Bartosz Hadyniak/E+ via Getty Images

Fundamentals

The war in Ukraine continues to put stress on global food and commodity supply chains. The mainstream media does not appear to be giving this issue enough attention. ZeroHedge published a report highlighting that Europe depends on Russia, Belarus, and Ukraine for energy, palladium, nickel, grains, pig iron, certain types of steel, and many other commodities. Energy, especially, is a vulnerability as Russia now is demanding payment in rubles. Europe cannot shift to other suppliers or energy in the short term. Pig iron and other iron and steel products are also being impacted heavily. The EU is also facing import issues with goods from third countries that rely on imports of raw materials from the war zone.

Just as supply chain issues caused by the pandemic were beginning to ease, now the war in Ukraine is causing more supply chain issues. Trade with Russia, Ukraine and Belarus has come to almost a complete halt with the West. Although they are not a major percentage of world trade, they are critical in certain sectors. The EU is losing exports to the war zone, as well as facing import shortages. The war in Ukraine shows no end in sight, so these shortages are not going to be short term. If Russia blockades Ukraine’s access to the Black Sea, it would further impact any Ukrainian exports of grains, metals and other commodities.

China’s COVID policy of locking down Shanghai is further impacting the global economy. Shanghai has a population that ranks it between Florida and Texas. It is the world’s busiest port. Locking it down, means a small, but significant chunk of the global economy is locked down. The lockdown may make the logistics issues of 2020 and 2021 look small in comparison. China’s lockdown also does not appear to be shrinking; if anything, the lockdown appears to be spreading.

Recession on the Horizon

In a talk recently, investment advisor Steven Van Metre warned of a coming recession. With inflation running higher and interest rates rising, consumers are starting to pull money from banks. The Wall Street Journal warned that for the first time since World War II, bank deposits could decline. Rising interest rates could ripple through the economy in unexpected ways, such as bank deposits declining.

With rising interest rates, consumers search for a better return on their savings. When banks keep savings return rates low, money moves out of banks. Some banks had been reaching regulatory limits on their capital, so the withdrawals should not hurt the banks. Banks had deposits on hand, which they could not loan out. Profit margins for banks should increase as deposits decrease.

One place the savings may go are money market funds, but we already have $1.7 trillion in money market funds. Money market funds may raise their return rates to make them more attractive than bank savings accounts.

Usually consumers are slow to move money out of savings accounts at banks, but that could occur much faster with inflation and the Fed raising rates more rapidly.

This summer the Fed is supposed to start unwinding its balance sheet. Banks will be happy, since it will release some of their capital and allow banks to persuade consumers to shift funds from savings accounts into money market accounts. Many of the money market accounts are backed by short-term treasury bills. If a flood of money enters the short-term part of the bond/bill market, then short-term rates should fall, which will then drag down long-term rates–the opposite of what many believe will happen. Money markets have to invest in T-bills of less than a year, since they have to stay liquid because no one knows when the holders of the money market funds will want their money.

Inflation For The Nation?

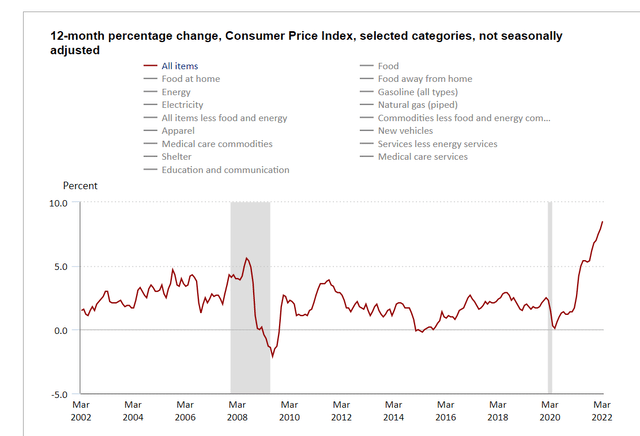

The Consumer Price Index hit 8.5%, the highest since the 1970s and 1980s. High prices and high inflation usually leads to consumers spending less, which brings both rates down. We expect the CPI to cool off. Food and energy prices are driving the CPI, with energy up 11% over the prior month, but crude oil is already coming down.

CPI (US BUREAU OF LABOR STATISTICS)

Wages are not keeping up with inflation. Average hourly earnings adjusted for inflation are down -2.7% year over year. Consumers are not keeping up with inflation, which means less spending, which means less inflation. If banks are going to flood money market funds with money from savings accounts as investors seek higher returns, then the money market funds have to buy more T-bills, which will drive short-term rates down, in turn driving inflation down and setting the stage of a recession.

The Markets

The key is to understand how to trade this fundamental situation. We have a lot of volatility this morning, Monday, April 18, 2022. Silver made a high of $26.49. It has then come down to $26.16 and then back up to $26.30. So we have a great deal of volatility in metals. Gold is at $1996, but we crossed the $2000 range.

For silver we are below the weekly Variable Changing Price Momentum Indicator (VC PMI) Sell level of $26.28. The signal is short, unless there is a close above $26.28. The target for the weekly is $25.59. Silver is warning you to be careful up here; it is a place where the market is likely to move down in the short term.

For gold, we made a high of $2003 early this morning, April 18, 2022. We are above the daily resistance level of $1996. We are also above the weekly Sell 1 level of $1994. The next target is $2012. The price is entering an area of distribution of supply and support levels. When resistance is broken, it becomes support with the target of $2012. If we close below $1994, we will activate weekly and daily short triggers–a strong short signal.

Bitcoin made a low of 38,535. It did not quite reach the weekly Buy 1 level 38,468, but found buyers at a higher level. Now we are in a bullish signal with targets of 40,330 and 40,637, according to the VC PMI.

Opinion and strategy

The 10-Year Treasury is at 2.83, which is a significant increase over the past couple of years.

“The 3 percent yield is in the cards,” Equity Management Academy CEO, Patrick MontesDeOca said.

The inflation rate in the US of about 8.5 percent and the 10-Year Note at even 3 percent, leaves at least a 5 percent negative yield. That cannot continue. At the same time, we have a $30 trillion debt. Interest rates, according to the IMF, should be about a percentage point above the inflation rate, so interest rates should be at about 9 or 10 percent.

“If that happened,” MontesDeOca said, “the global economy would collapse. There is no doubt in my mind.”

If the Fed raises rates too fast or too aggressively, they will kill the equity markets. By printing money, the Fed has been protecting the equity markets. At the same time, the US dollar has significantly declined. Even though assets, such as real estate have increased in price, the dollar is down about 30 percent in value. The increase in asset price is just reflecting the devaluation of the dollar. Gold and Silver will be looked at as a safe haven asset in times like this. Continue to accumulate long-term positions.

Be the first to comment