JHVEPhoto

Thesis

Google’s (NASDAQ:GOOGL) (NASDAQ:GOOG) Q2 card was well-received by the market, as investors expected a pretty horrid performance from the digital ad leader after Snap’s (SNAP) disastrous results the prior week.

We highlighted in our late June update (Buy rating) that we believe near-term headwinds impacting digital advertising have likely been baked into its valuation. However, we also emphasized that we didn’t expect GOOGL to outperform the market moving forward, as its revenue and earnings growth could moderate markedly from its long-term averages.

Furthermore, YouTube’s growth engine has also suffered tremendously, given challenging comps and ongoing signaling impact from Apple’s (AAPL) App Tracking Transparency (ATT) framework. Coupled with Google Cloud’s unprofitability, search advertising’s growth cadence will be critical to underpin its growth momentum. In addition, Apple, Amazon (AMZN), and TikTok (BDNCE) are gaining market share rapidly in the digital ad market. Therefore, Google will have to contend with more intense competition, which could impinge on its ability to match its previous growth rates.

Notwithstanding, we believe Google’s leadership in digital advertising remains unquestioned and unlikely to be moved in the short- to medium term. Therefore, we continue to fancy GOOGL as a core digital ad exposure in investors’ portfolios.

Accordingly, we reiterate our Buy rating on GOOGL but urge investors to temper their expectations of its forward outperformance.

Search Remains Resilient Despite Weaker Macros

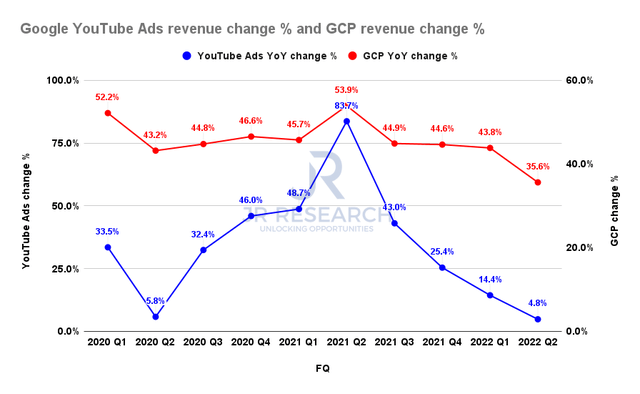

Google YouTube and GCP revenue change % (Company filings)

Google reported revenue growth of 12.6% YoY, with adjusted EBIT growth of 0.5%. Search advertising remains resilient, as it grew 14% YoY; thanks to travel and retail, but YouTube’s growth moderated significantly.

As seen above, YouTube’s growth has slowed markedly to 4.8% YoY, corroborating a marked deceleration that started in Q2’21. Therefore, we don’t believe that YouTube has been “immune” to Apple’s ATT changes and also seems to have been impacted significantly by worsening macroeconomic headwinds. Stratechery also accentuated in a recent commentary (edited):

Google continues to be reticent to explain why its search and YouTube have diverging results. Blaming tough YoY comps for YouTube is a red herring, given that later in the earnings call, CFO Ruth Porat highlighted that search was doing great despite tough YoY comps. The best explanation continues to be that YouTube has more brand advertising, which decreases during times of economic uncertainty. Also, YouTube relies much more on direct response advertising, which has been fundamentally weakened by ATT. – Stratechery

Google Cloud’s (GCP) growth cadence has also slowed down markedly, which suggests that macro headwinds could impact cloud spending in the near term. However, we are less concerned with its long-term growth visibility, as we believe cloud spending will continue to thrive, with GCP continuing to gain share. Notwithstanding, GCP’s unprofitability would affect the company’s overall profitability growth, exacerbated by YouTube’s slowdown and a generally weaker ad market.

Recovery For Google From FY23, But Don’t Expect Outperformance

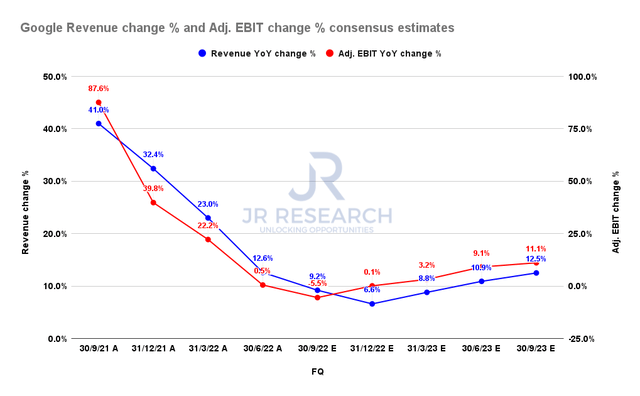

Google revenue change % and adjusted EBIT change % consensus estimates (S&P Cap IQ)

Google has continued to invest, likely impacting its EBIT growth cadence in the near term. However, we believe the company is using the pullback in spending by its competitors to entrench its leadership further and protect its market share.

eMarketer also cautioned in a June note that Meta (META) and Google are likely to continue losing share over the next few years. It emphasized (edited):

Google and Meta Platforms have had a dominant combined share of the digital advertising market for years, but their hold on the sector is easing. The decline for Google and Meta comes as TikTok, Amazon, Walmart (WMT), and Apple muscle in and take digital ad spending share. – eMarketer

Notwithstanding, the consensus estimates (very bullish) indicate that Google is projected to climb out of its nadir from Q1’23, as seen above. Therefore, given its reasonable valuation levels, we remain confident that the market is unlikely to pummel GOOGL further.

Still, Don’t Expect Outsized Performance From GOOGL Moving Ahead

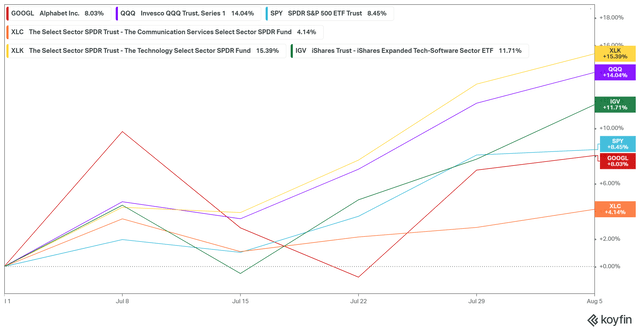

GOOGL performance % (Koyfin)

GOOGL has underperformed the Invesco QQQ ETF (QQQ) since we published our previous article. Notwithstanding, its performance remains comparable to the SPDR S&P 500 ETF (SPY), and GOOGL also outperformed its Communications (XLC) peers broadly.

However, when compared to its tech (XLK) peers broadly, GOOGL has fallen behind markedly, as we believe the market has de-rated the ad leaders, including META.

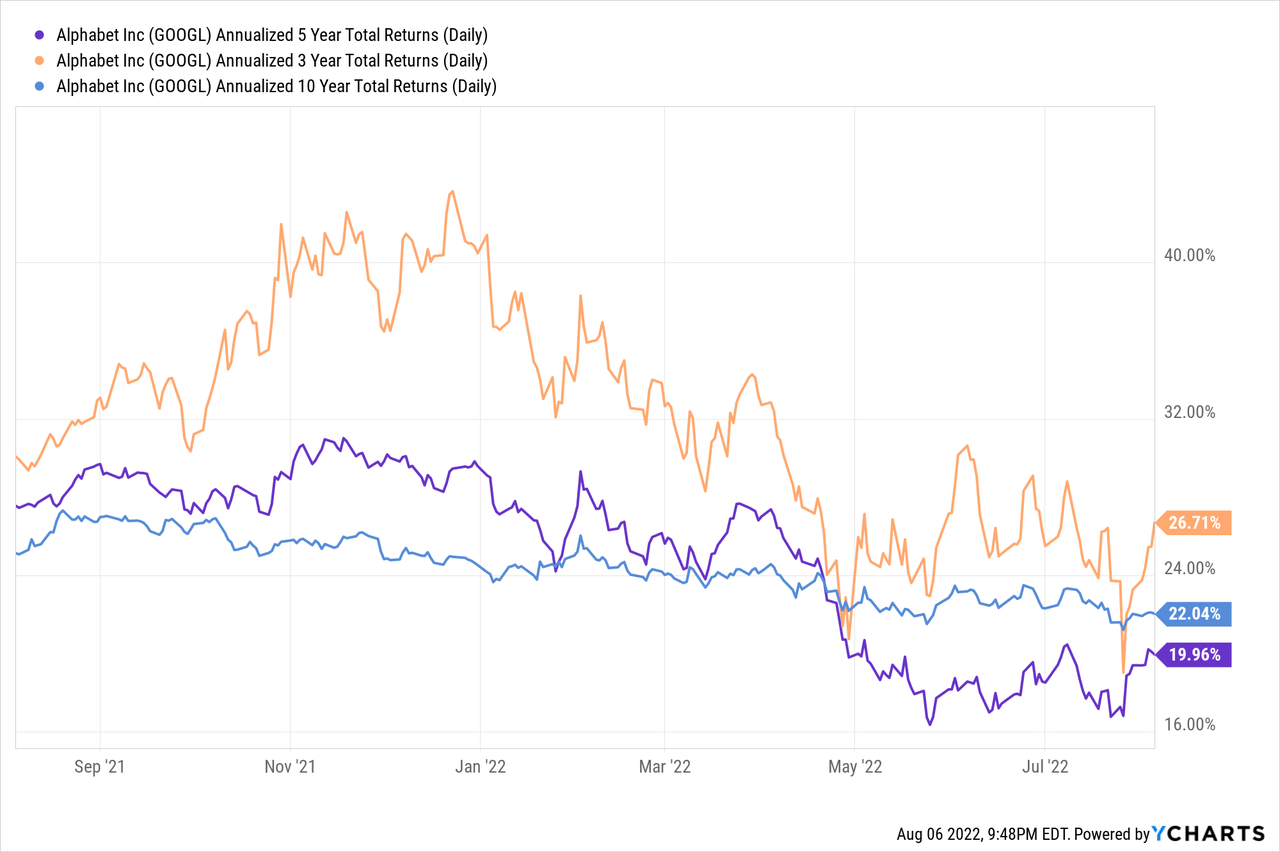

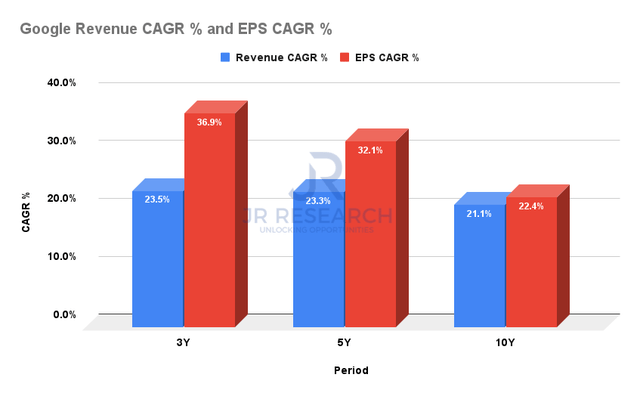

Google revenue and EPS CAGR % (S&P Cap IQ)

As seen above, GOOGL’s 3Y annualized total return CAGR outperformed its 5Y and 10Y averages. Therefore, we believe the de-rating is justified as Google couldn’t sustain its growth rates.

Notably, Google’s forward medium-term revenue and EPS CAGR based on the revised consensus estimates through FY26 is also unlikely to replicate its past performances over its 3Y, 5Y, or 10Y averages, as seen above.

Therefore, we believe it’s not reasonable for investors to expect continued market outperformance from the digital ad leader moving forward, given markedly slowing growth momentum.

Is GOOGL Stock A Buy, Sell, Or Hold?

We reiterate our Buy rating on GOOGL.

But, we believe it’s at most a market-perform rating, as its growth is expected to slow considerably over the next few years. However, we believe its competitive moat remains robust and still represents a solid core holding for investors in digital advertising. Moreover, its GCP optionality and recovery from YouTube’s near-term headwinds could also provide further upside surprises to our thesis.

Be the first to comment