Firstly, there is a scalable surcharge being levied on the proceeds of oil sales when the international Brent benchmark price is above certain levels. When Brent is selling for $67.30 to $75 per barrel a tax levy of 5% is applied to the proceeds of oil sales. That surcharge then increases to 10% when the market price is $75 to $82.20 per barrel, finally reaching 15% if the Brent price exceeds the final threshold.

Secondly, royalties payable on oil production, which in Colombia are levied at between 8% and 25% on the value of the oil produced, are no longer considered an operational cost that is tax deductible.

For these reasons, the effective tax rate for oil companies operating in Colombia has soared, nearly doubling from 36% to 70%, when Brent is trading at above $82.20 per barrel, according to local economic thinktank Fedesarollo. It is for that reason Gran Tierra’s projected 2023 annual free cash flow has taken a big hit when compared to 2022 as the chart below shows.

Gran Tierra 2023 Budget (Gran Tierra)

If Gran Tierra hits the 2023 FCF target of $65 million, then based on the current market cap of just over $340 million Gran Tierra is trading at 5.2 times projected 2023 free cash flow. This indicates that Gran Tierra is cheap, a lot less so than before, with a lower ratio than many similar U.S. peers, while GeoPark (GPRK) and Parex (OTCPK:PARXF)(PXT:CA) which both have extensive operations in Colombia are trading at over six times forecast 2023 free cash flow.

Interestingly, for Gran Tierra’s 2023 budget forecast annual EBITDA remains roughly the same compared to 2022. The company expects 2023 EBITDA of $440 million to $490 million, with a midpoint of $465 million, compared to a 2022 low case of $440 million to $460 million with a midpoint of $450 million for the 2022 low case. In my earlier article using the average EV to EBITDA ratio for Gran Tierra’s peers operating in Colombia I found that the driller when using the top end EBITDA estimate for 2022 was worth $3.66 per share or nearly 4-times its price of $0.95 per share at the time of writing.

Reappraising Gran Tierra’s fair value

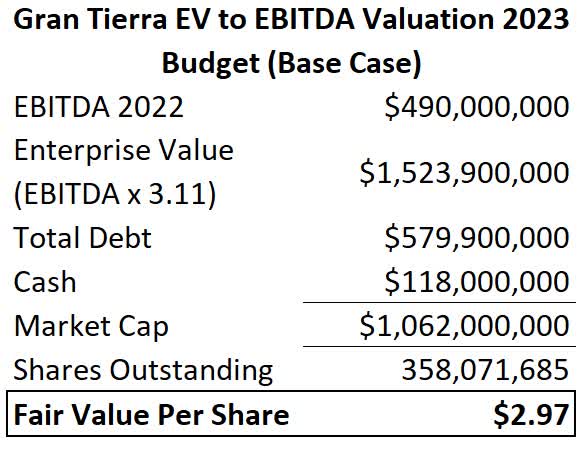

When calculating Gran Tierra’s indicative fair value per share using its forecast EBITDA, I have relied upon table below setting out the EV to EBITDA ratios for Gran Tierra and its upstream peers operating in Colombia.

EV to EBITDA Ratios (Wall Street Journal)

Based on the latest 2023 guidance from Gran Tierra my earlier EBITDA-based valuation does appear too high. Clearly, lower EBITDA will cause the indicative fair value of Gran Tierra’s shares to fall. When using the lower end of the driller’s 2023 forecast EBITDA of $440 million Gran Tierra has an indicative market value of $2.53 per share as the table below shows. When conducting these calculations, the common shares outstanding, debt and cash remain unchanged from Gran Tierra’s October 2022 Corporate Presentation and Third Quarter 2022 Operational Update.

Gran Tierra

*Total Debt sourced from the October 2022 corporate presentation.

** Cash sourced from Third Quarter 2022 Operational Update.

***Shares Outstanding source from Third Quarter 2022 Operational Update.

Upon taking the midpoint of Gran Tierra’s 2023 EBITDA forecast of $465 million the indicative fair value increases to $2.75 per share as the table below illustrates.

Gran Tierra

*Total Debt sourced from the October 2022 corporate presentation.

** Cash sourced from Third Quarter 2022 Operational Update.

***Shares Outstanding source from Third Quarter 2022 Operational Update.

Finally, when utilizing the upper end 2023 EBITDA forecast of $490 million for the company’s projected 2023 budget, Gran Tierra has an indicative fair value of $2.97 per share, as the table highlights.

Gran Tierra

*Total Debt sourced from the October 2022 corporate presentation.

** Cash sourced from Third Quarter 2022 Operational Update.

***Shares Outstanding source from Third Quarter 2022 Operational Update.

On the basis of Gran Tierra’s 2023 forecast budget the company has an indicative fair value per share of $2.53 to $2.97. That range is more than double Gran Tierra’s share price of $0.95 at the time of writing indicating that indeed there is still considerable upside available for investors along with a solid margin of safety.

The preferred industry methodology for valuing upstream oil producers is to determine the net asset value (NAV) of the company’s proven and probable reserves per share, which uses the net present value with a 10% discount applied of those reserves. In my last 2 November 2022 article on Gran Tierra, I calculated that the after-tax NAV for the driller’s proven or 1P reserves was $2.34 per share, which rises to $3.36 per share when the company’s proven and probable also called 2P reserves were used.

Clearly, the tax hikes implemented by Petro’s administration will impact the after-tax value of Gran Tierra’s oil reserves. What is clear is that higher taxes on oil production will cause the net present value of future revenue generated by the oil produced from those reserves to fall while finding and development costs will likely increase. At this time, however, it is nearly impossible to ascertain just how significant that impact will be on the after-tax NPV10 of Gran Tierra’s oil reserves and hence the NAV for its 1P and 2P oil reserves.

It is important to note that a conservative price deck was used to formulate Gran Tierra’s after-tax NPV-10 for its 1P and 2P reserves. The NPV-10 was calculated using a forecast five-year average Brent price of $70.37 per barrel with the international benchmark expected to be $70.36 per barrel for 2026. That price is significantly lower than the $77 Brent price at the time of writing and less than the price forecasts of various industry analysts as well as government agencies. According to the Bloomberg Consensus Brent will average $89.18 per barrel from 2023 to 2026 and trade at an average of $80.10 the final year of that five year period.

For some time, Gran Tierra has reported a solid reserves replacement rate, which for its 1P reserves during 2021 was an impressive 123%, where any number over 100% indicates that the oil reserves grew. Notably, when it comes to valuing the driller using its NPV-10 to determine the NAV of its 2P reserves, 65% of those reserves are comprised of Gran Tierra’s 1P oil reserves. Gran Tierra experienced considerable exploration success during 2022, drilling four successful exploration wells. That points to another strong annual reserve replacement ratio for 2022 and the likelihood that the company’s reserves will grow when reevaluated at the end of 2022.

Those developments indicates that while Colombia’s new taxes for energy companies will impact the after-tax NPV-10 of Gran Tierra’s reserves, the value of its oil reserves will increase because of higher forecast oil prices and additions. For these reasons, the after-tax NAV of $2.34 per share for Gran Tierra’s 1P reserves and $3.46 for its 2P reserves are maintained for the time being.

Conclusion

Colombia’s tax reform, which was written into law during early November 2022, has sharply impacted the Andean country’s economically vital hydrocarbon sector. As Gran Tierra’s forecast 2023 budget indicates, projected free cash flow will fall sharply year over year to $65 million or around 41% lower than 2022 projections. It will also negatively affect the value of the driller’s after-tax oil reserves although projected higher oil prices and reserve expansion will offset that impact. For that reason, I have chosen to maintain the after-tax NAV per share values for Gran Tierra calculated in my November 2022 article at this time with it to be reviewed when the driller announces its 2022 year-end reserves.

Gran Tierra’s 2023 forecast annual EBITDA has also fallen sharply, also due to a lower forecast Brent price for the base case, meaning that the company’s indicative fair value per share is lower. At this time, when using an EBITDA based valuation and accounting for the company’s 2023 guidance, Gran Tierra has an indicative fair value of $2.53 to $2.97, which is more than double its market price of $0.95 per share at the time of writing. This indicates there is still considerable upside ahead and a solid margin of safety for investors despite the impact of Colombia’s tax hikes for energy companies and recent oil price volatility.

Be the first to comment