JHVEPhoto

Thesis

In our pre-earnings update, we reminded investors that significant pessimism had been priced into Google (NASDAQ:GOOGL, NASDAQ:GOOG) stock. While GOOGL has underperformed the SPDR S&P 500 ETF (SPY) since our previous article, it has managed to maintain strong buying momentum against its critical near-term support.

Therefore, the post-earnings selloff has been undergirded by buyers seeing a bargain at the current valuations. It’s unquestionable that Google’s Q3 earnings release clearly highlighted significant near-term challenges across its advertising segments.

However, we explain why we investors shouldn’t be overly pessimistic at these levels. The market is forward-looking, and it seems credible that the market could give CEO Sundar Pichai and his team the opportunity to reaccelerate its operating leverage growth in FY23.

Google has significant scale economies, even though it’s investing extensively in data centers and AI capabilities to further extend its competitive moat in AI to future-proof its business model. As such, it led to the weakening of its gross margins.

However, Google still has material levers in its OpEx base that it can pull to help improve its ability to drive operating income growth moving forward. Moreover, Pichai accentuated that Google will become even more disciplined with its capital allocation by “realigning resources to invest in (its) biggest growth opportunities.”

Hence, management knows what investors are looking for in GOOGL. We believe Pichai and his team are keenly aware that it needs to continue investing aggressively in its core business (Search, YouTube) while building up its AI capabilities to extend its competitiveness against its rivals.

At the same time, Google also identified critical levers in its headcount metrics that could help mitigate its OpEx base moving forward. Therefore, it’s heartening to know that CFO Ruth Porat accentuated that Google “expects headcount additions will slow to less than half the number added in Q3.” It indicates that the company remains focused on driving further productivity growth while keeping its eyes focused on the long-term prize.

Coupled with attractive valuation and price action that remains constructive, we reiterate our Buy rating on GOOGL.

Look Past Google’s Expected Q3 Struggles

We articulated in our previous article that the data points leading to its earnings release demonstrated that the overall ad environment had weakened considerably. Coupled with competitive challenges relating to Apple’s (AAPL) ATT and TikTok’s (BDNCE) advances against YouTube, it continued the massive deceleration in Google’s advertising revenue growth.

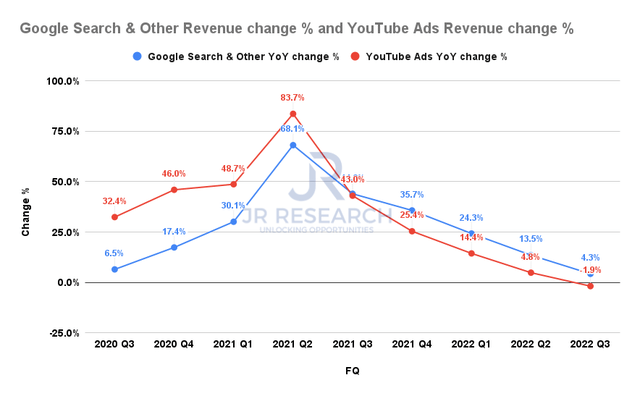

Google Search revenue change % and YouTube revenue change % (Company filings)

No surprises here at all, as Google’s critical ad drivers continued its broad-based slowdown from Q2. As such, Google Search posted revenue growth of 4.3%, while YouTube delivered revenue growth of -1.9%.

There’s no need to over-complicate the analysis in parsing the impact of its pandemic-driven growth. It simply wasn’t sustainable, particularly for YouTube.

The critical question that investors need to ask is whether Google can turn it around in FY23.

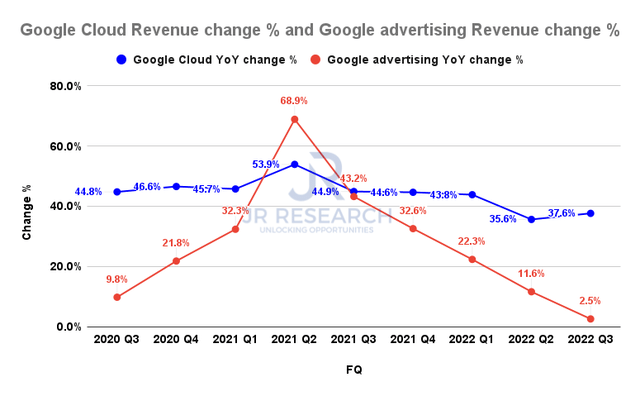

Google Cloud revenue change % and Google advertising revenue change % (Company filings)

Even Google Cloud’s solid performance in Q3 couldn’t help lift its operating leverage, as it remains in investment mode. But, its 37.6% revenue uptick in Q3 suggests that Google Cloud CEO Thomas Kurian and his team significantly outperformed the corporate average.

Therefore, we believe it’s a critical driver for Google, even as its path to profitability is not likely in the near term.

But we think the market knows that. Moreover, given that it has managed to maintain its remarkable topline growth while narrowing its operating losses to -10.2%, it continues to benefit from scaling up. Hence, it should at least help mitigate the impact on Google’s operating margins moving forward as it moves toward profitability.

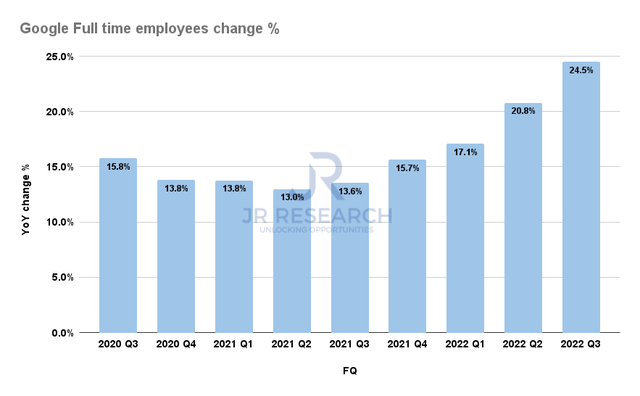

Google full-time employees change % (S&P Cap IQ)

And therefore, the one big lever that Google can pull is against its headcount growth.

As seen above, Google’s headcount grew by 24.5% in Q3. Excluding Mandiant, the growth was 22.8%. Hence, Google has continued to invest quite aggressively in its headcount while topline growth has continued to slow markedly. Coupled with its data center expenses, it led to operating deleveraging as operating income fell 19% YoY (Vs. revenue growth of 6.1%).

Notwithstanding, management’s commitment to reducing headcount growth shows that management is sensitive to the macro issues investors are concerned about.

Using management’s commentary as a guide, Google’s headcount growth could still grow by more than 22% in Q4, but down from Q3’s 24.5% growth. Moreover, it would represent a QoQ growth of about 2.7% against Q3’s 7.3% uptick. Therefore, we believe it should help mitigate the challenges seen in its OpEx cadence.

Is GOOGL Stock A Buy, Sell, Or Hold?

GOOGL stock last traded at an NTM EBITDA of 10.2x, well below its 10Y mean of 12.5x. Its NTM P/E has also fallen to 19.4x, in line with its industry peers’ forward P/E of 19.8x.

While Google may no longer be the fast-growth tech behemoth as the ad industry growth continues to slow over time, it’s also no longer expensive like in 2021.

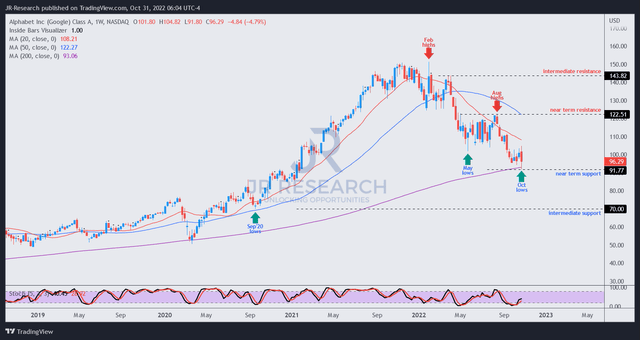

GOOGL price chart (weekly) (TradingView)

GOOGL’s post-earnings selloff was rejected, even though we have yet to glean a validated bullish reversal.

However, the 200-week moving average (purple line) is a trustworthy support level that should continue to attract long-term buyers to defend this level. As such, while we expect near-term volatility to continue, we postulate that buyers will not give up this zone so easily.

Coupled with an attractive valuation and a management team sensitive to the macro worries of investors, we are confident that Pichai and his team’s execution prowess should help recover Google’s mojo in the medium term.

Maintain Buy, and we urge investors to continue layering in, taking advantage of weak holders bailing out.

Be the first to comment