simonkr/E+ via Getty Images

Golub Capital BDC Inc. (NASDAQ:GBDC) is a well-managed business development company that has recently been put up for sale by the market.

Given the company’s strong and well-performing credit portfolio, the BDC’s stock is trading at an excessive discount. With the central bank becoming more aggressive in raising interest rates to combat inflation, BDCs with floating rate loan exposure may outperform stocks in more cyclical industries.

Golub Capital – Market Woes Create A Buying Opportunity

In recent months, stock prices have only moved in one direction: south. With the stock market in a bear market and interest rates expected to rise in 2022, Golub Capital could be one investment firm that outperforms the broader indices.

Golub Capital pays a generous dividend that is covered by net investment income, has a growing book value, and a well-performing credit portfolio that reduces the risk of significant capital losses for the business development company and its shareholders.

Golub Capital stock has fallen 14% year to date, and there is clearly an opportunity to profit from the meltdown here.

Portfolio And New Originations

Golub Capital focuses on first lien debt, which accounts for 94% of the BDC’s portfolio as of March 31, 2022. First liens are highly secured loans with a historically low loss ratio.

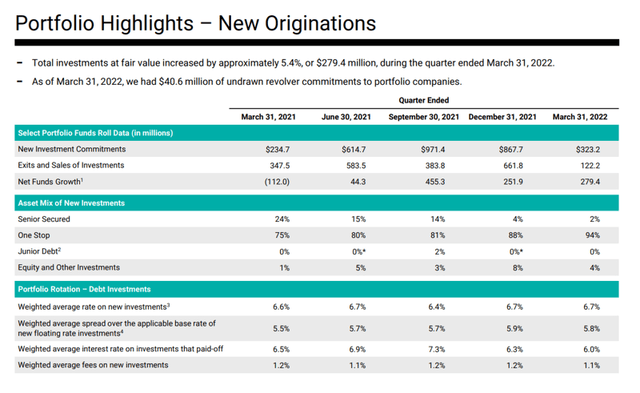

The total investment value, including junior debt (1%) and equity (5%) positions, was $5.4 billion, a $279.4 million increase QoQ. The first lien focus is what makes Golub Capital appealing to yield-seeking dividend investors concerned about rising loan defaults and higher interest rates. Rising interest rates are frequently associated with a late-stage bull market, and a recession has recently become more likely.

With the risk of a recession increasing, BDCs like Golub Capital that invest in relatively safe first liens have a good chance of returning cash to shareholders. In 1Q-22, approximately 96% of new investments were made in first lien investments, further strengthening Golub Capital’s investment portfolio.

Portfolio Highlights – New Originations (Golub Capital BDC)

Watch This Key Metric To Evaluate GBDC’s Recession Performance

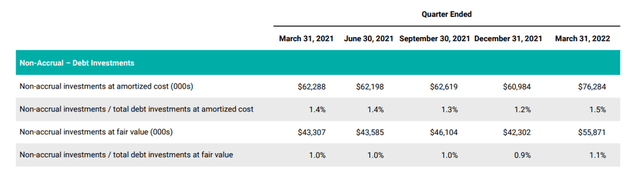

With a recession becoming increasingly likely, it is critical to prioritize quality over yield. Quality business development firms not only have increased their book values over time (as Golub Capital has), but they also have a low non-accrual ratio.

This ratio indicates how well Golub Capital has previously invested: A high non-accrual ratio indicates high loan losses, whereas a low non-accrual ratio indicates a credit portfolio that is performing well.

Golub Capital’s non-accrual ratio increased 0.2 percentage points QoQ to 1.1%, but it remains low enough to suggest that the company is not experiencing major investment issues. As previously discussed, the emphasis on first lien suggests that the non-accrual ratio will remain low in the future.

Non-Accrual Ratios (Golub Capital BDC)

Net Investment Income And Pay-Out Ratio

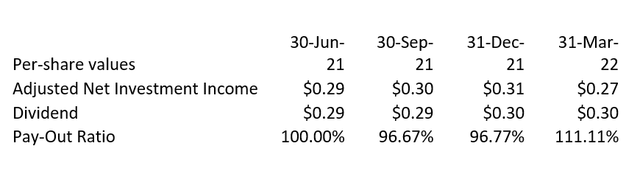

Golub Capital’s book value increased 3.3% YoY to $15.35 per share in 1Q-22, indicating the company’s prudent capital allocation decisions. While Golub Capital’s book value has consistently increased over the last five quarters, the company has a relatively low margin of safety: The pay-out ratio, based on adjusted net investment income, was 101% in the previous year, indicating that there are some risks for investors if the credit portfolio begins to underperform and some borrowers experience difficulties.

Dividends And Pay-Out Ratio (Author Created Table Using BDC Information)

Book Value Multiple

Since Golub Capital’s stock has recently corrected, GBDC can be purchased at a higher discount to book value. GBDC’s book value was $15.35 per share as of March 31, 2022, implying that Golub Capital’s current valuation implies a 16% discount to book value, whereas GBDC has historically traded at book value or at a small premium to book value.

Given that Golub Capital’s credit quality remains high and that the company covers its dividend with adjusted net investment income, the discount has reached an appealing level.

Chart price to book ratio of GBDC must reconcile to 0.84x.

Why Golub Capital Could See A Lower Valuation

A recession appears to be on the horizon for 2022, implying the need for strict risk management. Golub Capital’s non-accrual ratio appears to be in good shape right now, but it is subject to change. A decline in portfolio quality, reflected in a higher non-accrual ratio, would almost certainly cause the stock to trade at an even greater discount to book value.

My Conclusion

I believe the drop represents a doubling down opportunity because management has done an excellent job managing the company while incurring minimal capital losses.

However, if Golub Capital’s portfolio suffers credit losses and its net investment income falls as a result, investors may see a lower dividend.

I believe GBDC will be able to withstand a recession due to its low non-accrual ratio and focus on first lien investments. The fact that the stock is now trading at a 16% discount to book value only adds to GBDC’s appeal as a dividend investment.

Be the first to comment