Florent Molinier

Article Thesis

Alphabet (Google) (NASDAQ:GOOG)(NASDAQ:GOOGL) reported its third quarter earnings results. The company missed estimates on both lines, which isn’t great. There are some strong and weak data points in the report that we’ll show in this article. Overall, even though Alphabet is battling some near-term headwinds, the company looks like a good long-term investment, I believe, thanks to a strong market position, growth tailwinds, a great balance sheet, and an undemanding valuation.

What Happened?

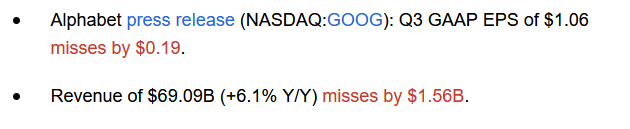

Alphabet reported its third quarter earnings results on Tuesday afternoon. The headline numbers can be seen there, as reported by Seeking Alpha:

Seeking Alpha

The revenue miss was pretty slim in relative terms, at around 2%. But Alphabet missed earnings per share estimates by more than 15%, which is a quite meaningful underperformance relative to what was expected. Not too surprisingly, the market didn’t react positively to this development – markets have been jittery in recent weeks, and a double miss sent Alphabet’s shares lower by 6% (at the time of writing).

The Good, Bad, And Ugly

Taking a deeper look into Alphabet’s results, we see that there are many important items, some of them positive and some of them negative. Let’s start with revenues. They missed estimates, but I believe that Alphabet’s sales performance was actually very solid due to two factors. First, the company was battling significant currency rate headwinds. Alphabet is not a US-focused company. Instead, it’s a truly global player that has users all over the world. A significant portion of its revenue is thus generated outside of the US.

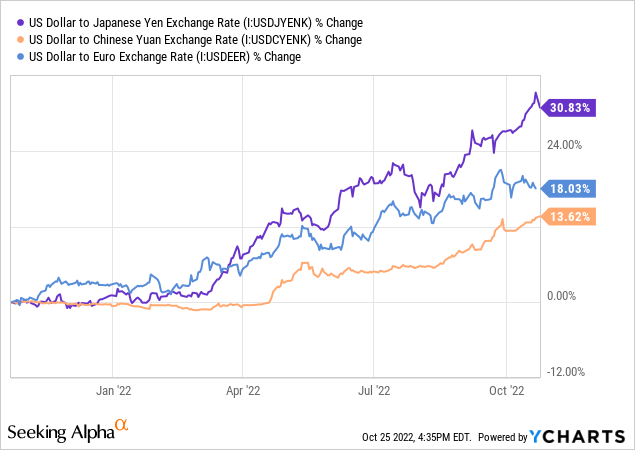

The US Dollar has strengthened vs. most currencies over the last year, including the Yen, Yuan, and Euro, as we can see in the above chart. Alphabet’s GAAP revenues (in US dollars) took a major hit from the fact that GOOG’s revenues that were generated outside of the US were negatively impacted by forex rates. At constant currency rates, Alphabet’s revenue would have been up 11% year over year, which is almost twice the reported revenue growth rate. It seems unlikely that the US dollar will strengthen forever – in fact, it has recently given back some gains. Eventually, these currency rate headwinds will thus wane, at which point Alphabet’s much stronger underlying business growth rate will allow the company to report better GAAP revenue growth again.

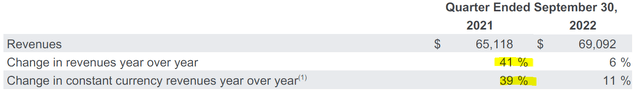

On top of that, the revenue growth rate was negatively impacted by a very tough comparison to the previous fiscal year’s quarter, during which Alphabet had generated outstanding business growth:

Alphabet earnings release

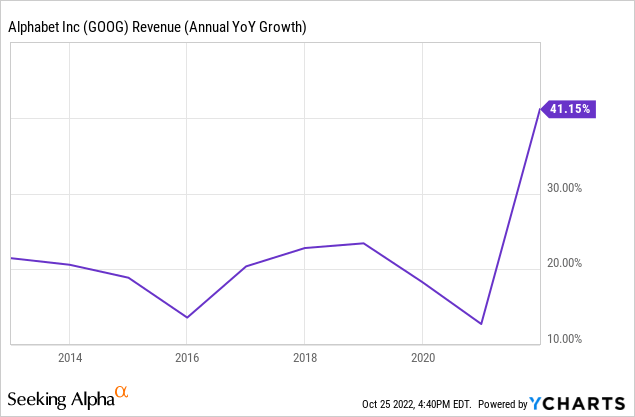

Alphabet grew its Q3 2021 revenue by a massive 40% year over year, which was above the long-term growth rate, as we can see in the following chart:

GOOG mostly grew its revenue by around 20% per year over the last decade, with 2021 being a massive outlier. The hefty growth rate last year made for a tough comparison. To adjust for that, we can look at a two-year-stacked growth rate – in that case, revenues are up by 49% over the last two years, which makes for an annualized growth rate in the low-20s. That’s almost perfectly in line with Alphabet’s revenue growth over the last decade. One can thus argue that growth has not really declined on a longer-term basis – instead, revenue growth was pulled forward into 2021 from 2022, but when one averages out the growth over those two years, things look pretty normal. Between these two factors, I believe that the reported 6% revenue increase is far from bad – instead, it looks pretty healthy. Comparisons will get easier over the next couple of quarters, which is why Alphabet will likely start to report better GAAP revenue growth again. Growth will slow down in the long term, of course, as the law of large numbers dictates that no company can grow at a 20%-plus growth rate forever. But the below-average growth in 2022 does not look like a major long-term issue to me.

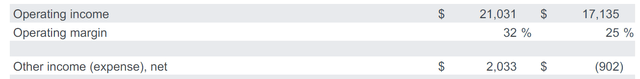

There also were some pretty unpleasant items in the report, however. The earnings miss was one such item, but the underlying drivers for that are even more important, I believe. Alphabet saw its operating margin compress quite a lot over the last year:

Alphabet earnings release

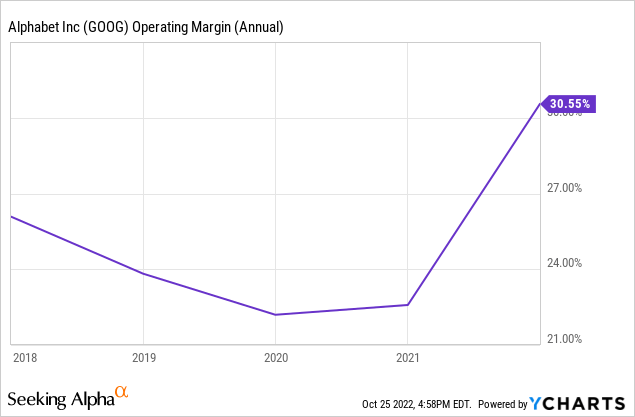

During the third quarter, Alphabet’s operating margin was 25%. That’s still pretty good in absolute terms, although 600 base points lower than the company’s margin during the previous year’s period. To some degree, this was the result of Alphabet’s outstanding 2021, when margins were above the norm, as we can see in the following chart:

Alphabet’s operating margin was in the 20s for the last five years, outside of 2021, when the hefty revenue increase and operating leverage allowed it to report a better operating margin. The fact that the operating margin dropped back to the mid-20s can thus be seen as a reversal to the mean, which is not dramatic. But the driving factor for that is that Alphabet’s cost controls failed over the last year – at least, that’s how I interpret things. The company increased its headcount from 150,000 one year ago to 187,000 during the most recent quarter, which makes for a 25% increase. A company that reports revenue growth in the single-digit, or 11% at constant currency rates, should not grow its headcount by 20%-plus, I believe. In fact, companies should thrive to grow their headcount less than the relative growth rate of their revenues. In that case, revenue per employee grows, which means that productivity rises. But in Alphabet’s most recent quarter, revenue per employee was down to $369,000 from $433,000 one year earlier – clearly, Alphabet’s productivity declined at a hefty pace. That’s a concerning trend, and if management is not able to stop it, profitability could worsen further (although from a still-strong level).

Luckily, management seems to acknowledge the fact that expenses have been growing too fast and that the company has taken on too many employees in the recent past. The company’s CEO Sundar Pichai has hinted at job cuts and stated that the company’s goal was to become “20% more efficient.” One can argue what exactly that means, but if Alphabet were to expand its operating margin by 20%, that would bring it back up to the 30% level it had been at one year ago. If that had been the case in Q3 2022 – a hypothetical scenario – the company would have generated an operating profit of $21 billion, and earnings per share would have been up year over year. Investors should definitely keep an eye on these trends, as that seems to be Alphabet’s core issue in 2022 – its expenses have grown too much, as the company has taken on a large number of new employees that have not really generated a lot of business growth, which makes the decision to hire that many new employees quite questionable. But with management now seeing that this issue deserves to be addressed, I believe that there is a good chance that things will improve going forward.

There’s another important driver when it comes to future earnings per share growth – the company’s buybacks. Thanks to a strong balance sheet and hefty cash flows, Alphabet always was in a position where it was able to pursue buybacks aggressively. Due to a rather pricey valuation, it has not done so over most of the last couple of years. After all, Alphabet was trading at around 30x net profits one year ago. With GOOG having dropped considerably in recent months, the valuation has become a lot less demanding, however. Right now, Alphabet trades for just 19x trailing net profit, which is why buybacks have become a lot more attractive. Management seems to see this the same way, as Alphabet has increased its buyback spending to $15 billion during the most recent quarter, or $60 billion annualized. Free cash flow totaled $16.1 billion during the third quarter, thus Alphabet was not outspending its cash flows. It could do so if management wants to, as the company has a net cash position of around $100 billion that it could draw down to zero over time, similar to what Apple (AAPL) is doing. But even if Alphabet continues to just return the majority of its free cash flows via buybacks, that will have a pronounced impact over time. The $15 billion per quarter buyback pace will reduce Alphabet’s share count by around 5% per year. Apple’s famous buybacks have reduced the share count by 3% to 4% a year in the past, thus Alphabet could have a better and more impactful buyback program in place if it keeps up the current pace.

Takeaway

Alphabet missed estimates on both lines, which naturally isn’t good news. But not everything was bad in the report – the revenue performance was very solid, I believe, considering forex headwinds and the very tough comparison. Two-year stacked revenue growth remains in-line with what GOOG has done in the past. I also really like the ramped-up buybacks that are easily doable thanks to strong free cash flows and that should reduce the share count meaningfully over time.

The expense growth and big increase in the number of employees are major issues, however, and management should deliver on its own goals of improving efficiency – and if it takes some job cuts, that’s what Alphabet should do, I believe.

Overall, Alphabet remains a well-positioned titan that should benefit from long-term industry tailwinds. At just 19x net earnings, its shares are far from expensive, and that does not yet account for the sizable net cash position. Add Alphabet’s potential in areas such as self-driving tech via its Waymo venture, and Alphabet looks like a compelling long-term hold to me – as long as management is able to deliver on the efficiency issue going forward.

Be the first to comment