RiverNorthPhotography/iStock Unreleased via Getty Images

Thesis

Goodyear Tire & Rubber Company (NASDAQ:GT) is a well-established, American tire manufacturer in the Auto-parts industry. Despite good quality products and a global sales presence, stock and financial performance over the past decade has been underwhelming, with recent results failing to increase optimism. In this analysis, I examine Goodyear’s value standing, after a review of its business and financial performance.

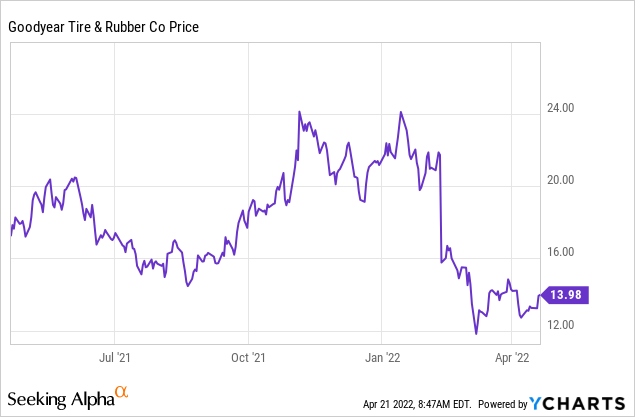

Stock Performance

Goodyear’s stock performance through the last few years has been disappointing. The stock has recorded losses of -60% over the trailing 5-year period, while on a broader 10Y basis GT’s stock price has appreciated by just 24%. That is during one of the most momentous bull markets in recent stock market history. Historical performance has many long term investors growing hopeless with regards to the company’s future.

Shorter-term performance fails to deliver good news as well. Down -35% YTD, Goodyear saw a sharp drop in early February, despite delivering strong Q4 results. Management’s reiteration of challenging inflationary pressures, combined with disappointing forward guidance are mainly to blame for the decline. Currently, GT trades -53% lower, compared to all-time high levels, at a $3.73B market cap and pays no dividend.

The Business

The Goodyear Tire & Rubber Company is a leading U.S based leading tire manufacturer, distributor and marketer, with operations across the world. Apart from tire manufacturing the company also provides other rubber-related chemicals, while also offering repair and other services. However, approximately 80% of the company’s revenue is derived from tire sales. Goodyear’s comprehensive tire product line includes solutions for automobiles, trucks, motorcycles, aircrafts, industrial vehicles and more. The tire industry is highly competitive. They have two major competitors globally: Bridgestone (based in Japan) and Michelin (based in France).

On June 7, 2021 Goodyear completed the acquisition of Cooper Tire & Rubber Company for approximately $3.1B. The two companies maintained complimentary product portfolios and through the acquisition GT looks to strengthen its leadership position in the global tire industry. The transaction should also yield, according to management, tax and other financial benefits. Cooper’s financial results have been included in Goodyear’s consolidated financial statements since the acquisition.

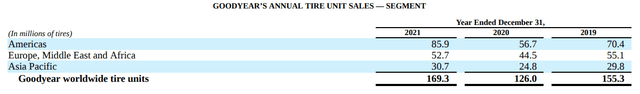

Global Sales Diversification

Goodyear enjoys global brand recognition and the company’s sales reflect a strong presence both in EMEA and Asia. North and South America account for around 50% of total tire sales (boosted after the incorporation of Cooper’s sales in 2021), with EMEA following at 30% and Asia Pacific at around 18%. Overall, sales are well diversified across the world, and while that carries significant benefits, it also exposes the company in geopolitical risks and more complex supply and distribution chain challenges.

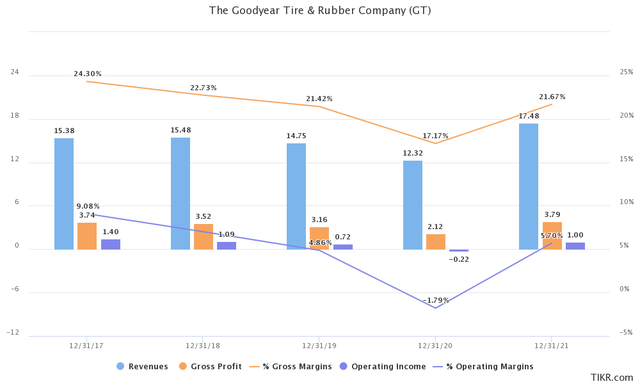

Financial Performance

A closer look at Goodyear’s financial performance over time will bring about some concerns. Revenue has remained stagnant over the past 5 years, while in 2020 the company experienced a significant decline in sales, recording an operating loss. Results for the 2021 fiscal year, although appearing to signal a rebound, also include the recently incorporated Cooper numbers, therefore overstating revenue growth. Sales for 2021 reached $17.5B, while gross and operating income came in at $3.8B and $1.0B.

Profitability is another main area of concern for the business. Margins appear relatively weak, yet not significantly diverging from industry averages, facing pressure from increasing competition and manufacturing costs. Goodyear’s gross margin, barring the 2020 fiscal year, has hovered between 21 – 25%, while operating margins have historically struggled to surpass the 5% mark.

Analysts expect sales growth to pick up over the next couple of years with revenue reaching $21B at the end of 2023. In 2022 net income growth is forecasted to record a moderate 2% YoY increase, with growth accelerating in 2023. Turning around growth performance is going to be key in Goodyear’s efforts to provide investors with some optimism regarding the company’s long term prospects.

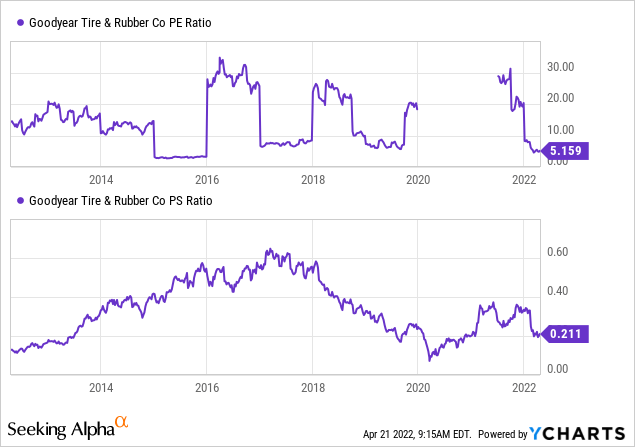

The Obvious Value Play

As expected, Goodyear is trading at an arguably inexpensive valuation. Forward P/E and P/S multiples of 6.6x and 0.2x indicate a nosebleed valuation. To confirm what initially surfaces, I examine valuation multiples on a historic basis. While both P/E and P/S ratios have seen large fluctuations over the past decade, currently, they both stand at the low end of historic averages. During normal times of operations, Goodyear usually trades around a 10x P/E or higher, a fact that indicates that the company might actually offer an interesting value play today. P/S ratio history also leads to a similar conclusion.

Risk Factors

An extended global presence as well as a large manufacturing capacity bring various risk factors into the equation for Goodyear. Explained in detail in the company’s 10-K report, that I recommend thoroughly examining, a few significant ones are summarized below:

Increasing input costs: Given the current inflationary pressures, raw material, energy and transportation costs are on the rise and can severely affect operating results. The volatility of raw material costs may cause margins, financial results and liquidity to fluctuate, placing a strain on the company’s business operations.

Debt Concerns: Goodyear maintains a substantial amount of long-term debt. The company’s future ability to access financing could be impaired as a result, while the company also has increased vulnerability towards economic downturns or other adverse macroeconomic developments. Cash flow that could be employed towards capital expenditures and dividends or buybacks are also tied up for interest payment, decreasing Goodyear’s room to maneuver.

Lasting Covid-19 impact: Supply chain disruptions as a result of the Covid-19 pandemic still persist, in part leading to the build-up of the inflationary pressure mentioned before. The pandemic also negatively affected sales and profitability, especially during the 2020 fiscal year.

Final Thoughts

After all things are considered, despite an inexpensive price point, I would refrain from committing to Goodyear as a long term investment at this time. Until the macroeconomic inflation outlook becomes more clear or the company materializes its effort to grow its sales and profitability capacity, I would rate GT as a hold.

Be the first to comment