JHVEPhoto

Investment Thesis

Alphabet Inc. (NASDAQ:GOOG, NASDAQ:GOOGL) (“Google”) is at the forefront of the fast-growing online ad industry; the company has impressive list of promising projects. However, the medium-term economic agenda is likely to be a headwind for the company’s operating results, as core revenue of Alphabet comes from the advertising business. According to our forecast, the major pressure on financial results shall be put in Q4 2022-Q1 2023, negatively affecting the company’s share price. Therefore, we believe it is worth waiting for a more attractive entry point over the long-term horizon.

The online advertising market has not yet fully been affected by the economic slowdown

For a long time, the online ad sector exceeded the expectations of analysts and business owners, with high annual growth rates. It was driven by increased focus on the e-commerce industry and general digitalization of global consumption patterns. However, the first half of 2022 has already made it clear that such high growth rates cannot be sustained for too long.

Pressure on consumers, combined with high cost-push inflation, has forced advertisers to cut their budgets. Large companies, whose businesses are largely driven by advertising revenue, have reported about the challenges in the statements for investor (notably Meta Platforms (META), Snap Inc. (SNAP)). The slowdown of MAU growth was not as high as analysts had forecasted after Q1, but we believe the main challenges for the business are still ahead.

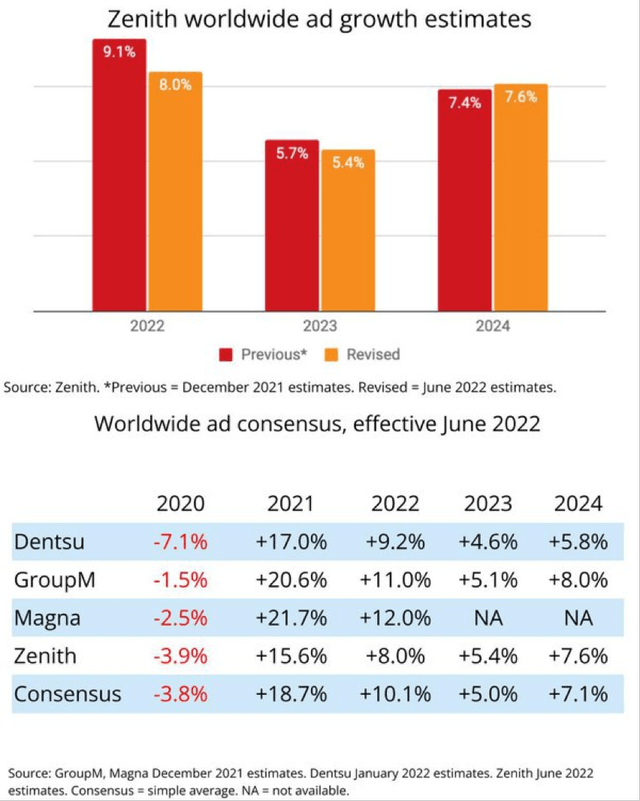

According to recent forecast of the Zenith agency, in 2022 global online ad spending shall increase by 8% (by 1.1% less than the agency’s forecast in December 2021). However, we expect Q4 2022 and Q1 2023 to be the most challenging period for the business. We believe the main growth has already taken place in the first half of this year.

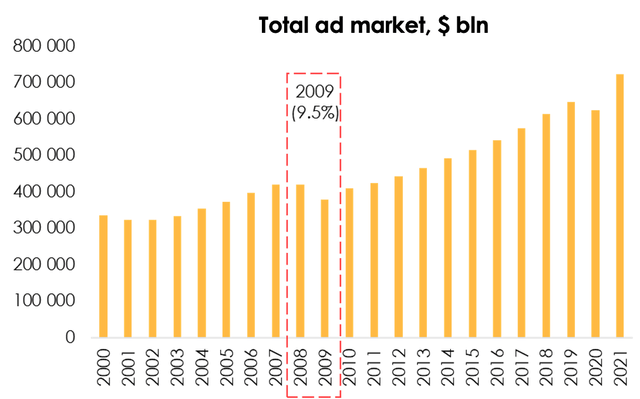

Although online ad has now substantially displaced other forms (e.g., TV, radio, and banner advertising), it is still a relatively young market, so it has not yet undergone serious stress tests in challenging macroeconomic environment. We believe that the dynamics shall be similar to what we witnessed in the broader U.S. advertising market in 2008-2009 ( the ad budgets were down by 8-10% y/y, according to Statista), but the market decline shall be less severe as the industry has relatively weak geographical constraints ( decline in activity shall be partly offset by smaller, fast-growing markets) and the duration of recession shall be shorter. We expect the decline in advertising budgets to reach -4.98% y/y in Q4 2022 – Q1 2023.

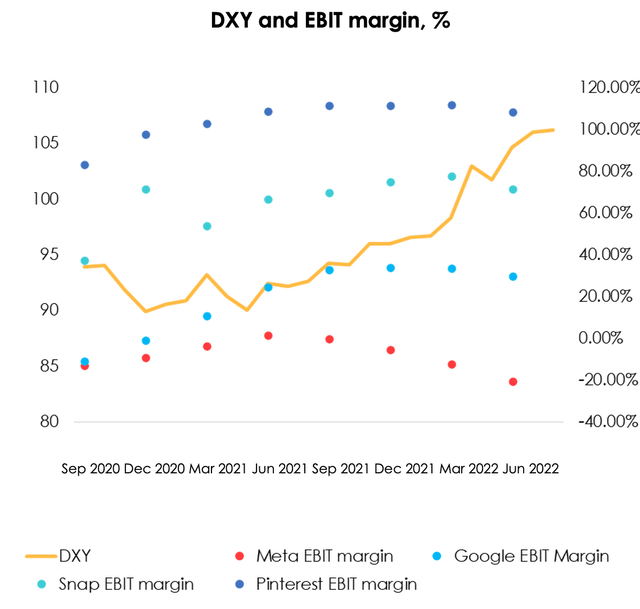

The companies’ margin is decreasing due to large share of foreign currency revenue

Another important issue for advertising companies that deliver their services globally (Google, Meta Platforms, Snap, etc.) is high USD exchange rate against other currencies right now. Since the majority of online ad is in the USA and this market is domestic and the largest one, the bulk of companies’ expenditures is denominated in dollars. However, revenue from foreign customers mostly comes in local currencies.

Given the current global economic climate (particularly in Europe, the second largest market), we believe dollar shall be strong against other currencies in the near term, creating additional challenges amidst declining CPC (Cost-per-click) and CPV (Cost-per-view) metrics in the global market. Short-term margin of online ad companies shall continue to decline based on revenue volume. Moreover, even though many of these companies have already announced suspension of aggressive recruitment, the effect shall take time to take place and its actual scale shall not be too significant.

Demand for advertising is about to recover

Previously, we have already mentioned that the main problem with the economy right now is falling real income due to galloping inflation, but we expect the rate to stabilize in 2H 2023, when the Fed shall implement a more dovish monetary policy.

We believe that similar to 2020, the injection of liquidity shall drive consumer activity, the marginal effects of customers ad spending is likely to increase, causing growth of CPC, CVC rates and the number of advertisers.

Valuation

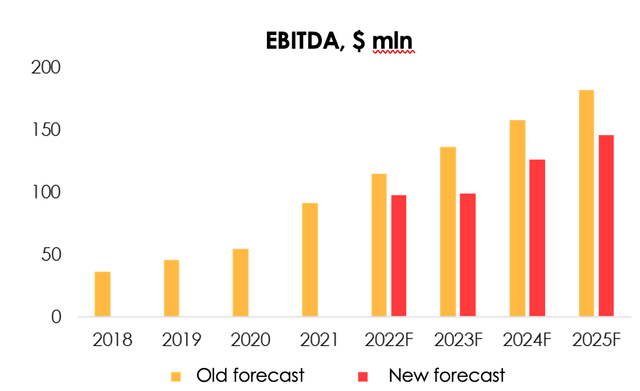

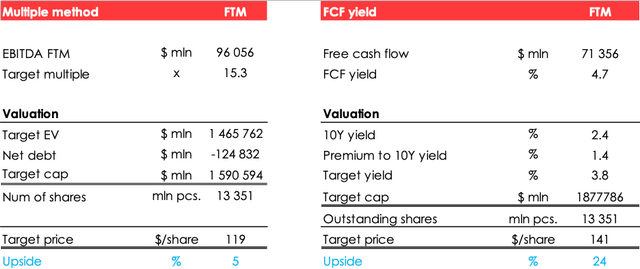

Given the expected ad market decline in Q4 2022, slower projected growth rate in 2023, the current exchange rate effect and lower CPC, we have conservatively revised our forecast for Alphabet EBITDA.

Based on our forecast, the price of the company’s stock is $130.0 per share, we consider the current market price to be fair and have revised the rating of the company to HOLD. Upside – 13%.

Conclusion

We believe Alphabet is a good choice for long-term investors, but the near-term difficulties observed in the online ad market could cause decline in quotes after a poor report, providing an opportunity to buy the security at a lower price. We recommend investors with Alphabet in their portfolio to hold their position or reduce it to more conservative values, while those who are just considering buying the stock should wait for more attractive market price.

To effectively manage the position, it is worth keeping an eye on financials of Alphabet, reports from other companies in the sector and industry reports (e.g.,Dentsu, Zenith).

Be the first to comment