Justin Sullivan The strong pullback of Alphabet ((NASDAQ:GOOG)(NASDAQ:GOOGL)) stock has already created attractive upside, but we are not ready to buy it. There are strong negative indicators in the online ad market that will extend into 2023. Nevertheless, Alphabet seems to be one of the best options in the online ad industry. The company still has attractive organic business growth opportunities, so we’ll keep an eye on buying the stock at more attractive price levels.

Investment Thesis

Marketing budgets are groggy

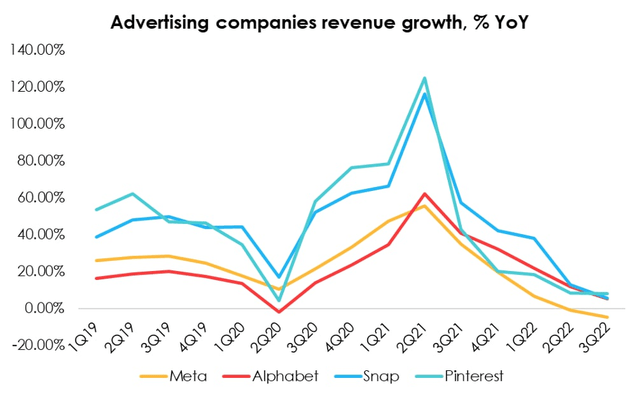

Although Alphabet is a diversified business with many products, its main revenue comes from online advertising. In our previous article, we mentioned that potential recession would be a strong hurdle for this business, and there were several disappointing Q3 reports from companies in the advertising sector.

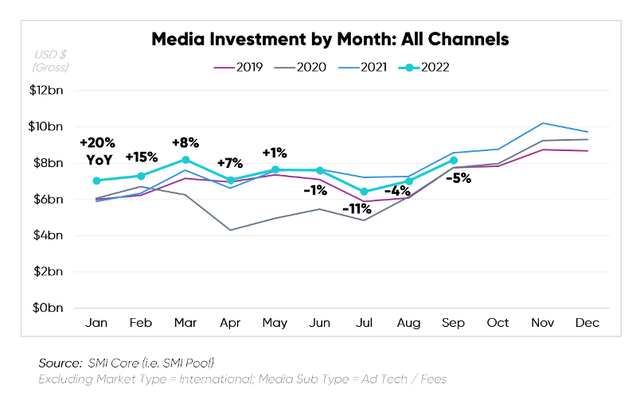

Marketing budgets of corporate companies remain flexible, so it’s relatively easy to cut spending on user engagement, except when a large, long-term contract is concluded. Recent Martech study shows that ~60% of B2B executives are either reducing or not increasing the budgets in 2022. According to Standard Media, the overall media investment index was down for the fourth consecutive month as of September.

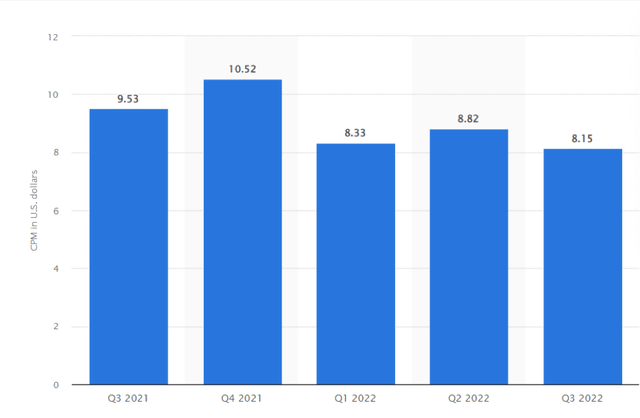

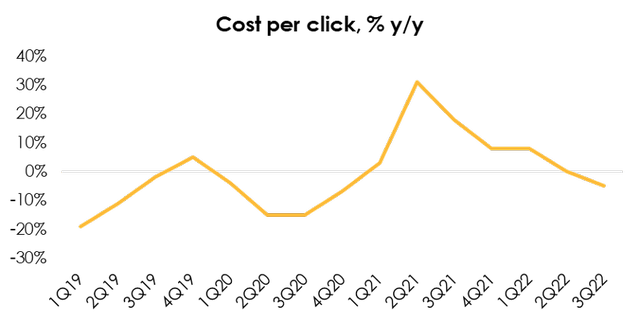

Meanwhile, the online ad market is relatively liberal. In most cases, customers are free to choose monetization options (clicks / conversions / views), and sometimes they can the price for traffic acquisition. So, cost-per-click / per-view metrics fluctuations in the industry are standard and highly dependent on the current environment and customer sentiment, according to Statista.

This year we’ve seen a decline in industry Cost-per-mile metrics and Google, the biggest player in the industry, is no exception.

At the same time, we believe that the recession peak has not yet passed, consumers remain strong, so advertising budgets of e-commerce representatives also have not suffered a lot. We expect a further decline in monetization figures in H1 2023, with a subsequent recovery by the end of the year.

Margins pressure

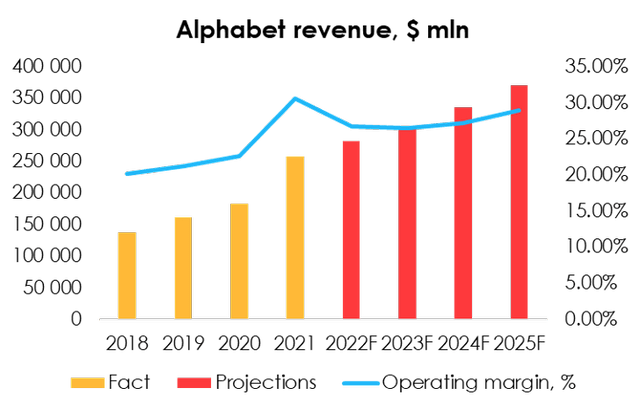

Alphabet set a high benchmark for operating margin in 2021, which was heavily influenced by the timing of revenue recognition in 2021 according to the management. Now it’s more difficult to maintain the same level of profitability due to several factors:

1) Lower user engagement cost for ads amid steady growth in operating costs

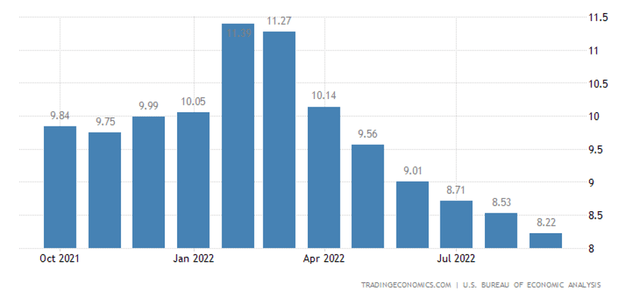

Throughout 2022, Alphabet has recruited labor force at a high rate, which is one of the company’s major expense items. In Q3, the company hired 12,785 employees, but intends to significantly slow the pace as early as Q4. With the US wage growth remaining high, according to TradingEconomics, a rapid recovery in margin is unlikely in the face of having large headquarters in the US.

2) The share of high-margin products in the revenue structure of Google is declining

Although most of the revenue is generated by the ad business, the company’s portfolio is very broad. In 2022, we have observed revenue outflow from high-margin business areas (e.g., in the mobile gaming segment). Meanwhile, the expansion of the hardware range is quite negative for the company’s total margin, as it is a low-yield business compared to digital products.

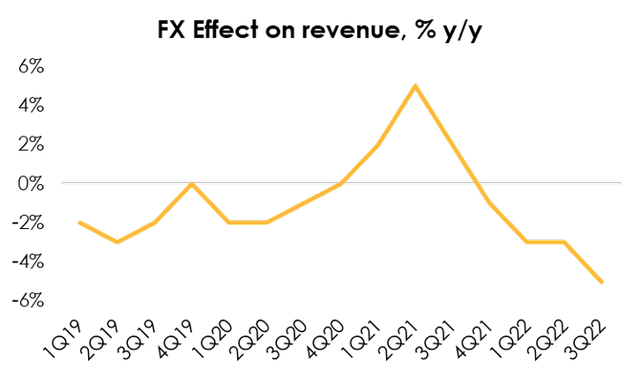

3) The dollar exchange rate remains a headwind for international companies

About half of the company’s revenue comes from international customers, but Alphabet pays most of its expenses, including R&D, in dollars, so DXY appreciation relative to global currencies affects operating income more than revenue.

Although that the peak has already passed, we believe that the negative effect will subside only by the end of 2023, as this will require a more significant increase in rates by global central banks and a decline in inflation to levels lower than in the US.

There are still opportunities for Alphabet

Despite challenges across the industry, we don’t consider ourselves bearish on Alphabet. The company still has several competitive advantages – leadership position in search aggregators, broad product portfolio both for consumers and in the B2B segment, fast-growing divisions.

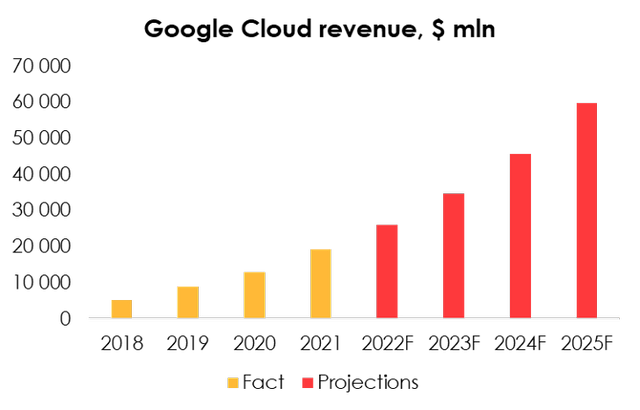

The cloud service segment of Alphabet is growing rapidly, although it constitutes a relatively small part of business (~10% of total revenue). In Q3, the segment revenue increased by 37.6% YoY, comparable to the growth rate of the market. Given the small share of Google in the cloud service market we expect the company to maintain high revenue growth rates (CAGR of 32% per year) of the division in the next few years.

YouTube Shorts monetization and revenue sharing with creators also remain a strong catalyst for Alphabet. The segment monetization will help to offset the decline in revenue of its core ad business as the company is showing ~30 bn short videos a day now.

As a result, we don’t expect revenue to decline in 2023, but only to decelerate. Meanwhile, we believe the company will slightly improve margin next year due to the normalization of the dollar exchange rate, cost-per-click metrics recovery, and a slower pace of recruitment.

Valuation

After Q3 earnings we have lowered the EBITDA forecast for $97.6 bn (+7% y/y) to $91.4 bn (+0.2% y/y) for 2022 and from $99.1 bn (+2% y/y) to $97.0 bn (+6.2% y/y) for 2023 due to:

- The ongoing impact of the high dollar rate relative to world currencies.

- A lower forecast for profitability amid a change in the product mix and the decline of the cost-per-click (CPC) metric.

- A revision of the forecast for the recovery of the advertising market: According to the updated estimates, the impact from the decline and recovery will be smoother.

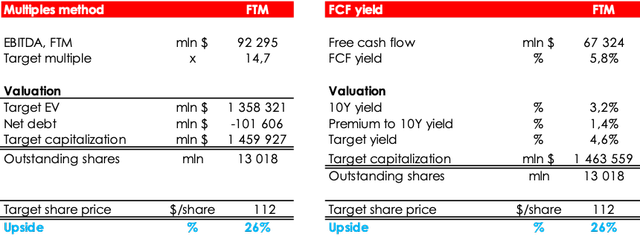

We are evaluating GOOGL fair value price based on EV/EBITDA multiples method & FCF Yield method are lowering the fair value of shares from $130 to $112 due to:

- The reduced EBITDA forecasts for 2022 and 2023.

- The increase of the 10Y fair yield from 2.4% to 3.2%.

- The shift in the FTM valuation (we earlier included the period from 3Q 2022 through 2Q 2023 into the forward 12 months EBITDA forecast, while now the forecast period runs from 4Q 2022 to 3Q 2023).

Based on the new assumptions, we are maintaining the rating at HOLD. The upside is +26%.

Conclusion

Google, like the entire advertising industry, is facing shrinking demand on the part of customers, and we believe the pressure will only intensify in H1 2023. Despite all the downsides, the company still has good prospects. First and foremost, the fast-growing cloud service segment and expanding monetization opportunities for the world’s most popular streaming service.

Although there was a significant upside after the report, we are not ready to buy Alphabet stock now. We believe that risks of the index to decline in the medium term amid the stronger dollar, high inflation, and tightening financial conditions are high, and Alphabet is not the security you want to own in the bearish market. We are willing to wait for a more significant upside and consider the stock purchase when the upside will be >30%.

To manage the position, we recommend keeping an eye on Alphabet financial statements, industry research, and reports of its competitors (Meta Platforms, Snap etc.).

Be the first to comment