Justin Sullivan/Getty Images News

Thesis

If I needed to pick one stock and hold it for the next decade, I would pick Alphabet/Google (NASDAQ:GOOG) (NASDAQ:GOOGL). In my opinion, Google is the best positioned company to benefit from an accelerating digitalization and a nascent AI-revolution – having both the capability and the platform to push exciting innovation in the internet sector.

Despite Google’s enormous potential, the stock looks very cheap. If we consider an investment opportunity as a function of both price and growth (PEG ratio), Google is the most attractive bet in the FAAMG universe. Moreover, Google looks even more attractive when compared to the S&P 500. Based on a residual earnings framework which I anchor on consensus analyst EPS estimates, I calculate a fair implied share price of $3,532.17/share, implying material upside of about 62.4%.

The secular growth story

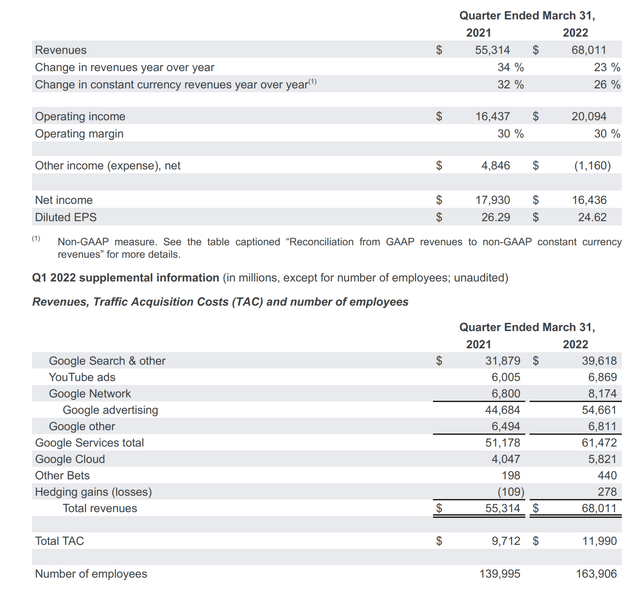

Shares of Alphabet lost approximately 20% YTD – mostly driven by macro-economic concerns and cooling investor sentiment toward equities, especially growth companies. Meanwhile, Google continued to perform. In Q1 2022, Google achieved record revenues of $68.01 billion. Most notably, both Google Advertising and Google Cloud recorded year-over-year growth of >20%. Moreover, despite significant inflationary pressures Google sustained operating income margins of 30%. That said, Google’s operating profitability remains best in class – 200% higher than the 9.17% average sector margin.

Google Q1 2022 Earnings

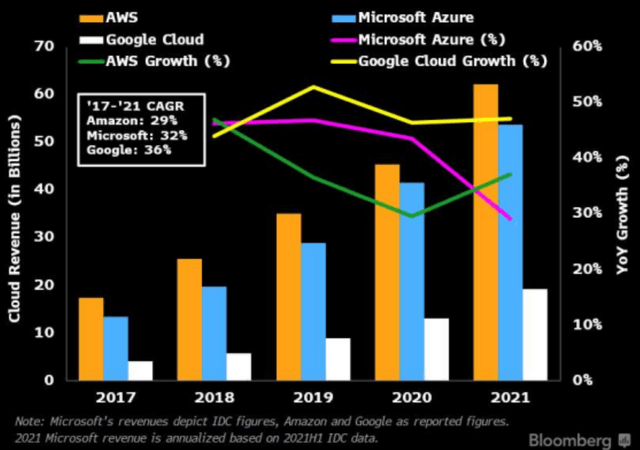

Analyst consensus believes Google can sustain >20% topline growth throughout 2022 and well into the mid 2020s (Source: Bloomberg Terminal, July 2022). If we consider nominal GDP growth at slightly below 3%, Alphabet is outpacing the broad market by a factor of x7! The strong outlook is deeply anchored on Google’s Cloud business potential, which is quickly catching up to peers Microsoft (MSFT) and Amazon (AMZN). In that context, Bloomberg Intelligence highlights that Google’s Cloud business has consistently outperformed peers with regard to growth. From 2017 to 2021, Google Cloud grew at a CAGR of 36% vs. 32% for Microsoft Azure and 29% for Amazon AWS. Also notable, Google’s operating cloud margins are currently at -16% vs. about 25% for AWS and >30% for Azure (Source: Bloomberg Terminal, July 2022). Thus, there’s significant upside for EPS accreditation.

Source: Data IDC; Calculations and Graph Bloomberg Intelligence

Personally, I’m extremely bullish on Goolge’s business outlook as I believe the company’s products are more relevant than ever – given the accelerating demand for AI, data analytics and information discovery/organization. From a value proposition perspective, Google has a leading position in the most attractive growth verticals of the Internet sector, including (1) video with YouTube, (2) various PaaS offering with Google Cloud, and artificial intelligence/information with Google search, voice and Waymo.

Google’s enormous market potential also is supported by the continuous search for innovation. Most notably, in the past five years Google spent more than $100 billion in research and development – the highest absolute R&D investment of any company globally. To put things into perspective, Google spent x10 as much money in R&D as Tesla (TSLA), which is arguably the most popular growth company.

Is Google stock cheap?

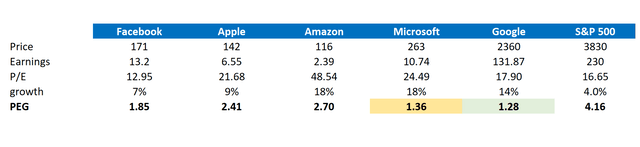

So, is Alphabet stock cheap? I strongly believe so. If we consider the FAAMG universe (I do not include Netflix (NFLX)), Google’s P/E of x17.9 is the second lowest. Only Meta’s (META) x12.95 multiple is lower. But merely looking at P/E is a “cheap” analysis and I argue that P/E must be put in relation to the company’s expected growth (three-year CAGR expectations). That said, the PEG ratio is broadly considered as an informative valuation metric to capture the relative trade-off between the company’s current stock price, current earnings and the expected growth. The ratio is calculated as a P/E divided by three-year CAGR expectation. Most notably, Google’s ratio of x1.28 is the lowest amongst the FAAMG peers and looks very attractive. When compared to the x4.16 PEG for the S&P 500, Goolge’s valuation looks almost incredible.

Analyst Consensus EPS; Author’s Calculation

How to value Google

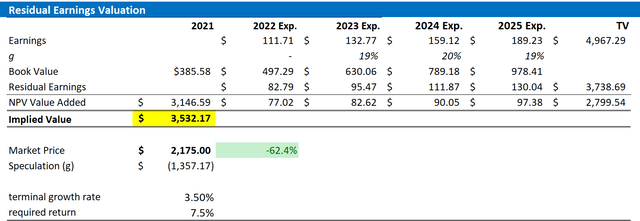

I have shown that Alphabet is actually not expensive on a relative basis vs. FAAMG stocks – and especially the S&P 500. But on an absolute basis, what could be a fair per share value for the company’s stock? To answer the question, I have constructed a Residual Earnings framework and anchor on the following assumptions:

- To forecast revenues and EPS, I anchor on consensus analyst forecast as available on the Bloomberg Terminal.

- The estimate of the cost of capital, I use the WACC framework. I model a three-year regression against the S&P to find the stock’s beta. For the risk-free rate, I used the U.S. 10-year Treasury yield as of July 01, 2022. My calculation indicates a fair WACC of 8%.

- To derive Google’s tax rate, I extrapolate the three-year average effective tax rate from 2019, 2020 and 2021.

- For the terminal growth rate, I apply expected nominal GDP growth at 3.5%. Although I think that growth equal to the estimated nominal long-term GDP growth is strongly understating Google’s potential, especially as the company is spending 20% of revenues in R&D, I want to be conservative in my valuation.

- I do not model any share buyback – further supporting a conservative valuation.

Based on the above assumptions, my calculation returns a base-case target price for Google of $3,532.17/share, implying material upside of about 62.4%.

Analyst Consensus EPS; Author’s Calculation

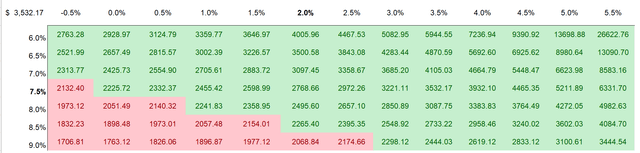

I understand that investors might have different assumptions with regard to Google’s required return and terminal business growth. Thus, I also enclose a sensitivity table to test varying assumptions. For reference, red cells imply an overvaluation as compared to the current market price, and green cells imply an undervaluation. The risk/reward looks highly favorable to me.

Analyst Consensus EPS; Author’s Calculation

Risks

I would like to highlight the following downside risks that could cause Google stock to materially differ from my price target:

First, a worsening macro environment could negatively impact Google’s advertising business. However, I personally see any recessionary impact on advertising as transitory. Perhaps, a recession could even help Google’s advertising business, as marketers are pressured to think about advertising ROI – where search has an undisputed advantage over traditional advertising. With regard to Google’s Cloud business, I do not see any material slowdown as likely – even in a recession.

Second, investors should monitor competitive forces in the cloud industry. I highlighted Google’s operating margins for cloud are significantly lower than margins for AWS and Azure. Personally, I believe the margin gap will be closed, as Google’s PaaS focus is a high-margin business opportunity. However, as competition amongst Cloud competitors intensifies there’s reason to doubt that >30% operating margins are unsustainable.

Third, arguably most of Google’s current share price volatility –especially to the downside – is driven by investor sentiment towards stocks. Thus, it’s likely that Google stock experiences significant volatility even though Google’s business outlook remains unchanged. Furthermore, higher inflation and rising-real yields impact Google’s stock price, as the higher discount rates decrease the net present value of long-dated cash flows.

Fourth, Alphabet’s size and scale are too difficult to ignore for antitrust officials. While the company has managed to defend past lawsuits in the EU and the U.S., the anti-competition allegations against Alphabet could accelerate. For interested readers, there was an amazing article written by a Seeking Alpha analyst: Google Stock: This Regulatory Pressure Is A Disaster (NASDAQ:GOOG). I highly advise to read the article.

Conclusion

Google is an outstanding business with an unmatched mix of growth potential (1), profit margins (2), and competitive moat to defend growth and margins against competition (3). Moreover, the company is cheap with considerable valuation upside. Based on a residual earnings framework anchored on analyst EPS estimates, I calculate a fair valuation of $3,532.17/share. Given the material upside of 60%, paired with Google’s exceptional track record to deliver value, I assign a Strong Buy recommendation.

Be the first to comment