As expected, Gran Colombia Gold (OTCPK:TPRFF) reported good Q4 2019 financial results. The company produced 65,237 toz gold, which is a new quarterly record. Compared to Q3, gold production increased by 16% and compared to Q4 2018, it increased by 18%. Also the overall 2019 production set a new record, at 239,991 toz gold. The majority of production (214,241 toz gold) is attributable to the Segovia mine, the remaining 25,750 toz gold were produced at the Marmato mine.

Source: Own processing, using data of Gran Colombia Gold

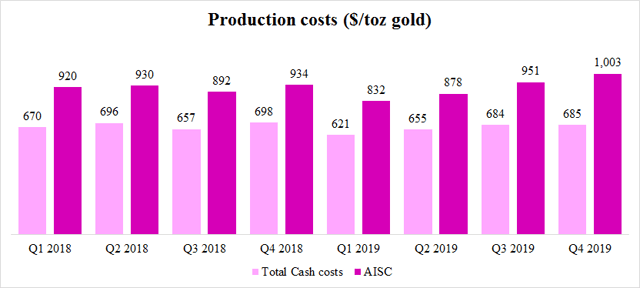

Although Gran Colombia’s gold production increased notably in Q4, the unit production costs didn’t decline. While the total cash costs remained almost unchanged, at $685/toz, the increased sustaining capital expenditures pushed the AISC up to the $1,003/toz level. It represents a 5.5% growth in comparison to Q3, and a 7.4% growth in comparison to Q4 2018.

Source: Own processing, using data of Gran Colombia Gold

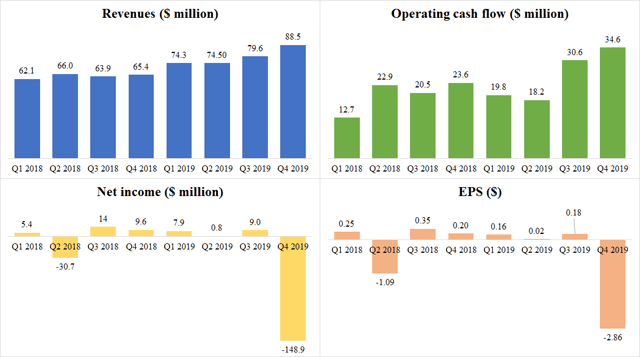

The increased production volume, as well as strong gold prices, helped Gran Colombia’s revenues to reach a new record high in Q4. The company recorded revenues of $88.5 million, which is 11% more than in Q3 and 35% more than in Q4 2018. The strong revenues were reflected also by improved operating cash flow that amounted to $34.6 million. It increased by 13% quarter-over-quarter and by 47% in comparison to Q4 2018. The overall 2020 operating cash flow crossed the $100 million mark.

Although the Q4 operating cash flow was strong, the net income looked scary. Gran Colombia recorded a net loss of $148.9 million, which means EPS of -$2.86. However, the huge loss was caused only by an impairment charge of $153.6 million associated with the Marmato project. The impairment charge was made because the carrying value of Marmato was over $190 million, while Gran Colombia made a spin-off of this asset assigning it a fair value of $44.2 million. An adjusted Q4 net income equaled $17.1 million and the adjusted EPS equaled $0.33.

Source: Own processing, using data of Seeking Alpha and Gran Colombia Gold

Source: Own processing, using data of Seeking Alpha and Gran Colombia Gold

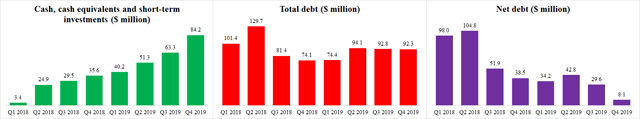

The strong cash flows helped to boost Gran Colombia’s balance sheet. The cash position increased to $84.2 million, which is 33% more than in Q3 and 137% more than in Q4 2018. However, it is important to note that the growth of the cash on hand volume was partially caused also by a C$15 million (approximately $10.7 million) private placement that occurred in early November.

While the cash on hand keeps on growing, the total debt remains almost unchanged, around $92 million. As a result, the net debt keeps on declining nicely. As of the end of Q4, it equaled only $8.1 million. Another good news is, that during Q1 2020, the volume of total debt declined significantly. In January, the principal amount of outstanding gold notes was reduced from $68.75 million to $63.875 million, and in March, it was reduced to $44,712,500.

Source: Own processing, using data of Seeking Alpha and Gran Colombia Gold

Source: Own processing, using data of Seeking Alpha and Gran Colombia Gold

Gran Colombia has also released updated resources and reserves estimate, valid as of December 31, 2019. The volume of measured and indicated resources increased by 2%, to 1.36 million toz gold, at a gold grade of 11.7 g/t. The volume of inferred resources increased by 9%, to 1.27 million toz gold, at a gold grade of 9.6 g/t. The volume of reserves declined by 3%, to 670,000 toz gold, at a gold grade of 10.5 g/t. Overall, in 2019, Gran Colombia was able to outline more gold than it produced, which is positive news.

Another positive news is that Segovia also should produce a lot of gold in 2020. According to the guidance, the annual production should range from 200,000 to 220,000 toz gold. Fortunately, the coronavirus hasn’t disrupted Gran Colombia’s operations yet, and the guidance is still valid. However, according to Lombardo Paredes, Gran Colombia’s CEO, while the Q1 operations were not disrupted, April may be challenging.

Gran Colombia intends to be very active on the exploration front in 2020. It plans to drill 45,000 meters at Segovia. Approximately 1/3 of the drilling should be focused on regional targets, especially on the known veins that haven’t been mined yet. However, also here, some risk of coronavirus-related delays and disruptions exists.

As can be seen in the chart above, Gran Colombia Gold’s shares were really heavily impacted by the coronavirus crisis. The share price experienced a more than 50% decline between the middle of February and the middle of March. Although the share price has slightly recovered from the lows around $2.2, the situation is still complicated. The gold price recovered from $1,450/toz to $1,640/toz and remained above the $1,600/toz level for several days, but today, it broke the psychological support and started declining. The stock market (represented by the Dow Jones Industrial Average) is stuck at a resistance level that is situated around the level of 22,500 points. The panic phase of this crisis is maybe over, but the declines (probably less dramatic) may return. In this case, Gran Colombia’s shares could retest their recent low around $2.2.

As can be seen in the chart above, Gran Colombia Gold’s shares were really heavily impacted by the coronavirus crisis. The share price experienced a more than 50% decline between the middle of February and the middle of March. Although the share price has slightly recovered from the lows around $2.2, the situation is still complicated. The gold price recovered from $1,450/toz to $1,640/toz and remained above the $1,600/toz level for several days, but today, it broke the psychological support and started declining. The stock market (represented by the Dow Jones Industrial Average) is stuck at a resistance level that is situated around the level of 22,500 points. The panic phase of this crisis is maybe over, but the declines (probably less dramatic) may return. In this case, Gran Colombia’s shares could retest their recent low around $2.2.

What I like about Gran Colombia Gold’s Q4:

- The gold production set a new record high.

- The revenues and operating cash flow set new record highs too.

- The net debt kept on declining rapidly.

What I don’t like about Gran Colombia Gold’s Q4:

- The AISC increased to $1,003/toz gold.

- The company made a C$15 million private placement, although it had a very comfortable cash position. It is questionable whether the share dilution was really inevitable.

Disclosure: I am/we are long TPRFF. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Be the first to comment