GOLD PRICE OUTLOOK:

- Gold prices up with stocks, US Dollar lower amid Fed outlook speculation

- Markets may be finding relief in rate hike expectations’ front-loaded skew

- January US CPI data eyed as traders weigh the policy path beyond 2022

Gold prices have managed a tepid upswing at the start of February. For the most part, the move has run inversely of a pullback in the US Dollar and parallel to a rebound in the bellwether S&P 500 stock index, a proxy for broad-based risk appetite across financial markets.

In all, this price action seems to reflect evolving Fed policy bets. Policymakers’ increasingly assertive posture on stimulus withdrawal coupled with supportive economic data – most recently, January’s payrolls report – have driven up near-term rate hike expectations. The longer view has softened, however.

Fed funds futures imply that the push to price in five 25bps rate hikes for 2022 has likewise seen the 2023 outlook soften, from three such increases to two. A single rise seems to have drifted out to 2024, implying adjustment to a more gradual path after fireworks this year. Strikingly, a cut is now priced in for 2025.

Fed Funds futures-implied rates policy path 2022-2025

Fed funds futures chart created with TradingView

In all, what this may reflect is a market that has begrudgingly come to terms with what Fed Chair Powell and company intend to do in the months ahead, while finding solace in hopes for a tightening cycle that is brief and quickly moderated. Incoming CPI data may prove key in sustaining such thinking.

Data due today is expected to show that the headline inflation rate rose to 7.3 percent on-year in January. The core reading excluding volatile items like food and energy is seen printing at 5.9 percent for the same period. That translates into the fastest rate of price growth since 1982.

An outcome broadly in line or even on the soft side of expectations may bolster the markets’ latest thinking, pulling down rate hike bets in the years beyond 2022. That might boost gold prices. Alternatively, an upside surprise beckoning longer-lasting Fed action may push the yellow metal downward.

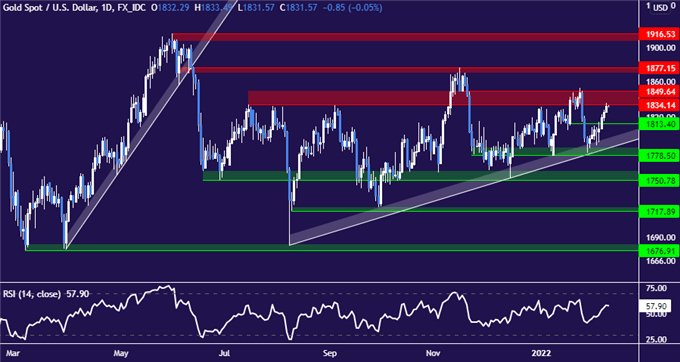

GOLD TECHNICAL ANALYSIS

Gold prices have edged back up to near-term range resistance in the 1834.14-49.64 area. Breaking above that on a daily closing basis may expose the next upside barrier running up into November’s swing top at 1877.15. Alternatively, slipping back below minor support at 1813.40 eyes key boundaries at 1778.50 and 1750.78.

Gold price chart created using TradingView

GOLD TRADING RESOURCES

— Written by Ilya Spivak, Head Strategist, APAC for DailyFX

To contact Ilya, use the comments section below or @IlyaSpivak on Twitter

Be the first to comment