yorkfoto

Investment Thesis

Grab (NASDAQ:GRAB) is South-East Asia’s largest on-demand platform that runs business across local commerce and financial services. Its 3 core verticals are Mobility (transportation), Deliveries (food and parcels) and Fintech. Grab has come a long way since its founding in 2012 where it operated in just 1 country and 1 city. Today the company has grown exponentially with its presence in 8 countries and 480+ cities in South-East Asia. Over the last 10 years, Grab has focused on expansion/growth rather than profitability. While this has led to a strong market share in multiple countries, it has come at the cost of profitability. In the current macro-economic environment, Grab’s stock has been oversold due to its high losses. However, management has recognized the importance of profitability and have made the decision to prioritize profitability over growth. Given Grab’s strong foothold in South-East Asia, if the management can execute on profitability well, I think the stock has 40-50% upside from its current share price.

Market Dynamics and Story So Far

Grab went public at a high valuation of $40+bn through a SPAC deal on the NASDAQ exchange in December 2021. Since then, the company’s stock price has faltered leading to a 77% decrease in valuation since the day of its IPO.

Grab’s growth story has been nothing short of phenomenal since its launch in 2012. The company quickly conquered the South-East Asian market across its core Mobility (Transportation) business and soon diversified into the synergistic Deliveries (Food and Parcels) and Fintech businesses.

Grab has had a mixed performance over the COVID period. While its mobility business was severely hampered due to the COVID lockdowns, the company has done well to reinvent itself in the Deliveries and Fintech business. However, navigating through the COVID period while building out new verticals and focusing on growth has come at the cost of profitability.

Investor Day Download and Q2’22 earnings

Grab recently held an investor day on 27th September 2022 where it highlighted its longer term aims in the region. Management has made it clear that they are committed to focusing on profitability while compromising on growth.

Some of the key highlights were:

- Grab to focus on leveraging partnerships/advertising to drive higher margin growth moving forward

- Estimated revenue growth of 45-55% yoy for 2023

- Growth to be driven from new verticals such as Grocery deliver and Financial Services

- EBITDA Profitability to be achieved in H2’24

Q2’22 Earnings

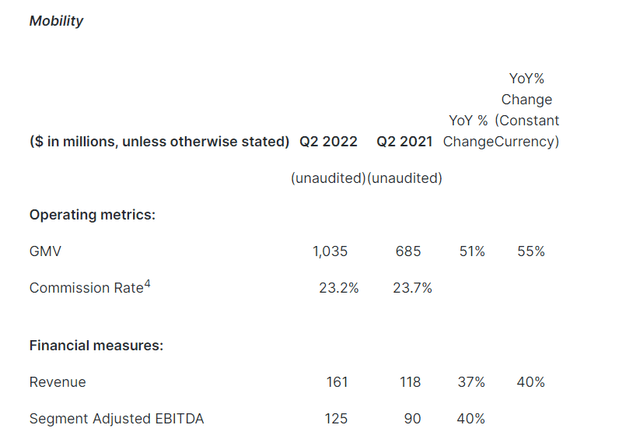

Mobility (Transportation)

Grab Q2’22 Earning Presentation

Grab’s mobility business continues to be its core profit driver and has grown steadily over the last 12 months as South-East Asia has been recovering from COVID lockdowns.

GMV grew 51% yoy returning to pre-pandemic levels while monetization rates stood at roughly the same amount (i.e 23%). Revenue grew 37% yoy to 161mn USD versus 118mn USD for the same quarter in the previous year. The key highlight is that EBITDA grew 40% yoy to 125mn USD from 90mn USD for the same quarter in the previous year. Mobility remains Grab’s most profitable business line which is important as Grab focuses on profitability over the coming years.

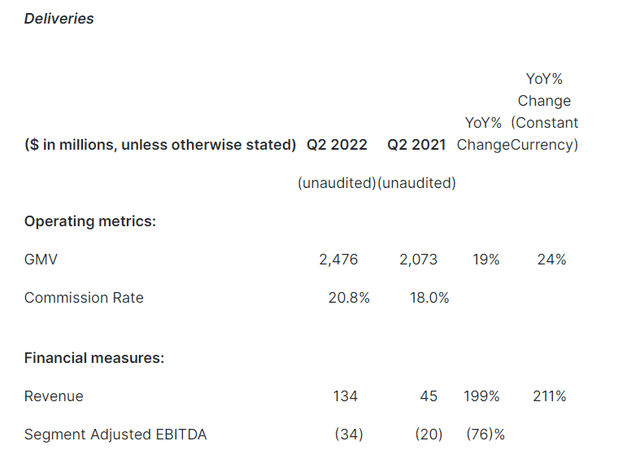

Deliveries (Food and Parcels)

Grab Q2’22 Earning Presentation

Grab’s Deliveries business saw a healthy growth rate in its topline with GMV growing by 19% yoy to 2.47bn USD from 2.07bn USD in the previous year. Monetization rate grew a healthy amount by 2.8% points too. Grab managed to severely reduce its net incentives resulting in a strong Revenue growth of 199% yoy to 134mn USD from 45mn USD for the same quarter in the previous year.

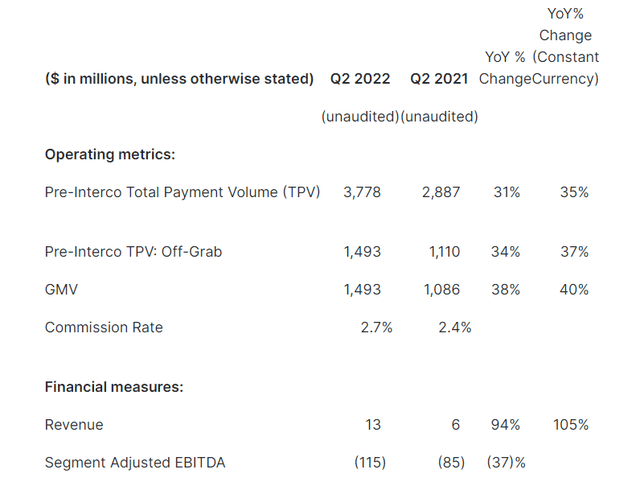

Fintech

Grab Q2’22 Earning Presentation

Grab’s fintech business has seen strong growth yoy with GMV growing 38% yoy to 1.49bn USD from 1.08bn USD for Q2’22. However, monetization rates remain low at 2.7% resulting in net Revenue of ~13mn USD.

The majority of incentives for Grab’s business are deployed through its payment wallet resulting in a high burn rate and EBITDA of (115mn) USD.

Projections and Valuation

Moving on to projections for its three key segments:

Mobility: Grab is by far the Mobility market leader in South-East Asia. Today Mobility serves as Grab’s high profit margin business and is set to grow strongly as countries recover from the COVID lockdowns. Macro-economic changes and demographic shifts coupled with increased smartphone penetration will be a strong headwind for this business line.

Deliveries: Grab continues to be the market leader in the e-commerce business within South-East Asia. In sharp contrast to the mobility business, the Deliveries business is characterized by low margins and high competition in South-East Asia. The vertical saw strong growth during the COVID period as countries were under lockdown. Moving forward, growth is expected to stabilize as countries have reopened post the COVID period.

Fintech: Grab has a substantial lead in the Fintech vertical due to its external investments in fintech players and acquisition of licenses across the region. South-East Asia demographics are characterized by a high unbanked rate and low access to financial institutions. This vertical will continue to be a strong headwind for the company moving forward.

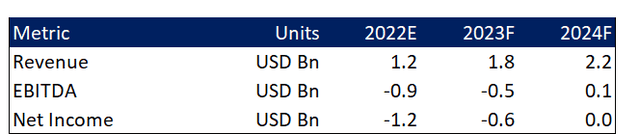

I expect Grab’s financial projections to grow along these lines:

At the current share price of ~2.81 USD, Grab’s market capitalization is about 10.8bn. Given the focus on profitability, Grab should trade at a forward peer multiple of ~8-10x which implies a share price of ~3.9-4.2USD.

Given the current stock price of ~2.81 USD, this implies an upside of ~40-50%.

Given that Grab’s stock price has fallen >70% since its IPO, there is no doubt that a lot of the downside has already been reflected in the stock price. However, given that South-East Asia is still in the infancy stage of technology penetration compared to countries like China, Grab still has a long way to go over the next 5 years.

The ideal way to value a business like Grab would be through an SOTP valuation (i.e. finding the valuation of its individual components and adding them to give a total valuation number)

Key Risks

Competition: Competition from both local and global players is a key risk here. Grab is currently competing against multiple different competitors across it’s different verticals. Local company GoTo serves as Grab’s largest competition in the Mobility/Fintech space with a strong foothold in Indonesia. Grab has multiple competitors in the Delivery space such as GoTo, DeliveryHero (Foodpanda), Shopee and Deliveroo. Given the low margins of the business, high competition and incentives could lead to slower profitability for Grab.

Inflationary Pressures: The current macro-economic environment is characterized by high inflationary pressure. The increase in inflation for consumers across South-East Asian countries could hamper spend in the Mobility and Deliveries Vertical.

Takeaway

The current macro-economic environment requires Grab to focus on profitability rather than growth. In the recent investor day, Grab’s management has acknowledged this and made the firm decision to focus on profitability rather than growth. Given Grab’s strong market share in the South-East Asian region and favorable demographics, Grab has the potential to recover from its recent price slump over the coming year. At ~2.81USD today, the stock has potential upside of ~40-50% with more growth potential in the coming years.

Be the first to comment