Florent Molinier

Investment Thesis

Graco (NYSE:GGG) was facing supply chain constraints in Q2 FY22 but saw improvement at its supplier base exiting the quarter. The supply chain challenges led to an increased order backlog in the quarter. The company has been investing in its plants and equipment to improve the throughput at its facilities and has successfully improved the output by 30% since 2018. I believe that in 2H FY22, the revenue growth should benefit from the improvement in supply chain constraints, a healthy order backlog, and increased capacity at its facilities. This growth should be partially offset by a slowdown in the order rates in its Contractor segment due to the softening in the housing industry. However, the long-term fundamentals for the housing industry remain strong with lower housing inventory levels, record high home equity, and favorable demographics. The company’s margin should improve as the higher input costs stabilize and with the implementation of an additional price hike in August. While I like the company’s fundamentals, the stock is currently trading at 27.23x FY22 consensus EPS estimate of $2.59 which is not cheap. Hence, I prefer to be on the sidelines.

GGG’s Q2 FY22 Earnings

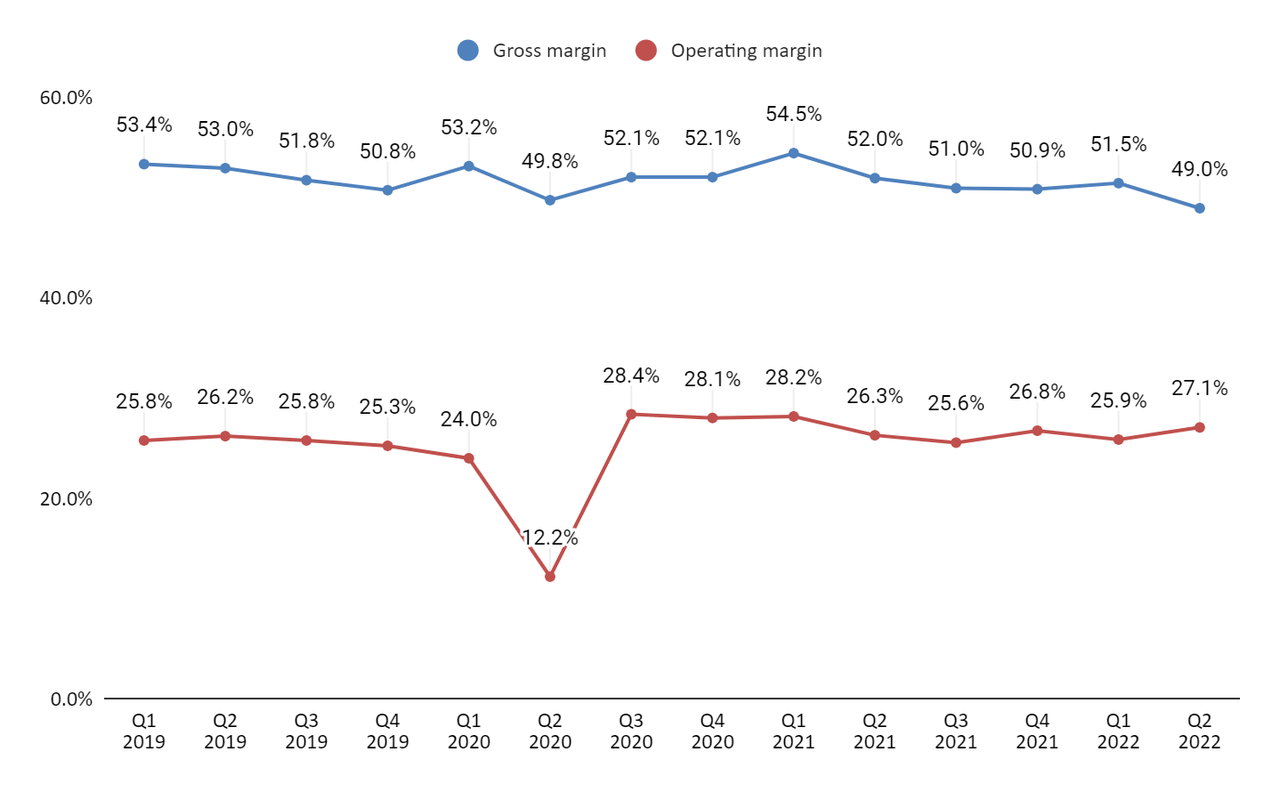

Graco recently reported better-than-expected second quarter FY22 financial results. The net sales in the quarter were up 8% Y/Y to $548.5 million (vs. the consensus estimate of $533.85 million). The EPS in the quarter was up 10% Y/Y to $0.68 (vs. the consensus estimate of $0.67). The sales growth in the quarter was due to double-digit sales growth in the Industrial and Process segments, partially offset by flattish Y/Y growth in the Contractor segment. The operating margin in the quarter was up 80 bps Y/Y to 27.1% due to increased sales volume and lower operating expenses. The improved operating margin and lower share count resulted in a 10% Y/Y growth in EPS.

Revenue growth prospects

In Q2 FY22, the Industrial segment grew 10% Y/Y as the demand for the products remained strong, partially offset by the pandemic-related shutdowns in China. The sales of the Process segment grew 27% Y/Y due to the strong demand for lubrication equipment, process pumps, and environmental and semiconductor products. The contractor segment’s sales remained flat Y/Y due to the continued component shortage for large paint sprayers. The sales for the segment in the North America region grew 5% Y/Y and the shutdowns in China and lost sales in Russia led to a decline in sales in the Asia Pacific and EMEA regions.

The consolidated order backlog at the end of the quarter was up 69% Y/Y. In the Contractor segment, the order backlog remained elevated in the quarter by 10% compared to that at the end of FY21 and nearly doubled Y/Y. In the Industrial segment, the booking rates in the Asia Pacific region improved at the end of the quarter as the restrictions in China were lifted. The backlog in the segment is up $30 million compared to the end of last year and $60 million Y/Y.

While the company experienced supply chain challenges in the second quarter, it started to see improvement in its supplier base as it came out of the quarter. I believe, that as the supply chain constraints further improve in the second half of FY22, the company should be able to convert its healthy backlog into revenue. The backlog conversion should be further supported by the investments made by the company. , Since 2018, Graco has invested $425 million to expand its global manufacturing capacity. The company made investments in new machine tools and new equipment to improve the throughput at its facilities. This expansion has allowed the company to support higher demand in the last few quarters and increase its output by 30% since 2018. Furthermore, the restrictions in China related to the Covid lockdown are now lifted, which should further benefit the company in terms of order rates and sales across its product portfolio.

The increased capacity, healthy backlog, and improvement in the supply chain should support the revenue growth in 2H FY22. This should be partially offset by the slowdown in the order rates in the Contractor segment due to the softening of the housing industry. The management has guided a high single-digit revenue growth on an organic constant currency basis in FY22.

In the Contractor segment, the Pro business is expected to remain strong as the professional contractors have a healthy backlog of commercial, residential, and remodeling projects. In contrast, the DIY business is experiencing a slowdown as the foot traffic at home centers is reduced due to the increased inflation. The management does not break out numbers in terms of Pro and DIY. However, they guided that the Pro business is more profitable compared to the DIY. So, strong Pro should benefit the company. The current situation is not very different from what another company under our coverage Masco Corp. (MAS) which sells to both DIY and Pro customers is experiencing.

In the long term, the tailwinds for the housing industry, such as the lower home inventory levels, record-high home equity, and favorable demographics, should benefit the Contractor segment. Additionally, a tight labor supply in the market should act as a tailwind for the company. The advancement in technology has led to more efficient and cheaper equipment (when depreciated over a long period) compared to manual labor, which should benefit the company.

Margins

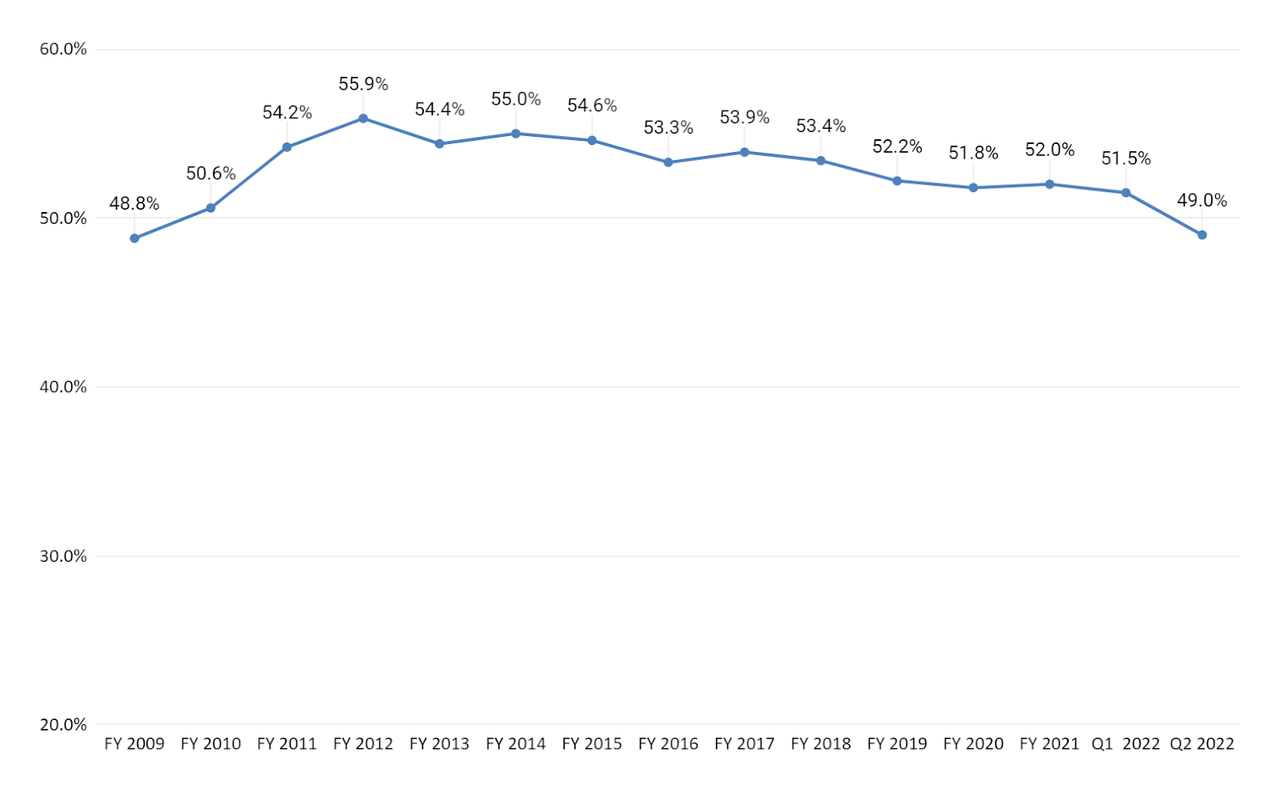

In Q2 FY22, the gross margin of the company was down 300 bps Y/Y and 250 bps down sequentially to 49% due to the elevated material costs and 100 bps from the negative currency translation. This was the lowest gross margin level since 2009 for the company. The pricing actions taken at the beginning of the year were not enough to offset the impact of these costs. However, the operating margin in the quarter improved 80 bps Y/Y and 120 bps sequentially to 27.1% due to lower operating expenses.

Graco’s gross margin since 2009 (Company’s data, GS Analytics Research)

Graco’s quarterly gross margin and operating margin (Company’s data, GS Analytics Research)

A lot of the company’s input costs have accelerated since the beginning of FY22, and it started to see a negative PPV (a variance between the expected costs and actual costs). This started showing up in the company’s financials in the latter half of March and became more meaningful in the second quarter. As a result, the company decided to take another price hike in August. This price hike should take effect throughout the third quarter and help the company offset the input cost pressure on a dollar basis. I believe that as the higher input costs across commodities and components stabilize in the second half of FY22, the company’s margin should improve.

Valuation & Conclusion

The stock is currently trading at 27.23x FY22 consensus EPS estimate of $2.59, which is only slightly lower than its five-year average forward P/E of 28.17x. The company’s revenue should benefit from the improvement in supply chain constraints, a healthy backlog, and increased throughput at its facilities. With the implementation of another price hike in August and stabilization in higher input costs in 2H FY22, the company’s margin should expand. While I like the company’s future prospects, I don’t find valuations compelling enough. Hence, I have neutral rating on the stock.

Be the first to comment