Galeanu Mihai/iStock via Getty Images

Thesis and reason for this article

One year before the pandemic, in early 2019, I wrote an article: “Governments And Central Banks Got It Wrong, Will They Learn?” I wrote that article when Donald Trump was fighting with Fed Chair Jerome Powell regarding increasing interest rates. The article advocated that the productivity gains from the fourth industrial revolution will keep the inflation in check, that raising the interest rates was not justified, and that central banks should drop the interest rates rather than increasing them.

Shortly thereafter, Mother Nature unexpectedly threw the plague our way. To avert a recession, central banks dropped the interest rates effectively to zero, removed the reserve requirements for banks, and governments started distributing free money to almost everyone with no concern about the inflationary pressures of this quantitative easing; governments and central banks bet that productivity gains would keep the inflation in check and had no worries about their quantitative easing strategies.

No one expected the perfect economic storm that ensued. That storm combined the abnormal increase in the money supply with wars, supply chain problems, lockdowns, and OPEC(+) greed. This resulted in a rapid increase in inflation at an unprecedented rate. Central banks accordingly reacted by increasing the interest rates at an unprecedented speed.

This article looks at how the current inflation unfolded and what is done about it. The article then shows that the central banks actions are not justified based on an analysis of the leading economic indicators, and what should be done instead. The article concludes with what the future is holding for us and presents the reasoning for what should be done to address the high unemployment and deflation expected.

The history: What was the original bet and what went wrong?

Since the beginning of the century, futurists have been predicting massive productivity gains emanating from the fourth industrial revolution that we are currently experiencing. The hallmarks of the economic impact of this industrial revolution can be summarized in the following points:

4th Industrial Revolution (Getty Images)

Extremely high productivity and Artificial Intelligence (AI) automation: During the first three industrial revolutions, machines replaced humans in performing repetitive manufacturing jobs and productivity grew by leaps and bounds. This manufacturing productivity growth, impressive as it may be, pales compared to the productivity gains in the services sector which started with the third industrial revolution. According to Salesforce (CRM), the fourth industrial revolution is expected to transform production in a way that was never experienced.

More jobs lost than created and unprecedented levels of unemployment: AI-enabled machines and processes are currently replacing humans in almost all walks of life. The spectrum of lost jobs spreads from monotonous repetitive jobs to artistic jobs like acting and music composition. Except for a few disciplines (e.g. politics, judges, mental health counseling, elementary school teachers, …) there is no discipline that will not be impacted. I have covered the level of lost jobs resulting from the 4th industrial revolution in my 2019 article.

I am not saying that computers will replace humans but rather that one professional using AI-enabled computers will replace many individuals who are not.

Continuously growing economy: With the increased productivity and lower overall labor costs, the economy is expected to continue growing at a steady rate according to the World Economic Forum 2016 article. Futurists do not see an end in sight for this growth because AI-enabled machines will continue improving based on the computer’s ability to learn from its experiences (aka, machine learning). McKinsey conducted a survey in May 2022 showing how AI adoption is widely spread in the companies, and is expected to continue grown.

PwC states that AI will stimulate global economic growth by $15.7 trillion by 2030, which I personally believe is a conservative estimate. These numbers paint a bright future for the AI revolution.

Very low inflation and even deflation: With the increased productivity, lower labor costs, futurists expected that the prices will continue dropping. Many futurists sounded the deflation alarm resulting from the productivity gains, urging central banks to do something about it from a monetary policy perspective. Many Seeking Alpha authors explained that deflation would happen in 2023; here is a list of some articles from the last three months:

- September 17, Doug Noland, Weekly Commentary: Deflation And Policy Mistakes

- September 28, Lawrence Fuller, From Inflation to Deflation

- October 12, Steven Saville, Monetary Tightening Into Deflation

- October 15, Lance Roberts, Deflation Will Become The Problem When ‘Something Breaks’

- November 11, Richard Durant, CPI: Deflation Kicks In.

Inflation to Deflation (Getty Images)

Consolidation and the rise of mega corporations: Currently, of the 100 largest economies in the world, 51 are corporations while only 49 are countries, based on corporate sales and country GDPs. Using AI-enabled computers is not easy, and requires massive resources. As a result AI will increase the corporate consolidation and the growth of these companies. Futurists expected that only larger companies will be able to compete in such an environment, and the “mega corporations” will emerge. These mega corporations will be much larger than the big companies we are now seeing like Amazon (AMZN), Apple (AAPL), Elon Musk’s group of companies (TSLA), Alphabet (GOOG), Facebook (META), Tencent (OTCPK:TCEHY), Alibaba (BABA), and Disney (DIS), just to name a few.

Remember, this is what futurists were expecting just before 2020. Then the plague hit us.

COVID: Was it a blessing in disguise?

The plague hit us, and the world locked down. I think that central banks saw a silver lining to what everyone construed as an economic curse. Here are some things that might have gone through their minds:

- We will finally have a temporary reprieve from AI productivity growth because of the lockdown; Computer power used for AI training has been doubling every 3.4 months, a scary neck breaking exponential growth rate.

- Productivity will temporarily drop because of the lockdowns which will provide a temporary break from the deflationary pressures.

- We will have an opportunity to experience the effects of high unemployment and distributing free money during a high-productivity period.

The central banks thus took some serious quantitative easing actions to concurrently capture multiple birds :

- Reduce the possibility of a recession

- Reduce the possibility of a long-term deflationary environment

- Reduce the possibility of social unrest emanating from high unemployment

- Prepare the economy to a world with of high productivity and low inflation

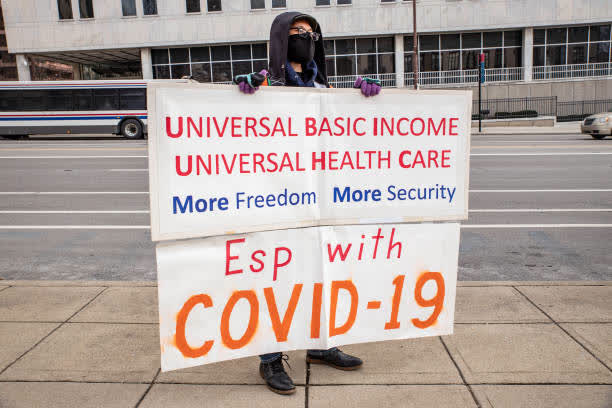

- Experiment with the implementation of Universal Basic Income (UBI).

The last two points were the bet that governments and central banks made. Their predications, however, were not materialized, and their bet was lost.

The perfect storm and how the bet was lost

At the end of the plague, a few events happened concurrently, and these events resulted in the unexpected abnormally high inflation:

Supply chain problems: COVID lockdowns and closing of manufacturing and transportation facilities around the world resulted in major disruptions that exposed the fragility of the global supply chain network. Central banks did not expect this fragility in the supply chain and as a result their expectation of early resolution of the supply chain problem did not materialize; actually, specialists and leaders are expecting the supply chain problems to persist through 2023.

Zero COVID policy in China: Even with the decline in the virility of the virus, China continued to lockdown areas where cases of COVID were discovered. This double-edged sword resulted in shutting down many manufacturing facilities and contributed to increasing the supply chain problems, thereby fueling the inflation. While China recently started retreating from this policy, its COVID policies are still far more strict than any other country.

OPEC(+) reducing the oil production: OPEC(+) unexpectedly started cutting oil production at the end of the pandemic as global demand slowed down to keep the oil prices high. This resulted in a higher inflation.

Russia Invading Ukraine: Russia invading Ukraine was the final nail in the perfect storm coffin. Sanctions and counter-sanctions, combined with supply chain disruptions resulting from the war increased the prices of goods and contributed to a higher inflation. The US Federal Reserve published a comprehensive report in May 2022 about “The Effect of the War in Ukraine on Global Activity and Inflation,” and I strongly recommend reviewing it.

This perfect storm resulted in an abnormally high inflation, higher than we have seen in the last 40 years. Central banks responded by rapidly increasing the interest rate.

I will explain why I believe that this monetary policy was flawed in the next section.

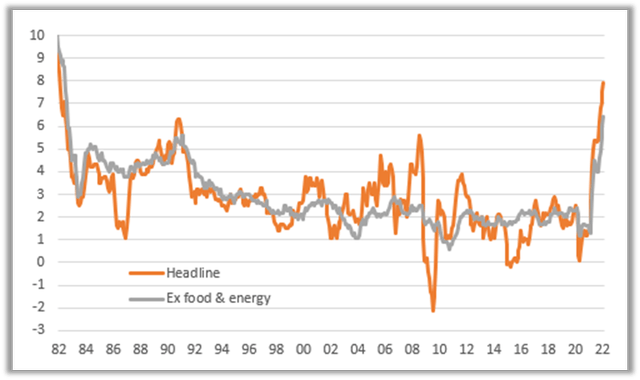

Source: investing.com, US Inflation At 40-Year High And The Only Way Is Up.

The present: What are they doing now?

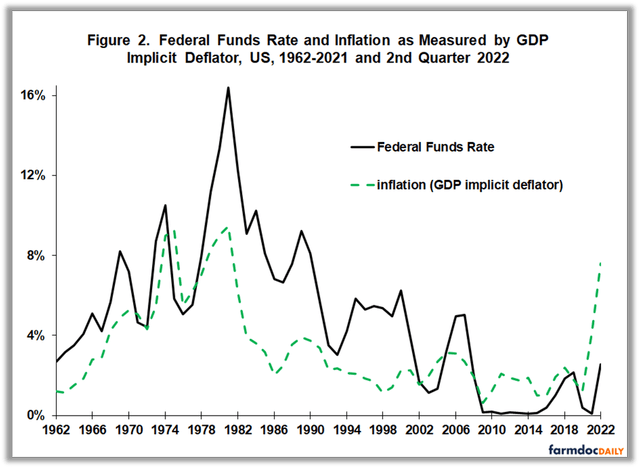

To manage the 40-year high inflation rate, the central banks started increasing the interest rates at an unprecedented rate; historically, the central banks were never behind inflation as much as they are now, as shown in the next chart from Ohio State University in October 2022.

Source: Farmdoc Daily, Update on US Interest Rates and Inflation.

Because the inflation was the result of a shortage of supply rather than an abundance of demand, the increase in the interest rates would have a minimal effect on the inflation. Actually, the increase in the interest rate may even work against keeping inflation in check:

- A major part of the government spending is on servicing the government debt. The increase in the interest rate would increase the government spending, and this will lead to the inflationary deficit financing.

- The increase in the interest rate will result in increasing the mortgage rates. The increase in mortgage rates will result in the inflationary rent increases.

- The increase in the interest rate will result in a drop in the investments associated with productivity gains. The drop in the productivity is inflationary.

Of course, increasing the interest rates will have a direct effect in reducing the demand, resulting in price reductions. However, this impact will not be significant because the inflation problem we are facing is more of a supply problem than a demand one.

The bigger risk now is a recession combined with deflation. Instead of blindly increasing the interest rates based on backward looking indicators (like the CPI and PPI), central bank governors need to look at forward indicators like the ones I am enumerating next:

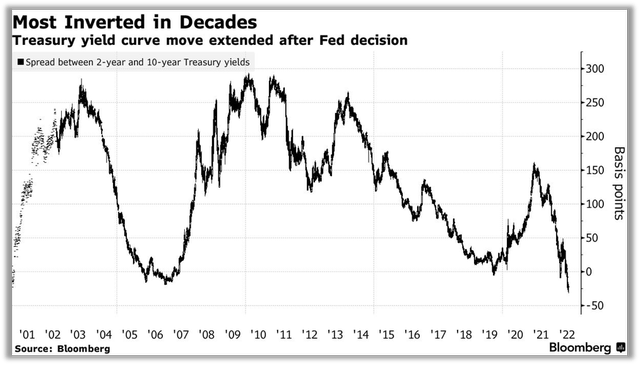

The inverted yield curve: We now have an inverted yield curve at a level that we have not seen since the early 80s. The yield curve inversion has historically been a very reliable indicator of an upcoming economic recession. I wrote a SeekingAlpha article in 2019 explaining the impact of an inverted yield curve in detail. This is an ominous sign that we are heading towards a recession.

Source: Bloomberg, Widely Watched Yield Curve at Most Inverted in Decades After Fed Hike.

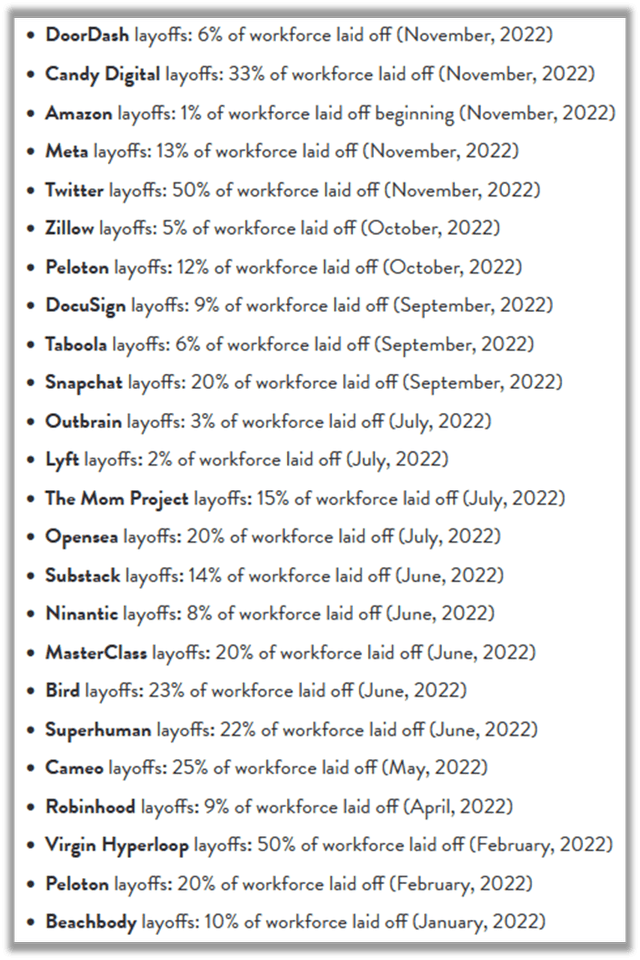

High-tech layoffs: 2022 experienced a strong employment market in most industries but also experienced significant mass layoffs, especially in the high-tech industry as shown in the next list. These conflicting signals indicate that the layoffs are not because of financial reasons but rather because of productivity gain reasons emanating from these companies’ investments in AI. This explanation points to the potential of significant layoffs in other industries as they start adopting AI technologies; this would lead to high unemployment.

Source: Mondo, Mass Layoffs in 2022: What’s Next for Employees?

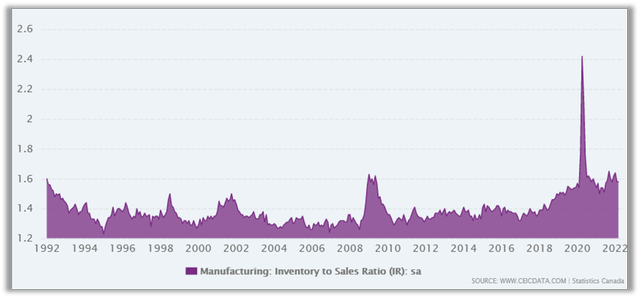

Retail sales and the increased inventories: The key ratio here is the inventory to sales ratio. When the economy falls into recession, typically businesses do not cut back inventories as quickly as sales decline, so the inventory/sales ratio rises sharply. Except for the outlier resulting from the COVID we are now experiencing inventories at a level that we have not seen over the past 30 years; this is a sign of a deflationary recession.

Source: CEIC Data, Manufacturing Inventory to Sales Ratio.

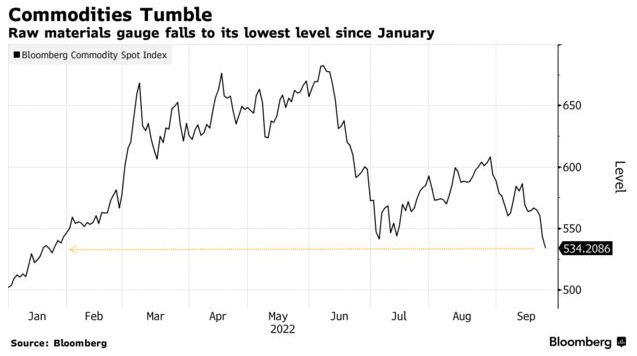

The commodity prices: The Bloomberg Commodity Spot Index, which tracks futures contracts for everything from oil to copper to wheat, fell 1.6% (a drop of 22% from its peak in June) to settle at its lowest level in 2022. A fast drop in commodity prices has traditionally been linked to recessions.

Source: (Bloomberg)

Source: Bloomberg, Commodities Gauge Falls to Lowest in 8 Months on Recession Fears.

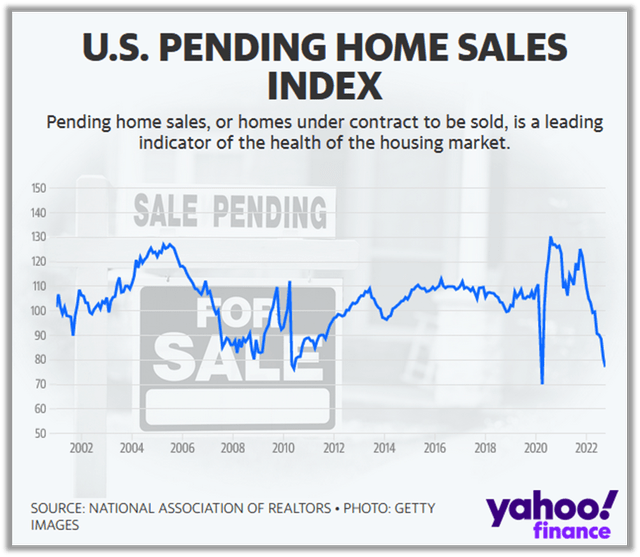

The housing market: The housing market drop represented by home sales index has traditionally been linked to recessions. The last few months have experienced a continuous drop in the housing market, and there is no end in sight; we have yet to see the impact of the increase in the interest rates. This is a very strong indication of a recession.

Source: Yahoo Finance, RH CEO: ‘The housing market is collapsing.’

Central banks seem to be mostly relying on the inflation lagging indicators (CPI and PPI) in their interest rate decisions. The above leading indicators would prompt us to believe that inflation has already been tamed and that we are heading towards a deflationary recession.

The future: Where are we heading?

Central banks have a few alternatives related to their monetary policy, each leading to a fundamentally different outcome:

- Continue increasing the interest rates at the same aggressive pace experienced since the end of the pandemic to catch up with the inflation

- Immediately start dropping the interest rates

- Slow the rate of increase gradually and then start dropping it.

We will analyze the above three paths from the hypothesis that we are heading towards a deflationary recession as per the leading indicators:

Continue increasing the interest rates at the existing pace: Central banks could continue increasing the interest rates to catch up with the inflation based on the lagging indicators. This direction would ensure a deep and long deflationary recession. This should not be the chosen alternative.

Immediately start dropping the interest rates: While this would eliminate the possibility of an immediate recession, the inflation may be out of control again. An immediate drop in the interest rate would result in an abnormal rally to the stock market, which is inflationary. This should not be the chosen alternative.

Slow the rate of increase gradually to zero and then start dropping it: Dropping the increase of the interest rates gradually so that it reaches zero within 3-5 interest rate decisions, and then start dropping the interest rate is a viable strategy. It would keep the inflation in check, curtail an abnormal inflationary rally in the stock market while averting a serious deflationary recession. This seems to be the only available approach from a monetary policy perspective and there is a possibility that Central Banks are heading towards this direction.

What should we do about the long-term structural problems?

Gradually dropping the rate of increase of interest rates and then dropping it would rein in inflation while averting the pending deflationary recession.

However, the risk of deflation cannot be controlled via monetary policy alone. Continuing to drop the interest rate would forestall deflation, but at one point we will reach a zero-interest rate and the monetary policy would be ineffective.

In addition, the technological advancements should result in an abnormally high level of unemployment, expected to be much higher than the 25% of the Great Depression. Social unrest would ensue from this level of unemployment and it should be averted.

Thus, we have two problems to solve: High Unemployment and Deflation.

High Unemployment:

Retraining will not be an alternative for unemployment because the newly created jobs will be a fraction of the lost jobs.

We can increase the size of the government and hire people for “make-work” jobs or spend on infrastructure projects and additional services. This is the approach that some third-world countries have adopted, and it would work for the short term. However, the problems we are facing are structural long-term ones, and government make-work jobs are not the solution.

A shorter work week can be legislated (3 or 4 days per week instead of 5), but then again, this would be a short-lived solution and it comes with significant challenges.

Birth control is a good solution, but it is a long-term one, and has some serious social implications.

Effectively, there is no solution to reduce the level of unemployment with the pending productivity gains. And, we should not forget the social unrest emanating from abnormally high levels of unemployment.

The only solution for this is distributing Universal Basic Income (UBI). This is not welfare for the unemployed, but rather a minimum income for everyone whether they are working or not. We will further discuss UBI later.

Deflation:

The solution for the deflation problem is not easy either.

The interest rates can drop but there is a physical limit of zero. This leaves fiscal policy as a tool to handle deflation. Like with high unemployment, the government can create “make-work” jobs or spend on infrastructure and additional services. Big governments come with their own problems, and this is not a long-term solution.

Another fiscal policy is the “free distribution of money for all,” aka, UBI. Please note that our attempts of distributing free money failed miserably during COVID.

Source: (Getty Images)

Why did UBI fail during COVID?

Distributing free money during COVID did not work because of various reasons:

- It was a glorified welfare system rather than a real UBI given to everyone whether they are working or not.

- We had the perfect storm after COVID as described at the beginning of the article that resulted in lower productivity rather than the higher productivity expected.

- The public was not ready for the introduction of such a program, and most people pumped their money into the stock market.

- The distribution of the funds was not well organized, and the welfare structure was an incentive for people to quit their jobs causing job shortages thereby increasing the wages and inflation.

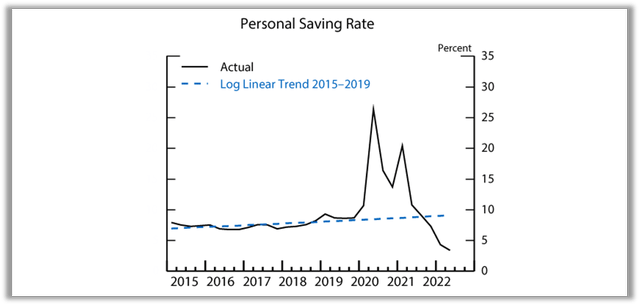

- Everyone knew that this free money would not last, so some saved the cash instead of spending it as was expected.

Source: (Federal Reserve System)

Source: Federal Reserve System, Excess Savings during the COVID-19 Pandemic.

Arguments against UBI

Adam Smith Institute published a very interesting article about the top nine arguments against UBI, and tried to debunk them. The nine arguments against UBI in this article are:

- Such a system removes the incentive to work

- People are more likely to find work meaningless when it is no longer their main source of income

- Such a scheme would be too costly to be feasible

- Giving everyone money would lead to excessive inflation

- A basic income would worsen poverty and inequality

- There are political implications – excessively high levels of UBI/NIT would be promised by politicians to garner support

- Increased costs from higher levels of welfare tourism

- Basic income makes people more reliant on the state

- Introducing basic income could create a “slippery slope.”

I will not comment on debunking these nine arguments and I strongly suggest that you read the article. I will instead present an argument for UBI emanating from the two concerns we expressed earlier, the high unemployment and deflation:

- With high unemployment, people who already have jobs will feel privileged to earn the extra money in addition to the UBI, and quitting their jobs will be unlikely.

- UBI would only be offered when there are huge productivity gains as a means of controlling the deflation through deficit financing.

- With deficit financing combined with the continuous productivity gains, we would reach the goldilocks economy with inflation between 1% and 3%.

- The continuous economic growth should keep the debt level constant compared to the GDP.

- The current taxation structure would not work with UBI, and we need to move more towards consumption-based taxation rather than income-based taxation for individuals. Income-based taxation would remain with corporations.

Conclusion

There is an old adage: “Conjurers are liars even if they tell the truth.” I don’t even claim that article is a prediction, and attest that it is just an educated guess based on research and many years of economic and market experience.

The unexpected perfect economic storm led to the current inflationary environment and this article provides an case that it is a transient one; the article shows that leading economic indicators are pointing to a pending serious recession in a deflationary environment.

Through the process of elimination, the article explains how gradually dropping the rate of increase of interest rates and eventually dropping it to close to zero is the only approach to be taken after the mistakes that central banks have made by rapidly increasing the interest rates.

While this monetary policy may be the solution for the current inflation crisis, it cannot address the structural crisis emanating from the productivity gains and resulting in high unemployment and deflation. A deficit-financed fiscal policy combined with a change in the structure of taxation is the only solution for this long-term structural crisis. When combined with social unrest resulting from an unprecedented unemployment level, the ideal policy would be the introduction of Universal Basic Income that is financed by quantitative easing and deficits.

Again, “Conjurers are liars even if they tell the truth.”

Be the first to comment