chonticha wat

2022 – A year of conflicting forces

- Gold posted a small gain in 2022; no mean feat given an unprecedented rise in rates and a strong US dollar.

- 2022 was a textbook example of gold’s stable and uncorrelated performance amid market turbulence.

- Weak institutional demand was offset by retail investment – driven by inflation and geopolitics – and central banks had an exceptional year of net buying.

Looking ahead

- We find that developments since the launch of our 2023 outlook have been consistent with the markets’ consensus scenario, but with a nod to a more severe downturn which could continue to be gold positive.

A last-minute surge

A 3% gain in December took gold to US$1,814/oz, cementing a y-o-y gain of 0.4%, something that looked unlikely to many just two months ago (Table 1). A strong start to December set the tone for gold to make a series of highs and higher lows over the month.

Available demand data shows that gold was supported by a solid gain in COMEX futures net long positions.1 ETF investors were more cautious but the consistent outflows experienced since May were absent.

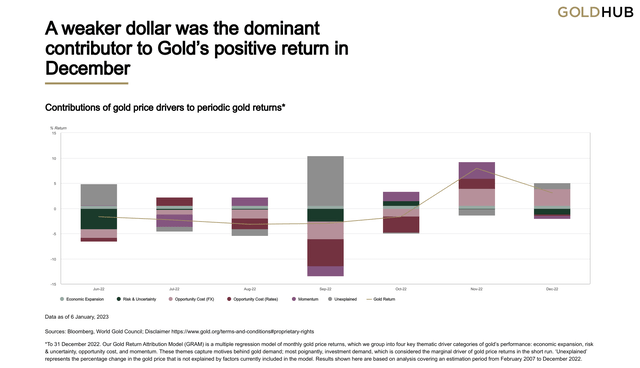

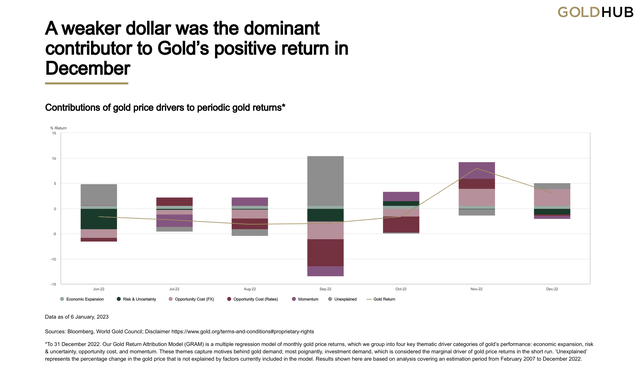

Our Gold Return Attribution Model (GRAM) suggests much of the positive return in December was due to a weaker US dollar (Chart 1), as other factors such as futures positioning and rates largely netted each other out. The US dollar index (DXY) fell below its 200-day moving average for the first time since June 2021, signalling perhaps that its reversal since late September is gathering momentum. The strong move lower in the DXY appeared to be a major contributor to gold’s recovery in Q4.

On release of our Q4 Gold Demand Trends at the end of January, we will have a better sense of how other sources of demand and supply fared in the last three months of the year.

Chart 1: A weaker dollar was the dominant contributor to Gold’s positive return in December

Contributions of gold price drivers to periodic gold returns*

Data as of 6 January, 2023 (Sources: Bloomberg, World Gold Council)

*To 31 December 2022. Our Gold Return Attribution Model (GRAM) is a multiple regression model of monthly gold price returns, which we group into four key thematic driver categories of gold’s performance: economic expansion, risk & uncertainty, opportunity cost, and momentum. These themes capture motives behind gold demand; most poignantly, investment demand, which is considered the marginal driver of gold price returns in the short run. ‘Unexplained’ represents the percentage change in the gold price that is not explained by factors currently included in the model. Results shown here are based on analysis covering an estimation period from February 2007 to December 2022.

Table 1: Gold’s y-t-d performance remained positive for investors outside the US

Gold price and return in different periods across key currencies*

| USD (OZ) | EUR (OZ) | JPY (G) | GBP (OZ) | CAD (OZ) | CHF (OZ) | INR (10g) | RMB (G) | TRY (OZ) | AUD (OZ) | |

|---|---|---|---|---|---|---|---|---|---|---|

| 31 December 2022 price | 1,814 | 1,694 | 7,646 | 1,501 | 2,458 | 1,677 | 48,246 | 402 | 33,935 | 2,662 |

| December return | 3.4% | 0.5% | -1.8% | 3.2% | 4.5% | 1.1% | 5.1% | 0.6% | 4.0% | 3.1% |

| YTD return | 0.4% | 6.7% | 14.4% | 12.5% | 7.7% | 1.7% | 11.8% | 9.0% | 41.2% | 7.1% |

Gold price and return in different periods across key currencies*

*As of 31 December 2022. Based on the LBMA Gold Price PM in local currencies: US dollar (USD), euro (EUR), Japanese yen (JPY), pound sterling (GBP), Canadian dollar (CAD), Swiss franc (CHF), Indian rupee (INR), Chinese yuan (RMB), Turkish lira (TRY), and Australian dollar (AUD).Source: Bloomberg, ICE Benchmark Administration, World Gold Council

A year of conflicting forces

Strong retail and exceptional central bank demand offset weakness from institutional investors

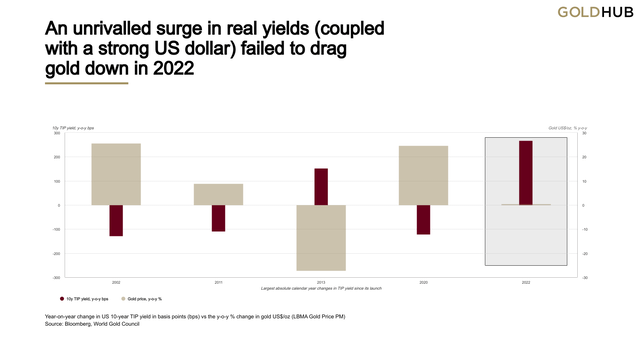

- Gold prices posted a small gain in a year when real yields (10-year TIPs) rose an unprecedented 250bps and the dollar gained over 8%. The previous largest annual rise in yields was 150bps with a flat dollar. That year – 2013 – saw gold prices fall almost 30%.

- 2022 provided a textbook example of how diverse sources of demand and supply can counterbalance one another and provide gold with its uniquely stable portfolio-additive performance.

- Institutional (ETFs/OTC/Futures) demand was weak but retail demand was strong and central bank net buying exceptional.2 Together, these counteracting sources of demand and supply drove gold to a marginal gain in 2022.

Beware the real rate dollar trap

The US 10-year Treasury Inflation-Protected (TIP) security yield, a proxy for real interest rates and the opportunity cost of holding non-yielding gold, has historically been a reliable higher frequency driver of gold prices for two decades but has been less stellar over lower frequencies.3

The consistent inverse relationship would have suggested a steep fall in gold as yields rose over 250bps in 2022. But the relationship only held intermittently. The strong US dollar (+8%) as proxied by the DXY index should have proved equally challenging, given the historically negative relationship. Yet, it also failed to drag gold down over the full calendar year (Chart 2).

We have highlighted in the past, here and here, that while these two drivers are necessary, alone they can be insufficient drivers of the gold price, as they capture only a portion of demand and supply.

2022 a textbook example of gold’s portfolio value

Chart 2: An unrivalled surge in real yields (coupled with a strong US dollar) failed to drag gold down in 2022

Sources: Bloomberg, World Gold Council

Gold’s portfolio value

In our view, gold’s resilience in 2022 was a result of its often ignored multifaceted sources of demand and supply.

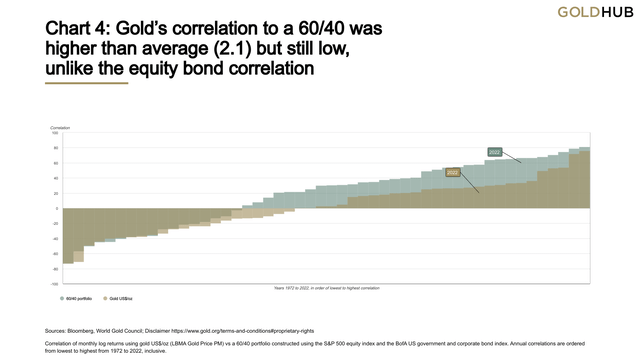

The confluence of these opposing forces not only took gold to a small gain in 2022, but allowed its volatility to remain close to its long-term average of c.16% – for a 60/40 equity-bond portfolio which experienced one of its most volatile years (Chart 3).

Although gold’s correlation to a 60/40 portfolio was higher than its average (2.1) – along with the correlation between equities and bonds – it remained low at 20, an indicator of gold’s characteristic as a consistently reliable diversifier during market turmoil (Chart 4).

Chart 3: During the third most volatile year for a 60/40, gold’s volatility remained subdued

9 January, 2023 (Sources: Bloomberg, World Gold Council)

*To 31 December 2022. Our Gold Return Attribution Model (GRAM) is a multiple regression model of monthly gold price returns, which we group into four key thematic driver categories of gold’s performance: economic expansion, risk & uncertainty, opportunity cost, and momentum. These themes capture motives behind gold demand; most poignantly, investment demand, which is considered the marginal driver of gold price returns in the short run. ‘Unexplained’ represents the percentage change in the gold price that is not explained by factors currently included in the model. Results shown here are based on analysis covering an estimation period from February 2007 to December 2022.

Institutional gold demand was weak on higher yields and a stronger US dollar

Weak institutional investment demand was a visible headwind for gold in 2022. Aggressive monetary policy in most Western economies and a strong safe-haven bid for the US dollar conspired to reduce interest in ETFs, futures and OTC investment. The question many commentators posed was why gold didn’t fare better, given multi-decade high inflation.

The answer, in our view, is two-fold:

First, long-term inflation expectations remained conspicuously well anchored in 2022, suggesting that investors were confident that central banks could control inflation. Second, institutional and professional investors are likely more interested in how they are compensated for inflation, and hence take more cues from monetary policy than inflation developments.

Chart 4: Gold’s correlation to a 60/40 was higher than average (2.1) but still low, unlike the equity bond correlation

Sources: Bloomberg, World Gold Council

Correlation of monthly log returns using gold US$/oz (LBMA Gold Price PM) vs. a 60/40 portfolio constructed using the S&P 500 equity index and the BofA US government and corporate bond index. Annual correlations are ordered from lowest to highest from 1972 to 2022, inclusive.

High prices and geopolitics drove strong retail investment

Counteracting this institutional malaise, retail investors were solid buyers of gold in 2022, with y-t-d demand in Q3 at an eight-year high. Our analysis suggests that retail investors, especially in Emerging Markets which make up about 60%2 of the sector, are more wary of inflation – as well as the level of prices – given scant access to protection. Particularly for non-US investors, gold proved a lucrative investment in 2022, gaining well in their local currencies (Table 1). In Europe and the US, retail investment stayed buoyant in the face of and heightened geopolitical risk.

Exceptional central bank buying provided a further boost

Arguably the most surprising development in the gold market in 2022 was the level of demand from central banks. By the end of Q3, 673t had reportedly been added to reserves, a historical high. In October and November, additions continued but at a slower pace. A substantial portion of those additions remains unreported, making it difficult to determine the date of purchase, but the scale of buying would likely have supported the price of gold in 2022.

Looking ahead

In our 2023 outlook, we outlined how consensus economic expectations suggested a stable but positive outlook for gold prices. A few developments since the publication suggest that the consensus scenario is still playing out, but with a nod to a more severe economic downturn (Table 2).

Table 2: The market consensus of a mild recession (World Gold Council 2023 Outlook) appears to be playing out, but with a nod to a more severe downturn

| Market consensus: Mild recession | Developments since the launch of our 2023 outlook |

|---|---|

| Fed funds max:5%,year-end:4.6% | The December FOMC meeting produced a new terminal rate for 2023 of 5.1%, 50bps higher than in September. The market is now pricing in 4.99%5, testing the Fed’s resolve. Given a fall in long-term inflation expectations and a growing recession likelihood, it appears the consensus outlook is valid. |

| Slightly higher bond yields | As we noted in the outlook, longer-dated bond yields (US) were probably going to prove stickier than perhaps consensus anticipated. Having settled around 3.5% in early December, the US 10-year Treasury yield jumped to 3.7% by 5 January 2023. |

| Weaker US dollar | The US dollar index (DXY) has found a home around 104. BoJ policy may be supportive of yen strength, but a mild winter and lower inflation in Europe may test the resolve of the ECB for a weaker euro, despite hawkish rhetoric. On balance a short term reprieve for the dollar could be on the cards. But a recession and lower inflation could spill over into US dollar weakness ahead. |

| Mild recession | Economic data has started to surprise on the downside and the Fed admitted in its recent minutes that a recession outcome is now a “plausible alternative” to its baseline. |

| Inflation halves | While not in the clear yet, US inflation appears to be petering. The PCE deflator data came in weaker as did ISM prices paid, with the survey hitting 39.4, its lowest since February 2020. |

| Pressured equities | With the exception of China, equities have traded lower, with the MSCI world down 4.3%. US forward P/E (16.8 as of 5 January 2023) still sits above the historical average for recessions. (13.4 since 1971). |

| China opens in H1 | China has rapidly opened up. This has jolted risk-on sentiment with MSCI China returning 5% since the beginning of December. However, a rise in infections appears to be hampering economic activity although an uptick in the latest composite PMI (48.3 vs 47) was welcome. |

| Commodities, down then up | Commodities continued to trickle lower in December posting a 2.8% drop over the month |

| Geopolitical risk remains | A resolution to the Russia Ukraine war remains elusive |

| Implication for gold | Gold’s strong start to the year so far appears consistent with the consensus implications we outlined in our 2023 Outlook |

Source: World Gold Council

The consensus scenario is playing out, but with a nod to a more severe economic downturn (Table 2).

Regional insights

China: As the Chinese New Year (CNY) approaches, local gold demand saw a seasonal rebound in December: the average daily trading volume of Au9999 was 38% higher m-o-m.3 This was primarily driven by manufacturers’ active replenishment ahead of the traditional gold sales boost around the CNY holiday. But when comparing with previous years, Au9999’s average volume last month marked the weakest December since 2013. The sudden end of China’s zero-COVID policy in December has, ironically, played a key role.4 Even though all COVID related restrictions were lifted, consumers voluntarily stayed home to either recover from the rapid spread of Omicron or avoid being infected. As a result, local economic activities and consumption were dented during the month. But this is not likely to last as China’s intense reopening wave looks set to pass quickly.

India: Indian retail demand remained muted during the seasonally quiet month of December. Higher gold prices remained a key headwind for gold demand during the month impacting both wedding and regular purchases. With muted demand, the local market discount widened to US$30-35/oz from US$14/oz at the end of November.

Europe: While the ECB eased off the tightening pedal – lifting interest rates by 50bps in December – it was at pains to make clear its job is far from done. Inflation remained elevated at 10.1% in November, although down from the record 10.7% the month before, and policymakers still see risks to the upside. The BoE, which also increased interest rates by 50bps during the month following a slight fall in inflation, acknowledged the “considerable uncertainties around the outlook” and will respond “forcefully” if needed.

US: Two highly anticipated announcements during the month appeared to send sentiment in opposite directions. The first was the release of the consumer price index (CPI). The data showed that headline inflation rose only 0.1% in November from October, bringing the y-o-y gain to 7.1%, the lowest level since December 2021. Many investors assumed that the good news on inflation would have a notable impact on Fed policy but the release of the December policy meeting statement, the second anticipated announcement – followed by Jay Powell’s press conference sent gold lower as ongoing rate increases are likely. While, as widely expected, the Fed slowed its pace of rate increases by announcing a 50 bps increase in the federal funds target rate, the official statement reiterated that ongoing rate increases are likely, increasing gold’s opportunity cost.

Central banks: Central banks bought a net 50t of gold in November, up 47% m-o-m. The People’s Bank of China (PBoC) announced the first addition to its official gold reserves since September 2019, adding 32t in the month. The Central Bank of Türkiye (19t) and the Central Bank of the Kyrgyz Republic (3t) also added to their gold reserves in November. On the sales side, the National Bank of Kazakhstan (4t) and the Central Bank of Uzbekistan (2t) were the largest sellers.

ETFs: Physically-backed gold ETFs registered their eighth consecutive month of negative demand in December, with global holdings declining by 4t (US$534mn (4t)) to 3,473t (US$203bn (3,473t)). Nonetheless, the pace of outflows continued to slow amid a 3% rise in the gold price during the month. Over the past year, holdings in global gold ETFs lost 110t (US3$bn (110t), a 3% decline y-o-y. Aggressive rate hikes from major central banks and a strong dollar during the second half led to sizable outflows, more than offsetting positive demand accumulated during the first four months of 2022. North America, Europe and Asia all contributed to the overall fall in global holdings over the year. In contrast, Other region saw a fractional rise of 0.2t in holdings.

Table 3: European ETFs led small net outflows in December

Gold ETF holdings and flows by region*

| Total AUM (BN) | Flows (tonnes) | Flows (US$mn) | Flows (% AUM) | |

|---|---|---|---|---|

| North America | 100.6 | 8.8 | 531.7 | 0.51% |

| Europe | 91.2 | -13.8 | -1091.4 | -0.88% |

| Asia | 7.3 | 0.8 | 44.7 | 0.68% |

| Other | 3.5 | -0.2 | -19.5 | -0.35% |

| Total | 202.7 | -4.5 | -534.5 | -0.13% |

*Data to 31 December 2022. On Goldhub, see: Gold-backed ETF flows.Source: Bloomberg, Company Filings, ICE Benchmark Administration, World Gold Council

Footnotes

- Managed Money category

- OTC data as of Q3 2022

- Higher frequencies: days, weeks and months, Lower frequencies: Quarters and years

- 2022 y-t-d bar and coin demand.

- Fed Fund Futures curve as of 5 January 2023

- The 2022 CNY Holiday will occur between 21st and 27th January.

- For more, see: China to manage COVID-19 with measures against Class B infectious diseases- China.org.cn

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Be the first to comment