Dmitriy Yermishin

Thesis

Golden Ocean Group Limited’s (NASDAQ:GOGL) relatively weak guidance at its Q3 earnings release didn’t surprise us. We highlighted in our pre-earnings update that the market has continued to weaken through November as global economies head toward a recession.

Therefore, some investors could have been stunned by the steep selloff in GOGL yesterday, as it gave up nearly 13% of its value. We postulate that the de-rating is justified, as the market needed to reflect a lower dividend per share for Q3, which came in below the previous consensus estimates.

However, we gleaned that management has also attempted to de-risk its execution risks through H1’23, as it provided a soft outlook. Moreover, with GOGL down nearly 50% from its June highs, we believe the market has anticipated a significant slowdown through its battering.

Furthermore, GOGL’s YTD total return of 23.4% is still outperforming the market significantly, given its robust dividend yields, helping to mitigate the weakness in its price performance. Hence, GOGL’s 5Y total return CAGR of 16% is still a delight for long-term investors who followed through over time.

Despite the moderation in its distribution, we believe the opportunity for a medium-term re-rating looks attractive. We discuss why investors should ignore the noise and focus on its attractive long-term fundamentals and constructive price action to add exposure.

Maintain Buy with a price target (PT) of $11.

GOGL Underperformed Q3 Consensus Estimates

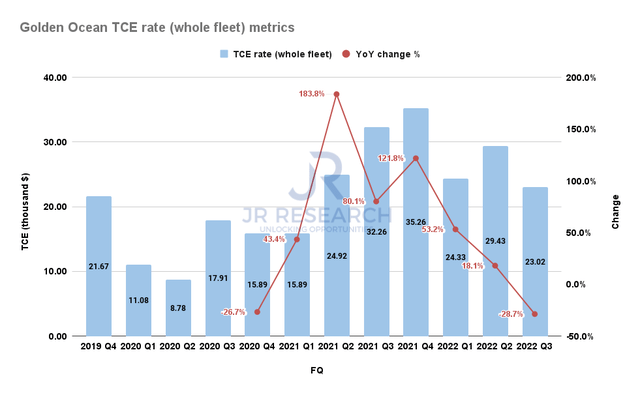

Golden Ocean TCE rates change % (Company filings)

Golden Ocean posted a time charter equivalent (TCE) rate of $23.02K in Q3, down from Q2’s $29.43K. It was also down 28.7% from Q3’21, as freight rates continued to normalize from their highs in Q4’21.

Coupled with further easing of port congestion that saw six ships dry-docked in Q3 (Vs. one in Q2), it also extended its off-hire days significantly to 272 (Vs. 187 in Q2).

Consequently, it resulted in Golden Ocean posting Q3 revenue of $195.6M, down 36.1% YoY. Furthermore, it also impacted its adjusted EBITDA of $118.2M, down 48.5%.

Notwithstanding, the Street had already modeled for a relatively weak Q3 given the weakness seen in the market. However, Golden Ocean’s performance was still way below what the Street had penciled in, which likely worried some holders about the company’s outlook for FY23.

But Management Likely De-risked Its Guidance

Moreover, management was forthright in its earnings commentary, expecting the weakness to persist through H1’23. However, Golden Ocean maintained that its long-term fundamentals remain robust, as the global order book remains low relative to historical averages.

Furthermore, management highlighted that its relatively young fleet age of six years puts the company in an enviable position to leverage IMO regulations that could compel older global fleets to sail at reduced speeds from 2023/24. As such, it could help to sustain its medium-term utilization rates, undergirding the company’s robust fundamentals relative to the industry.

Therefore, we believe management has likely de-risked its forward guidance to help manage the Street and investors’ expectations leading into FY23. As such, we should expect analysts to reflect markedly lower estimates moving forward. Hence, it should help Golden Ocean to potentially outperform if it executes well, given the reduced projections.

GOGL’s Medium-Term Outlook Remains Attractive

With the reduction of its distribution per share to $0.35 for Q3 (down from Q2’s $0.60 per share), GOGL’s NTM dividend yield has also fallen to 12.7%, despite the battering yesterday.

Therefore, we postulate that the selloff is justified, given the reduction in its distribution to keep its yield in line with the one standard deviation zone over its 10Y mean. We expect its dividend yield to remain at elevated levels, as the market needs to reflect higher execution risks through the global recession. Therefore, a near-term re-rating is unlikely, but shares remain attractively priced for a potential medium-term re-rating for patient investors.

Furthermore, management highlighted that the potential reopening of the Chinese economy could be a significant tailwind that could lift the industry’s outlook. We share management’s optimism as China already refined its zero COVID rules last week, while also issuing a slew of measures to manage its property market malaise.

As such, we postulate that the “China effect” has not been materially reflected in GOGL’s buying sentiments, even though Chinese equities have gotten a boost recently. Therefore, investors should remain calm as GOGL sails through this transition period into a more normalized TCE rate environment while lapping highly challenging comps from an unsustainable FY21 backdrop.

Is GOGL Stock A Buy, Sell, Or Hold?

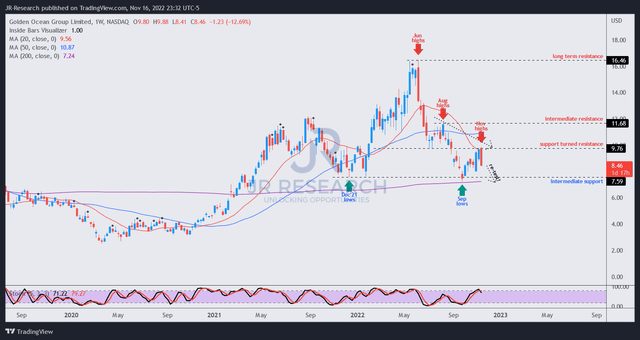

GOGL price chart (weekly) (TradingView)

GOGL appeared to be resisted by its “support-turned-resistance,” as we anticipated in our previous article. We emphasized that GOGL was already overbought as it recovered from its September lows, but buyers failed to retake its 20-week moving average (red line).

As such, the market could potentially force a re-test of its September lows before reversing the selling momentum resulting in a bullish reversal. However, we must caution that our thesis of such a reversal has not been validated, even though we expect its September lows to hold robustly.

Accordingly, we encourage investors to leverage the downside volatility to layer in, while keeping ammunition to add aggressively on a successful re-test of its September bottom if it pans out.

Maintain Buy with a PT of $11.

Be the first to comment