Drew Angerer

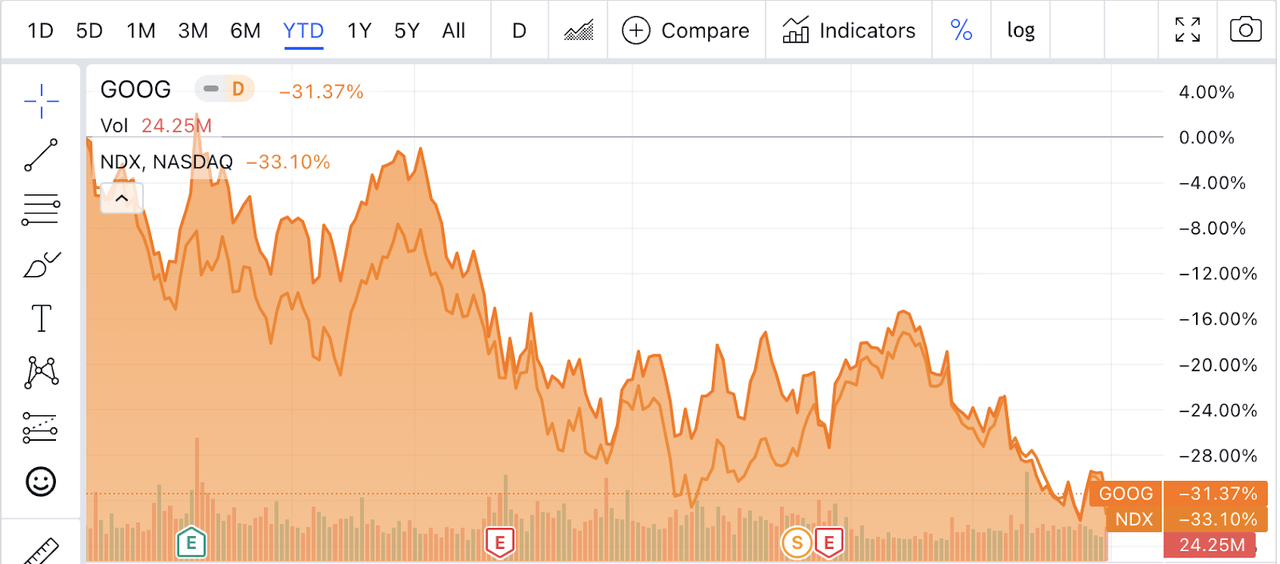

In 2022, sentiment toward Alphabet (NASDAQ:GOOG) stock (hereafter referred to as “Google”) is as bad as it’s been in years. The stock is down 32% for the year so far, and many people think it could fall further. The coverage on Seeking Alpha is still predominantly bullish, with 8 ‘buy’/’strong buy’ ratings among the 10 most recent articles, and only 1 sell. However, going by the actual buying and selling in the market, sentiment toward Google looks bearish.

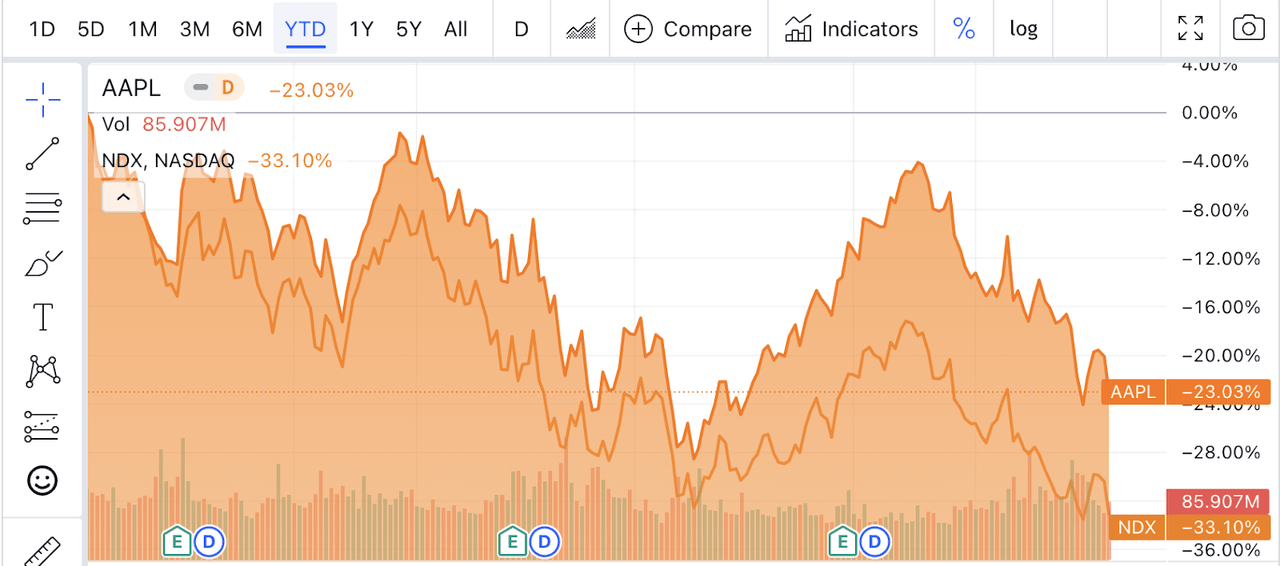

Which is why we can safely state that buying Google in late 2022 is a contrarian play. The commentary on the stock may sound bullish, but if you look at the markets, you know the sellers are out there somewhere. Furthermore, this can’t be explained by mere sector momentum. Google’s results this year are pretty similar to those of the NASDAQ-100, but other tech stocks are doing better. Apple (AAPL) is approximately 9% ahead of the NASDAQ-100 for the year, which proves that even mega-cap stocks can outperform.

Google ytd performance (Seeking Alpha Quant)

Apple ytd performance (Seeking Alpha Quant)

Now, if Google is a contrarian bet right now, the next logical question to ask is:

Is it a good one? This is an important question because GOOG is a very common portfolio holding. Many passive investors have heavy exposure to GOOG via S&P 500 index funds.

To determine whether GOOG is a good contrarian bet, we need to get a handle on what bears are thinking. When stocks go down, they go down for a reason. Big investors aren’t stupid, they usually have sensible reasons for selling off stocks when they do. In Alphabet’s case, one valid reason for a re-rate is simple macroeconomics: the Fed is raising interest rates, and that’s taking a bite out of high-growth tech stocks. The higher interest rates go, the less valuable growth becomes, and the more valuable high yields/cheap valuations become. So, tech stocks usually take a beating when interest rates go up.

Remember the Apple example, though: not all tech stocks necessarily have to go down a lot in periods of fiscal tightening. Some individual tech stocks can defy broad market trends. So we need to look deeper to figure out why Google has fallen so much.

A second possible reason for bearishness toward Google is general weakness in ad-tech. Google is first and foremost an advertising company, with ad revenue making up 88% of total revenue. Ad-tech is not in a great place right now overall. Meta Platforms (META) delivered negative revenue growth in its most recent quarter, while Snap (SNAP) and Twitter (TWTR) missed estimates. If you were evaluating Google based on its peer group, then you would conclude that it was having a tough year.

Google is in fact having a tough year on the bottom line. Its second quarter earnings growth was negative, and its operating income growth was way behind the inflation rate. However, unlike the other ad-tech companies just mentioned, Google still has double digit revenue growth, along with an economic moat. It could easily pump bottom line results by cutting costs. For this reason, I argue, the stock should not be viewed as another ad-tech name, but rather as a robust moat stock whose fundamentals will outperform those of its peer group in the year ahead.

Google – a Moat Filled With Sharks

Google is a well known moat stock with numerous competitive advantages. It has the #1 search engine by market share, the #1 ad platform, and the #1 mobile operating system by user count.

There are reasons to think that these competitive advantages will endure over time.

Google Search is protected by the fact that few people care to use the alternatives. It has a 92% market share in Western nations and 83% globally. Most people have heard about the alternatives to Google search, such as Bing and DuckDuckGo, but few actually use them. So it looks like Google Search is just more popular than the competition.

Google’s ad platform is likely to keep its competitive advantage. This is because Google allows instantaneous targeting with no prior user data. When you type a search query into Google Search, you immediately let Google know what you want, so it can serve you an ad based on that. Google therefore does not depend on the copious amounts of user data that Meta and other social media companies do–it gets intent directly from on-platform user behavior. This is extremely important because Apple no longer lets ad platforms track users’ data without their permission.

Finally, the mobile OS space is a duopoly. There are some open source alternatives to Android and IOS out there but not many people use them. Google is currently #1 by user count while Apple takes the crown on revenue. Given the lack of interest in new mobile OSes, both Apple and Google look pretty safe.

Youtube is also worth mentioning here. It doesn’t have quite the moat that Apple’s other services do–Tiktok and Instagram Reels are serious competitors–but it’s the #1 most popular brand with Gen Z. This is an important advantage because habits formed young tend to last.

Taking all the above factors together, we can see that Google has an economic moat. In fact, it has several of them. Charlie Munger once quipped that Google possessed a “moat filled with sharks,” an allusion to the unassailable nature of the company’s competitive position. We can see the power of that “shark-filled” moat when we look at Google’s recent financial performance.

Google’s Recent Results

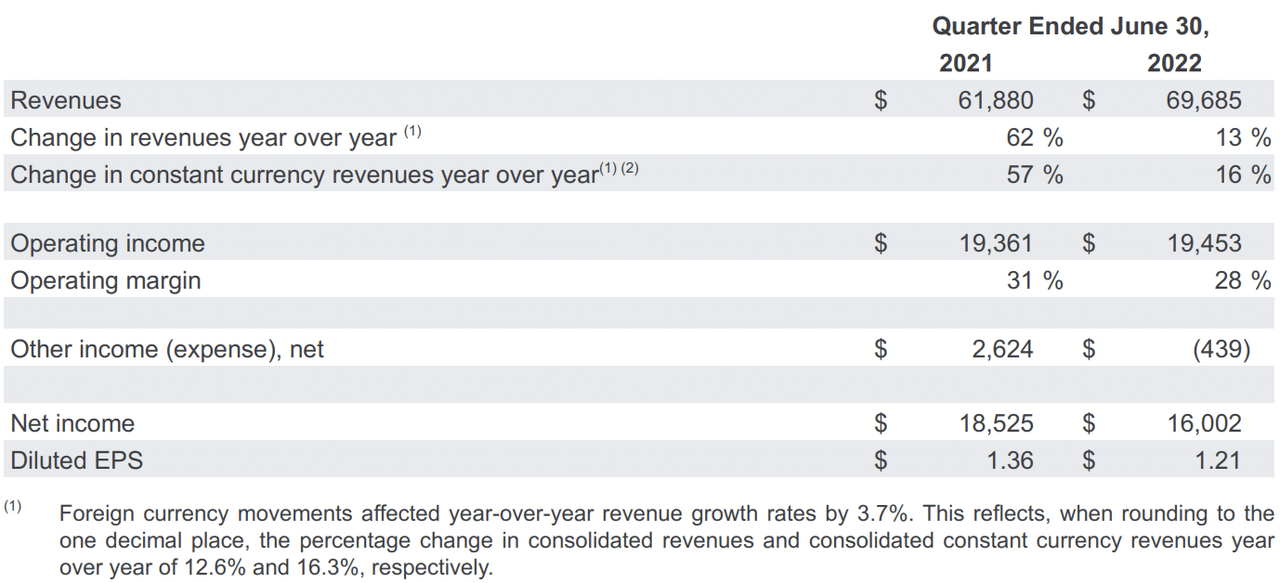

A strong competitive position isn’t just an asset in itself–it also tends to lead to high quality earnings. This can be seen by looking at Google’s most recent earnings release. In the second quarter, Google delivered:

-

$69.6 billion in revenue, up 12.6%.

-

$19.4 billion in operating income, up 0.4%.

-

$16 billion in net income, down 13.6%.

-

$1.21 in diluted EPS, down 11%.

Google Q2 earnings (Alphabet Inc)

As you can see, revenue growth was strong, while most earnings metrics declined. That might not look great on the surface, but you need to consider Google’s capacity to cut costs, as well as its performance relative to its competitors.

To begin with, Google could easily accelerate its growth in operating income and stem the bleeding in earnings. As of the most recent quarter, Google had a laptop business (PixelBook), a cloud gaming service (Stadia), and a “lab” for speculative projects. The Pixelbook and Stadia have been axed completely, while Area 120 has seen a 50% reduction in spending. The cost savings here could be to the tune of billions of dollars per year–enough to produce an improvement in earnings in the upcoming quarter. Some of the axed projects were cut in the quarter about to be reported. For example, the Pixelbook was axed on September 14, with two full weeks still remaining in the third quarter. We may see lower costs reported in the Q3 release as a result of that decision.

Assuming that Google can get its costs under control, then there’s a lot of potential here. Google has an excellent balance sheet, with a 0.11 debt/equity ratio and a 2.8 current ratio, suggesting extremely high liquidity and solvency. Basically, the company has enough money in its war chest to ride out a period of depressed economic activity.

In light of all the advantages it has–the moat, revenue growth and balance sheet–Google stock appears cheap right now. At today’s prices, GOOG trades at just 18.5 times earnings and 13.5 times operating cash flow. Very low multiples for a tech stock these days. And if Google can return to its previous positive growth trajectory, it will end up being worth more than it is today.

Risks and Challenges

As I’ve shown in this article, Google has an enormous laundry list of advantages. It has an economic moat, a strong brand, solid top line growth, and an A+ balance sheet. It looks like an open and shut case. Nevertheless, there are some risks and challenges to keep in mind, including:

-

Legal risk. Anti-trust fines and lawsuits are a big risk factor for Google. Just recently, an EU court upheld a $4 billion fine against Google on appeal, while a UK law firm cooked up a $25.4 billion lawsuit. The $25 billion lawsuit appears speculative but the $4 billion fine will probably have to be paid out–there’s only one more level of courts for Google to appeal to. Google has taken many fines like these over the years, and it will take many more in the future. On a full year basis, $4 billion is not even that big a bite out of the company’s net income. However, the legal risk is worth keeping in mind, as a truly enormous settlement (let’s say $25.4 billion) would change the conversation.

-

A slowdown in innovation. Earlier I mentioned Google’s aggressive cost cutting as a positive for the company. In the near term, it is. Over the long term, it could prove to be more of a hindrance. The tech industry is constantly changing, and companies with innovative products tend to attract new users. The basic formula of Google Search, Youtube and Android haven’t changed in a decade. If, as a result of cutting costs, Google misses out on genuinely good engineering ideas, then its results could suffer for it–not this year, but in the distant future.

If you’re considering taking a position in Google, you shouldn’t forget the risks listed above. They’re both pretty serious, especially the legal risk. On balance, though, Google stock is a good value. It’s fairly cheap, it has a huge moat, it owns Gen Z’s favorite brand, and it is still growing relatively quickly. On the whole, Google is one of the best contrarian plays available in this tech-hating market.

Editor’s Note: This article was submitted as part of Seeking Alpha’s best contrarian investment competition which runs through October 10. With cash prizes and a chance to chat with the CEO, this competition – open to all contributors – is not one you want to miss. Click here to find out more and submit your article today!

Be the first to comment